In the previous section of the article, we covered a comprehensive overview of Curve Finance. We will discuss its functionality, fees, safety, and usage instructions.

Now, in this concluding part, we will explore additional topics related to Curve Finance, such as the use cases of the Curve Finance token, utilizing the Curve Finance calculator, a comparison of Curve Finance versus Uniswap, and an overview of the Curve Finance DAO.

Curve Finance Token Use Cases

Curve Finance implements a governance structure through the $CRV token, enabling token holders to directly influence the protocol’s operations. This governance model ensures decentralization and empowers individuals who have invested in the protocol to manage it actively.

Source: Twitter

The $CRV token primarily functions as a governance token, granting holders the ability to put forward proposals and participate in voting on governance matters.

Additionally, the token serves secondary purposes, such as staking and boosting. Engaging in these functions necessitates locking $CRV tokens and acquiring the $veCRV derivative:

- Liquidity providing: $CRV incentivizes liquidity providers on the Curve platform by rewarding Liquidity providers with $CRV in exchange for providing liquidity.

- Governance: $CRV is also a governance token, which gives holders the right to vote on proposals that affect the future of the Curve platform. For example, holders can vote on new features, changes to the fee structure, or the distribution of $CRV rewards.

- Staking: By staking $CRV tokens, users can lock them up to contribute to the network’s operation and receive additional $CRV rewards.

- Boosting: $CRV can also be used to increase the returns of liquidity providers. When a liquidity provider stakes $CRV, they receive $veCRV tokens, which promotes the amount of $CRV rewards they earn.

In addition to these central use cases, users can leverage $CRV to:

- Pay for transaction fees on the Curve platform

- Purchase NFTs on the Curve platform

- Participate in other DeFi protocols that integrate $CRV

The Curve Finance token, $CRV, holds significant versatility and value, serving multiple purposes within the ecosystem. As the Curve platform continues to expand, the demand for $CRV will also rise accordingly.

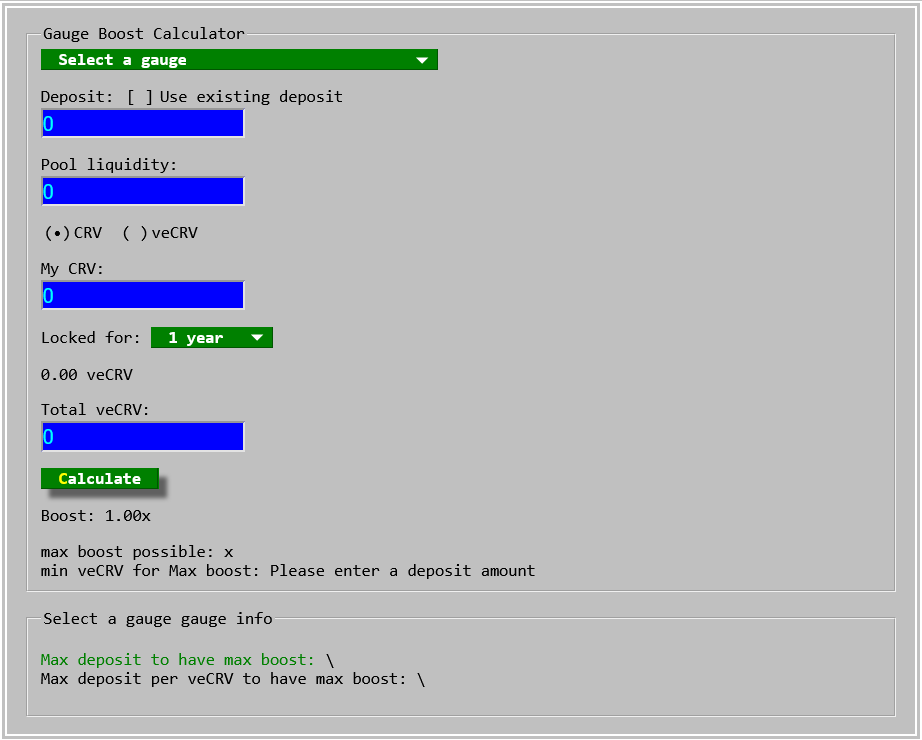

Curve Finance Calculator

One of the primary incentives for holding $CRV is the ability to enhance your rewards on provided liquidity. By vote-locking CRV, you gain voting power to actively participate in the DAO and receive a boost of up to 2.5 times on the liquidity you contribute to Curve.

Determining the required amount of $CRV that must be locked to initiate boosting your rewards is essential.

Each gauge within Curve has distinct requirements, meaning that some pools may be easier to boost than others. It depends on factors such as the amount of $CRV locked by others and the current liquidity gauge state.

Source: Curve Finance

To conveniently calculate the potential boost, Curve provides a calculator. So, by utilizing this calculator, users can assess the amount of boost they can earn with their existing $veCRV tokens. It enables users to make informed decisions regarding their participation in boosting rewards.

Curve Finance vs. Uniswap

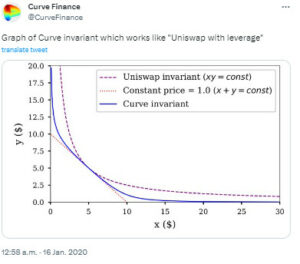

Uniswap and Curve are decentralized exchanges (DEXs) and automated market makers that have gained significant traction. While they initially operated in different niches, recent developments have turned them into competitors.

