CoinMarketCap (CMC) is arguably the world’s most-used price-tracking website for crypto assets. CMC provides millions of crypto users with the tools to research crypto assets and make investment decisions.

CoinMarketCap tracks the capitalization of different cryptocurrencies by listing prices, market capitalizations, available supply, and trade volumes over the last 24 hours. It’s no surprise that thousands of crypto users rely on CoinMarketCap for market insight and accurate information about projects daily.

CMC is one of the OG’s of crypto having launched in 2013. So, the platform’s predictions, and opinions of the crypto market are often noteworthy. CoinMarketCap recently partnered with some of the leading voices to analyze the performance of the crypto market in 2022 and also provide insight into possible trends in 2023. Here’s a dive into the 2023 Crypto Playbook.

What is the Crypto Playbook all About?

The CoinMarketCap Crypto Playbook seeks to provide an accurate understanding of the crypto market in 2022, using it as a launchpad to analyze the 2023 market. The playbook described 2022 as a “boss fight” due to three major factors.

- the Russian-Ukraine war triggered a global recession which plunged different industries into dark times.

- The collapse of former crypto giants such as Luna, 3AC, Voyager, Celsius, and FTX discouraged further mainstream adoption of cryptocurrency and led regulators to the doorstep of the crypto industry.

- Huge uncertainty surrounded the role played by Bitcoin’s four-year cycle in the market downturn in 2022.

CoinMarketCap believes 2023 can be the year the market builds further or rebuild what was lost in the previous year. The analytics company also expressed positivity that crypto users can get much-needed insight on regulatory policies across areas such as DeFi, CEXs, and DEXs.

A Review of the CMC Playbook

Self-custody and Centralization

Centralization is always a major concern among crypto users. However, the collapse of FTX reopened the conversation, unlocking opportunities for decentralized exchanges and self-custody. According to CMC, the trend of owning keys raised questions such as “how we can make DeFi products more user-friendly and provide easier solutions and options for people to use crypto, but not in a centralized way?”

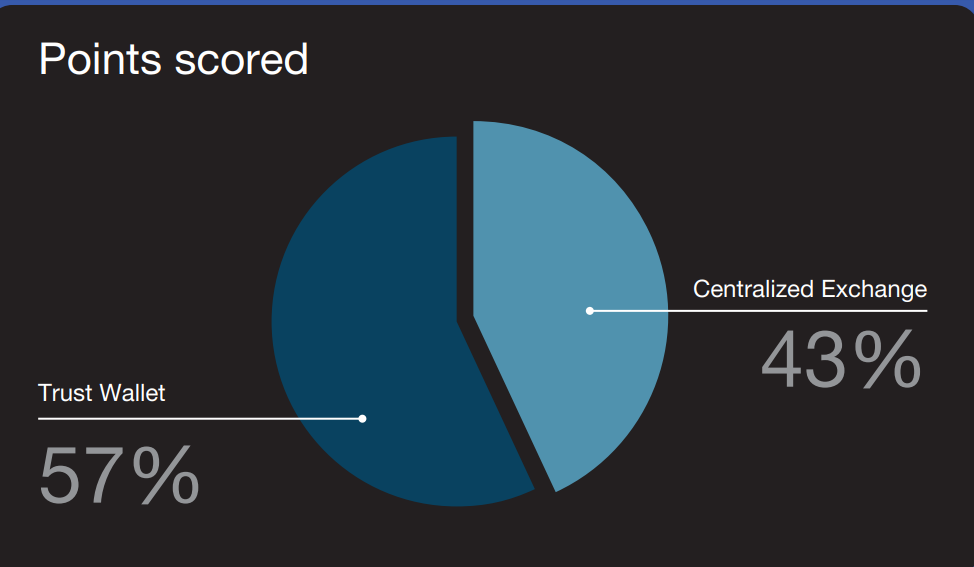

Already, crypto users are making the shift from custodial to non-custodial wallets. A survey by Trust Wallet verifies this fact. 43% of surveyed Trust Wallet users store their assets on centralized exchanges. However, 57% of participants have opted to self-custody their assets on Trust Wallet.

According to the survey, customers have lost confidence in centralized exchanges due to the events of last year. Users have now adopted solutions that give them full control of their assets.

Users have found out that true ownership comes with more benefits. Trust Wallet reported a 140% increase in active users days after FTX imploded. And the growth trend has continued.

The CEX Vs DEX Debate

Centralized exchanges such as Binance continue to control much of the market due to their structure and strength. However, the playbook noted that decentralized exchanges are putting up strong competition for market control and the collapse of FTX in November was a plus to their cause.

