Yearn Finance is an Ethereum-based, open-source DeFi lending protocol. The concept of Yearn Finance is to maximize the user’s yield by automatically moving the user funds among different DeFi lending protocols like Compound, Dydx, Curve, or Aave. It is one of the most popular and most decentralized DeFi projects in the crypto industry till now.

The platform was single-handedly developed by Andre Cronje and launched in February 2020. Just immediately after launch, Yearn Finance has gained significant adoption in the crypto sphere that can easily be seen with the increase in the value of the YFI token. In early September, the platform’s native token, YFI, has even reached a peak value of approximately $44,000.

Table of Contents

Yearn Finance Application

To access the application, go to their official page.

The yearn.finance site contains the below UI applications:

- Vaults

- Earn

- Zap

- Experimental

- Stats

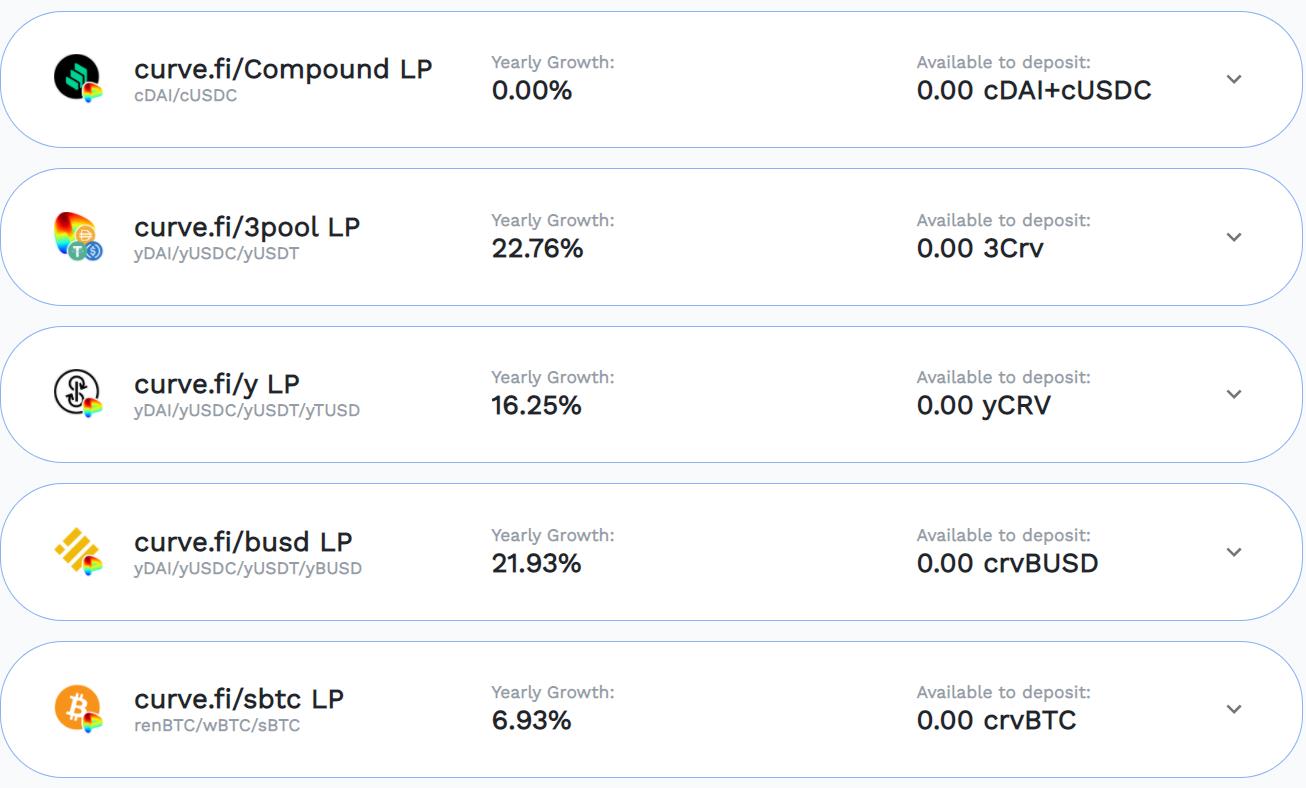

Vaults

Vaults are the pools of funds that follow certain strategies. It helps the community members to work together in building strategies that determine the best yield protocol.

Vault Characteristics

- Use any asset as liquidity.

