In Part 1 of this series, we explained the basics of Decentralized Finance (DeFi). We also evaluated its difference from the traditional financial systems and discussed how they will change the future. In this Part, we will review the top DeFi projects across segments.

A quick recap of the different DeFi segments:

- Decentralized Exchange Protocols (DEX)– DEXs are P2P exchanges of assets, where no third-party acts as the intermediary in a transaction. Example: 0x;

- Stablecoins – A stablecoin is an asset that offers price stability characteristics making it suitable as a medium of exchange, a unit of account, and a store of value. Example: Paxos;

- Lending Protocols – Decentralized Lending Protocols allow an individual to access a much wider pool of willing lenders. Hence, there is no need for intervention of a central bank. Example: MakerDao;

- Derivative Protocols/Prediction Markets – In a decentralized prediction market, there is no central authority regulating and controlling the entire prediction market. Example: Augur;

- Tokenization Protocols – A security token is a tokenized, digital form of traditional securities. It doesn’t need to have a utility. Example: Harbor;

- KYC/AML/Identity – In decentralized identity solutions, the central party does not retain a user’s identity details nor can it use the details for its own convenience, without the user’s prior permission. Example: SelfKey.

Decentralized Exchange Protocols (DEX): 0x

About:

0x is an open protocol that enables the peer-to-peer exchange of assets on the Ethereum blockchain. Anyone in the world can use 0x to service a wide variety of markets ranging from gaming items to financial instruments to assets that could have never existed before.

0x boasts of the following numbers: Total Transactions: 713K, Total Volume: $750M, Total Projects: 30+

Features:

- Support for all Ethereum Standards: 0x Protocol facilitates the decentralized exchange of a growing number of Ethereum-based tokens, including all ERC-20 and ERC-721 assets;

- Networked Liquidity: 0x is lowering the barrier to entry by building a layer of networked liquidity that allows businesses to tap into a shared pool of digital assets;

- Flexible Integration: Businesses and projects (relayers) can easily add exchange functionality to any product experience;

- Robust Smart Contracts: 0x Protocol’s smart contracts go through two rounds of rigorous security audits;

- Extensible Architecture: 0x’s modular pipeline enables a user to plug in their own smart contracts through an extensible API;

- Efficient Design: 0x’s off-chain order relay with the on-chain settlement is a gas efficient approach to p2p exchange, reducing blockchain bloat.

Products:

- Asset Swapper: Tap into 0x’s networked liquidity and swap tokens;

- 0x Instant: A free and flexible way to offer simple crypto purchasing in any app or website;

- The 0x Launch Kit: Anyone can launch their own exchange or marketplace in minutes;

- 0x Protocol Governance: Users can vote on 0x Improvement Proposals (ZEIPs) using ZRX tokens.

Popular projects which are already using 0x Protocol include dYdX, Gods Unchained, etc.

Stablecoins: Paxos

About:

Paxos Standard (PAX) considers itself a digital dollar. Just like other crypto assets, it can move instantaneously, anywhere in the world, any time of any day, and it’s programmable. It is USD-pegged (1:1). The funds are carefully protected, audited and regulated.

PAX boasts of the following numbers: Total PAX transacted ~ $ 60.7 Bn, Total PAX minted ~ $ 1.2 Bn

Key Features and Benefits

- Redeem PAX for dollars within one business day and pay lower fees;

- Send or receive, using an Ethereum wallet;

- The stablecoin is listed on 100+ exchanges;

- The Paxos exchange, itBit, will allow users to cash out of their holdings directly and instantaneously to PAX;

- PAX is available 24/7 to facilitate settlement against any type of asset including crypto, security, and asset tokens or for payments.

PAX is a programmable token that can participate in the larger global community of tokens, helping create a global platform for programmable money with stability.

How to Use PAX

- Peer-to-Peer: Instantly send and receive US dollars around the world;

- Commerce: Use PAX to pay for goods and services;

- Trading: Move instantly between dollars and crypto;

- Holding: Enjoy the stability of the US dollar by converting cash to PAX.

Lending Protocols: MakerDao

About

Maker comprises a decentralized stable coin, collateral loans, and community governance. Its product, Dai (DAI) is a stable and decentralized currency. It allows businesses and individuals to realize the advantages of digital money without experiencing volatility. Maker (MKR) is the governance token for the Dai Credit System. MKR holders have the important responsibility of making decisions around the risk that will impact the future of the system.

