Introduction

In Part 1 of this series titled Understanding Cryptocurrency Funds: Part 1 – Analysing the current state of the market, we tried to understand: What are cryptocurrency funds? What are its benefits? Types of cryptocurrency funds? How have the cryptocurrency funds market behaved historically? What are the risks associated with investing in a cryptocurrency fund?

In this article, we will discuss the top things to look out for when investing in a cryptocurrency fund.

A quick recap:

What are the cryptocurrency funds?

Cryptocurrency funds pool money from investors and invest them into a group of assets focusing entirely, or partially, on cryptocurrencies or other decentralized digital assets, using different strategies. The funds are managed by dedicated experts or insider investors. The funds charge fees for their work on analysis and selection of investment opportunities. It has been seen that some traditional funds also hold a small percentage of cryptocurrencies.

Types of cryptocurrency funds (Details in Part 1 )

Depending on the risk appetite, investment strategy, return policy and few other features cryptocurrency funds can be broadly classified into 4 types:

- Public funds

- Private funds

- Hedge funds

- Venture capital funds

What are some of the risks of investing in cryptocurrency funds? (Details in Part 1 )

Cryptocurrency Funds are a relatively new investment class. The market is not mature yet. This makes investing in cryptocurrency funds risky. Risks include

- Loss of control

- Bad strategies

- Knowledge and Experience

- Volatility

- Historical Returns

- Fees

- Local Tax Rules

- Regulatory uncertainty

- Frauds

So, let us now come to the main part of this article.

What are the top things to look out for when investing in a cryptocurrency fund?

There are not many integrated guidelines currently available, so we have created one.

- Strategy

- Goal: Is the fund focussed on stable long term growth and hence takes fewer risks (Top 10-20 Cryptocurrencies, Non-crypto assets) or has it adopted a high risk/high reward strategy to maximize profit in short terms (Pump & Dump coins, ICOs)? Does the company’s investment strategy match with your individual goal?

Source: Eurekahedge

-

- Research Methodology: How cryptocurrencies are chosen for investment? Does the fund use technical analysis, fundamental analysis or some other investment approach?

- Trading strategy (Reference: Rakesh Kumar’s Blog)

- Manual vs Bots: Does the fund use manual trading or bots? Manual trading is more focused on careful selection, bots, on the other hand, are more flexible to market movements.

- Long/Short: Does the fund do shorting?

- Event trading: Some funds trade large volumes in and around market events. Example: forks, product release, regulatory changes, etc

- Social Media Sentiment Trading: Some funds trade based on Twitter, Reddit, and other news sentiments.

- Arbitrage: This is a very popular strategy. Some funds take advantage of a variation of Crypto asset prices between exchanges.

- Multi/ Hybrid strategy: Many funds deploy multi-strategy as and when the situation demands.

- Risk Management: – Regulation

-

- Jurisdiction: In which jurisdiction is the company registered? Is it a legal entity? For example, when we were reviewing TradeSatoshi we also checked it’s registration in Companyhouse

- Regulation: Even though regulation is still a work in progress, it is important that you invest in a fund which proactively meets the regulatory requirement. For example, as per Capitalfundlaw, below are the examples of requirements if a company is registered in the US.

- Registration with the CFTC: No, if the fund manager purchases cryptocurrencies outright, and yes, if the fund manager purchases cryptocurrencies with margin, leverage, or as a futures contract.

- Registration as an RIA with the SEC or Comply with State Investment Advisor Regulation: Not yet. However, note that the cryptocurrency fund is itself security, and must satisfy an exemption from registration under the Securities Act of 1933 (usually Regulation D Rule 506). Funds should preemptively register with the SEC or state securities division, and also take necessary precautions.

-

Please check if the fund meets the regulatory guidelines in the country where it is registered. Check out the rules and regulation of your own country.

- Security:

-

- Custody services: Some fund use a custody service like Coinbase to protect investor’s interest.

