With the exponential growth of the crypto economy, DeFi has witnessed a surge in popularity and widespread adoption. Curve Finance stands out among the DeFi protocols operating on Ethereum.

In this article, we will explore the unique characteristics that set Curve Finance apart from other DeFi platforms constantly emerging in the space.

What is Curve Finance?

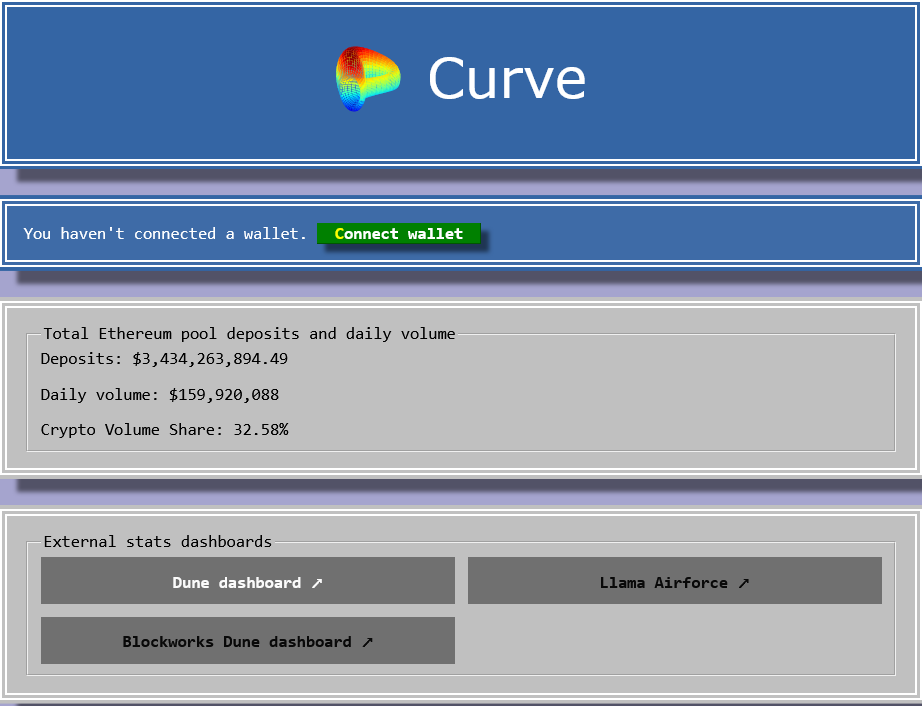

Curve Finance is an automated market-making protocol that facilitates efficient and cost-effective swapping of stablecoins. As a decentralized liquidity aggregator, it allows individuals to contribute their assets to different liquidity pools and receive rewards through fees generated by trades.

By leveraging Curve, users can benefit from low-slippage transactions and enjoy the advantages of participating in a decentralized ecosystem. More specifically, it offers effective and low-slippage trading for assets such as several renditions of the US dollar (USD).

Source: Curve Finance

Curve Finance is an automated market maker (AMM) platform that shares similarities with Uniswap and Balancer. However, what sets Curve apart is its unique focus on liquidity pools comprised of assets similar to stablecoins and wrapped assets like wBTC and tBTC.

By adopting this approach, Curve leverages more efficient algorithms, resulting in significantly lower fees, slippage, and impermanent loss than other DEXs on Ethereum. Moreover, Curve Finance incentivizes users who provide liquidity to Curve’s pools with its native token, $CRV, as a reward for their contributions.

Besides, $CRV holders can participate in the platform’s governance actively. It includes the privilege to vote on proposed modifications (such as alterations to the fee structure), ensuring that the community has a say in shaping the future of Curve Finance.

How Does Curve Achieve Low-Slippage Trading?

Curve Finance employs a specialized automated market maker (AMM) algorithm for stablecoins. Unlike conventional order book systems, users engage directly with the AMM for their trades. This unique algorithm capitalizes on the inherent stability and minimal price volatility of stablecoins.

Source: Twitter

By leveraging this characteristic, Curve Finance facilitates highly efficient and low-slippage trading experiences. It particularly excels in swapping tokens within a similar price range. This exceptional feature empowers users to manage their stablecoin positions effectively and access liquidity across various stablecoin assets.