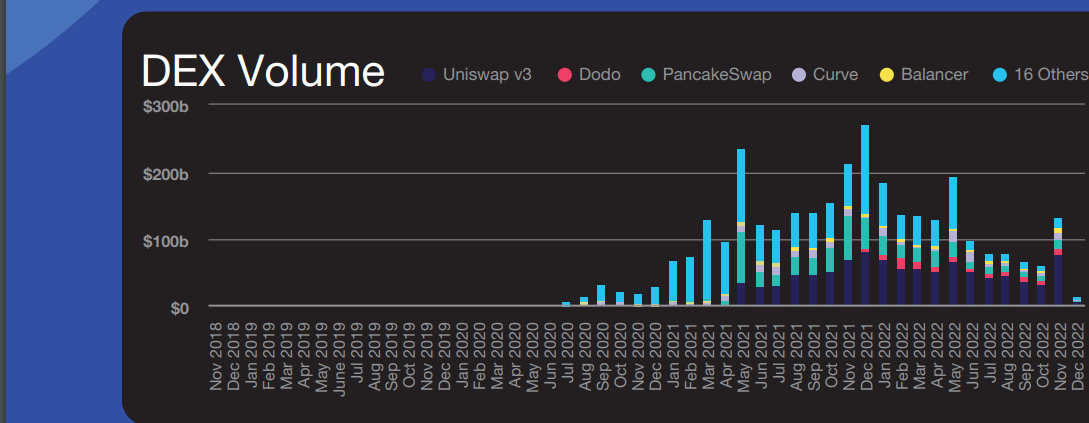

Data from the playbook shows that DEXs have supported over two trillion

dollars in volume to date. They also averaged more than $100 billion every month in 2022. Uniswap commands about 70% of these activities.

Despite the former gap, DEXs seem to be catching up with CEXs. The DEX-to-CEX spot volume ratio peaked above 25% in February 2022 and has been on the rise. DEXs comes fully equipped with technologies that give them a clear edge over their centralized rivals. So, the playbook anticipates that users will prefer DEXs to CEXs due to factors such as

- increased transparency,

- self-custodied assets,

- permissionless access.

However, DEXs still have a long way to go before claiming the top spot. The playbook recommends what DEXes must improve on to gain market dominance. A DEX will need to:

• Build more user-friendly onboarding flows

• Improve the retail user experience

• Compete on cost and fees

NFTs and GameFi

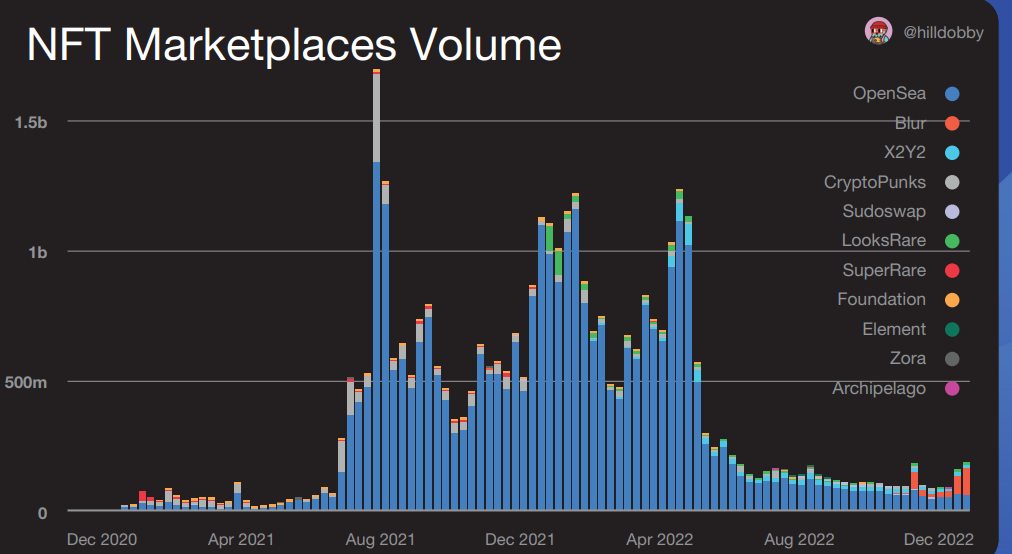

The CMC playbook predicts huge potential for the NFT and GameFi space despite the ups and downs recorded. NFT marketplaces have been on the increase. And concepts such as NFTFi have brought about new use cases like ticketing or real-world assets on-chain.

The blockchain world is still in its early stages. So, developers have brought on new models such as free-to-play and play-to-earn. However, CoinMarketCap predicts that the industry is finally set for a clear direction.

