As the debt ceiling crisis looms, bond and equity markets are feeling the jitters. Investors are anxious about the possibility of a historic default, but amidst the chaos, there may be a glimmer of hope for one asset: Bitcoin. Let’s dive in!

Market Scene

The banking crisis shows no signs of abating, with First Republic Bank becoming the latest casualty, sending shockwaves through the market. However, to everyone’s surprise, this bad news did not tank the market. Instead, it sparked a rally in the bitcoin and altcoins market, just like the last banking crisis.

Last time, the feds intervened to save the day, but this time the US Government refused to step in, leaving everyone wondering how the banking crisis would play out.

Adding to the uncertainty were concerns about several dormant BTC whales and ETH addresses that suddenly became active. While this is not uncommon, the sudden surge in activity raised suspicion.

Could someone have found a way to compromise old wallets? Or were people arrested during the Silk Road era finally accessing their old funds?

Staying vigilant about potential sell pressure and security risks is always essential.

Just as the market seemed to be recovering midweek, a curious market dump occurred, attributed to alerts that Mt Gox and US Government wallets were moving funds, causing panic among investors. While it turned out to be a false alarm, the funds in question will eventually hit the market, leaving many wondering if another dump will follow.

The Federal Reserve will announce its latest interest rate decision on May 3rd, and investors anticipate a 0.25% increase. As this is the most probable outcome, we can expect it to have a neutral to positive impact on both the crypto and general financial markets.

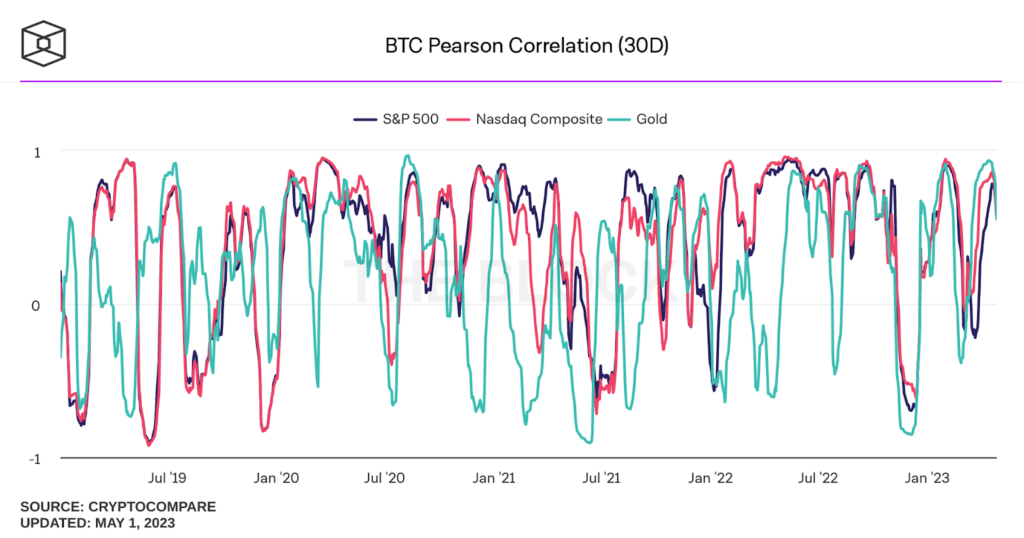

Source: The Block

However, given the decreasing correlation between cryptocurrencies and major stock indices, the impact may be closer to neutral.

