Staking is a good investment option in all markets. It seems even more true in volatile markets like we have now. And staked value can be a good indicator that a project is ‘on sale’ and worth buying now.

You can’t have a PoS chain without staking, right? Staking helps to secure and run the chain. It’s vital. And with that, staked value is one of many tools we can use to identify great projects.

And just like how some flock to certain blue chips vs others, some projects attract LOTS of staking. Projects with lots of staking have some important benefits like:

- Often long term HODLers

- Sign of Active Communities

- They ‘voted with their dollars’ by investing in the native token

- They have good, active governance

But for us as investors, they create an opportunity.

How so?

Staked Value and Circulating Supply

In almost every article you see here on Altcoin Buzz, we talk about the coin or token and its price activity. If the numbers are available on market cap, total supply, and circulating supply, we present that to you because those tokenomics are important.

With staking, we get to use tokenomics in our favor. There could be a supply squeeze and more demand for the token than available out in the market.

Let’s look at an example.

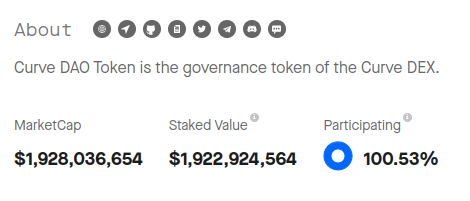

CurveDAO

CurveDAO ($CRV) is the governance token for the Curve app. Curve is a DEX. $CRV is the #77 market cap project in the cryptoeconomy so it’s pretty big. Here are the Curve token stats, from Coingecko:

- Total Supply: 1.65 billion

- Circulating Supply: 392 million (rounded up)

- Market Cap: $1.9 billion

Now let’s look at how much Curve is staked.

Source: Staking Rewards

As you can see, the entire market cap, 100% of it, is staked value for Curve. In other words, there are few Curve tokens out there on the open market for buyers.

One thing to make clear, circulating supply is the supply open to the public for trade. For Curve, that number is 392 million. But there are Curve tokens that are part of this $1.9 billion stake that are NOT part of the circulating supply, too.

How?

Because insiders like early investors or the management team could be staking a portion of their own inside holdings too. And those holdings don’t count as part of the circulating supply.

But even accounting for this, do you think Curve tokens will be easy or difficult to get in the open market when looking at these numbers? Do you think a supply squeeze could happen? It definitely could.

And it could be a sign that Curve is undervalued.

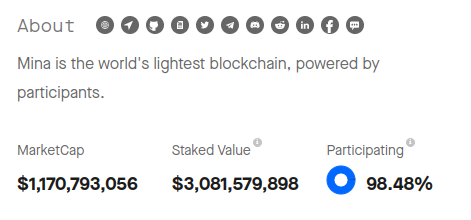

Mina Protocol

Mina Protocol and their $MINA token are another example. Here are the numbers:

- Total Supply: 881 million

- Circulating Supply: 334 million

- Market Cap: $1.17 billion

Source: Staked Rewards

This case is even more severe. 98% of the eligible tokens are staked but insiders are definitely staking this one. The staked value is $3 billion while the market cap is $1.1 billion.

Again, do you think it will be easy or difficult to get $MINA on the open market? It’s a sign the project as a whole could be undervalued too.

Conclusion

So you see in these two examples of Curve and Mina, that huge percentages of the circulating supply of coins are locked up in staking. And stakers are much more interested in the long-term success of a project than traders are. They HODL and they vote on governance issues, and their stake helps keep the network for their project safe.

You should not trade only by this indicator or any ONE indicator, but looking at the staked value on PoS chains may help you uncover undervalued projects like these might be.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.