IDOs and its coins were flying under the radar. However, it seems that they’re back. The $SAVM IDO saw a 286x. That was only a few days ago.

So, we are going to look into 7 promising projects that don’t have coins yet. This will be a 2-part series, and this is Part-1.

1) BeFi Labs

BeFi Labs is a BRC-20 trading terminal. You can trade BRC-20 and Ordinals tokens. What sets them apart is that you can also use your preferred wallet. This includes EVM wallets like MetaMask or Trust Wallet.

That’s besides the obvious choices like UniSat or Leather Wallet. Another impressive feature is that they don’t charge any trading fees. Being able to use your preferred wallet is a game changer. Setting up new wallets can be challenging.

$SAVM pulled a 288x from IDOs participants on @theapeterminal.

41x from launch price.

15x if you were slow to buy and bought few minutes after the launch at $1.$BEFI (@BefiLabs) is open for registration on @theapeterminal and 53k participants already.

I thought people… pic.twitter.com/FfpzjR8PcH

— Kaduna (@CryptoKaduna) January 20, 2024

Transactions are fast. Furthermore, BeFi moves with ease between CeFi, DeFi, and Web3. BeFi refers to this setup as CeDeFi. It also offers cross-chain options. You can move assets between Bitcoin and Ethereum, Binance, or Solana. So, instead of slow and expensive Bitcoin transactions, BeFi is fast.

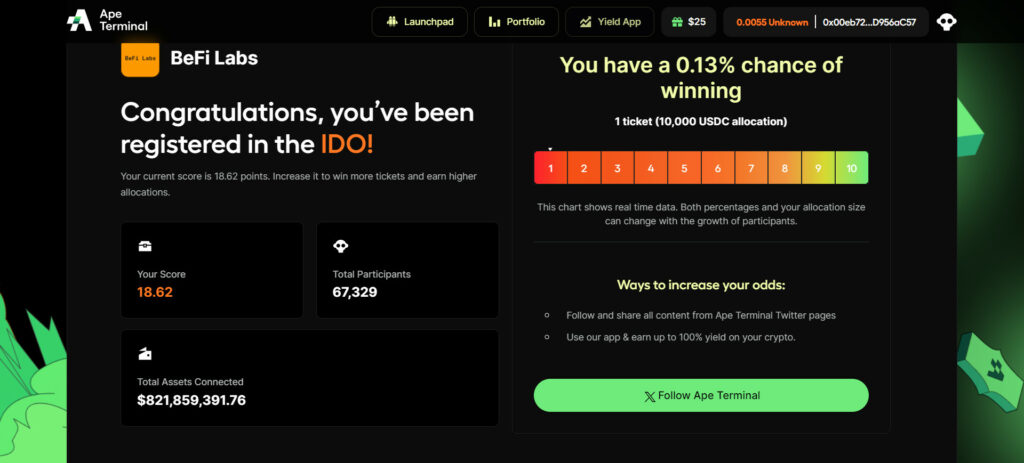

Their IDO is on the Ape Terminal. You can sign up, but it is a lottery system. There’s no guarantee you can get into the IDO on the 4th of February. Currently, there are 67k people signed up for this IDO. You can sign up with the link under the picture below.

Source: Ape Terminal

2) Lends Finance

Lends Finance is a lending and borrowing platform. It’s powered by THORChain. However, Lends calls Arbitrum its home. That’s currently the most popular L2 solution on Ethereum. Besides lending and borrowing, Lends offers more. For example, you can also swap or use a P2P orderbook.

Lends works with L1 Streaming Swaps. In other words, it breaks down a large swap into various smaller swaps. This reduces slippage and you receive a better price execution. It’s efficient and also offers lower fees. The smaller swaps, or sub-swaps, can spread out over 24 hours. The optimization is all automated but can take time. So, being patient pays off by receiving better price offers. These are the Price Optimized Streaming Swaps, and you can’t speed them up. This way, they offer both the best pricing and efficiency.

Ape Terminal – IDO #4 🦍

Lends – @Lends_so🟠 Official lending interface on Thorchain, valued at $1.8 billion.

🟠 Cross-chain lending with 0% interest and no-liquidation loans.

🟠 Over $70 million in TVL.

🟠Listing at 12.5M FDV. Details soon. pic.twitter.com/vGR9fsDswk— Ape Terminal (@theapeterminal) December 26, 2023

For lending, it uses THORFi lending. As collateral, you can use crypto assets like BTC, ETH, or BNB. During minting, the platform swaps these assets to RUNE. You can also earn a yield on single assets with THORFi savers. Among others, there’s no risk of impermanent loss.

Their IDO is also scheduled on Ape Terminal, but there’s no fixed date yet. Ape Terminal is currently the most popular launchpad for new coins.

3) Oxya Origin

With Oxya Origin, we’re in the blockchain gaming space. You can find various games on Oxya Origins. They range from shooters to strategy and much more. Furthermore, the ecosystem is player-owned. You can join their private Beta, and this qualifies you for their starter pack.

We're gearing up to launch the closed BETA in Q1 2024.

Here's a quick thread to explain how we are preparing it 👇

Our primary focus is on achieving two key objectives for an outstanding release:

– Assembling an exceptional team.

– Garnering strong community support.👥Team… pic.twitter.com/EpJOpMzK7g

— Oxya Origin (@OxyaOrigin) January 15, 2024

The graphics are stunning since the team used Unreal Engine 5. The game has four components, for instance:

- Genesis Avatars — The floor price on OpenSea is currently at 0.068 ETH.

- Lands — The OpenSea floor price is currently at 0.285 ETH.

- Colonies — Their floor at OpenSea is at 0.255 ETH.

- Alpha Keys — Their floor on Atomic Hub on Wax is 730 WAX.

Oxya Origin uses both AI and Web3 tech to reach as many gamers as possible. With their P2E (Play-to-Earn) option, the team wants to engage players. Currently, there’s no further information available about their IDO. So, keep an eye out on their social media. Below is a trailer video for their private beta.

4) Entangle

With Entangle, we enter the realm of DePin (Decentralized Public Infrastructure Network). That’s where Entangle fits in. DePin can cover wireless, servers, sensors, energy networks, or digital or physical networks. To clarify, this can be power grids, cloud services, mobility networks, and much more.

13 Blockchains

60+ DApps and counting

Soon the Entangle universe will touch every corner of Web3 pic.twitter.com/JAEJNxnCAW

— Entangle (@Entanglefi) January 19, 2024

For example, Entangle uses oracles. In blockchain technology, oracles are important. That’s because blockchains can’t communicate with the real-life world. So, oracles can gather information and relay this to a blockchain. This can be weather reports or crypto prices and anything between. Middleware makes the connection between blockchains and physical infrastructure. The DePin platforms are the middleware. Entangle currently operates an incentivized testnet.

DePin decentralizes the infrastructure marketplace. It’s one of the most promising verticals in crypto. Samples of other DePin networks are Akash, Arweave, or Filecoin. Currently, there’s no information about their IDO available. So, it’s recommended to keep an eye out on their social media. The picture below shows how important middleware is. It connects the blockchain with the real-life world.

Source: Entangle blog

Conclusion

This is Part-1 of a 2-part series about top coins with a 10x-100x potential. All the mentioned projects have an IDO with their coins coming up. The mentioned projects cover various verticals, like blockchain gaming or DePin. This article found inspiration from this X thread.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.