This is Part 2 of our Beginner’s guide to X2Y2. Here’s a link to Part 1. In Part 1 we covered 4 popular questions about this NFT marketplace. Here, in Part 2, we will discuss another 3 questions.

So, let’s dive straight in to X2Y2.

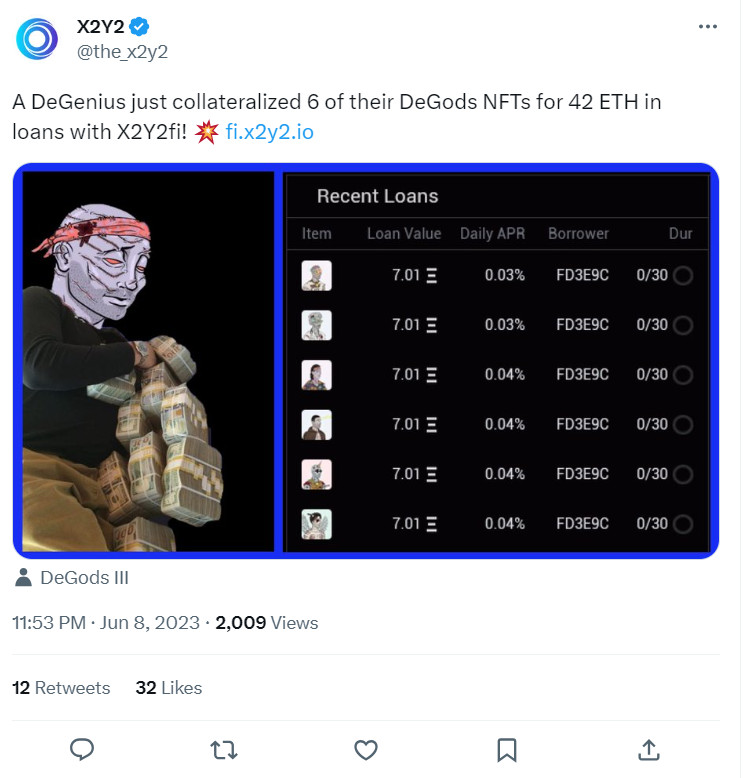

Source: Twitter

Where Can You Buy the X2Y2 Token?

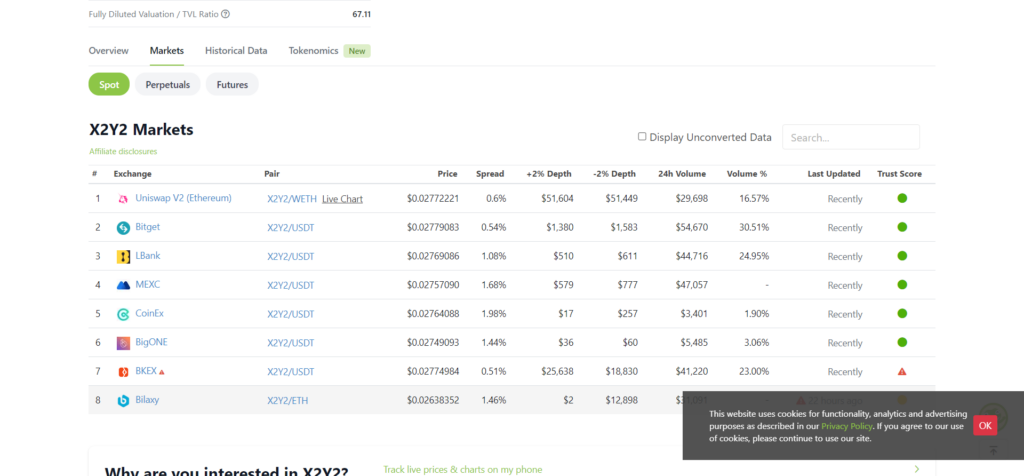

The X2Y2 token is available in Uniswap V2 on Ethereum. There are also a handful of centralized exchanges that offer the token. For example:

- Bitget.

- MEXC Global.

- Or CoinEx.

