Restaking is a new narrative in DeFi. Currently, most of the restaking action happens on Ethereum. EigenLayer laid the foundation for this.

However, other chains are following suit. Picasso, which calls the Cosmos Hub it’s home, is now offering restaking on Solana.

1/ 📈 Restaking is coming to @Solana.

Picasso & @ComposableFin are bringing restaking to Solana via our upcoming @IBCProtocol connection.

Dive into our latest blog for all the details:https://t.co/JzOXUpVyLn pic.twitter.com/i8zC45cb2M

— Picasso $PICA (🎨,🎨) (@Picasso_Network) December 13, 2023

This option offers more rewards and extra security to platforms. So, we’re going to take a look at how Picasso introduces restaking to Solana.

Connecting Solana with the IBC Protocol is a great achievement. Two protocols already on the IBC achieved this now. Picasso and Kujira. They’re bringing the IBC to Solana. However, it’s only Picasso who offers restaking. So, that’s what we will focus on.

Picasso Brings Restaking to Solana

This Solana IBC will bring Polkadot, Kusama, Cosmos, and Ethereum into the IBC hub. This will grow the IBC as a cross-ecosystem. Picasso allows for Trustless connections with the Solana ecosystem. This allows Solana liquidity to enter the Cosmos DeFi ecosystem.

Picasso made a Solana <> IBC connection. This gives Solana a new guest blockchain role in the IBC. This is a novel design. Until now, Solana, Near, and Tron didn’t meet the IBC’s technical criteria. The guest blockchain solution seems to have solved this issue.

That’s where restaking comes into the picture. With the Solana <> IBC connection comes access to Solana platforms. For example:

- Marinade Finance — Automated staking platform.

- Jito — Liquid staking.

- Solend — Lending and borrowing protocol.

- Marginfi — Another lending and borrowing protocol.

- Orca — AMM.

Now you can use LSTs (Liquid Staking Tokens) from Solana platforms, on another chain. Here you can restake them. For instance, jitoSOL or mSOL. You can also use all other DeFi use cases. The cross-chain setup allows Solana to enter the Cosmos Hub. However, it also works the other way around.

3/ 🤝 Why?

Just as @EigenLayer pioneered restaking on @Ethereum, we plan to bring this attractive functionality to @Solana as it opens up various opportunities and benefits for users and builders.

— Picasso $PICA (🎨,🎨) (@Picasso_Network) December 13, 2023

Restaking With Picasso on Solana

So, we know now that Picasso brings restaking to Solana. A quick recap on restaking first. You stake an asset with a validator. In return, you receive a derivative token, or a liquid staking token (LST). This token your stake again. Two major things are happening now. You increase your yield, and you secure more than one network. You can find more information on restaking in our Restaking guide.

For starters, Picasso offers restaking for three coins. SOL, jitoSOL, and mSOL (Marinade Fiance). Orca LP tokens and bSOL (Solblaze, liquid staking) may also be joining this list. The original idea for restaking stems from the Ethereum chain. EigenLayer developed this concept. Currently, they have a TVL of $1.71 billion. This places them 11th on the list of TVL on the Ethereum chain. Only one month ago, EigenLayer’s TVL was $275 million. This demonstrates that there’s a demand for restaking.

However, until now, restaking was only available on the Ethereum chain and its apps. Now, other chains are also starting to offer this. Sandeep Nailwal, a Polygon co-founder, mentioned restaking for their new multichain approach. Their new POL token will play a role in this. Picasso is bringing this new narrative to Solana.