The unique concept of Collateralized Debt Position Smart Contracts:

Anyone who has collateral assets can leverage them to generate DAI on the Maker Platform. This can be done through Maker’s unique smart contracts known as Collateralized Debt Positions (CDP). These CDPs hold collateral assets deposited by a user and permit this user to generate DAI. But, generating DAI also accrues debt. This debt effectively locks the deposited collateral assets inside the CDP until it is later covered by paying back an equivalent amount of DAI. At this point, the owner can again withdraw their collateral.

When the user wants to retrieve their collateral, they have to pay off the debt in the CDP. They will also have to pay a stability fee, which they have continuously accrued on the debt over time. It is paid in MKR (or DAI if using the CDP Portal UI).

Use Case: A Lending system using Collateralized Debt Position

Lending through Collateralized Debt Position is MakerDao’s game-changer. It is still a work in progress and will be made more effective in the coming days.

Bob needs a loan, so he decides to generate 100 DAI. He locks an amount of ETH worth significantly more than 100 DAI into a CDP and uses it to generate 100 DAI. The 100 DAI is instantly sent directly to his Ethereum account. Assuming that the stability fee is 1% per year, Bob will need 101 DAI to cover the CDP if he decides to retrieve his ETH one year later.

– From MakerDao’ s website.

Read more here: Top 5 Working Cryptocurrency Projects With Great Token Utility

Prediction Markets: Augur

About:

Augur is a trustless, decentralized oracle and peer to peer protocol for prediction markets. It is deployed on the Ethereum blockchain. Augur forecasts the results of different events basing on the Wisdom of the Crowd Principle (large group’s aggregated answers are often superior to the answer given by any of the individuals in the group).

Augur’s decentralized oracle system has the ability to identify the truth of an incident. This is Augur’s ultimate innovation. So Augur produces honest predictions about the future and reports of what has already occurred and the present state of the world.

How Augur Works:

Augur markets follow a four-stage progression:

- Creation

- Trading

- Reporting

- Settlement

A user can ask a specific question about a real-world event in the future. Trading begins immediately after the market creation, and all users are free to trade on any market. Market creators will receive an Augur coin (REP) encouragement from the fees for buying shares. After the event, on which the market is based, has occurred, its outcome is determined by Augur’s oracle. Then, traders can close out their positions and collect their payouts.

How Augur solves the Oracle Problem:

In a Decentralized Prediction Market (DPM) there’s no operator! A market actor or a group of actors stand to gain millions or even billions by manipulating an outcome and claiming that Y occurred when in fact X was the true outcome. This is The Oracle Problem.

Augur uses an incentivized communal resolution system. Market outcomes undergo a resolution process whereby participants can dispute outcomes by placing a financial stake. Those who stake on the accurate outcome, or more precisely, on the outcome that the market ultimately resolves to, win an additional stake. Those who report inaccurate outcomes lose their stakes. This incentivizes honest reporting.

The Token (REP)

Reporters use Reputation (REP) during market dispute phases of Augur. REP holders must perform work, in the form of staking their REP on correct outcomes, to receive a portion of the market settlement fees. If s/he does not report correctly, s/he does not get the fees and loses REP. Also, if s/he does not participate in a fork (when the network has a very large dispute over an outcome), s/he loses 5% of his REP. Passive holders of REP who don’t use the coin within the Augur protocol to stake on disputes and forks are penalized.

Uses

- Political Forecasting;

- Event Hedging;

- Weather Prediction;

- Cryptocurrency Speculation.

Advantages

- Open: DPMs let anyone, anywhere, anytime trade-in and create markets on any outcome;

- Free (almost): DPMs only impose fees, where needed, to secure the network. Fees tend to be minimal and trend toward zero over time;

- Reliable: DPMs eliminate counterparty risk and shady operators; participants need not trust anyone to custody their funds;

- Resilient: DPMs are more resistant to censorship and corruption. Also, they have no single point of failure;

- Information Lake: When you fuse each of these traits together you get a borderless liquidity pool that serves as an efficient market for absorbing and aggregating the world’s information.

Tokenization Protocols: Harbor

About:

Launched in 2018, Harbor’s mission is to power the future of crypto-securities. For this, it wants to build a decentralized compliance protocol that standardizes the way securities are issued and traded on blockchains. The platform streamlines the alternative investment experience for investors, issuers and their placement agents. It unlocks liquidity options for traditionally illiquid assets.