- Use liquidity as collateral and manage collateral at a safe level to avoid a default.

- Borrow stablecoins.

- Put the stablecoins to work on some farming.

- Reinvest earned stablecoins.

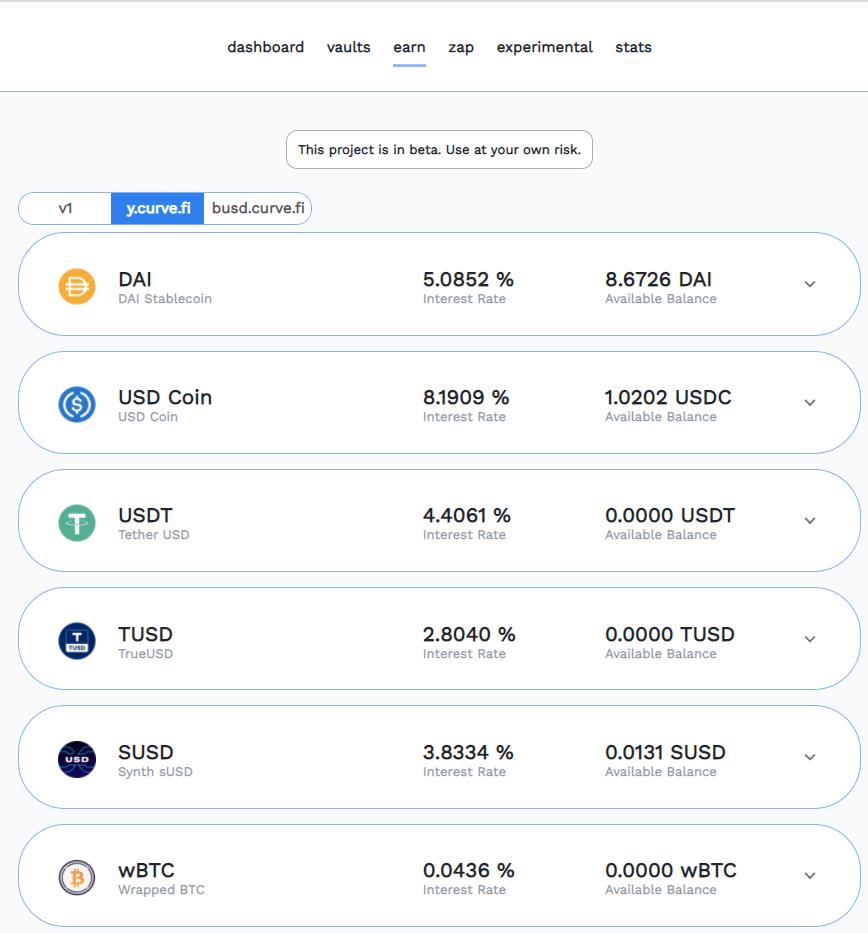

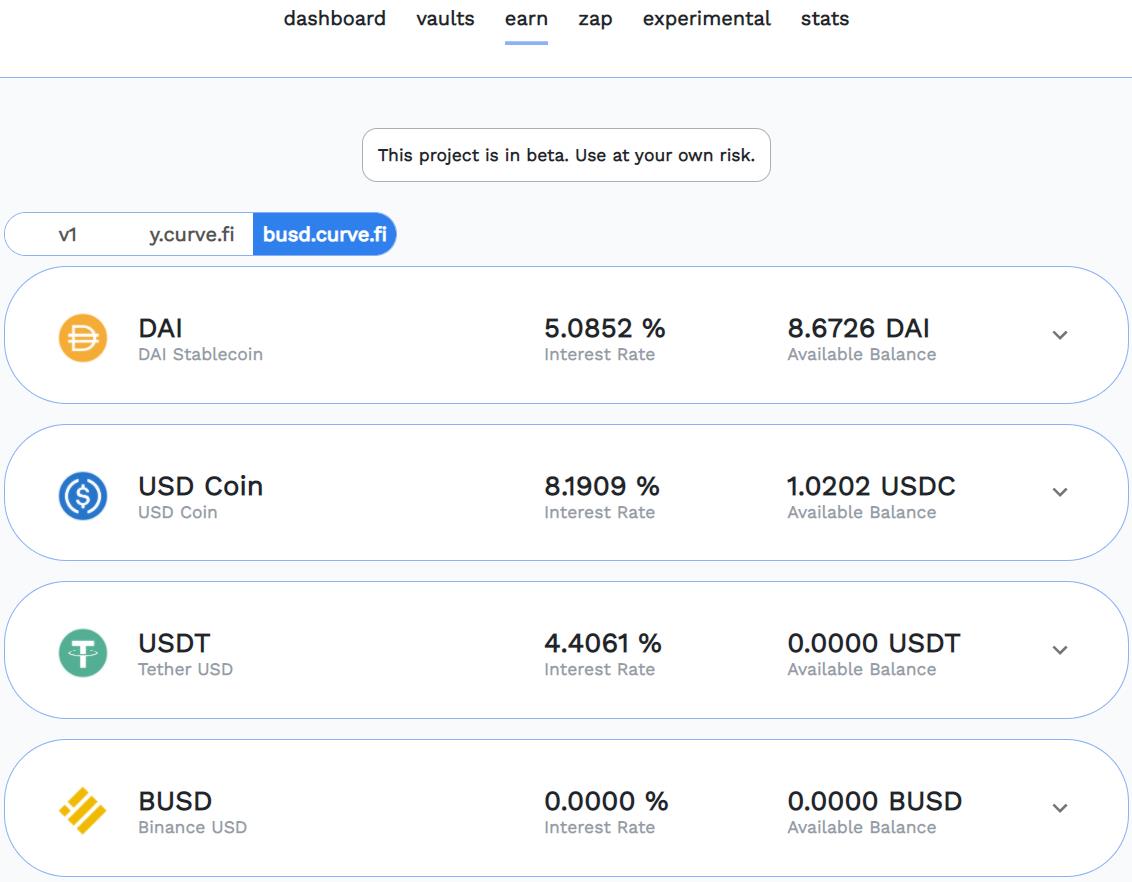

Earn

Earn is a lending aggregator that automatically switches the user funds between lending platforms. Users can deposit DAI, USDC, USDT, TUSD, WBTC, or SUSD into high yielding DeFi protocols like Compound, Dydx, or Aave whenever the interest rate changes.

Users can use the Earn page to deposit into these lending aggregator smart contracts. The code behind the application manages and benefits the users to obtain the best high-interest rates among all the platforms involved.

y.curve.fi

Busd.curve.fi

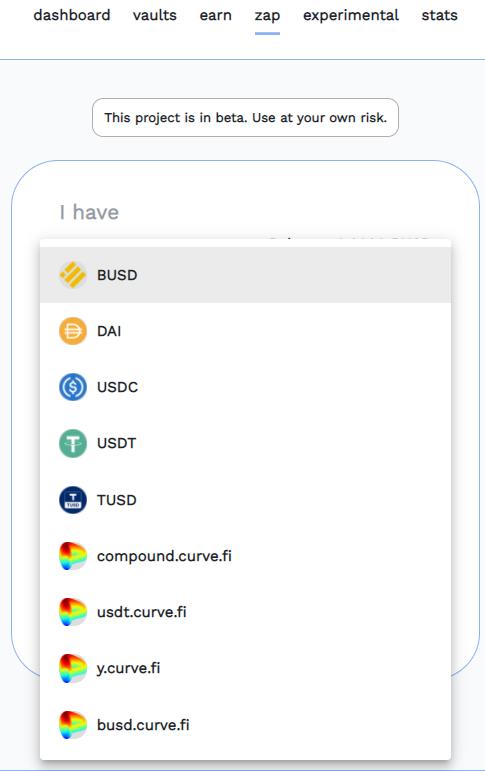

Zap

