Bitcoin can no longer be ignored as it continues to set new highs for 2020. Given the fact that bitcoin price surged by 90% since January 2020, the mainstream financial media coverage is growing. According to the very recent Wall Street Journal post, a renewed surge of investor interest in bitcoin is being witnessed. This is primarily because investors fear the inflation will swell in the coming years and bitcoin is now being considered as a potential hedge against inflation. As mainstream media attention returns to bitcoin, new entrants will swarm into space for quick profits. Effectively, this will drive the price up even faster.

Undoubtedly, bitcoin price has risen sharply this year. At the time of the press, bitcoin is trading at $13,694. Crypto analyst PlanB’s tweet agrees with the recent Wall Street Journal post that bitcoin is the best performing asset of the year 2020. However, his analysis reveals something even more interesting. According to PlanB’s Bitcoin vs Gold vs SP500 Growth comparison chart (2013-2020), bitcoin has been outperforming major asset classes for the last 5 years and more.

Source: @100trillionUSD

Understanding and comparing the returns

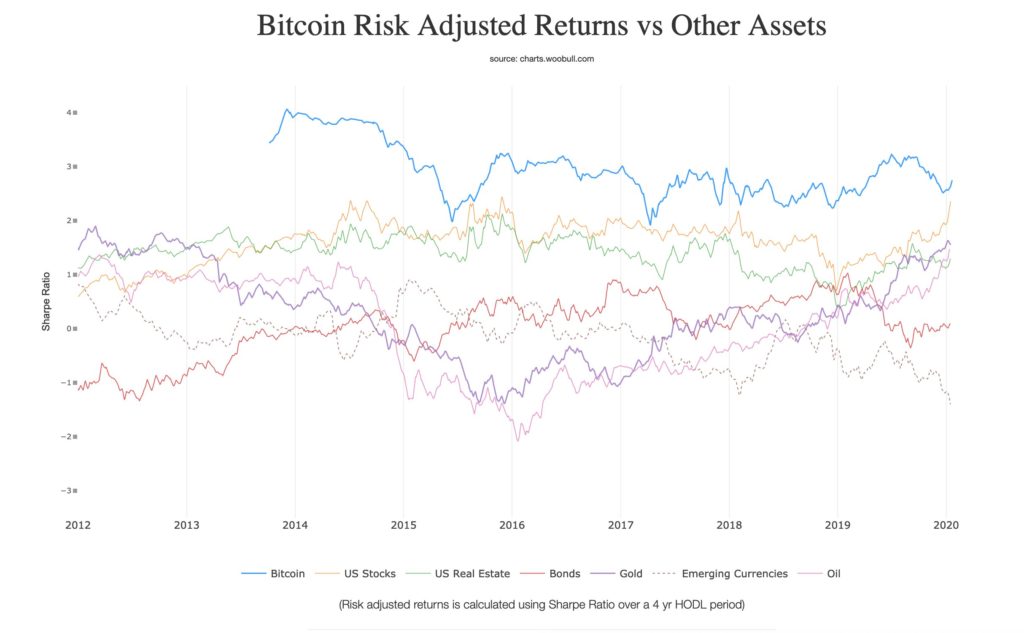

Since its inception bitcoin has been identified as an asset with massive volatility. However, the WooBull chart clearly shows that even the risk-adjusted bitcoin outperformed all major assets like gold, US stocks, US Real Estate, bonds, oil, and emerging currencies.

Source: @100trillionUSD

Institutions rush to bitcoin

The Securities and Exchange Commission (SEC) has not approved a bitcoin ETF yet. Even then institutional investors are embracing bitcoin. In the last couple of months, we saw companies like Square Inc., MicroStrategy, and PayPal adding bitcoin support or using it as a hedge in their corporate treasury.

Big bitcoin bet

It seems the Wall Street Journal cannot stop talking about bitcoin. On October 30th, WSJ published a detailed article about MicroStrategy buying bitcoin worth $425 Million. According to WSJ, MicroStrategy could have bought back a ton of their stock, but they chose to take an unprecedented risk. This is because the company now believes that “cash is trash”. Thus, MicroStrategy bought bitcoin to prevent it’s purchasing power from going down.

Interestingly, bitcoin investment news worked wonders for MicroStrategy. Its shares have been stagnant for years. However, as soon as it announced the bitcoin investment in August 2020, within 24 hours, the stock jumped by 9%. According to crypto analyst Kevin Rooke, MicroStrategy made an unrealized profit of over $100 Million by investing in bitcoin.

Food for thought

For the kind of price growth bitcoin has exhibited, PlanB believes there is no reason for not having bitcoin on a portfolio. According to Willy Woo, someone’s $1 investment in bitcoin at the first market price would be worth $18,073,700.00 today.

And just for kicks… $1.00 invested in BTC at the first market price = $18,073,700.00 today, do that with Gold and it would be $1.81. pic.twitter.com/MYQOjxXX8Z

— Willy Woo (@woonomic) November 2, 2020

Bitcoin price

Impressively, the bitcoin price has surged by over 19% in last 14 days. At the time of press, it is trading close to $13,694.

For the latest crypto-related news, do check-out our Altcoin Buzz YouTube channel.