So, as you can see, limited options. However, a couple of established CEXes and a good DEX offer this token. The current price of the X2Y2 token is $0.0262. It has a market cap of $7.42 million. There’s a max supply of 1 billion tokens. The total supply is 595 million tokens. Currently, there are 282 million tokens in circulation.

Source: CoinGecko

How to Stake the X2Y2 Token?

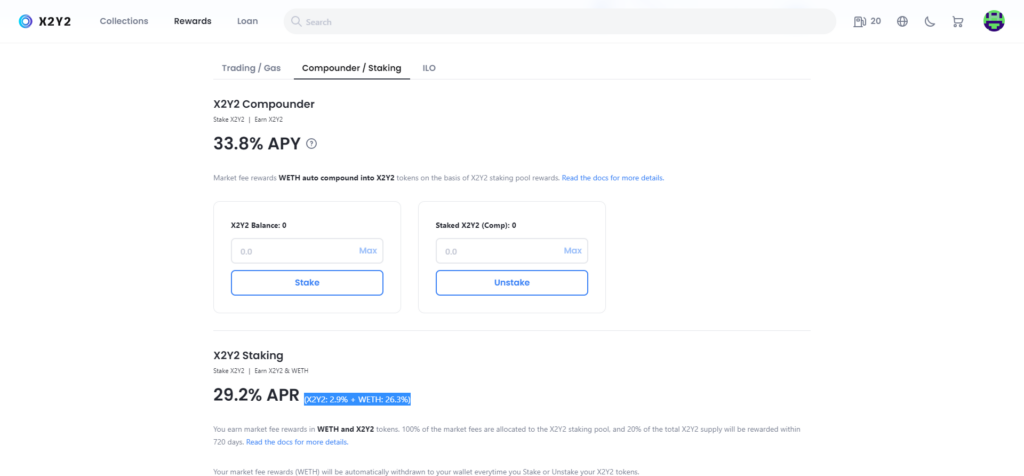

You can stake and get rewards on the X2Y2 website. Your rewards come in two different ways. Here you go,

- A market fee rewards in wETH.

- An X2Y2 token reward.

Out of the max supply of 1 billion tokens, 65% is for staking rewards. The deposit and withdrawal fees are free. Yes, that’s right, 0%! It also has auto-compounding. The current reward is 33.8% APY. There’s an easy-to-follow staking guide here.

The auto-compound option converts the wETH into X2Y2 tokens. In turn, it re-stakes these tokens in the liquidity pool. This results in a higher amount of staked tokens. Another great feature is that the staking rewards don’t expire. In other words, you can claim them at any time. To clarify, using these options means that you stake and receive rewards in X2Y2 tokens.

If you stake without auto-compounding, the rewards are in X2Y2 tokens and wETH. The current APR is 29.2% (X2Y2: 2.9% + WETH: 26.3%). The picture below shows the staking/rewards page on their website.

Source: X2Y2 rewards

X2Y2 vs OpenSea

The biggest difference between the two platforms must be that X2Y2 has its own token. There have been rumors of OpenSea having its own token. However, that’s where this bucket stops for the time being. Another explanation may be that OpenSea wants to have an IPO or an Initial Public Offering. Having a token may make this more difficult.

From the outlook, both platforms look similar. However, under the hood, it’s a different story. However, there are more differences. For example:

- Decentralization. OpenSea’s market share was as high as 90%. So, the more NFT marketplaces there are, the more decentralized the space becomes.

- Bulk selling. OpenSea has ‘Bundles’, which are similar.

- OpenSea users can import their NFTs from OpenSea.

- Fee distribution. This platform distributes all platform fees to its users if you stake their tokens. On the other hand, the 2.5% OpenSea fees go to the developers.

- X2Y2 claims that it will have no downtime. This is in contrast to OpenSea. Regular updates can cause all kinds of issues.

On a different note, OpenSea has a variety of private investors. This platform doesn’t want to go down this road.

Conclusion

This is Part 2 of a two-part beginner’s guide about the X2Y2 NFT marketplace. In Part 1 we answered 4 questions about this platform. In Part 2 we answered another 3 questions. For example, where you can buy their token and how to stake it. We also looked into the difference between this platform and OpenSea.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.