Binance CEO Changpeng “CZ” Zhao announced his resignation from the exchange on Tuesday. His resignation was part of a settlement deal with the US Department of Justice (DOJ).

The deal would see Binance pay a $4 billion settlement fine to continue its operations. The exchange was also required to announce a leadership change. Let’s discover more about this important news.

How did the Crypto Ecosystem React to CZ’s resignation?

As one would have expected, the crypto market reacted to this news. Futures traders, betting on further growth, felt this impact the most. Exchanges have liquidated $227 million worth of crypto perpetual futures positions in the last day. Almost 80% of the total was made up of bullish longs. Bitcoin also reacted to the news. BTC fell by roughly $2,000 to $35,600. However, BTC has now stabilized at $37.642.

It should come as no surprise that Binance’s BNB coin took the biggest hit from the situation. In a matter of hours, BNB dropped from a five-month high of almost $270 to a three-week low of $222. However, the asset has since gained some ground and is now valued at more than $235.

Bitcoin has been on a good run lately. But many believe the Binance settlement deal and CZ’s resignation could spell doom for the market. But that’s not what the experts think. Let’s see what experts think the future holds for Bitcoin.

#BNB volatility exploded as US dropped the hammer:

🔸 Price crashed 15% after DoJ news

🔸 CZ resigned

🔸 Binance is solvent & has a new CEO

🔸 Key support at $230 & $200Bias is bearish, but I am optimistic so long $200 holds.

More in my 1 min TA video, like & follow! 💪 pic.twitter.com/37R5veF9Ib

— Duo Nine ⚡ YCC (@DU09BTC) November 22, 2023

Is This Situation Bad for Bitcoin?

A lot of cryptocurrency investors and business executives consider the settlement to be a good thing. If Binance’s legal issues are resolved, the market as a whole may be spared serious danger. Some experts believe this settlement improves investor confidence in crypto. And it could hold bullish sentiments for bitcoin.

Some others believe the settlement could pave the way for the approval of a spot bitcoin ETF. In order to comply with anti-money laundering and sanctions regulations, among other things, Binance agreed to be subject to compliance monitors from the Justice Department and Treasury for a maximum of five years.

The U.S. SEC previously cited market manipulation as a reason for rejecting spot Bitcoin ETFs. But the deal with Binance, the biggest player in crypto, could eliminate that limitation.

