Many people who joined the crypto industry last year would have been left disappointed because all the promises of good returns were beaten down by the bear market. Last year was not only disappointing but also frustrating for crypto investors.

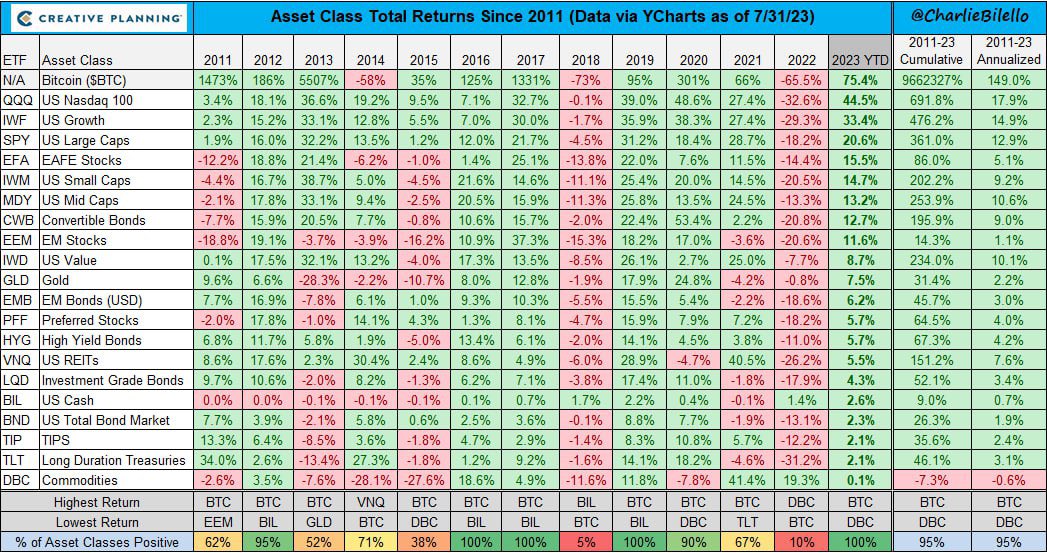

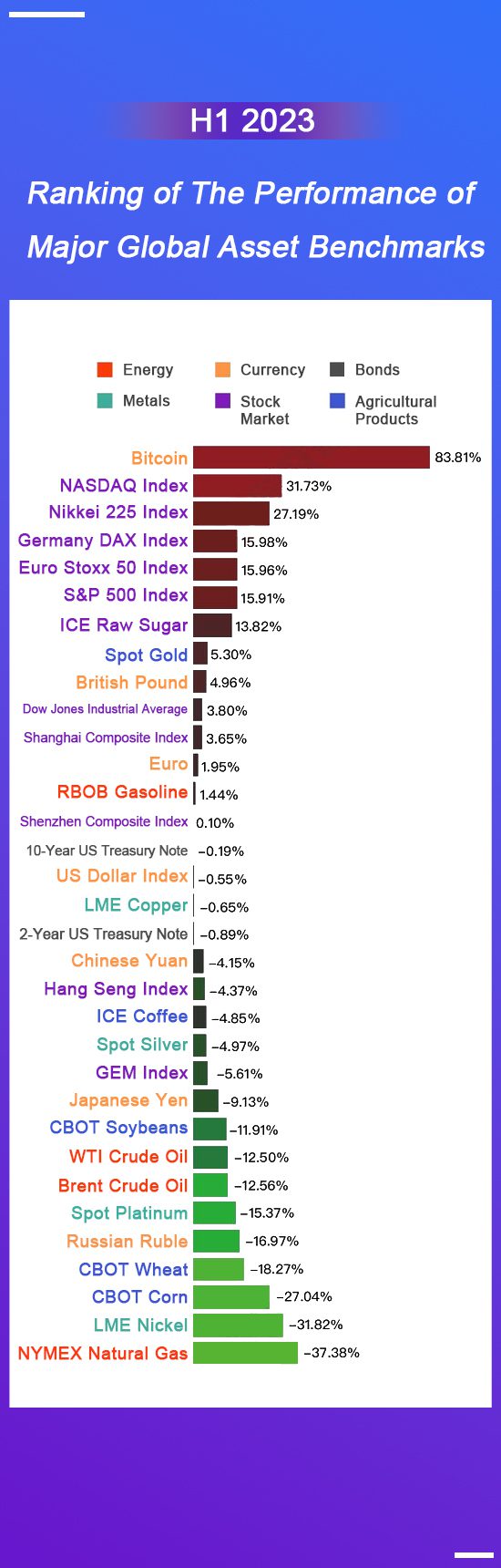

But what if we told you that Bitcoin (BTC) is currently the best-performing asset of 2023? The price of bitcoin has soared 83% in 2023 after plunging more than 60% last year, making it the best-performing asset class out of more than two dozen monitored by Goldman Sachs analysts.

Bitcoin has shown strong potential to be a lucrative investment opportunity and has drawn the interest of both individuals and organizations. Bitcoin has outmatched other major global assets like the British Pound, NASDAQ, Japanese Yen, Euro, NYMEX Natural Gas, and other stocks.

Bitcoin is both a medium of exchange and a store of value. And despite some regulatory resistance, Bitcoin has continued to unfold new possibilities. But what’s driving Bitcoin’s position as the best-performing asset of 2023?

There’s been massive institutional adoption of Bitcoin in 2023

The growing institutional adoption of Bitcoin is one of the main factors influencing the cryptocurrency’s performance in 2023. Major businesses and financial organizations have begun dedicating a portion of their portfolios to BTC in recognition of its usefulness as an inflation hedge. In addition to boosting Bitcoin’s legitimacy, this institutional inflow also helped drive up its price.

Even if If #Bitcoin doesn't do another 800% Price jump within the next 8-10 years, and "only" goes up 80-100% from here it will still be a better investment than the most profitable stock market of the world (US stocl market).#BTC is the best performing asset in history, dont 😴

— Bitcoin FACTS (@Scavacini777) August 6, 2023

BlackRock, the biggest asset management company in the world with almost $10 trillion in assets under management, submitted an application for a Bitcoin spot ETF on June 15. Other organizations, including Fidelity and others, were prompted by this action to submit a similar application for a spot ETF.

