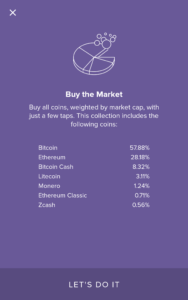

Circle Invest allows investors to easily “Buy the Market” by purchasing all seven coins available on their platform in one transaction, allocations based on current weighted market cap.

On May 22, Circle Invest released a much needed feature, buy the market. Circle is a peer-to-peer technology company based in the U.S. They are backed by Goldman Sachs and in February 2018 they purchased U.S. based cryptocurrency exchange, Poloniex. In March 2018, they released their crypto trading app, allowing investors to easily buy and sell Bitcoin (BTC), Ethereum (ETH), Ethereum Classic (ETC), Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), Zcash (ZEC) with no fees and instant purchases. Also, recently they announced the creation of their own stable coin, U.S. Dollar Coin (USDC).

“Buy the market” simplifies investing in cryptocurrencies. You choose the amount of money you want to invest and you get a percentage of all seven coins based on the current weighted market cap. This is sort of like an index fund, allowing you to purchase a pool of funds in one purchase with a predetermined allocation. This is a very good way for investors to buy into cryptocurrency without much knowledge about the different coins if they still want exposure to the space. If any other company allows their investors to do this, none of them do it without management fees and a very low minimum purchase amount, $10 is the minimum.

The only problems with the platform is that it is only available in the U.S. and no cryptocurrencies can be sent on or off of the platform. On their website, in the support section, this topic is addressed with the following, “At the moment you cannot send or receive funds from an external cryptocurrency address. This is something we plan to support in the near future.” Once these two problems are addressed, Circle has a very good chance at legitimately taking away customers from Coinbase.