In the previous article, we described 6 indicators analyzed in Q2-2022. The spot market, stablecoins, bitcoin price vs trading volume, among others. However, in this first GeckoCon 2022 talk, there were other KPIs that you need to see.

Here are the 7 web3 indicators that were included in “The State of Web3” talk:

1) ETH 2.0 Merge Overview

In Q2-2022, we all heard the good news that the ETH 2.0 merge testnet was live. This road started on 2020 with the Beacon Chain upgrade. Then, in 2021, the following milestones were achieved:

- London Hard Fork.

- Altair Upgrade.

- Arrow Glacier Hard Fork.

Moreover, on 2022, Ethereum had these goals in its roadmap:

- Consensus Layer: ETH 1.0 and ETH 2.0 were called “execution layer” and “consensus layer” respectively. (January 24th)

- Ropsten Testnet Merge. (June 8th)

- Gray Glacler Hard Fork. (June 29th)

- The Merge (pending)

Finally, in 2023, Ethereum will develop “shard chains”. This will allow the splitting of transactions to increase the network’s TPS. Also, this will let smart contracts work in the merged web3 network.

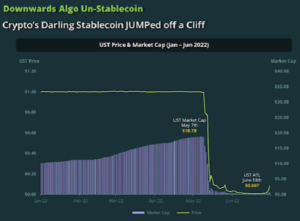

2) Downwards Algo Un-Stablecoin

In Q2-2022, we can all practically say that the UST emergency had a “domino effect” and it was an important part of the web3 industry. As a result, the UST marketcap decreased by 95.7% from its peak to June 30th. In its ATH, UST had a marketcap of $18.7 billion and ended up at $807 million at the end of June. You can see this in the picture below:

Source: GeckoCon 2022

Moreover, the deepening event generated that 99% of its value was decreased with the UST hitting ATL to $0.007 in late June. However, UST rebounded back to $0.05 at the end of the same month.

3) From Terra/UST to 3AC

In Q2-2022, the problem related to Three Arrows Capital also had negative effects on different web3 companies like:

- BlockFi

- Voyager Digital

- CoinFLEX

- Firbiex, among others.

On the other hand, the Terra/UST influenced the following crypto companies:

- Celcius Network

- Binance Labs

- Dephi Labs

- Coinbase Ventures

- USDT, among others.

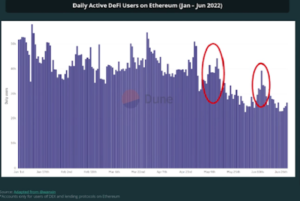

4) DeFi Daily Active Users

In Q2-2022, the average number of daily DeFi users decreased by 34.5% compared to April 1st. Unfortunately, the DeFi sector has fallen more than other ones. In the picture below, you can see how this indicator has decreased consistently.

The first red circle belongs to the number of DeFi users during the Terra collapse. As a result, trading volumes on Curve Finance and Uniswap skyrocketed as holders sell their LUNA & UST.

Source: GeckoCon 2022

Moreover, the second red circle belongs to the Celcius withdrawal bottlenecks on June 13th. Also, centralized exchanges had problems too, which made users decide to use more non-custodial DeFi protocols.

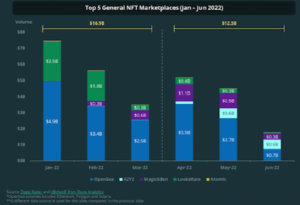

5) NFT Platform Trading Volumes

In Q2-2022, the NFT trading volume decreased by 26% comparing it to Q1-2022. In this period, OpenSea maintained its first place in the NFT marketplace sector. Also, Magic Eden and X2Y2 increased their participation.

Moreover, OpenSea’s integration with Solana ended up benefitting Magic Eden’s participation even more. At the end of Q2-2022, Magic Eden’s market share grew 32%.

Source: GeckoCon 2022

In addition, similar to LooksRare in Q1-2022, X2Y2 grew its users through an incentive program with wash trades. Even when both have a better fee structure, LooksRare and X2Y2 are still behind OpenSea but are increasing their market participation.

6) NFT Trends

From all blockchains, Solana is leading the NFT sector. Here are some great examples:

- STEPN: In April 2022, this move-to-earn NFT initiative had more than 300,000 users in a day. NFT shoes were trading for more than $1,200 a pear, and the GMT token broke its ATH ($48).

- Solana NFT Marketplaces: In Q2-2022, Solana increased its market share in NFT marketplaces. The latest numbers showed that Solana reached Ethereum in NFT volume after discounting wash trades.

Moreover, important NFT collections like Okay Bears, Trippin’ Ape Tribe, and DeGods migrate from Ethereum to Solana.

- Goblins & Free Mints: Goblins is an NFT marketplace that is known for not having a roadmap and no utility. However, that didn’t stop it from raising because of its memes ecosystem.

In addition, its free mint projects and copycats started to appear and they got viral rapidly.

- Art Blocks: Another great example of NFT migration is Art Blocks. This generated that this NFT collection grew in sale volume and price. It’s considered a “high art” model of NFTs.

7) Top 10 Crypto Exchanges

In Q2-2022, monthly spot trading volume dropped below $1 trillion for the first time in Q1-2021. Also, the top 10 exchanges (CEX and DEX) total trading volume declined 11.3% from Q1-2022 until now. The interest in the crypto industry has declined.

Source: GeckoCon 2022

As you can see in the picture above, the monthly trading spot volume in Q2-2022 consolidated at $1.3 trillion. However, it decreased to $0.9 trillion in June 2022.

Finally, considering the growing risk of centralized exchanges, they continue leading the sector. The CEX/DEX ratio has increased from 89% in Q1-2022 to 92% in Q2-2022.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.