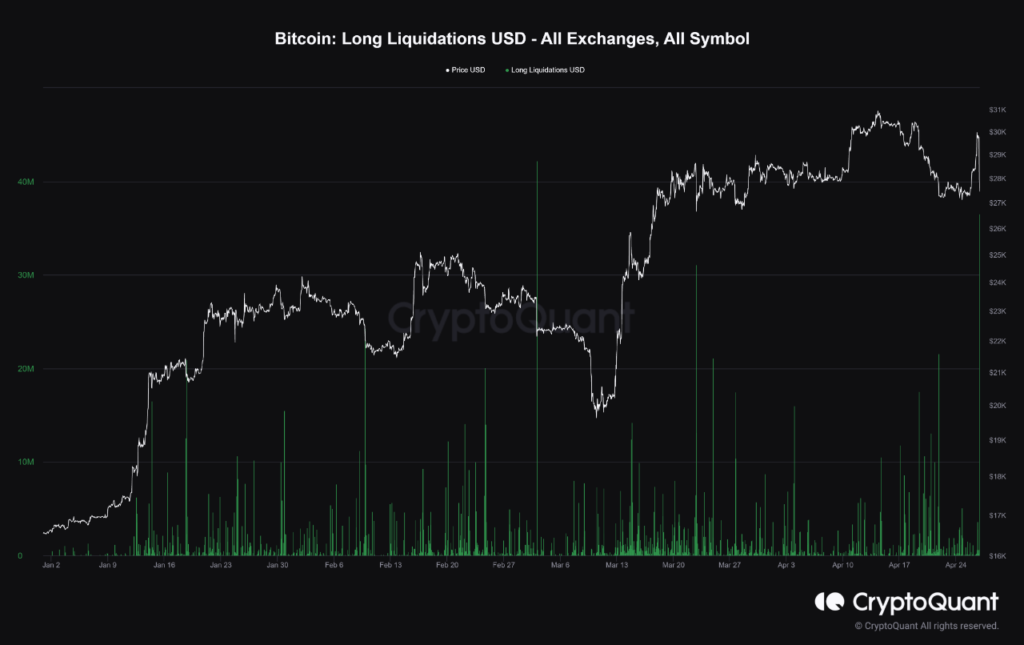

One area of concern we need to monitor closely is the amount of leverage in the crypto market. The recent sudden price dip was primarily caused by nearly $200 million of liquidations, mainly from leveraged long positions.

The crypto exchange, OKX, saw over $52 million in bitcoin futures liquidations on its platform, while Binance followed with $38 million in liquidations. Meanwhile, BitMEX witnessed the most significant single liquidation order, a bitcoin/tether trade worth $6 million.

Source: CryptoQuant

The high level of leverage in the crypto market is a cause for concern because even minor positive or negative news can result in significant price fluctuations caused by cascading liquidations or massive short squeezes.

The Regulatory Scene

The regulatory landscape surrounding cryptocurrencies remains uncertain, but one thing is clear: the U.S. government is continuing its push to exert greater control over the industry.

The Commodity Futures Trading Commission (CFTC) has warned that anonymity in crypto represents a national security threat, a stance that could signal future strict policies.

Besides, the CFTC has also suggested a potential settlement in the ongoing lawsuit against Binance. However, many other players in the crypto space are also facing lawsuits, including Binance’s CEO, CZ.

Moreover, this heavy regulation is already significantly impacting industry players, with Binance.US pulling out of a deal with Voyager due to regulatory concerns. Circle’s CEO has also hinted at the possibility of the company exiting the U.S. market, and Bybit has recently imposed mandatory KYC procedures.

However, not all industry players are willing to submit to government overreach without a fight. Coinbase has filed a lawsuit against the SEC to obtain regulatory clarity on cryptocurrencies, and Bittrex has also indicated its intent to contest the SEC’s charges against them.

Today, we filed a narrow action in the U.S. Circuit Court to compel the SEC to respond “yes or no” to a rulemaking petition we filed with them last July asking them to provide regulatory guidance for the crypto industry. 1/4 https://t.co/rlsS1DIFfl

— paulgrewal.eth (@iampaulgrewal) April 25, 2023

A South Korean court ruled Terra Classic not to be a security but has indicted Terra co-founder Daniel Shin. It suggests that both the U.S. and South Korea want to make an example out of Do Kwon and save face after many investors suffered losses on Luna.

Meanwhile, Hong Kong is poised to issue crypto company licensing guidelines in May, though it’s uncertain when exactly this will happen. Hong Kong has been rapidly moving towards crypto adoption, with officials recently reminding banks to offer services to crypto companies and issuing a demand for such services shortly after.

