In mid-March, Anchor Protocol launched on Avalanche. However, since 20th March, you can use staked AVAX (sAVAX) as collateral on Anchor. Nonetheless, the price of Anchor’s token, ANC, dropped 31.3% over the last 14 days. On the other hand, TVL on Anchor has increased by $1.9 billion over the same last 14 days.

Anchor is already offering 19.5% APY on UST. Also, LUNA, the native token of Anchor’s protocol, is currently on a mission to buy $10 billion worth of Bitcoin to back up their reserves. But, how is this impacting Anchor and sAVAX? In this article, you will find out the impact of sAVAX on Anchor. Let’s start knowing how you can add it to this DeFi protocol.

How Can You Add sAVAX as Collateral on Anchor?

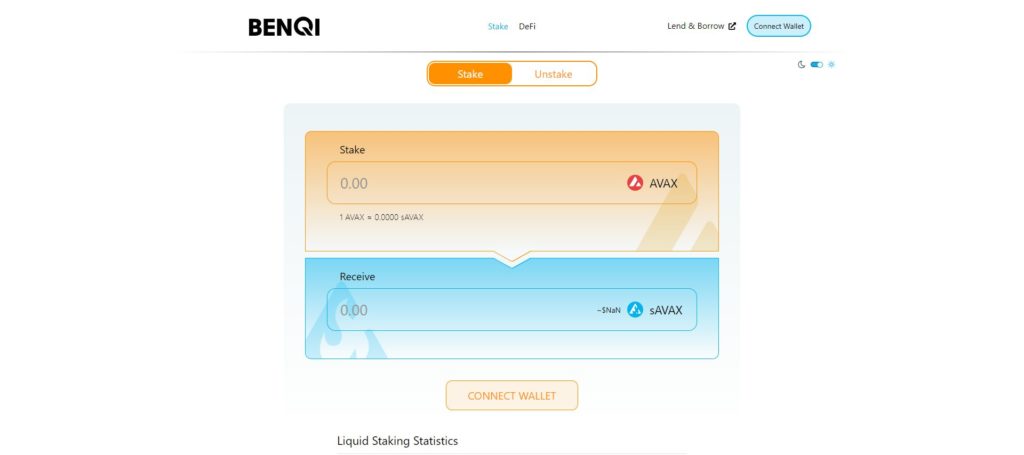

We need to stake AVAX to get sAVAX. You can do this on Benqi. This is a liquid staking protocol built on Avalanche. However, Trader Joe may give slightly better rates. Therefore, it may be worthwhile comparing rates.

1/ It’s happening – $sAVAX is now live as a new collateral option on Anchor!

You can now borrow $UST via @wormholecrypto with $AVAX as collateral through the xAnchor implementation of Anchor on @avalancheavax pic.twitter.com/B2vLk3MPj0

— Anchor Protocol (@anchor_protocol) March 23, 2022

However, we are going to use Benqi for this sample. You will need to connect MetaMask now to Benqi. Now swap AVAX to sAVAX. This will put sAVAX in your wallet.

Source: Benqi

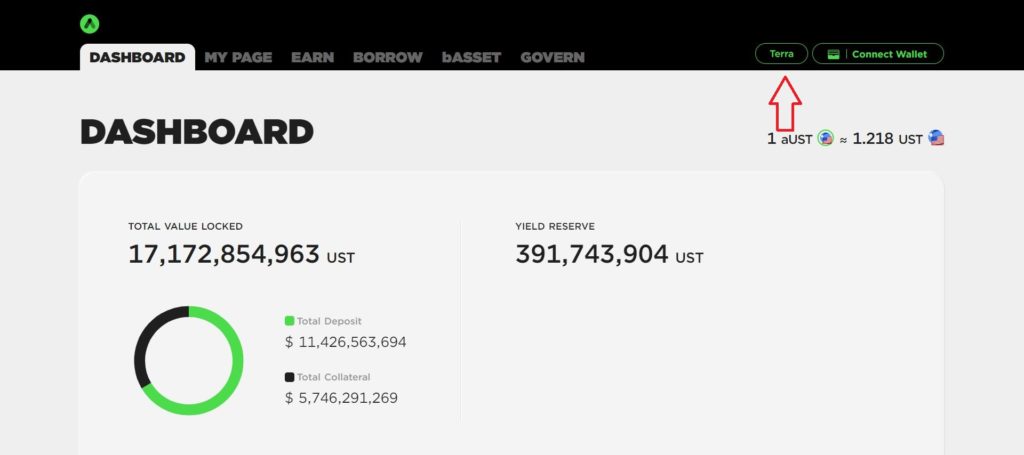

Now we are going to the Anchor web app. Here you will see a direct link on the Anchor Protocol to establish a connection with the Terra blockchain. The only thing you need to do is switch networks on Anchor’s UI in the top-right corner. See the red arrow on the picture below.

