The DeFi space has been innovating through this bear market. Back in 2021, many tokens of DeFi projects like Thorchain, Aave and Maker made huge gains. This was because they offered the best DeFi products and services.

Fast forward to today, the landscape has changed. New projects that offer better products and services are emerging. In this article, we’ll talk about one such project: Chainflip.

What Is Chainflip?

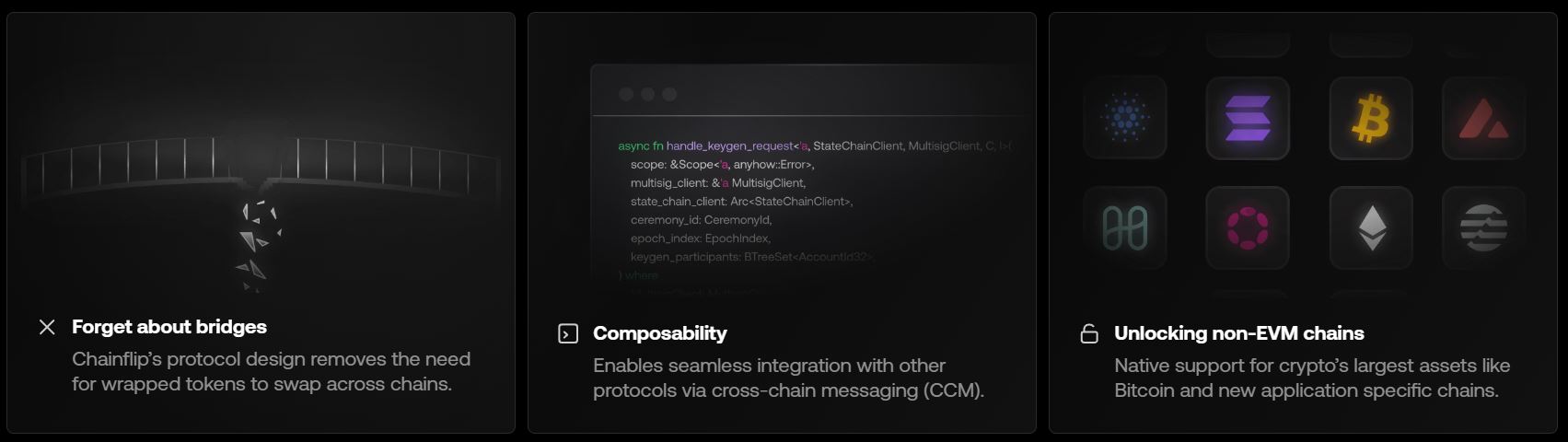

In short, Chainflip is a Automated Market Maker (AMM). It’s also a cross-chain Decentralized Exchange (DEX). This means that with Chainflip, you can swap assets between chains. For example, between native $BTC on Bitcoin’s network to $ETH on Ethereum.

So, what technology powers the Chainflip DEX? In a nutshell, it uses the unique Just-In-Time (JIT) AMM. With this, the DEX can provide users with low slippage cross chain swaps. It does this by using JIT market making strategies for Liquidity Pools (LPs). In turn, users like you and me save on fees during swaps. Aside from low slippage, Chainflip provides other benefits as shown below.

Why Chainflip can be Better Than Thorswap?

With its capabilities, Chainflip is in direct competition with Thorswap. To re-cap, Thorswap is Thorchain’s native DEX. With Thorswap, you too can swap native crypto assets across different chains. But, why is Chainflip better than Thorswap? To explain this, we’ll refer to the tweet below.

Why @Chainflip will crush @THORChain

A short 🧵 pic.twitter.com/DuGgLxsKY3

— pierre | thunderhead (@p1errem) October 15, 2023

Reason #1 – The JIT AMM

Firstly, the JIT AMM is more capital efficient compared to Thorswap’s. Simply put, the JIT AMM enables:

-

- Better market making strategies.

- More accurate pricing of assets.

- Greater resistance to front-running.

This greatly improves the user experience with the JIT AMM.

MEV hurts most protocols, but @Chainflip flips this notion on its head (no pun intended 😉)

Chainflip's innovative JIT amm embraces market maker "frontrunning" to give users significantly better pricing on their swaps

A dive into what makes Chainflip special🧵 pic.twitter.com/0hzBQE1T3T

— Thunderhead (@ThunderheadWrld) July 17, 2023

Reason #2 – The Cryptographic Signing Scheme

Secondly, Chainflip has a better cryptographic signing scheme. A.K.A. Flexible Round Optimized Schnorr Threshold (FROST). On the other hand, Thorswap uses a GG20 scheme.

To avoid getting too technical, we’ll sum it up for you. One, FROST allows for faster signing times than GG20. This means that users do not wait as long for signing. And two, FROST has better scalability. This means validators need not run expensive hardware to secure the network. This leads to more validators joining the network. In turn, this improves the network’s security and decentralization.

Reason #3 – Token Staking

Thirdly, Chainflip’s native token, $FLIP, has better staking options. Now, Thorchain has its own native token, $RUNE as well. Both tokens have the same important utility. To serve as a staking token for validators. In fact, they need large stakes to even become a validator. Sadly, this prices out small retail investors who want to stake tokens.

However, with $FLIP, investors have a liquid staking option. And that’s already built even before the $FLIP token has launched! Indeed, users can soon stake their $FLIP with stakedflip.fi. Then, they’ll receive a Liquid Staking Derivative (LSD) token. This represents the user’s stake and with it, users can earn a steady yield.

Chainflip’s $1 Million Liquidity Program

Moreover, Chainflip has announced a huge $1 million liquidity program! By providing liquidity, users can earn rewards in $FLIP. That’s a pretty good strategy to onboard new inflows to the ecosystem.

Announcing up to $1,000,000 worth of FLIP in Liquidity Provision Incentives for the Chainflip AMMhttps://t.co/rEKPggYRXT

We’re excited to release the plans of our brand new incentive program, which we hope will benefit many new Liquidity Providers on the Chainflip protocol.… pic.twitter.com/5Oo05O4TFF

— CHAINFLIP LABS (@Chainflip) October 12, 2023

Conclusion

To conclude, Chainflip’s really gearing up to succeed. It’s already showing clear signs that it’ll outperform its predecessor, Thorswap.

For now, the project is still at its early stages. Both its mainnet and the $FLIP token have yet to launch. But, we do have to say that the team has been making the right moves up till now. To stay on top of this new project, you can follow its Twitter account here.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.