IMF: The Villain

The IMF is arguably a controversial player in the global finance arena. Last year in May, the Central Bank of Argentina imposed a comprehensive ban on cryptocurrencies and prohibited institutional access to them.

This decision adversely affected the Argentine people, who rank 13th globally in crypto adoption due to high inflation and the need for a store of value. In isolation, the ban seems illogical, but Argentina is not operating in isolation. In March, the IMF approved a $45 billion loan to Argentina to tackle the country’s fiscal challenges, with conditions that included a stance against crypto.

Essentially, the IMF forced Argentina to choose between the loan and crypto, leaving them no choice. As a result, the Argentine Congress approved the IMF debt deal, discouraging crypto use. The IMF’s actions demonstrate its reluctance to let countries break free from the fiat system for which it is responsible.

The government of Argentina recently published a Letter of Intent entitled “Strengthening financial resilience,” which discourages the use of cryptocurrencies to prevent money laundering, informality, and disintermediation. This provision appeases the IMF’s demands, which come with a $45 billion loan to address the country’s pressing fiscal challenges.

Argentina has been a basket case for decades, because it’s uniquely targeted by the US, IMF and the World Bank.

Its economy is wrecked by ultimate debt traps, but the politicians and the elites keep making the same mistakes. Quite incredible! pic.twitter.com/s0RsFthf7s

— S.L. Kanthan (@Kanthan2030) April 13, 2023

However, this decision is devastating for the people of Argentina, where:

- Over 40% of the population lives below the poverty line.

- Inflation reached as high as 103% in February of this year.

Moreover, with prices of goods and services doubling annually and with crypto off the table, the IMF has prevented a desperate country from exploring new financial opportunities, trapping them as a fiat debt slave.

The IMF has made no secret of its stance on cryptocurrency.

In February, the organization voiced its concern about El Salvador’s adoption of Bitcoin, warning against financing Bitcoin purchases through tokenized securities due to fiscal and legal risks.

It is not an isolated incident; the IMF has a history of targeting countries that turn to cryptocurrency as a solution to their financial woes. For example, a $1.3 billion loan to El Salvador has been stalled for over a year, potentially scrapped due to the country’s adoption of Bitcoin.

The IMF’s behavior suggests a desire to maintain a fiat monopoly, even at the expense of impoverished nations. The Central African Republic’s adoption of Bitcoin was met with similar resistance from the IMF, citing legal, transparency, and economic policy concerns.

However, the IMF’s attempts to quash cryptocurrency adoption may prove futile in the long run. Undoubtedly, decentralized, digital, and immutable tech like Bitcoin will prevail against centralized institutions like the IMF.

Also a year ago, the IMF told El Salvador to stop using bitcoin and focus on fiat debt slavery.

Yet it is Argentina that is defaulting today, while El Salvador paid off its bonds. pic.twitter.com/Z7PFT5yRz8

— Saifedean Ammous (@saifedean) April 24, 2023

Now let’s look at the on-chain data.

