PancakeSwap is the largest AMM on the Binance Smart Chain. They have 3x more TVL (total value locked) at $6.5 billion than the next largest DeFi protocol on BSC. We are going to look at one specific investment option there today.

If you look at this AMM, there are some great deals and huge interest rates you can earn. So why are we asking if the best deal on PancakeSwap is a 14% APR?

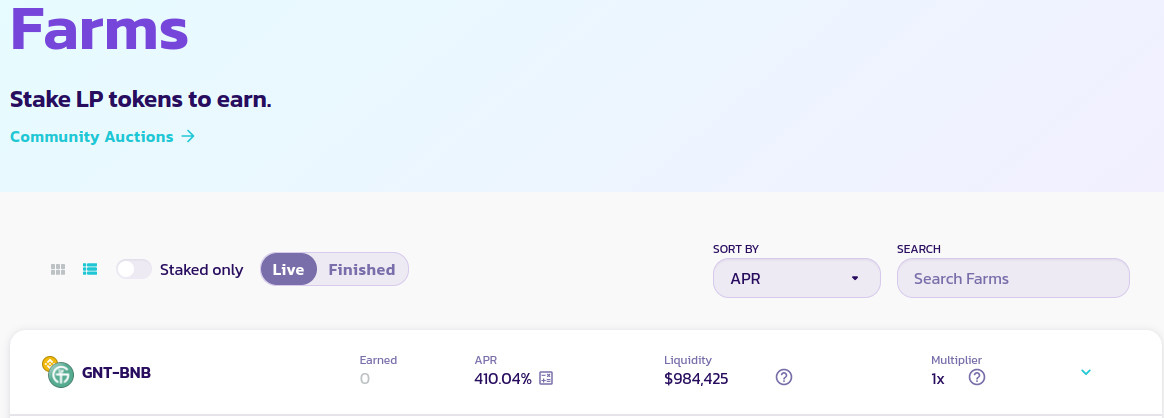

You could farm the GNT/BNB pair and earn up to 410% APR. GNT is a carbon-neutral DeFi app. Its token carries some risk or we wouldn’t be getting 410% on it, right?

Paired with BNB, the #3 market cap coin, the risk of impermanent loss is big on this pair.

Remember, when you invest in a liquidity pool like this, you own a % of the pool. If the values change dramatically, like 1 coin drops by 10% and the other rises by 15% then you are at risk of impermanent loss. This loss is the difference between investing in the LP vs. if you just HODL the 2 coins separately.

But what if we can get the best aspects of liquidity pools like:

- Good interest rate

- Immediate liquidity

- Established platform to reduce counterparty risk

- Quality liquid pair that doesn’t involve lots of swapping

and do all that with almost NO risk of impermanent loss?

Well, we can. At least on PancakeSwap, we can, with this pair.

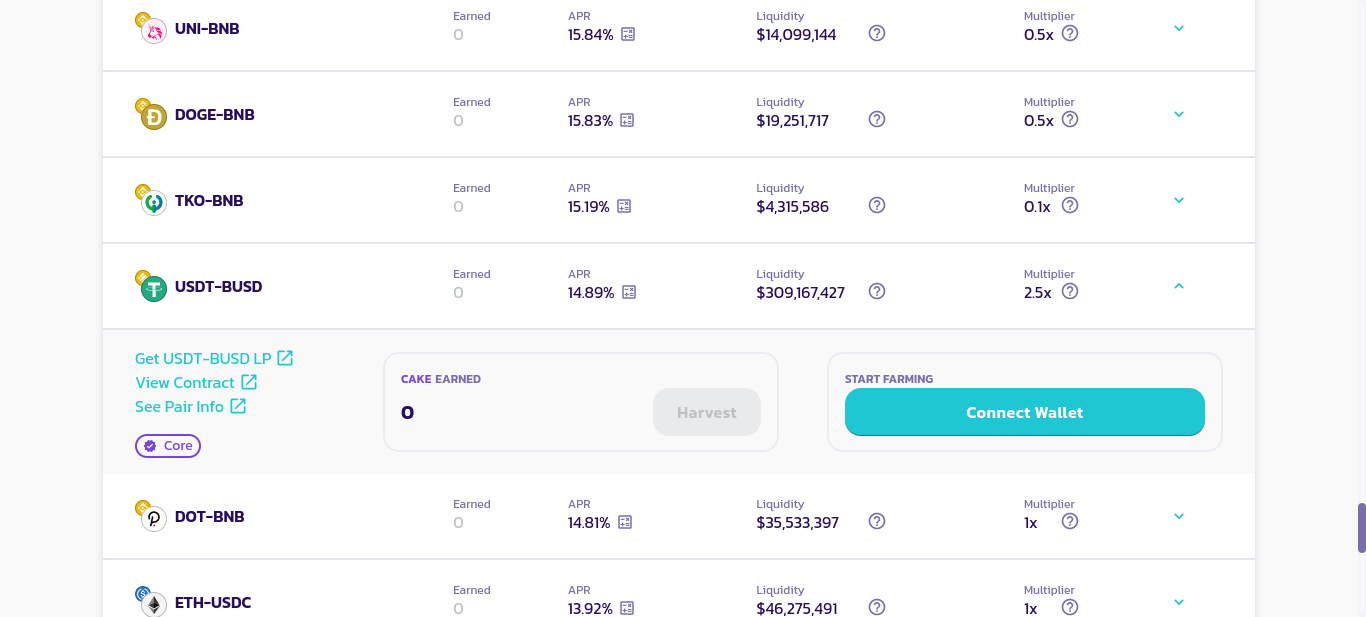

Source: PancakeSwap (same page on Farming)

The Stablecoin Pair

The pair we are talking about is the USDT/BUSD pair. Both are liquid stablecoins. USDT is the largest and BUSD is the largest stablecoin in the Binance system.

This liquidity pool has over $310 million in it and adds at least $50 million per day. And the risk of impermanent loss is almost zero.

Why?

Because the stablecoin prices are designed to stay stable. The most likely move between these 2 stablecoins is between 99c and $1.01 so barring an unusual event, your risk of impermanent loss is almost none.

And along with that, you are getting the chance to earn up to 14% on your stablecoins. That’s more than most platforms pay.

So you get:

- Price stability

- Almost eliminate impermanent loss risk

- Earn a great potential return

and all in a coin you are likely to hold anyway.

The reason this might be the best deal on PancakeSwap is not due to the returns. Lots of LPs there pay much more than 14%. But when we balance risk and return together, this pair really shines.

You have a chance to earn a double-digit return for very low risk on one of the most reliable platforms in DeFi.

Maybe you should go check it out.

Do you like getting tips like this?

Then come join us on Telegram to receive free trading signals.

Find out more about the blockchain and crypto space on the Altcoin Buzz YouTube channel.