Zap allows the users to switch between various stablecoins with just one contract interaction to reduce transaction costs. Users could also save on gas fees by either zapping directly in or out or curve pools from the base assets. It allows the users to swap into and out of (known as “Zapping”) several liquidity pools available on Curve.finance.

Currently, there are five stablecoins (BUSD, DAI, USDC, USDT, and TUSD) that users can “Zap” into one of two pools (y.curve.fi, busd.curve.fi) on Curve. Users can “Zap” out of these Curve pools into one of the five base stablecoins.

Yearn Governance Token (YFI)

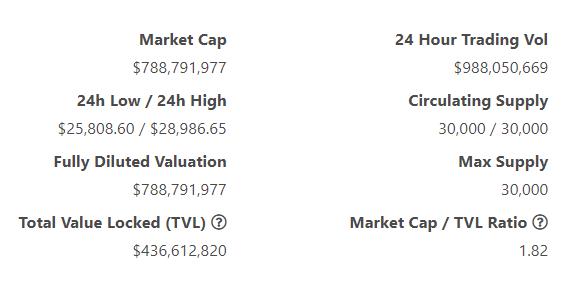

YFI (ERC20 token) is the platform governance token and can be used in doing governance activities like voting on a proposal for protocol upgrade/change. Until now, only 30,000 were minted and fully distributed.