Undoubtedly, Curve Finance is a vital component of the DeFi ecosystem, and it significantly enhances the trading landscape for stablecoins.

The Team Behind Curve Finance

The man behind Curve Finance is Michael Egorov. He formerly worked at LinkedIn and holds a Ph.D. in physics from Swinburne University of Technology.

Source: Twitter

Curve Finance resonates with Egorov’s vision of revolutionizing DeFi. Working alongside Egorov are two developers, Angel Angelov and Ben Hauser, and three community managers who bring a wealth of technical expertise to the table. Now, let’s go to the juicy part.

How Does Curve Finance Work?

As we discussed before, Curve Finance facilitates seamless trades through a decentralized exchange model, automated market maker (AMM). This innovative approach eliminates the need for a central exchange or order book.

Instead, trades occur directly between users using liquidity pools funded by other participants.

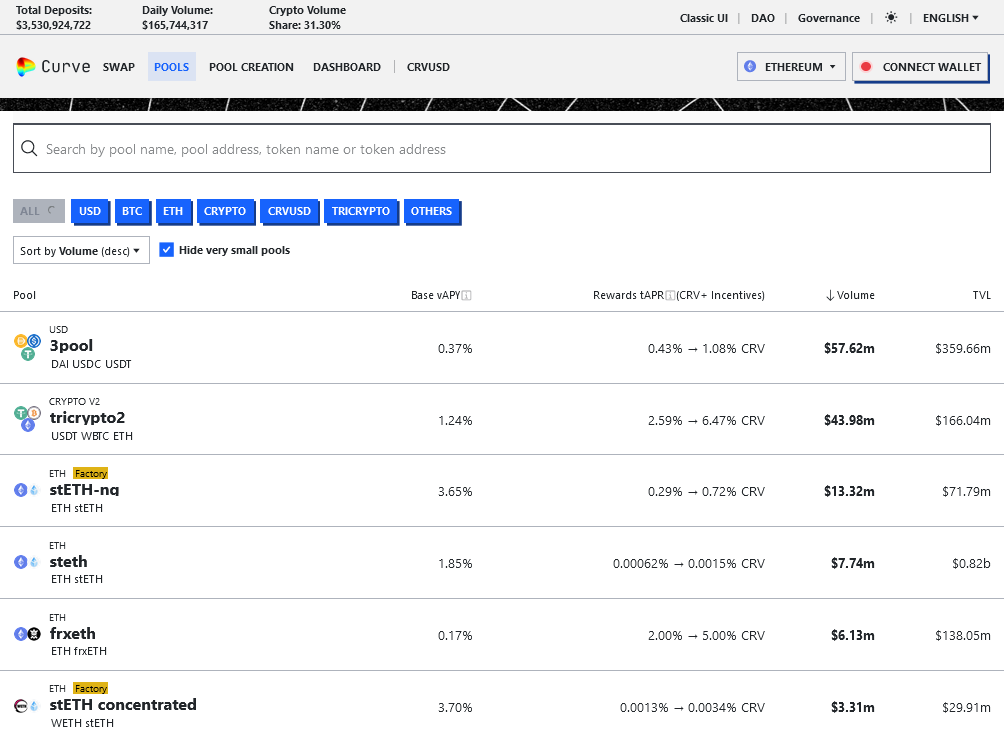

Source: Curve

Moreover, liquidity providers play a crucial role in AMMs by depositing their assets into these liquidity pools. The pools consist of two or more stablecoins with similar price movements, reducing slippage between expected and actual prices.

Curve Finance goes beyond basic trading functionality and offers additional features such as yield farming and liquidity mining. So, yield farming enables users to earn income passively by providing liquidity or depositing assets into the liquidity pools.

On the other hand, liquidity mining allows users to earn $CRV tokens, the native tokens of Curve Finance. Liquidity providers are rewarded with a portion of the fees collected on the AMM, often distributed as LP tokens, to incentivize their participation in the ecosystem.