Both incentivize liquidity provision through token rewards, with users staking Ethereum-based cryptocurrencies on Uniswap to earn $UNI tokens and staking stablecoins on Curve to generate $CRV tokens.

Uniswap introduced a new version, v3, which departed from its traditional constant product (XYK) liquidity curve. Instead, it introduced “concentrated liquidity,” allowing liquidity providers (LPs) to choose the specific price range for their liquidity provision. It resulted in a narrower band of liquidity.

Source: Twitter

On the other hand, Curve launched its version, v2, which also implemented concentrated liquidity. However, Curve’s market-making algorithm determines the liquidity range for LPs, providing a more passive LP experience.

Transaction Fees in Curve Finance

Regarding transaction fees, Curve takes pride in maintaining a consistently low fee of 0.04%. On the other hand, Uniswap, operating on the Ethereum platform, can experience higher fees due to network congestion. While the transaction costs on Uniswap can vary, they are generally higher than Curve’s.

Curve achieves its low transaction fees by allowing direct stablecoin exchanges without needing $ETH. In contrast, Uniswap uses $ETH as an intermediary for stablecoin trades, such as $USDT for $USDC transactions. It involves converting $USDT to $ETH and then $ETH to $USDC. Curve significantly reduces fees by enabling users to directly convert $USDT to $USDC.

Slippage

Regarding slippage, Curve gives users confidence that it will execute their stablecoin purchases at the desired price, thanks to the stablecoins’ typical tie to fiat currencies and their consistent 1:1 value ratio.

Conversely, Uniswap trades may experience price slippage, especially when swapping a cryptocurrency with low volatility for one with high volatility. The varying liquidity levels of different cryptocurrencies on the Uniswap platform can exacerbate price volatility and slippage issues.

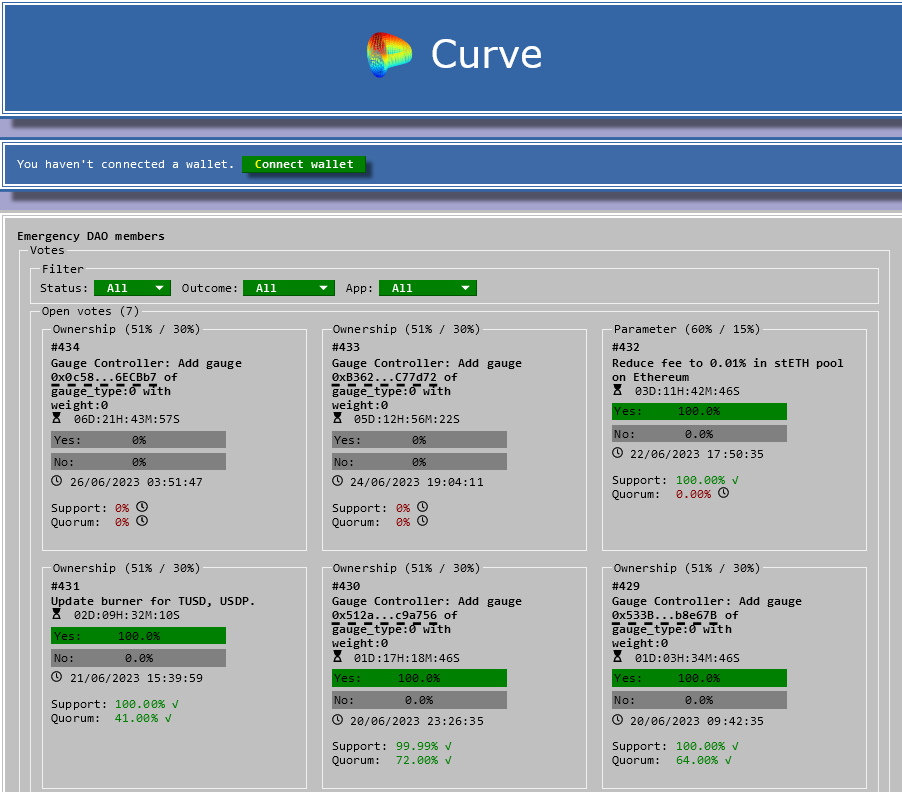

Curve Finance DAO

In August 2020, the Curve protocol embarked toward decentralized governance by establishing a decentralized autonomous organization (DAO) responsible for managing protocol changes.

Source: Curve

Like many other DAOs, the governance of the Curve DAO centers around a specific token, $CRV. Individuals with a minimum quantity of vote-locked $CRV tokens can submit proposals to propose updates to the Curve protocol.

These updates can encompass fee modifications, fee allocation, the creation of new liquidity pools, and adjustments to yield farming rewards. Holders of $CRV tokens participate in the voting process by locking their tokens, ultimately deciding whether to accept or reject a proposal.

Notably, the duration of the $CRV token lock-up period directly correlates with the amount of voting power assigned to the tokens. With the $CRV token serving as a governance mechanism, the Curve DAO stands out as an exceptionally decentralized organization that truly belongs to its users.

Conclusion

Curve has emerged as one of the leading platforms within the DeFi landscape due to its focus on stability and composability, prioritizing these aspects over volatility and speculation.

By embracing composable elements, Curve has positioned itself as a vital interconnected hub within the broader DeFi ecosystem. While it is essential to acknowledge that inherent risks exist in any DeFi protocol, Curve has demonstrated a consistent and stable track record since its inception.

Investors looking for opportunities in DeFi yield farming will find Curve a valuable option. The platform offers reasonable fees, great liquidity pools, and enticing incentives, making it an appealing choice in 2023 and beyond.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.