Users need to stake their YFI in a governance contract to get voting rights. And in return, these YFI holders receive a percentage of protocol profits for each of Yearn’s products at regular intervals. The Treasury Vault temporarily holds the profits of stakeholders and these profits are distributed to YFI holders once the treasury is at or above $500k USD. Profits are distributed as yCRV tokens.

Users can claim the rewards within three days of voting. Once you have voted, your YFI token will be locked for three days, i.e., you won’t be able to unstake your token.

How Does Yearn.Finance Work?

Yearn Finance is an open-source network and the underlying concept of the platform is to move the user’s funds among different lending protocols (Compound, Aave, Curve, and DyDx). The user funds are switched from one asset pool to the other depending upon the APY, i.e., it switches users holding from the least APY to the highest APY-yielding protocol.

The stablecoins used by the platform: DAI, USDC, TUSD, SUSD, WBTC, and USDT.

Yearn Finance works similar to other lending platforms. The users can deposit any ERC20 stablecoin such as DAI, USDC, USDT, TUSD, or SUSD into the protocol, and in return, they receive an equivalent amount of yTokens (i.e., yDAI, yUSDC, yUSDT, yTUSD, and ysUSD). The yTokens are just like any other ERC20 token. The underlying stablecoin is made available to lend.

And the catch is here. Instead of lending the stablecoins into any particular protocol, the Yearn Finance platform automatically switches the tokens into a protocol with the highest yield to maximize user profit.

The network also charges a small fee that is deposited into the the platform’s pool and can be only accessible to YFI token holders.

Different Products/Features Of Yearn Finance

- yearn.finance

yearn. finance is the main application component that is responsible for switching among various lending providers, i.e., DyDx, Aave, and Compound. It is designed in a way that it autonomously moves your funds to more profit-giving providers.

- ytrade.finance

ytrade will allow you to trade between $DAI, $USDC, $USDT, $TUSD, and $sUSD. It is not yet publicly launched. ytrade allows you to trade at leverage capped at 1000x with initiation fee pre-paid or 250x without initiation fee

- yliquidate.finance

Automated liquidation engine for Aave protocol. Allows 0 capital liquidations on a first-come, first-serve basis.

- yleverage.finance

Creates 5x leveraged DAI vaults with USDC. Over $9 million in short positions created with an average of 16% profit.

- ypool.finance

The first y.curve.fi <> sUSD curve.fi meta pool. Decommissioned currently in favor of a native asset pool. Before decommission, had over $10 million in assets.

- yswap.exchange

The latest release announced, a stable automated market maker, allowing single-sided liquidity provision while being yield aware and distribution rewards aware. Current AUM $75k as of launch yesterday.

- *.finance

Yet to be launched publicly, credit delegation protocol for smart contract to smart contract credit delegation lending.

Meta Yield Governance

Farming YFI can be done by using a staking pool. There are three ways through which it can be done.

- Pool #1 was an introduction to yearn.finance

- Earn the highest yield available among Compound, Aave, or DyDx by staking $DAI, $USDT, $USDC, or $TUSD

- Earn trading fees from the curve.fi

- Farm the anticipated $CRV token

- Recent daily APY ~32.87%

- Pool #2 through Balancer liquidity provision

- Provide liquidity and earn trading fees on top of your assets

- Earn more of the underlying

- Farm $BAL token if the pools are whitelisted

- 15% fee per trade

- Pool #3 balancer.exchange pool

The BPT is received from a balancer. exchange pool that is split between YFI and curve.fi tokens. This allows you to farm $CRV while receiving a yield from yearn.finance and receive trading fees from curve.fi.