Despite the bear market, the NFT sector enjoyed increased awareness as several leading web2 brands such as Coca-Cola embraced the trend. These adoptions signal a strong foundation for the future.

CoinMarketCap predicts that NFT projects will move to adopt layer 2 solutions like Arbitrum and Optimism. Also, the year will see increased integrations between AI and NFTs. Gaming projects will look to leverage AI for gameplay design.

NFTs and gaming will continue to work hand-in-hand and games will explore advanced use cases for their projects. It’s also intriguing to see how marketplaces and wallets develop to better suit the needs of specific consumers. Projects will also look into building more Web3-friendly wallets with DeFi features.

The zero-knowledge (ZK) rollup space will enjoy a huge year in 2023, as it gained a lot of attention due to general developments in layer-2 chains. ZK-rollups expect to make NFT usage and access 10x to 100x simpler and more secure. And this should lead to an increase in builders adopting NFTs for social media experiences and, ultimately, more users.

CBDCs and Central Banks

Central bank digital currencies (CBDCs) gained a lot of attention in 2022. The CoinMarketCap playbook believes there will be more CBDC production and testing in 2023. There will also be increased debate about the proper scope and limit of CBDCs. Lastly, private institutions will most likely put up a tough fight for the sector.

Adoption

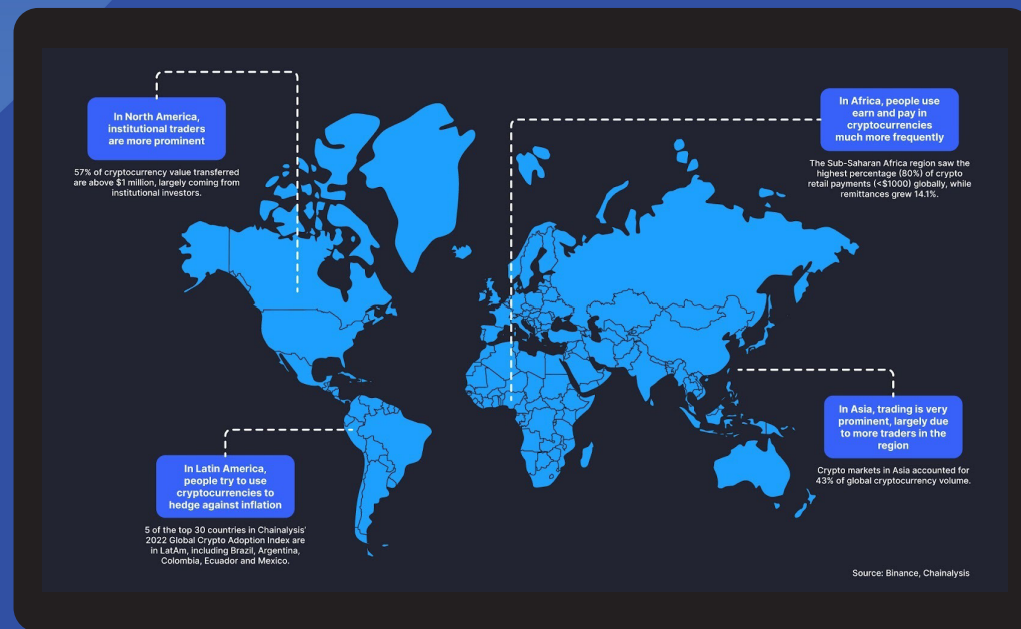

CoinMarketCap interviewed Binance CEO Changpeng “CZ” Zhao on his thoughts about crypto adoption in 2023. Zhao believes apps with better use cases will play a huge role in crypto adoption in 2023.

CZ noted that faster blockchains, education, and regulatory clarity will play huge roles in bringing more people into the industry. The events of last year affected trust in the crypto industry. So, CZ believes “the industry will have to shift towards a much more transparency-based system, one that users can verify.”

Regulation

Crypto regulation is a huge topic in 2023. SEC Chair, Gary Gensler spearheaded calls for tougher restrictions on the industry. And FTX’s collapse gave authorities more reasons to scrutinize the industry. 2022 featured regulatory developments, like sanctions on Tornado Cash and the EU’s implementation of MiCA.

However, the CMC playbook predicts that more conversations about crypto regulation will take place in 2023. These conversations will create the much-needed trust in digital assets needed for mass adoption.

In conclusion, CoinMarketCap’s insight into the crypto market offers great value. Investors, regular crypto users, and project builders can leverage the insight found in it to position themselves. Click on this site for a deeper dive into the playbook.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.