Once the SEC approved the BTC spot ETFs, it was a matter of time before new BTC ATHs would arrive. We not only have 11 spot ETFs, but also a new Dencun upgrade for Ethereum and the Bitcoin halving around the corner. Solana is in the midst of all this, and its price keeps rising.

So, let’s take a look if Solana can get to a new ATH in the current market surge.

The Current Situation According to Tristan Frizza, CEO and Founder of Zeta Markets

Tristan Frizza, CEO and Founder of Zeta Markets gave his view on the current situation. He expects Solana to be in the blockchain top 3 rather sooner than later. Many indicators are pointing in this direction. For example, growing engagement in DeFi. The overall TVL reached $100 billion again.

Another important occurrence he noticed is Solana’s number of daily transactions. It already managed to outnumber combined transactions of:

- Ethereum.

- Arbitrum.

- Avalanche.

- Tron.

- The BNB chain.

- Optimism.

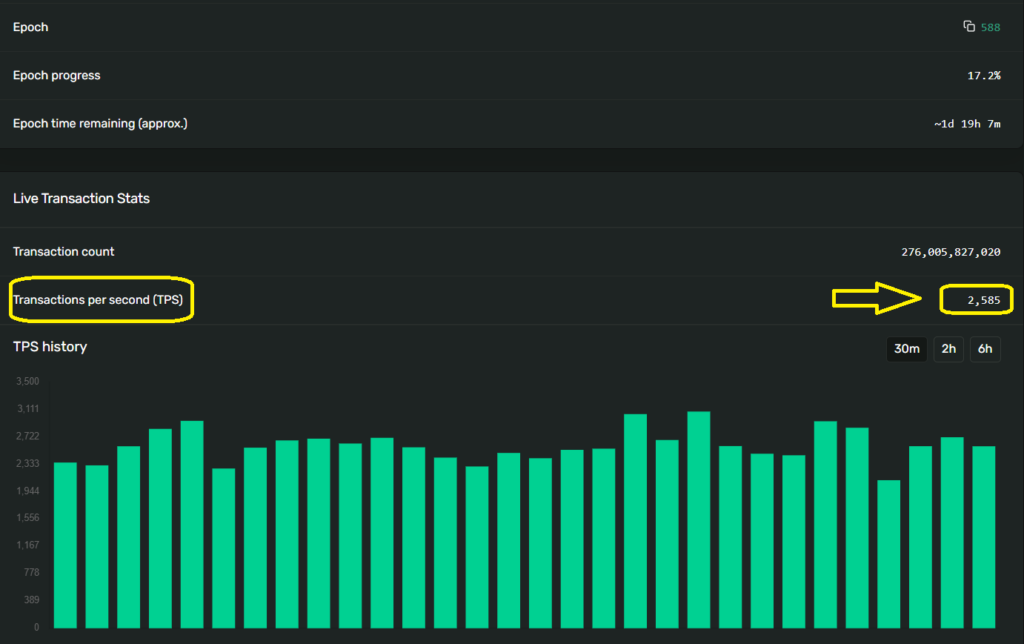

Although, the current situation is that Solana can’t get beyond 2,500 TPS. In theory, it can handle up to 65k TPS (transactions per second). See the picture below.

Source: Solana explorer

Furthermore, Frizza expects $SOL to cruise past its previous ATH of $260. He bases this observation partially on the spike of new wallets. It shows that users are actively using the network. He said that since late February, Solana DEXes has had over $2 billion in daily volume.

He also mentioned that Solana will be able to keep offering lower gas fees compared to Ethereum. Even after the Dencun upgrade. All these factors lead to him believing that a new SOL ATH is in the cards.

Bitcoin Spot ETFs

The Bitcoin spot ETFs didn’t waste much time to push the BTC price up. We’re currently in unchartered territory. Bitcoin started a price discovery journey. Its most recent ATH of $73,737.94 is only 3 hours away from the time of writing.

So, let’s put the BTC spot ETFs in perspective. Currently, there are 900 BTC mined per day. After the halving, in a bit more than a month, that goes down to 450 BTC per day. At the same time, BlackRock and Fidelity buy 9,000 BTC per day. These are only 2 out of the 11 spot ETF funds. In other words, a Bitcoin supply shock is imminent. This will only put more positive pressure on the BTC price.

Conclusion

Solana is making the most out of this bull run. Although it’s still well below its current ATH of $260, it’s doing great. Its current price just reached $172. Tristan Frizza, CEO and Founder of Zeta Markets expects Solana to become a top 3 blockchain by market cap. However, it’s not only Solana, the whole crypto market is surging. That’s because the BTC spot ETFs are creating a BTC supply shock.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.