The output token from this pool gives you the following rights:

- Vote on all proposals

- Earn YFI from the 3rd pool

- User can earn CRV

- BAL can be earned

- Earn interest

- Manage the system settings

- Every time you vote, you will be claiming your % of fees generated by the system

YFI Price Analysis And Token Stats

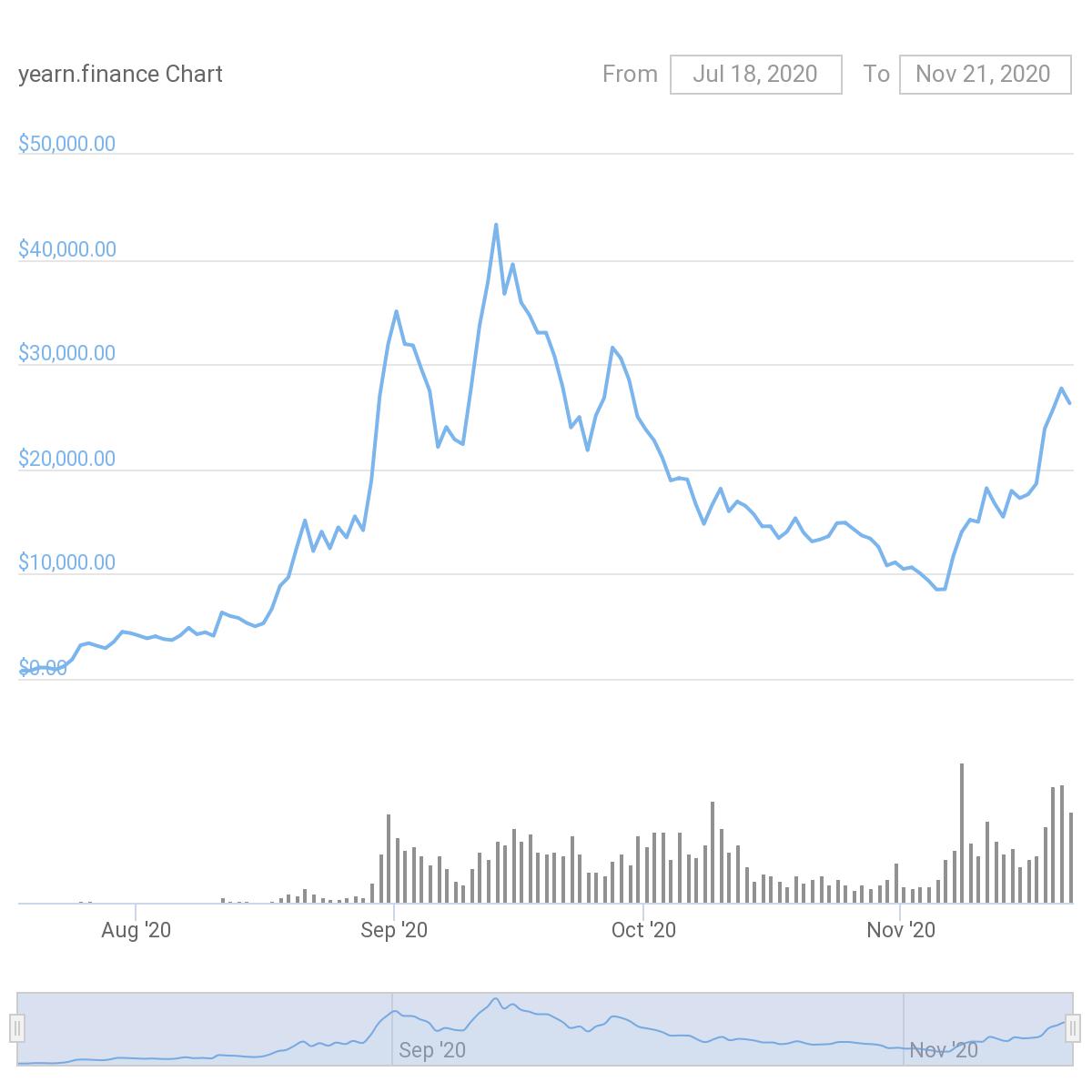

In July 2020, the token price was started at approximately $790 USD. Within one-and-a-half months, i.e., in the first week of September, it was trading at approximately $35k, followed by crossing a value of $43,000 within 12 days. That’s almost a 6000% increase in two months.

Source: Coingecko

The token’s stats as of November 21, 2020 9:45 pm IST:

Conclusion

The Yearn Finance project has been in the limelight since its launch. The YFI token has even crossed the value of $40,000 within a few months of its inception. This makes the token the most expensive token so far in the blockchain ecosystem. No other token has reached this milestone ever. Also, the platform aims to work efficiently with other DeFi lending platforms with a motive to provide a high yield to users. We can expect a high rise in the platform’s user base from those who want to benefit from the unique features supported by the project.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.