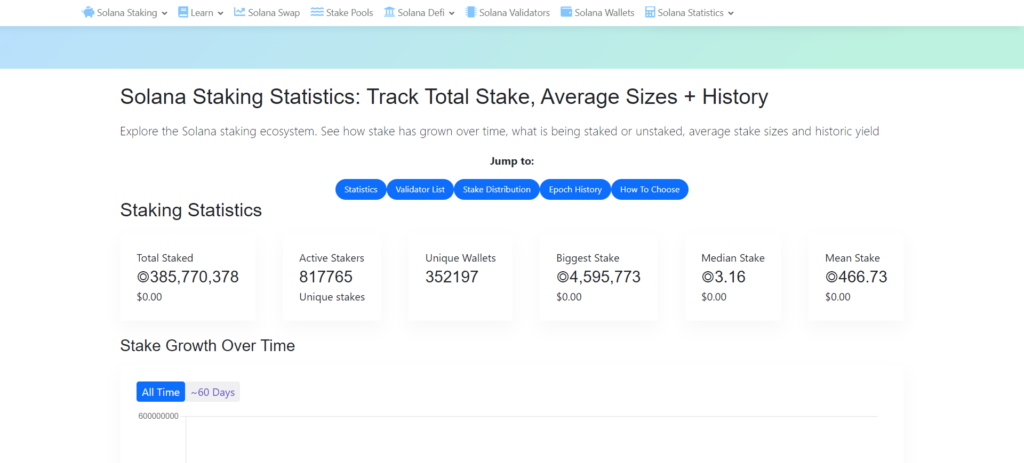

Currently, Solana has a circulating supply of 432.8 million tokens. No less than 385.7 million are being staked. That’s 89% of all SOL tokens that are being staked. Now, the guest blockchain needs validators and stakers. That’s where restaking is helpful. The picture below shows the staked amount of SOL tokens.

Source: Solana Compass

Restaking Vaults on Solana

Picasso is about to launch its first restaking product. This is a Restaking Vault that offers boosted rewards. There’s also a team competition. Picasso opens these vaults before the Solana <> IBC launch. This gives you the opportunity to early access. Once the validators are active, the vault delegates your restaked assets. Thus, the validators have an initial (re)stake supply to start with.

This will not only offer staking rewards but also enter you into a team staking competition. This allows you to compete for boosted transfer revenues. You will also be one of the very first stakers before anybody else can join.

How to Use the Restaking Vault

You can deposit three different tokens into the vault. SOL, jitoSOL, and mSOL. There will be three rounds and each round will have a cap. The first round has a cap of USD 5 million of SOL. Be aware that the vaults are not live yet. However, they should go live any time now. Keep an eye out for Picasso’s X account. So, this is how you can use the vaults:

- Once the vault is live, connect your Solana wallet to it.

- You have the option to join a team. More in a moment on this.

- Deposit mSOL (Marinade Finance) or jitoSOL (Jito).

- The vault locks your deposit until the IBC <> Solana connection launches.

- The vault delegates all assets once the connection launches. As a result, you have restaked assets.

- Your rewards are proportionate to the amount of staked assets and the staking length. However, you also receive a bonus for taking part in the vaults.

- After the connection launches, you can withdraw your assets anytime.

All set!

Restaking vault & team creation is on the horizon.

🌊 Wave 3 is dropping next Monday with 50 NFTs.

🔔Remember to turn on your notifications for the exact time. 1/ https://t.co/EIzwVZkt9X

— Picasso $PICA (🎨,🎨) (@Picasso_Network) January 16, 2024

Team Staking Competition

This team staking competition will last for 30 days. Your team competes for the greatest volume of staked assets. These rewards come in 17.5 million PICA and also in real yield. The winning team receives 80% of 30 days of transfer revenue.

To become a team leader, you need to buy an NFT on Tensor. The team releases the NFTs in 3 tranches.

- Tranche 1: 25 NFTs launched in early-Jan.

- Tranche 2: 25 NFTs, launched a week later.

- Tranche 3: 50 NFTs, launched a week later.

The third Tranche is coming up soon. As a team leader, you can make referral codes and assemble your team.

🤔 Why Become a Team Leader?

👥As a Team Leader, you can generate referral codes for team staking & invite others. Plus, enjoy 15% rewards from your team & a 1.25x boost on your deposits.

💰 After the NFT drops, 40% of the proceeds will be distributed to NFT holders(Team…

— Picasso $PICA (🎨,🎨) (@Picasso_Network) January 16, 2024

Conclusion

Restaking is a new narrative in DeFi. Until now, it was confined to the Ethereum chain. However, more chains are about to start offering this. Picasso is about to start restaking and vaults on Solana. We also discuss how you can restake your jitoSOL and mSOL in the Picasso vaults.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.