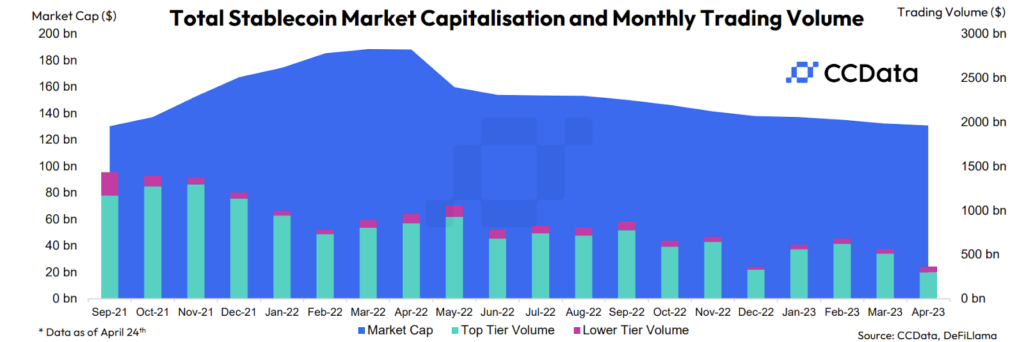

Stablecoin Market Cap Sees 13th Straight Month of Decline

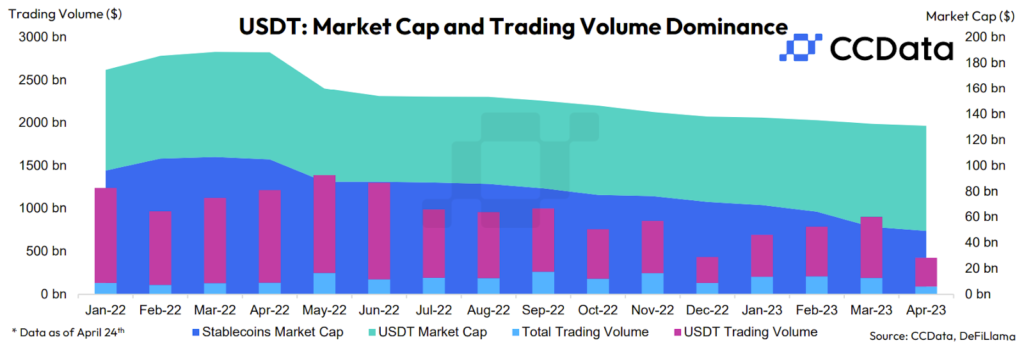

Stablecoins experienced a decline in their market capitalization in April 2023. The total market cap decreased by 1.08% to $131bn, the lowest since September 2021. This trend of decline has persisted for thirteen consecutive months, indicating a sustained decrease in demand for stablecoins.

Despite the decline in market capitalization, stablecoin trading volume grew by 13.6% in March 2023, reaching a value of $775bn.

Source: CCData

This growth was primarily due to several stablecoins losing their peg during the month. However, trading volume for April 2023 seems to be on track for a lower monthly figure, with only $365bn traded.

USDT Dominates Stablecoin Trading Volume

In contrast to the overall decline in stablecoins market capitalisation, USDT, one of the most widely used stablecoins, experienced a rise in market cap in April 2023. Its market capitalisation increased by 2.03% to $81.5bn, bringing it closer to its all-time high of $83.7bn recorded in May 2022.

Source:CCData

Furthermore, USDT’s market dominance continued to increase for the fifth consecutive month, reaching 62.1% in April – the highest since April 2021. This data suggests that USDT is gaining more traction in the stablecoin market than other stablecoins.

Moreover, USDT’s dominance is further reflected in its trading volume on centralized exchanges, accounting for 79.0% of all trading volume with stablecoins in April 2023. With 2,931 trading pairs, USDT is the largest counterparty on centralized exchanges, followed by USD with 2,246 trading pairs.

