Optimism is a popular layer 2 solution for Ethereum. It offers cheaper and faster transactions compared to Ethereum. Layer 2 solutions, like Optimism, also tackle the scalability issue.

Optimism uses optimistic rollups for this. According to DeFillama, it’s sixth with TVL among all chains. Its current TVL is around $661.9 million. So, let’s take a closer look at some top coins on Optimism for Q3-2023.

Meanwhile, one year after making its Optimistic debut, @VelodromeFi announces plans for a protocol overhaul with Velodrome V2, slated to launch in mid June.

Let's go racers! 🚴♂️💨https://t.co/X0tJCKh9zw

— Optimism (✨🔴_🔴✨) (@optimismFND) June 2, 2023

1) Velodrome Finance (VELO)

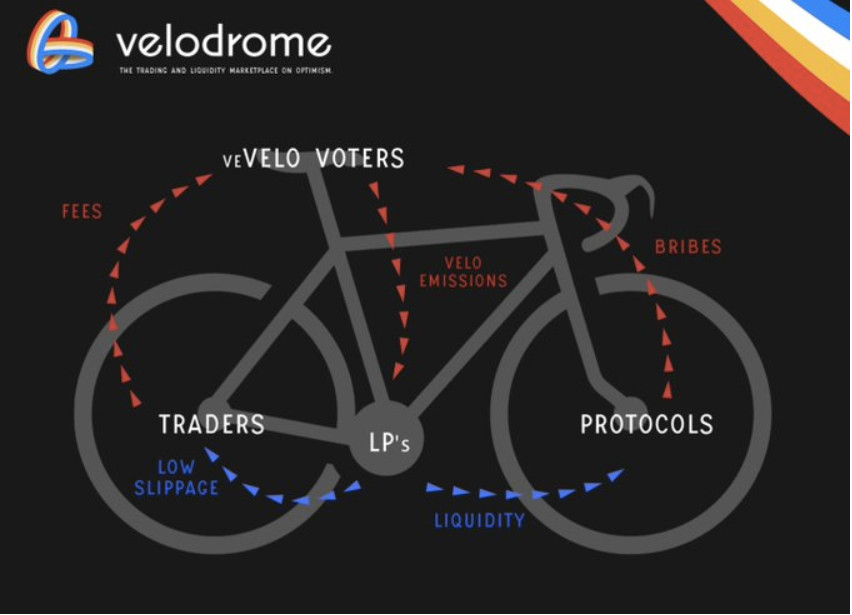

On Optimism, Velodrome Finance leads with the highest TVL. According to DeFillama, its current TVL is $165 million. Velodrome calls itself a next-generation AMM.

Velodrome first used to go by the name of veDAO on Fantom. That is until Andrej Cronje decided to leave DeFi and Fantom in early March 2022. That was the end for veDAO and many DeFi projects on Fantom. However, the veDAO team decided to continue and choose Optimism as their new home. They rebranded into Velodrome Finance.

The Velodrome V2 era has arrived with a bang, producing the highest fees in the protocol's history.

Read all about what is coming next with Velodrome Relay and our new concentrated liquidity AMM.https://t.co/tTJzGCSgIb

— Velodrome (@VelodromeFi) July 17, 2023

In this DeFi protocol, you can lock the native VELO token for 1 week, and up to 4 years. The longer you lock your VELO, the more veVELO you receive as a reward. This, in turn, gives you more voting power. You receive an NFT that represents your locked VELO. This is a veNFT. You can trade this veNFT on NFT marketplaces. On the other hand, Velodrome also uses rebasing. This allows the token supply to increase or decrease. It all depends on the price fluctuation.

The platform pays trading fees to veVELO voters. This resulted in high yields. As a result of this, the platform recently gained in popularity. Here’s an explanation in Velodrome’s docs about their ve mechanics.

- Price: $0.056057.

- 24-hour trading volume: $1,471,825.

- Total Supply: 1.153 billion tokens.

