Crypto users ended 2023 excited about the impending approval of spot Bitcoin ETF applications. For many, the arrival of this product marked the beginning of a new era for the market.

To some, spot Bitcoin ETF approval means wider mainstream adoption of cryptocurrencies. For others, it was the final hurdle for Bitcoin to become a major asset globally.

How Spot Bitcoin ETFs Fared in the First Week of Trading?

Fortunately, the SEC gave the nod to 11 spot Bitcoin ETF applications on January 10th. The event was met with wild jubilations from various corners of crypto Twitter, with many expecting massive gains and liquidity in the market. While it is too soon to conclude on the performance of Bitcoin ETFs, their performance in their first week of going live offers a glimpse of insight into what the future holds.

FalconX, a leading institutional digital asset prime brokerage, recently published a report on the performance of spot Bitcoin ETFs from launch to the first week. The report provides key insights into how this product has settled over the past few days as well as the brewing competition in that sector.

From Launch to Week One: How Did They Perform?

The introduction of the spot BTC ETF and the influx of capital that followed garnered significant interest, extending beyond crypto enthusiasts to a broader audience interested in investing. Spot BTC ETFs attracted an impressive $3.3 billion in gross inflows during the initial five days, and notable issuers like Blackrock and Fidelity each exceeded the $1 billion Assets Under Management (AUM) milestone.

However, FalconX considers the net figure to be around $1 billion. It reached this estimate excluding the $2.2 billion outflows from GBTC, the lesser known $200 million outflows from BITO, alongside other factors.

The report claims that the $1 billion figure closely aligns with what experts initially estimated the market to anticipate as net inflows during the first week or two.

JUST IN: 🇺🇸Grayscale's spot #Bitcoin ETF had ~$660 million in outflows yesterday — Bloomberg's Eric Balchunas pic.twitter.com/IxCbpAIS1I

— FlameseN アナリスト ₿ (@TraderFlameseN) January 23, 2024

The first of trading produced impressive numbers ($4,6 billion). Those figures seem to confirm the expectations many had of spot Bitcoin ETFs. The FalconX report considers the launch of spot Bitcoin ETFs as one of “the most successful in history” considering the figures from the first week.

Two Major Forces at Play

The report identifies two major, conflicting forces at play in the spot bitcoin ETF scene. The first involves top and larger issuers like Blackrock and Fidelity. The report states that both are consistently attracting substantial inflows, amounting to hundreds of millions of dollars daily.

Grayscale, on the other hand, is experiencing outflows in the range of $500 million per day. Many believe these outflows are strongly behind Bitcoin’s declining performance.

Good Morning.

In less than 15 trading sessions.

The new ETF’s are holding 100,000 #Bitcoin.

They haven’t even started deploying capital yet.

Wake up.

Get to ONE #Bitcoin.

— British HODL ❤️🔥🐂❤️🔥 (@BritishHodl) January 24, 2024

FalconX expects these forces to gradually decrease in impact over the coming months. However, the big task lies in identifying which of these forces will diminish first. Secondly, expect to anticipate which of the situations will have a long-term dominance in the market.

The author of the FalconX report predicts that “the strong inflow trend may initially taper down faster than the GTBC outflow.” He explains that “it is normal for ETF flows to recede from their launch levels and build sustainably from there,” adding that “it’s only anyone’s guess when the Grayscale outflows will shrink, but it’s not showing any signs of it so far.”

🚀 Update on US Spot #Bitcoin ETF net inflows sees total of $1.06B in first seven days pic.twitter.com/DT2YXC6f8C

— Crypto.com Research & Insights (@cryptocom_rni) January 24, 2024

Other Top Trends

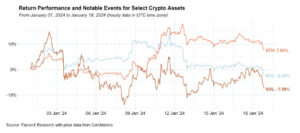

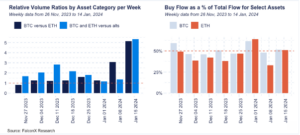

After the spot ETF debut, BTC has been the most active currency on our desk. More than 5 times as much BTC as ETH flowed through our desks. This ratio was last exceeded during the market turbulence in the middle of 2022. The majority of clientele, including ETF issuers, made stronger purchases, although hedge funds were more active sellers.

For ETH and BTC, the overall buy/sell ratios were pushed above one. Ethereum layer 2 projects like ARB, OP, and MATIC saw selling interest, while SOL showed buying interest among other altcoins.

Source: FalconX

Shift in BTC Order Book Dynamics as Depth Expands

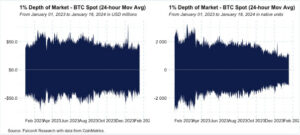

Projections surrounding the ETF introduction resulted in increased trading volume and increased investor familiarity with leverage. Relatively short-order books greeted this fresh interest. So, as we have been emphasizing for some time now, this was a major contributing element to the robust price movement that has been observed since October 2023.

The BTC 1% book depth has significantly increased by 30–40% after the ETF debut, after previously being at or below 1,000 BTC. The chart below demonstrates how the depth of the book has gradually increased from the levels shown before the ETF launch, although being still far lower than it was in October 2023.

Source: FalconX

Swift Recovery: ETH/BTC Ratio Returns to 0.06

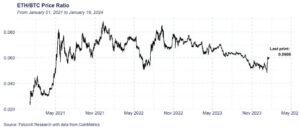

When ETH would cease underperforming BTC was one of the key subjects of discourse with investors over the past few months. The ETH/BTC ratio swiftly rebounded after falling below 0.05, the lowest point since May 2021.

Source: FalconX

The pace of the rebound was unexpected, even though the recovery itself was not. The focus shifts to the continuing spot ETH ETF applications, which could be authorized by May 2024. Also, the impending Dencun upgrade, which would increase Ethereum’s scalability, were two more evident price drivers.

Conclusion

The author remains “confident that the ETF inflows will ultimately dominate and prove an incredible supporting factor for prices.” He explains that “unlike IPOs, which typically go through a weeks-long book-building process before listing, ETFs launch only with relatively small seed investments and gather assets afterward.