Aggregate Market Transitions to Unrealized Profit

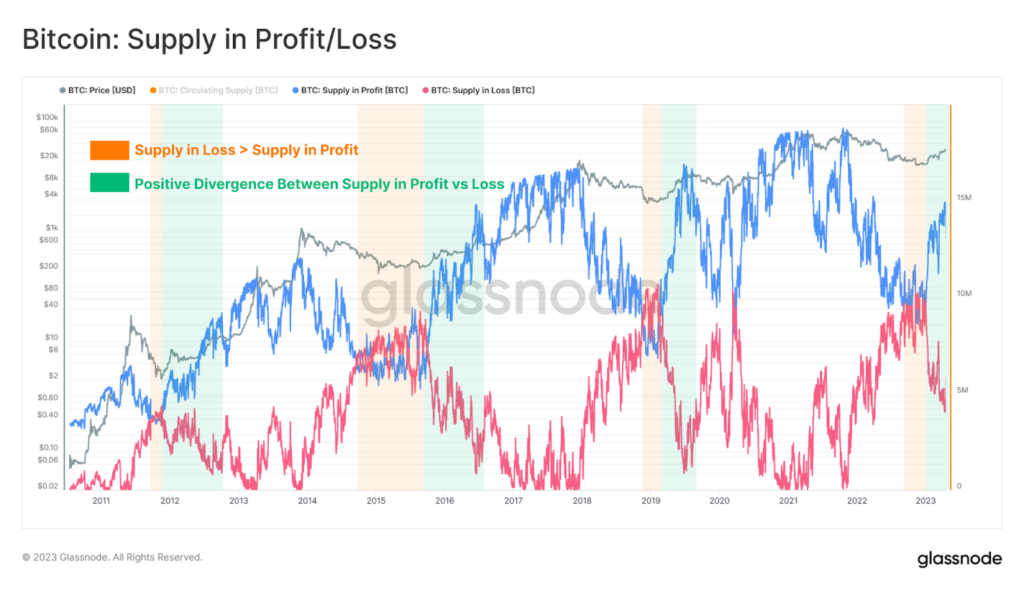

The aggregate market has started 2023 on a solid note, moving out of a phase of unrealized losses and into one of unrealized profits.

The significant divergence between the amount of supply held in profit and loss indicates this scenario. As a result, there is a growing incentive to take profits.

Source: Glassnode

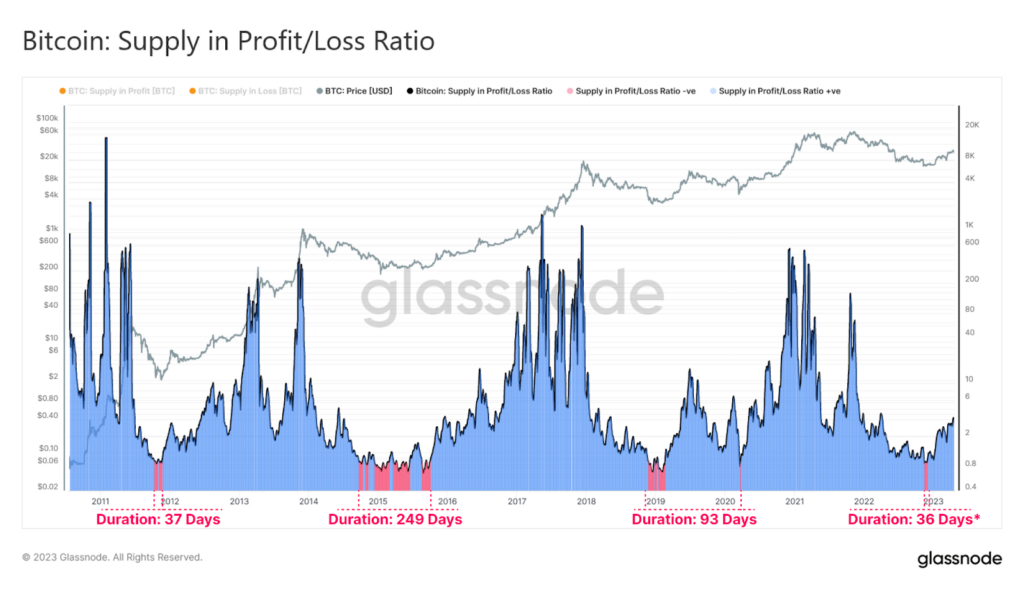

This shift is also evident in the ratio between the supply in profit and the supply in loss. Moreover, this oscillator has reached escape velocity this year, confirming the move away from a period of loss dominance, which occurred on only 415 out of 4638 trading days (9%).