Source: Velodrome docs

2) Synthetix Network (SNX)

Synthetix Network works with synthetic assets. These synthetic assets are like derivatives. In other words, you don’t have to own an asset, but you can still have exposure to it. As long as something has a reliable price feed, it can be a ‘synth’. You can find the platform on two chains, Ethereum and Optimism. Their current TVL is $361 million.

The Weekly Recap is here!

🚨 Election Results 🚨

⚔ Spartan Council & CC updates

⚔ Grants & Ambassador Council updatesPodcast on YOUTUBE: https://t.co/9F67BYNF9A

Anchor Podcast: https://t.co/uUdC4BCjmT

BLOG: https://t.co/lYk24wrstI

— SNXweave (@snx_weave) August 30, 2023

So, instead of owning an asset, synths do something else. They track the price of an asset. This gives you exposure to the said asset. However, you need to deposit collateral. For this, you can use the native SNX token or ETH. In turn, you stake the collateral. Here’s an explanation of how that works, from the platform’s docs. Currently, the platform uses Staking Interface V2. However, keep an eye out for V3, that’s coming soon.

Besides the synths, the platform also offers P2C or Peer-to-Contract trading. So, there’s no need for an orderbook. Synthetix has its origins in a project that went by the name of Havven. However, the team decided to change their direction and consequently rebranded to Synthetix. Now, all synths have the ‘s’ prefix. So, BTC becomes sBTC USD becomes sUSD, and so on.

- Price: $1.94.

- 24-hour trading volume: $31,864,207

- Total Supply: 323.5 million tokens.

Synthetix Perps employs a dynamic funding rate mechanism and a price impact function to ensure market balance. Both of these tools work in tandem to bring delta neutrality to market LPs.

Interested in learning about both of these functions? See the 🧵 below 👇

— Synthetix ⚔️ (@synthetix_io) April 27, 2023

3) Aave (AAVE)

Aave is a DeFi lending protocol. You can find Aave on nine chains. Its total TVL is $2.14 billion. However, on Optimism their TVL is $72 million. That still makes them third in TVL on Optimism. For lending and borrowing, Aave uses liquidity pools.

Aave v3 loans quietly hit a new record high for the year, and a record $100mm in new loans issuance. pic.twitter.com/G20h4LYb9Q

— Ryan Selkis 🪳 (@twobitidiot) September 1, 2023

To lend, you need to deposit an overcollateralized asset. Aave started out with a P2P lending model. However, it switched successfully to a liquidity pool model. Initially, it launched only on Ethereum. Nowadays, you can find Aave on 8 more chains, for example:

- Polygon

- Arbitrum

- Optimism

- Base

- Avalanche

In 2020, Aave was the first protocol to introduce flash loans. With a flash loan, you don’t need collateral. However, you need to repay the loan within a single block transaction. You can use flash loans for arbitrage. That is, to take advantage of asset price differences on different exchanges. The native AAVE token has various use cases. For instance:

- Governance – AAVE token holders can vote on the platforms’ direction.

- Collateral – Using AAVE as collateral gives you discounts on platform fees.

- Staking – Secure the protocol and earn rewards.

- Price: $54.99

- 24-hour trading volume: $63,723,555

- Total Supply: 16 million tokens.

gm @BuildOnBase.

Aave V3 is now live on Base. Get started at https://t.co/gzkAogksEq. pic.twitter.com/49zj6z0qiR— Aave (@AaveAave) August 22, 2023

Conclusion

Optimism is a popular Layer 2 solution that uses optimistic rollups. It’s a popular layer 2 on Ethereum. Hence, we look at three top platforms on Optimism. These are Velodrome Finance, Synthetix Network, and Aave.

– For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

– Unlock the key to managing your crypto portfolio like a PRO! Our top analysts bring you exclusive insights and the latest updates on cryptocurrency trading. Join Altcoin Buzz Alpha on Youtube or Patreon for just $15/month!

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.