DeFi had a rough year in 2022. However, since the FTX collapse, DeFi protocols are getting more traction again. Tezos is a blockchain that is well known for its DeFi protocols. It was roaring towards the end of 2021. However, how is DeFi doing now on Tezos?

So, we are about to find out. We will look at the top three DeFi apps on Tezos.

Check out the growing #Tezos #dApp ecosystem – #DeFi, #NFTs, #Gaming, and more – by visiting the @Tezos ecosystem map here:https://t.co/DiKUPEKFOD

— Tezos (@tezos) March 29, 2022

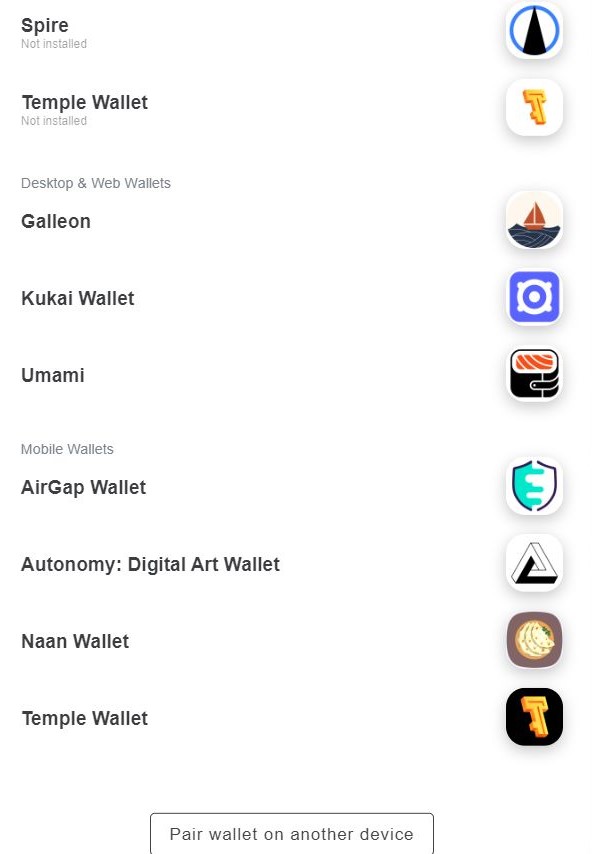

Tezos Wallets

Be aware that if you want to use the Tezos blockchain, you need a Tezos wallet. For example:

- Spire or Temple Wallet are their browser wallets.

- Galleon, Kukai Wallet, and Umami are desktop and web wallets.

For mobile wallets, you can choose:

- Naan Wallet

- AirGap Wallet

- Temple Wallet

- Or Autonomy: Digital Art Wallet

The picture below shows the screen that pops up when you want to connect to a wallet. These are all non-custodial wallets.

Source: Youves app

1) Youves

You create and manage synthetic assets on Youves. The protocol boasts that it is a decentralized, self-governing, and non-custodial platform. You can secure the synthetic assets with collateral. You can lock the appropriate collateral in a vault and mint the synthetic assets.

Not only that, but you need to over-collateralize your newly minted synthetics. Collateral ratios vary from 200% to 300%. In other words, if 1 XTZ token equals 3 USD, you can add 100 XTZ to a vault and mint 100 uUSD. (This is a collateral ratio of 300%.) However, the emergency collateral ratio is 200%. So, if the price of XTZ drops to 1 XTZ = 2 USD, now you reach the emergency collateral ratio. The vault will open, and you need to add more collateral.

However, if you miss out on this, another party can get access to the vault. The Youves docs explain very well how this works. Youves currently offers three synthetic assets: uSDC, uBTC, and uDEFI. So, as you can see, this works as a loan. Their interest is 7%, plus there is a 1% minting fee.

It is interesting how you can still earn with your XTZ after you use it as collateral. You can stake it, although here they call it baking. That’s because they use a liquid proof-of-stake model. To clarify, although you borrow, you can still earn money by baking your XTZ. Youves is the most popular DeFi protocol on Tezos. Their TVL is $31 million and their dominance on Tezos is 77%.

The picture below shows the Tezos TVL with the three protocols we discuss here.

Tezos Liquidity Baking

Liquidity baking has nothing to do with staking or baking XTZ. However, liquidity baking is the XTZ/tzBTC pair in a liquidity pool. They use a smart contract in an AMM for this. The idea behind this is to bring liquidity to the ecosystem. They incentivize this also by having a pool that is liquid enough for large swaps with low slippage. Tezos itself funds this pool. With each new block, Tezos adds 2.5 XTZ to the pool.

As a result, this pool generates more yield. This leads, in turn, to more liquidity for this XTZ/tzBTC pair. The number of tokens in the pool continues to grow, as demonstrated by the picture below.

Source: DeFiLlama

Furthermore, the pool has a fixed trading fee of 0.2%. They burn half of this, and the other half goes back to the pool. This all happens on the Sirius DEX. The video below gives a good explanation of liquidity baking on Tezos.

2) Kolibri

Hover Labs built Kolibiri, an algorithmic stablecoin. For this, they use CDPs, or Collateralized Debt Positions. However, Kilobiri names them “Ovens” instead. Now, in turn, they use these “ovens” (or CDPs) as collateral for a soft-pegged U.S. value stable asset, the kUSD.

Each of these ovens has four functions. Here is what you can do:

- Place XTZ into the oven.

- Remove XTZ out of the oven.

- Borrow kUSD against the oven. For this, you use XTZ as collateral.

- Repay the kUSD that you borrowed against the oven.

Kolibiri uses an over-collateralization formula for this. They explain this in their docs. DeFiLlama has their TVL at just under $5 million. It’s also a DAO, which means that you can vote on proposals. For example, to affect internal DAO parameters.

Furthermore, they also offer a liquidity pool. However, this pool didn’t have an audit. There’s a warning sign stating this before you can access the pool. They also offer farming. However, for this, you will get redirected to QuipuSwap. They offer, among others, a better UI.

Our farms running on @QuipuSwap:https://t.co/QDzndHuBpc to earn $kDAOhttps://t.co/7iX5jG5eMi to earn $kUSD#Tezos #Kolibri #Autonomous https://t.co/LBhT1YyIgR

— Kolibri (@KolibriDAO) January 17, 2023

Conclusion

We showed you the three best DeFi protocols on the Tezos blockchain. Youves – for synthetic assets. The Sirius DEX for liquidity baking. The third protocol we looked at was Kolibri. They have an algorithmic stablecoin and CDPs (or Collateralized Debt Positions). However, the DeFi position of Tezos has decreased since their best days in late 2021. As a result, the chain’s TVL dropped from $217 million in 2021 to $59 million in January 2023.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.