Source: Glassnode

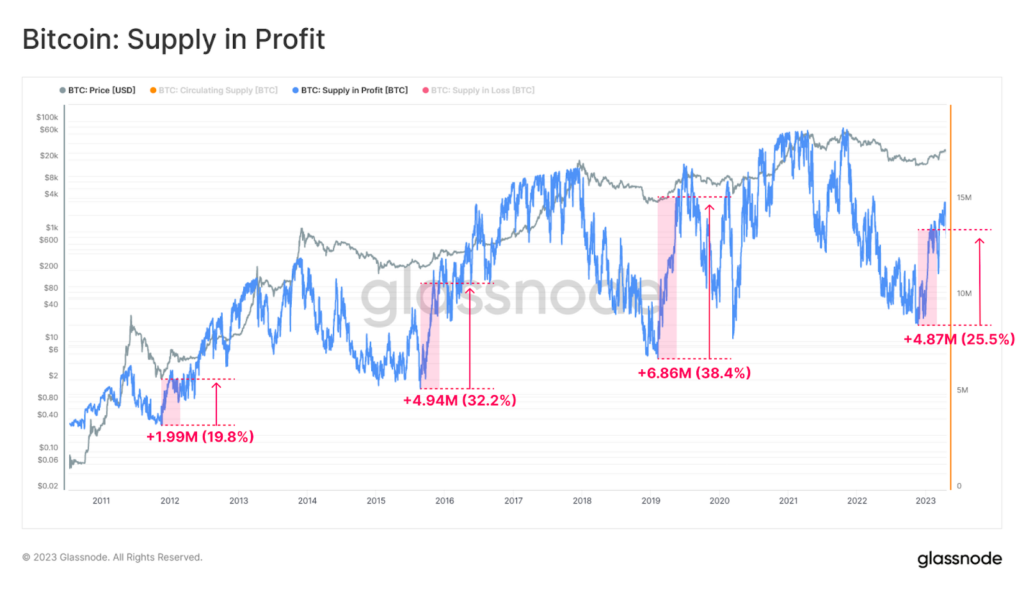

The price rising above the dense concentration of supply accumulated during the bottoming formation process has mechanically driven this rebound in unrealized profit. We can measure this phenomenon by looking at the 100-day change in profitable supply after major cycle lows in both BTC and the Percent of Circulating terms:

- 2011 Cycle Low: +1.99M BTC (19.8%)

- 2015 Cycle Low: +4.94M BTC (32.2%)

- 2019 Cycle Low: +6.86M BTC (38.4%)

- 2022 Cycle Low: +4.87M BTC (25.5%)

The current cycle has seen a comparable volume of supply re-entering a profitable position, indicating a similarly robust floor.

Source: Glassnode

As the market transitions towards a regime of unrealized profit, an increased incentive exists to take profits. Consequently, it may impact future market dynamics as investors decide whether to hold or sell their positions.