In the midst of these developments, the price of bitcoin nearly doubled from about $16,000 to over $31,000, surpassing other important assets like gold, the S&P 500, and the Nikkei 225 index. However, BTC currently trades at $29,161.28.

Additionally, the Bitcoin blockchain saw the development of Ordinals in the first half of 2023. The Ordinals Inscriptions are like NFTs. They enable the inscription of text, audio, and images onto a Satoshi, the smallest Bitcoin denomination.

Ordinals drove Bitcoin’s average daily transaction volume to a record high during the height of its growth. So, this resulted in increased network fees.

In addition, BTC’s performance this year has also been greatly influenced by regulatory clarity. Governments globally are starting to accept digital currencies and have established clear policies and rules for trading and using them.

Furthermore, retail and institutional investors alike now have more confidence as a result of the regulatory clarity So, more people feel secure participating in the Bitcoin market.

People see Bitcoin as a safe haven asset

Another reason for the massive participation in BTC is that most people see it as a safe haven asset, especially during these times of global economic breakdown. Investors globally have used Bitcoin to protect their wealth from inflation.

In addition, countries in Africa, Asia, and Latin America rely on Bitcoin for remittances. Bitcoin-based cross-border payments are not only cheaper but also a faster alternative for these users.

#bitcoin is the best performing asset since last 11 years & it may continue this trend for many years.

It is mind boggling that, still most of the people are not interested to find out, what is that hidden thing or secret for its success?

It is time folks: #studybitcoin #btc… pic.twitter.com/r9Df5MKIw1

— ₿itWarrior ∞/21M 🌋⚡️🕳🐇🍊💊 (@bitwar21) August 12, 2023

Bitcoin’s role as the best-performing asset in 2023 shows how much acceptance and interest it has received this year. Both individual and institutional investors have been drawn to it because of its decentralized structure and potential for an increase in value. We also anticipate Bitcoin’s position as a store of value and a medium of exchange to grow as the globe adopts decentralized banking and blockchain technology.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours.We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.