- Storage: Some fund set aside a percentage of company fund in Cold Storage like Ledger.

-

- Portfolio Diversification: Is the fund protecting investor’s interest through diversification? A Fund should not put all their eggs in one basket. Diversification should be across Large/ Small Caps, Industries, Regions, Crypto/Non-Crypto. This reduces the risk of losing money.

- Transparency:

-

-

- Portfolio: Is the fund transparent on the Portfolio they hold. Does their Portfolio match with their Goals?

- Rebalancing: Does the fund provide you with portfolio rebalancing details? Does the rebalancing decisions tally with market movements? Is there any hidden agenda of the fund to invest in certain cryptocurrency? Try to deep dive and understand these details.

- Tax documents: Some funds provide information to help investors file Taxes.

- Governance: Does the fund follow a defined governance methodology while making an investment decision?

- Communication channels: How often do they communicate via social media?

-

6. Social Media: Social media can be seen as a measure of Transparency, but we have kept it as a separate pointer considering the breadth of the subject.

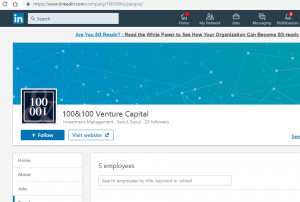

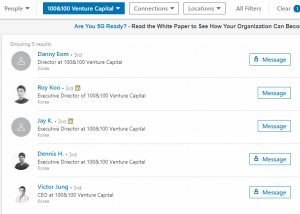

Check for completeness in Facebook, Twitter, and Linkedin Profiles. Check how often they post. Check what are the responses of the followers. Is there any Red Flag?

Example:

- Experience: Check the website/ Linkedin for the Team structure. Check Number of employees. Profile of Management. Do they have relevant experience both in Technology, Analysis, Trading, Marketing, and Management? Remember you need a right mix of all of these (plus passion) to drive a company.

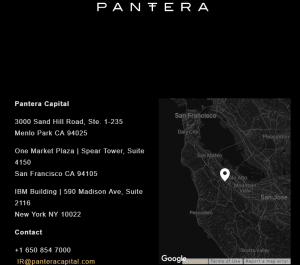

- Address: Country & City: Depending on availability

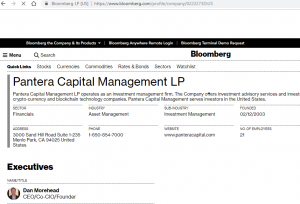

Let’s take an example of Pantera Capital.

- Find their address

- Check the validity of the address

- Check if the company is showcased by a reputed database

- Service Desk:

- Type of service: Is the fund providing a dedicated trading helpdesk or is it a common line?

- Time Coverage: Is the service 24 x 7? Is the service hour properly defined? What happens when you need immediate help?

- Mode: Chat, email, phone. Check out which options work. How responsive are they?

Call them up, email them. If required, do it multiple times. You will know how quick are they in responding to you.

- Fees and other financial factors:

- Fees: Calculate the Total annual management fee (include hidden charges)? Check for entry and exit fees. If a fund performs above a certain benchmark, they charge a performance fee, check out if the same is applicable for your fund.

- Minimum Investment: What is the minimum investment required? Some funds charge too high for a retail investor.

Conclusion:

Any investment with a third party carries its own share of risk.

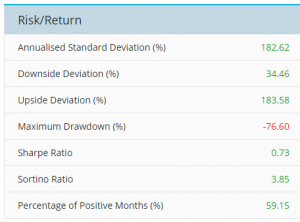

Many cryptocurrency funds try to maximize profits in a short period of time and hence adopt complicated alternative investment strategies in both rising and falling markets. This can be very risky in a Bear Market. The strategy of a fund should match your investment goals. Past performance is not a very good indicator of a fund’s performance in this volatile market.

We do not provide financial advice. Please do your own research and compare a range of options before selecting a fund.