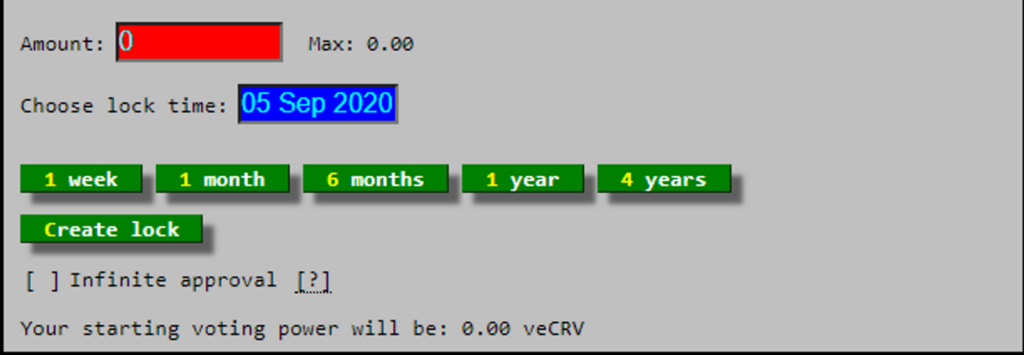

Furthermore, liquidity providers on the Curve platform receive CRV tokens in recognition of their contribution to liquidity provision. To actively participate in governance, users must lock their obtained CRV tokens for a predetermined period. After the lockup period, users receive vote-escrowed CRV (veCRV), which grants them voting rights on various DAO proposals and pool parameter changes.

The voting power of veCRV tokens, an unconventional ERC-20 implementation, is determined by the duration of the lockup period. As usual, the longer the CRV tokens are locked, the greater the obtained voting power.

In addition, users can stake CRV tokens on the Curve platform and earn a share of the trading commissions collected by the Curve protocol. This scenario provides an additional incentive for token holders to contribute to the platform’s success.

How To Use Curve Finance?

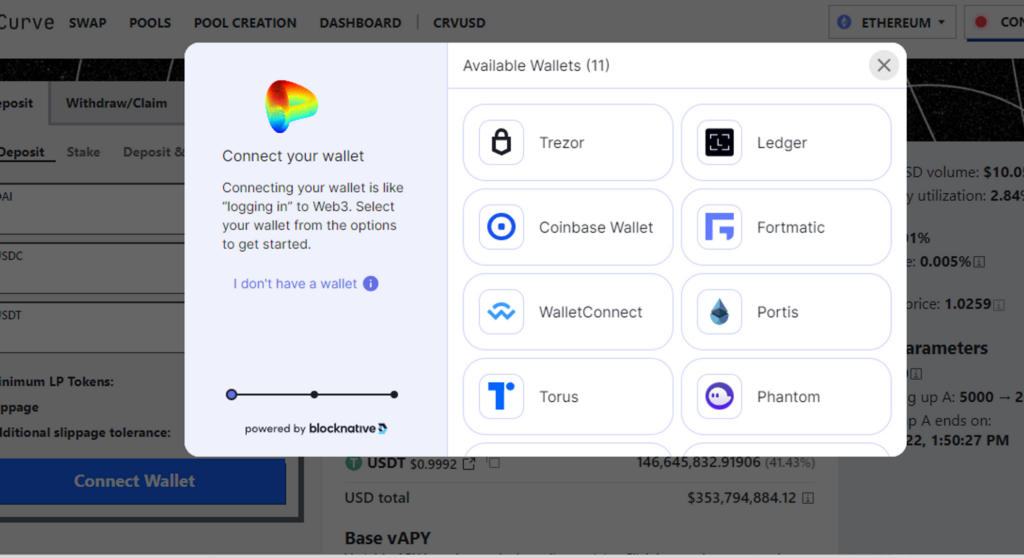

To use the Curve exchange, the user must use a compatible wallet. The list of wallets are:

Source: Curve Finance

How to Start Yield Farming On Curve Finance

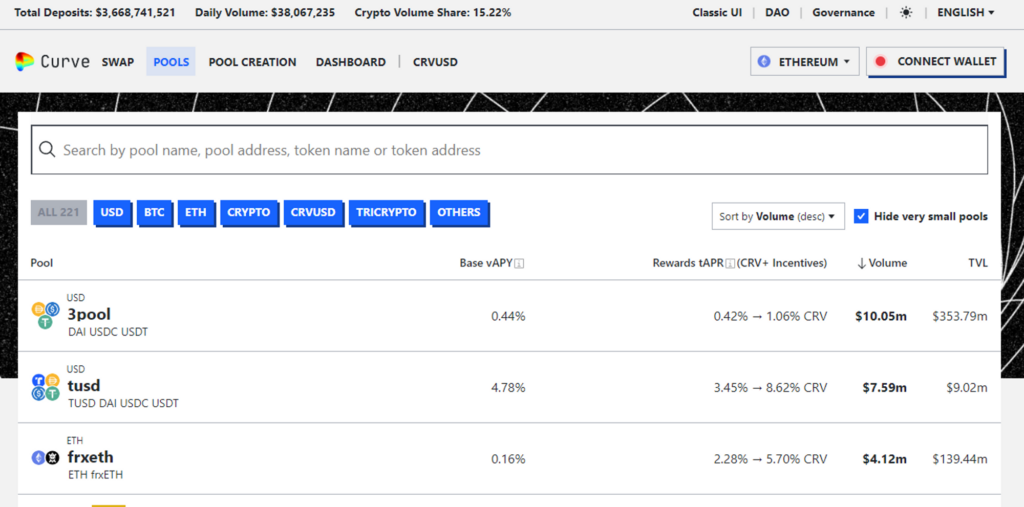

Step 1: To start, visit Curve.fi – Pools and browse the list of Curve pools that are accessible.

Source: Curve

Step 2: Choose a pool to give liquidity to begin to yield farming on Curve. There are multiple active pools listed on the Pools page. Below the pool name on each entry are the eligible tokens for deposit.

Step 3: Connect your wallet by clicking on the ‘Connect Wallet.’

Source: Curve

Step 4: The deposit interface will become available after you choose a pool. Curve will offer a deposit incentive in exchange for supplying liquidity to tokens with a lower ratio. Depositing is an option, and you can receive $CRV in incentives.

Step 5: You can earn more CRV tokens by staking your CRV after providing liquidity.

Is Curve Finance Safe?

Curve Finance has taken significant measures to enhance the safety and security of its platform. So, Trail of Bits has audited the fundamental Curve smart contracts, while the Curve DAO contracts have undergone audits by Quantstamp, and mixBytes too. These audits provide a level of assurance but do not guarantee absolute safety.

Source: Curve

It’s vital to note that, like any other smart contracts, Curve smart contracts carry inherent risks. Users who participate as LPs in Curve’s pools are susceptible to the overall systemic risk associated with the specific pool they join. Furthermore, employing lending protocols to increase yield introduces additional risk factors.

Nevertheless, Curve has demonstrated its reliability and commitment to security-conscious practices for over three years. Throughout this time, the platform has successfully managed billions of dollars in pools, indicating a track record of stability and security. But always DYOR!

Fees For Using Curve Finance

One of the main pros of using Curve is its notably low fees compared to many similar platforms.

The Curve DAO governs the determination of fees and pool parameters within Curve Finance. Presently, the fee structure across all pools is at 0.04%. Out of this fee, the platform allocates 50% to liquidity providers while distributing the remaining 50% to veCRV holders who are members of the DAO.

Conclusions

Curve has emerged as one of the leading platforms within the DeFi landscape due to its focus on stability and composability, prioritizing these aspects over volatility and speculation.

By embracing composable elements, Curve has positioned itself as a vital interconnected hub within the broader DeFi ecosystem. While it is essential to acknowledge that inherent risks exist in any DeFi protocol, Curve has demonstrated a consistent and stable track record since its inception.

Investors looking for opportunities in DeFi yield farming will find Curve a valuable option. The platform offers reasonable fees, great liquidity pools, and enticing incentives, making it an appealing choice in 2023 and beyond.

In the final part of the article, we will delve into some exciting topics concerning Curve Finance. We’ll explore the various use cases of the Curve token, learn how to leverage the Curve Finance calculator, compare Curve Finance with Uniswap, and gain insights into the workings of the Curve DAO.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.