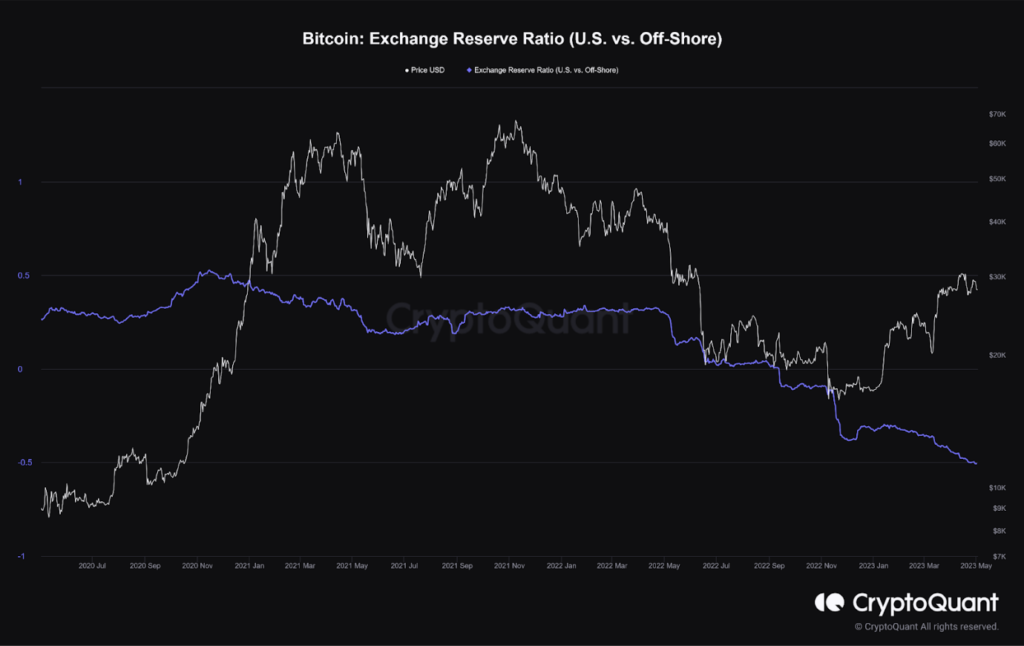

Reserve of Bitcoin in US Exchanges on the Decline

The data from CryptoQuant suggests that the Bitcoin reserve at American exchanges is declining, a trend observed across all CEXs in the long term.

Source: CryptoQuant

However, the decline in reserve appears to be more significant on American exchanges, which may be due to the recent regulatory demands of the US Securities and Exchange Commission (SEC).

The SEC’s recent restrictions may have led American investors to lose confidence in the domestic exchanges, prompting them to shift their Bitcoin holdings to offshore exchanges or personal wallets.

So, if American policymakers continue to pressure the cryptocurrency industry, they risk hampering its growth and innovation. As the market becomes increasingly global, regulatory burdens in one country may push investors to seek more favorable jurisdictions elsewhere.

Therefore, regulators must balance their oversight with support for the industry to prevent stifling innovation and investment.

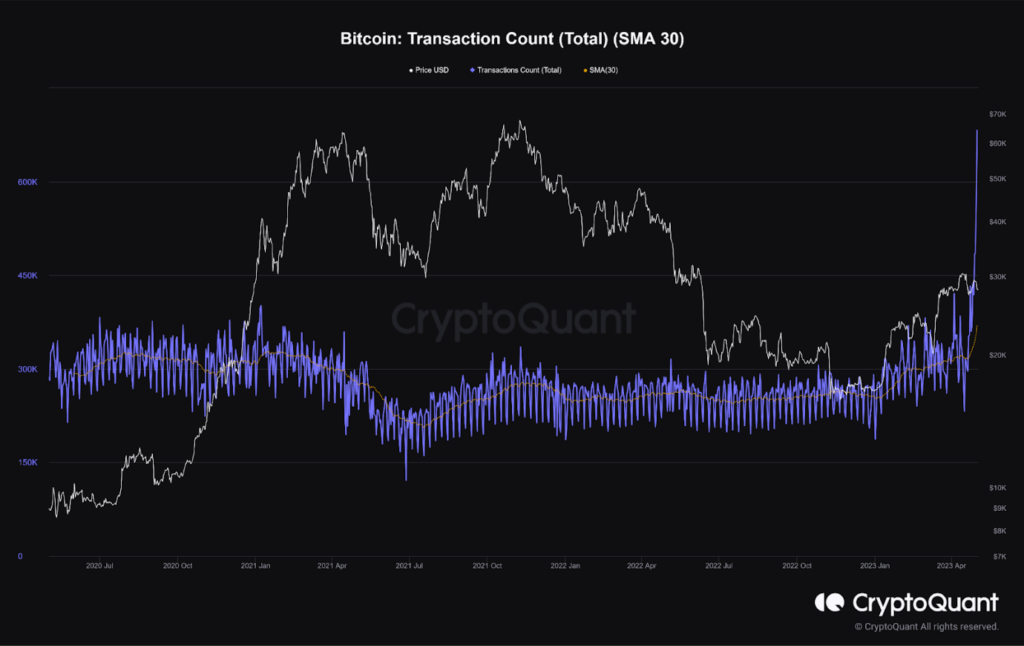

BTC Transaction Count Hit 22-Months High

According to data from a 30-day moving average, the Transaction Count for Bitcoin has reached a 22-month high, exceeding 682K transactions.