Notable features include:

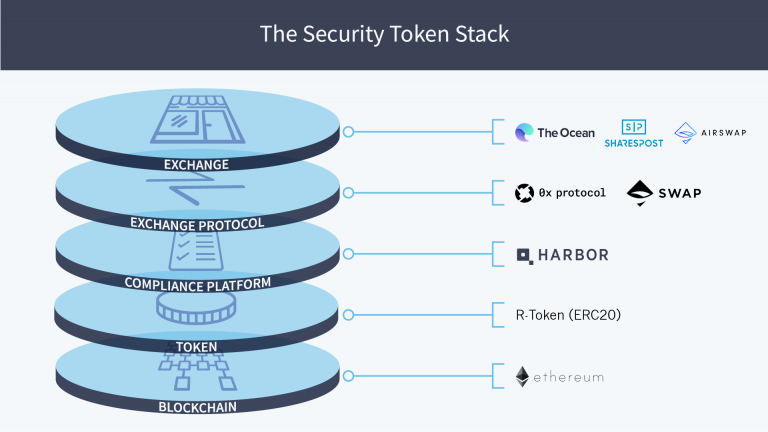

- Security Token Stack: Security Token Stack is a technology stack and an ecosystem — a network of on-chain smart contracts and off-chain processes. It works together to create a holistic solution for issuing, trading, and auditing securities using the blockchain as a store of value;

- R-Token: Harbor built the R-Token (an ERC-20 compatible token), as a core primitive of its compliance platform, to ensure compliance from initial offering through secondary trades. The security token does upfront checks using the whitelist provided by the compliance platform to ensure that all transactions occur within the required guidelines;

- Compliance Platform: The compliance platform bridges the on-chain and off-chain worlds throughout the lifecycle of the offering by publishing the result of off-chain processes to the on-chain whitelist. Elements of the compliance platform include the trade controller, issuance platform, policies and procedures, secondary trading, and testing/auditing;

- Interoperability: Harbor is chain agnostic, but it started with the Ethereum chain because it is programmer-friendly, has market penetration and has the largest ecosystem of wallets, exchanges and related services;

- Partnerships with exchange protocols: Partnerships with exchange protocols like 0x and Swap provide an essential layer to ensure a global liquidity pool. The decentralized protocols lower the cost of trading, remove barriers for overseas investors, and enhance security as it is not a centralized third party that holds funds or securities;

- Exchanges: R-Token can ensure securities trade only on properly licensed exchanges, like The Ocean, Sharespost, etc.

Do read our detailed articles on Security Tokens:

Understanding Security Tokens Part 1

Understanding Security Tokens Part 2

KYC/AML/Identity: Selfkey

About

SelfKey is an identity system built on an open platform consisting of several key components including

- SelfKey Foundation, a non-profit foundation;

- a technology stack with a free and open-source identity wallet for the identity owner;

- a marketplace with real products and services available at launch;

- a JSON-LD (machine-readable) protocol;

- connection to 3rd party identity microservices which comply with KYC laws and regulations;

- a native token called “KEY” which enables the SelfKey ecosystem to exchange value and information in an efficient, fully-digital, self-sovereign manner.

Problems of a centrally managed identity system

- Security and other risks: Most identity systems have large centralized databases containing millions (or billions) of identity records. Because of their sheer size, these centralized databases are high-value targets for hackers.

- Restricted access: The Operator restricts access to centralized databases. However, this often prevents identity owners from accessing their own data.

- Monopolies: If there were a single, for-profit organization with a database containing the identity data of every person on the planet, it would operate as a monopoly. Also, it will charge high prices for access to that data.

- Data protection compliance: A large, globally centralized database for identity could also breach data privacy and data protection laws.

- KYC regulatory requirements: For relaying parties – KYC is expensive and time-consuming.

How does Selfkey solve the problem

Selfkey introduces a concept called Self-Sovereign IDentity (SSID). This concept of Self Sovereign Digital Identity is similar to the way we store and manage our non-digital identities today. Currently, most of us keep identity documents such as passports and birth certificates or utility bills at our homes – safely, securely, under our own control. Self-sovereign identity in SelfKey is the digital equivalent of what most of us already do with our physical identity documents.

- Selfkey helps achieve compliance with the most comprehensive national data protection laws and KYC regulations and returns ownership and control of identity data back to the individual – the identity owner.

- It makes identity transactions more secure, private and efficient while complying with the myriad of laws and regulations that exist today.

- Its features include digitally signed verified identity claims, data minimization, proof of individuality, proper governance, and a user-centric identity system.

- SelfKey is designed to be censorship-proof, fair, inclusive, agile, and lean through a well-designed open source technology stack, and transparent legal & governance infrastructure through the SelfKey Foundation.

References: We have heavily referred to the official websites of individual projects.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

It’s a shame you don’t have a donate button! I’d without a doubt donate

to this superb blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google

account. I look forward to new updates and will talk about this website with my Facebook group.

Chat soon!

It is truly a great and useful piece of information. I’m glad

that you shared this helpful information with us.

Please keep us informed like this. Thank you for sharing.