In Part 1 of this series, we will go through the basic concepts of crypto derivatives. We will try to understand their potential impact on the overall crypto market.

What is a derivative? In a traditional sense, a derivative is a financial security that derives its value from an underlying asset. Thus, two parties get into a contract to agree on the terms and conditions of the future purchase or exchange of the underlying asset. The most common underlying assets for derivatives are stocks, bonds, commodities, currencies, interest rates, and market indexes.

Usually, market players trade derivatives Over The Counter (OTC). However, such a mode has a greater possibility of counterparty risk. Traditionally, exchange-traded derivatives are subject to rigid standards and heavy regulation.

Types of derivatives

Based upon the terms and conditions of the agreement between two parties there are multiple types of derivatives. However, the inherent concept remains the same, hedge a position, speculate on the directional movement of an underlying asset, or give leverage to holdings

- Futures: In a futures contract, two parties agree to buy or sell an asset at a predetermined price at a future date. Futures are traded on an exchange. The contracts are standardized. Under a futures contract, both parties are obligated to fulfill a commitment to buy or sell the underlying asset.

- Forwards: Forwards follow the concept of futures. However, the contract is customized (non-standardized) and is traded Over the Counter (OTC). As a result, forwards carry a high amount of risk.

- Options: Options also follow the concept of futures, with a key difference in the obligation clause. There is no obligation to exercise the agreement to buy or sell.

- Swaps: Swaps are often used to exchange one kind of cash flow with another. A popular example of swap is the interest rate swap. It is used to swap a variable interest rate loan to a fixed interest rate loan.

Crypto Derivatives

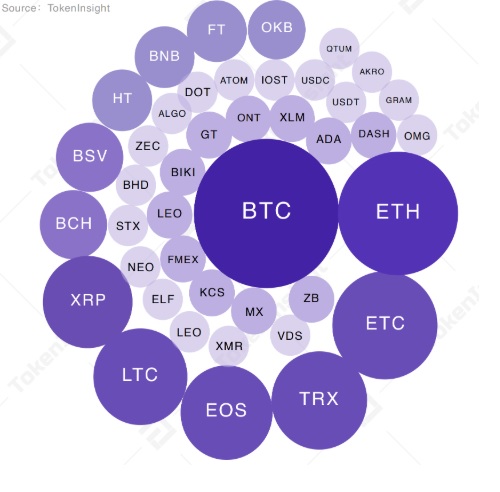

Crypto derivative contracts have cryptocurrencies as underlying assets. The most popular assets are Bitcoin and Ethereum.

Tokeninsight provides us with a list of underlying assets in derivative contracts. Bitcoin and Ethereum are the dominant cryptocurrencies.

Source: TokenInsight

A relatively new journey

LedgerX is the first federally regulated exchange and clearinghouse to list and clear fully-collateralized, physically-settled bitcoin swaps and options for the institutional market. In December 2017, The Chicago Mercantile Exchange (CME) was the first traditional exchange to declare entry into Bitcoin Futures. The Chicago Board Options Exchange’s (Cboe) followed them. Soon, the United States’ Commodity Futures Trading Commission (CFTC) allowed the CME, Cboe, and the Cantor Exchange to self-certify bitcoin futures contracts.

Since there have been new providers who have entered the crypto futures stage. Important existing market players include exchanges like Bitmex, Okex, Huobi, etc. In September 2019, Bakkt finally entered the crypto scene, offering Bitcoin Futures contracts.

NASDAQ, the second-largest stock exchange in the world is in the advanced stages of entering the Bitcoin Futures market.

As per Coingecko, the number of derivative exchanges increased 3 times within a period of 3 months, from 6 in July’19 to 17 in Oct’19.

The innovative part of crypto derivatives

The most important innovation for crypto derivatives is ‘on-chain derivatives.’ In this case, payouts occur completely on-chain through a smart contract, with reliance on off-chain oracles to gather outside blockchain information. In a decentralized crypto p2p model, you can enter into a smart contract with a counterparty who is willing to take the exact opposite exposure. This removes the involvement of the third party and hence potential fraud. Prediction markets like Augur are a great example.

Pros and cons of crypto derivatives

Pros

- Hedge against risk: Traders usually use derivative contracts for hedging risks which may arise from the fluctuations in the price of the underlying asset;

- Access to unavailable assets or markets: Derivatives can help organizations get access to otherwise unavailable assets or markets;

- Transfer of Risk: In a derivative contract, one party transfers the risk to another one, who is willing to take it;

- Price discovery: The derivative market generates signals. Traders then use them to get an insight into the short/long term movement of the market.

Cons

- Complicated valuation: The sophisticated design of the contracts makes the valuation extremely complicated or even impossible. Thus, they bear a high inherent risk.

- Lack of regulation: Many centralized crypto exchanges are not subject to regulation and hence can wrap up business anytime resulting in huge losses for the investors.

- Counterparty Default Risk: Over The Counter transactions do not necessary follow compliance and proper due diligence is needed before involving them.

- Highly risky in a volatile speculative market: The crypto market is yet to mature and hence cannot be predicted with a substantial amount of accuracy. This may lead to losses in cases of derivative investment.

The current state of Crypto derivatives

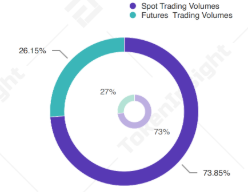

As per Cryptocurrency Futures Exchange Industry Research Report published in September 2019 by Tokeninsight

- The proportion of Futures Trading volume has increased to 26% (US$ 1,605.7 billion) vs Spot Trading volume at 74% (US$ 4,533.6 billion)

Source: TokenInsight

- BitMEX, OKEx, and Huobi DM have all managed to maintain their respective positions as the top three platforms within the crypto derivatives market for the current period of this report.

- The Chicago Mercantile Exchange (CME) became the sole offline marketplace for the trading Bitcoin futures contracts in the US after the Chicago Board Options Exchange (CBOE) announced the closure of its offline trading platform in March 2019.

- Since 2019, cryptocurrency derivatives have received continuous upgrades with newly added features such as options contracts, index futures, and leverage token.

Exchanges

Traditional Exchanges: Chicago Mercantile Exchange (CME)

Cryptocurrency Exchanges: BitMEX, OKEx, Huobi DM, Gate.io, Binance, etc.

Recently Bakkt has also entered the crypto futures market.

We will deep dive deeper into crypto exchanges in Part 2 of this series. We will also talk about the Top 3 crypto derivative exchanges for 2020 in the same.

Conclusion

Crypto derivative is a very risky proposition. Thus, only experts shuld be doing it. The crypto market place is still in a state of speculation. Hence traders might avail short term benefits through crypto derivatives. For instance, they can hedge market downturns and make a profit through shorting. Multiple factors that pertain to politics, international events, and economy affect an asset’s price. The Bitcoin economy will decide the coin’s price. Same with other cryptocurrencies. Hence, in the long run, once the prices of cryptocurrencies stabilize more, the crypto derivatives might not make a major difference.

Disclaimer

This article is not financial advice. It is for educational purposes only. It is our own point of view. Please do your own due diligence before making any financial investment decisions.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.