Source: Anchor web app

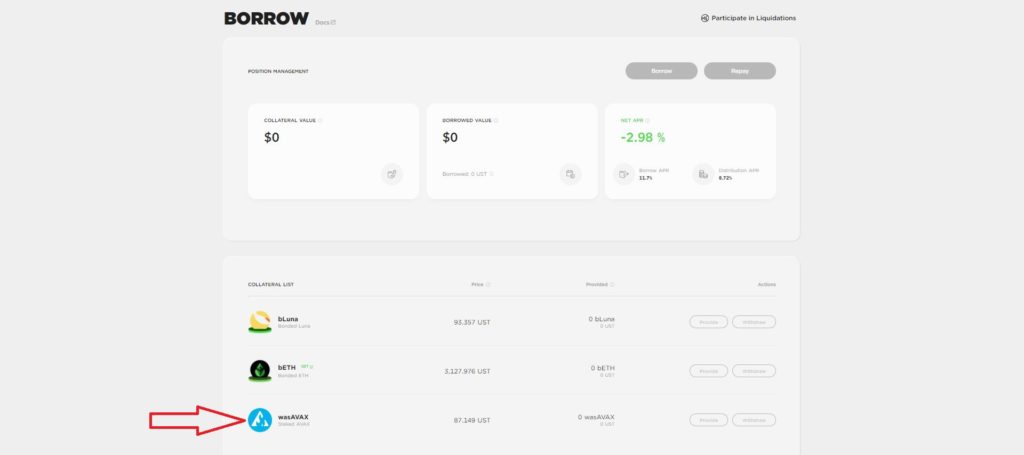

This will put us right on the xAnchor version of Anchor, right inside Avalanche. Click the “borrow” tab after you connect your MetaMask. It may be confusing when you don’t see an sAVAX tab, but the wasAVAX tab works just fine on this page. This means wrapped wormholeAVAX.

Now you can put your sAVAX borrow amount. After clicking the borrow button, your borrow utilization should not exceed 75%.

Source: Anchor web app

As a result, wormholeUST is now added to your wallet, the same as your borrowed amount. Congrats, you now borrowed cross-chain. UST with sAVAX as collateral.

Liquid Staking Borrowing UST with sAVAX

This is how you use liquid staking options by borrowing UST with sAVAX. As a result, your yield will compound. Remember, you are already getting ~7% yield on Benqi for staking AVAX and now also 19.5% on your UST on Anchor.

The impact on Anchor is imminent with an increase in TVL. $60 million was added by Avalanche, with a total increase of $1.9 billion in 2 weeks. Furthermore, there are also plans to bring Atom (bATOM) and Solana (bSOL) to Anchor. This would increase Anchor’s TVL even more. Most importantly, it will boost Anchor’s borrowing rate. This allows Anchor to offer the 19.5% for an extended period.

As a result, the demand for UST has increased. In turn, this will have a positive impact on the growth of the LUNA token. To clarify, printing more UST, means that LUNA becomes scarce. This is because the protocol burns LUNA when it prints UST. Consequently, the LUNA price will increase. This results in a massive boost for the Terra ecosystem. Anchor is part of this ecosystem and will therefore benefit as well. Guilty by association.

Conclusion

Avalanche is EVM compatible. This allows Anchor to move to Ethereum-based chains. For example, Polygon, Ethereum, Fantom, and more.

To sum up, adding Avalanche to the Anchor protocol proved to be a good move. Anchor’s TVL got an impressive boost because of it. However, it will help in more people lending UST to Anchor. As a result, this allows Anchor to sustain its 19.5% yield offer for a longer period.

Also, join us on Telegram to receive free trading signals.

Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.