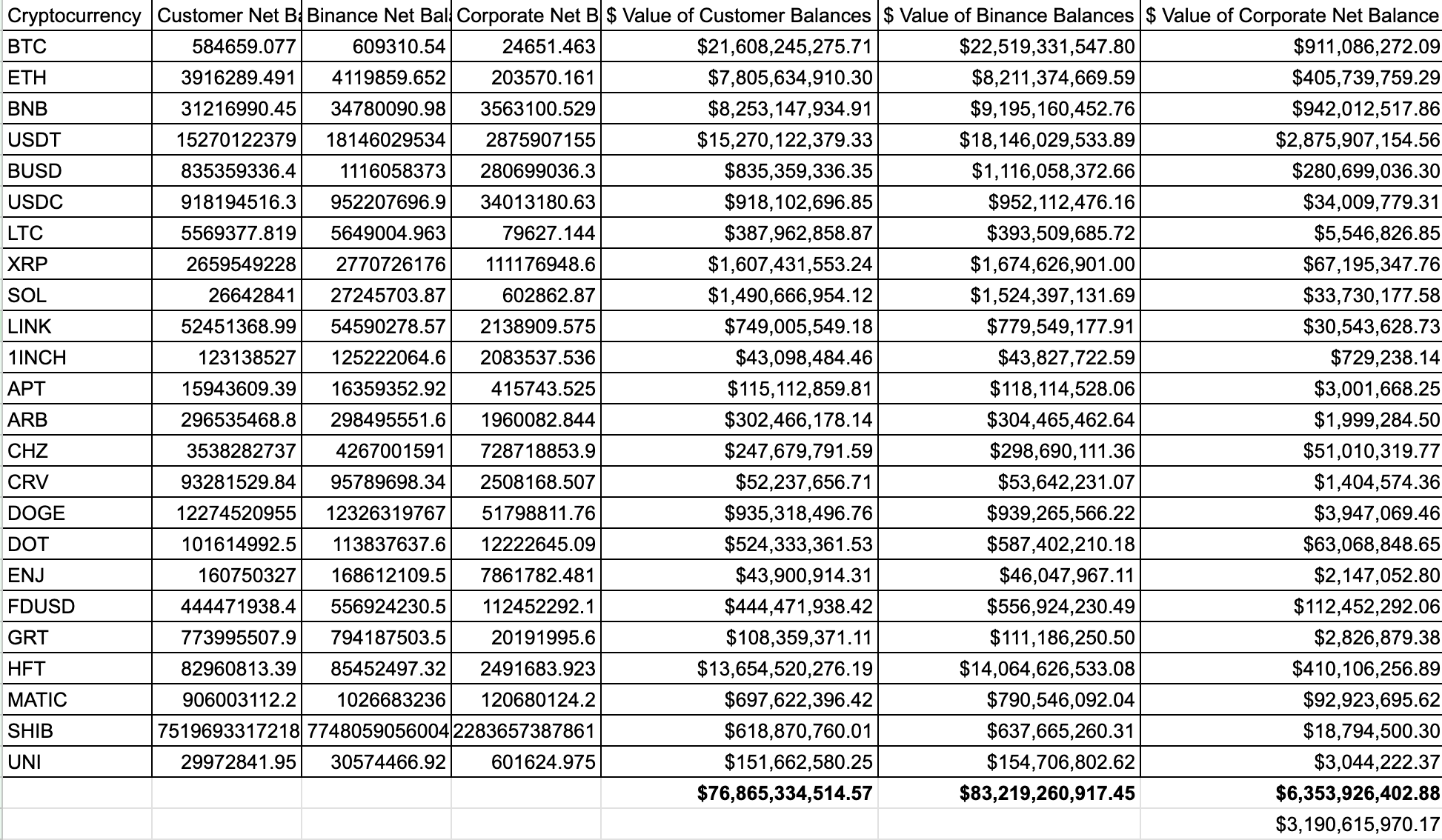

JUST IN: Binance has lost over $1 Billion in net worth (between outflows and lower asset prices) since CZ stepped down today 😮 pic.twitter.com/nrMWmW46KS

— Bitcoin News (@BitcoinNewsCom) November 21, 2023

Some said the SEC was concerned about Binance’s market dominance. But the settlement curbs that power. So, the regulator could possibly approve BlackRock’s application soon.

One Twitter user wrote: “There is no chance, and I mean zero, that this ETF is approved with Binance in its current position of market dominance. If this ETF is approved, Binance is either gone entirely or their role in price discovery is massively diminished.”

Further Impacts on Binance

As expected, there’ve been several conspiracy theories about the situation at Binance. One of the widely peddled beliefs is that the DOJ’s hunt for Binance’s market share was in favor of BlackRock.

Some users claimed BlackRock closely collaborated with the US government to approve its spot bitcoin application. One YouTuber, Colin Talks Crypto, remarked that Binance’s settlement happened “right before a Bitcoin ETF comes out.”

Does it seem fishy to anyone else that #Binance is being found guilty of money laundering right before a #Bitcoin #ETF comes out?

Is there any connection?

For example:

• Is it a way for BlackRock to acquire a massive amounts of BTC for cheap/free?

• Is it a way to remove…— Colin Talks Crypto 🪙 (@ColinTCrypto) November 21, 2023

Colin asked in a recent tweet, “Is it a way for BlackRock to acquire massive amounts [sic] of BTC for cheap?” “Is it a way to remove competition from U.S. markets right before the ETFs go live?”

Binance derisking is one of the biggest catalysts we could have in crypto.

+ Crypto is a "real" industry post $4 billion settlement

+ CZ takes a long-needed Miami vacation a la Arthur

+ Market rips higher, ETFs approved in Jan

+ GOP wins 2024 election, crypto laws passed🫡 CZ

— Ryan Selkis (d/acc)🪳 (@twobitidiot) November 21, 2023

Some pointed out that BlackRock and its rival Vanguard jointly own 11.5% of Coinbase, Binance’s main rival. They suspect that the action against Binance might have been orchestrated in favor of BlackRock. BlackRock recently met with the SEC and discussed how it could employ an in-kind or in-cash redemption approach for its spot BTC ETF.

A piece of news as huge as CZ’s resignation is bound to draw speculations from different points. But what many agree on is that this could have bullish sentiments for Bitcoin. However, only time will tell.