This metric reflects the number of transactions on the Bitcoin network during a specific period. As such, it is helpful in assessing Bitcoin’s growth and adoption and identifying trends and patterns in transaction activity.

Source: CryptoQuant

The transaction count was low during Bitcoin’s early days due to limited adoption and the network’s infancy. However, as more people began to use Bitcoin, the transaction count snowballed.

Besides, the transaction count is an essential metric for assessing the overall health and activity of the Bitcoin network.

High transaction counts indicate a high demand for Bitcoin and show that users use it for various purposes, such as buying and selling goods and services, making investments, or transferring funds.

Moreover, the recent increase in transaction count is significant because scaling solutions like Lightning network and SegWit have been implemented to alleviate pressure on the Bitcoin network and facilitate faster, more efficient transactions.

Undoubtedly, the increase in transaction count is evidence of the success of these scaling solutions and the growing adoption of Bitcoin among users. It also suggests the potential for continued growth and expansion in the cryptocurrency market as more people become interested in Bitcoin.

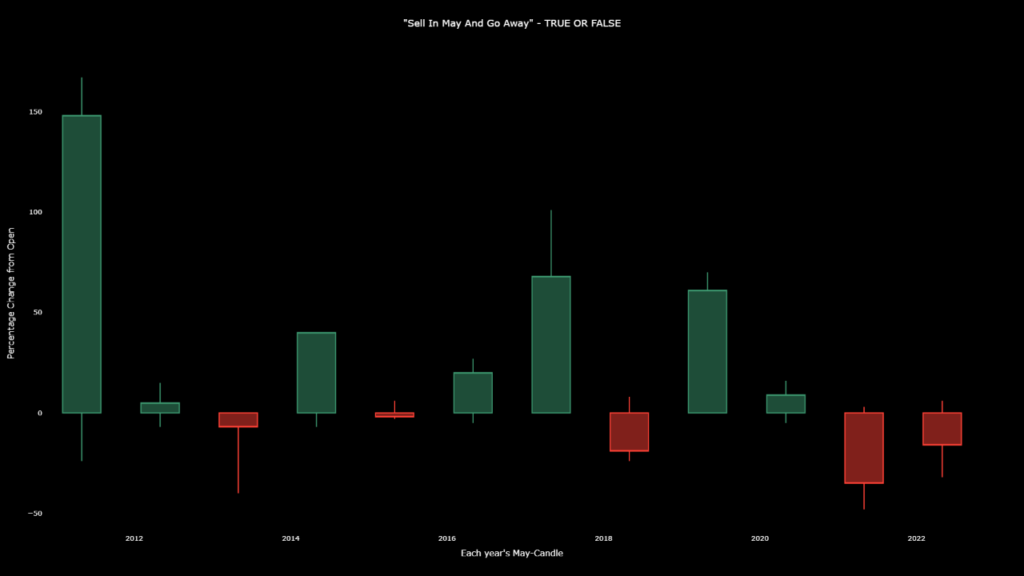

Sell in May and Go Away?

The “Sell in May and go away” principle has been a common practice in traditional finance, but history shows mixed results when it comes to Bitcoin.

While the principle doesn’t seem to work for Bitcoin directly, we can see some interesting observations.

Source: CryptoQuant

Looking at the chart of Bitcoin’s monthly candles over the last 12 years, we see seven out of twelve May candles were green, indicating positive returns.

- However, the size of these green candles has been diminishing over time, which could suggest a decline in Bitcoin’s maximum gains.

- Furthermore, the last two May candles have been red, indicating a sell-off in May.

While this doesn’t necessarily mean that the principle applies to Bitcoin, it does highlight the potential for some seasonality in the market.

It’s important to note that the “Sell in May and go away” principle doesn’t just apply to May but suggests moving to cash or less risky assets for the summer months and returning to the market later in the year.

Moreover, additional research into this strategy with Bitcoin may be worth exploring, but for now, it seems that the principle doesn’t strongly impact Bitcoin’s market behavior.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.