Staking in a PoS network, secures the network. However, one downside is that you lock up your staked tokens. They become dormant. One solution is liquid staking. You receive derivative tokens or LSTs for your staked assets. These LSTs you can use in DeFi, to increase your yield. Restaking is a new narrative in crypto. Its goal is to increase capital efficiency. It’s another way, to make your staked assets work for you.

So, in this article, we take a closer look at what restaking is and how it works.

What is Restaking?

Restaking means that you receive derivative tokens (LRTs) for your staked assets. These LSTs you can use in DeFi, to increase your yield. However, you can also use them for restaking. Restaking is a new narrative in crypto. Its goal is to increase capital efficiency. It’s another way, to make your staked assets work for you.

It allows you to stake your assets on the main chain, but at the same time, also on other protocols. As a result, you secure more than one network. This also results in higher rewards. However, that seems only fair, since you also have higher slashing risks. Slashing can happen when a validator acts maliciously or dishonestly. The validator risks losing all his tokens. If you delegate to such a validator, your staked assets may also be at risk.

Coingecko just launched the "Restaking" category.

The current total Restaking market cap is $114M.

I believe it will be the fastest-growing category in 2024. pic.twitter.com/Rbg6yTUtuO

— Ignas | DeFi Research (@DefiIgnas) January 10, 2024

EigenLayer

The pioneer in this field is EigenLayer. This protocol is active on the Ethereum chain. However, we see more options on other chains surfacing. For example, Picasso, which calls the Cosmos Hub is its home. Nonetheless, Picasso is active on Solana with restaking. Polygon’s new multichain option will also offer restaking. There are plenty of other platforms that are starting to offer restaking. Most of them use Eigenlayer as their basis. For example, Pendle or Sommelier and plenty of others.

The restaking narrative has massive potential. For instance, CoinGecko has started a restaking category, LRTfi. The market cap is $252 million, between only two protocols. This market is bound to grow. The current market cap increase is parabolic. However, it also still needs to prove itself. If it is the big narrative, we expect it to be, there will be more fragmentation. If it remains a niche, the market will concentrate on a handful of players.

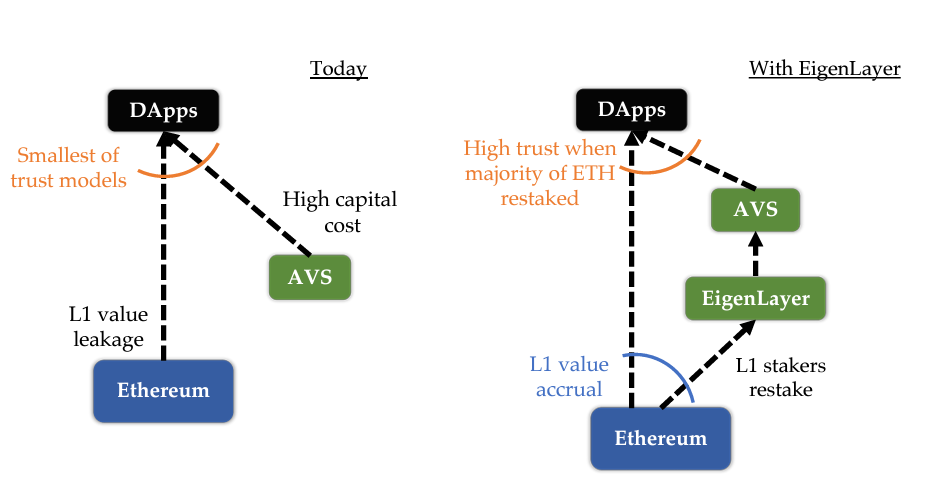

So, to recap this part, restaking uses among others Liquid Restaking Tokens or LRTs. This is a derivative token that generates more value for your staked tokens. It benefits the main chain, stakers, and other networks. The picture below shows how actively validated services work on the left. On the right is how EigenLayer works.

Source: EigenLayer docs

How Does Restaking Work?

Restaking works slightly more complex than liquid staking. The LRT supply chain is more complex. It adds extra steps compared to liquid staking. So, here’s an explanation why. In general, you can restake in three different ways.

- Natively — A validator restakes their ETH on the Beacon Chain to EigenLayer (EL). However, there’s no cap on the deposit. You can restake as much as you want.

- Superfluid — This is currently not available. It allows you to restake LP positions.

- Liquid — Restake your LSTs to EigenLayer smart contracts. EL does the restaking. However, EL has a cap. The next cap raise isn’t due until 29th January and is open for only four days. Liquid restaking has two options.

- Basket-based Liquid Restaking (bLRT). The LRT protocol deposits various LSTs. You receive 1 LRT for this. This way, you can diversify your LST assets. This seems to be the most used option. Among other things, it consolidates liquidity. However, it can also be complex to manage the LST basket.

- Isolated Liquid Restaking (iLRT). Now you deposit one LST and receive one LRT in return. It allows for controlled risk exposure and is easier for getting bribes.

The Dapps that you use to restake your tokens with are the Actively Validated Services, or AVSs. Some liquid tokens, available for restaking, are:

- stETH (Lido)

- swETH (Swell)

- rETH (Rocket Pool)

- ETHx (Stader Labs)

- cbETH (Coinbase)

As of 29th January, EL will also add sfrxETH (Frax), mETH (Mantle), and LsEth (Liquid Collective). Here are some LRTfi protocols:

- Agilely — LRT Collateralized Debt Position (CDP).

- Pendle — Yield trading for eETH.

- Ion Protocol — Lending platform for LSTs and LRTs.

- StakeEase — Cross-chain restaking aggregator.

- LayerLess — Omnichain liquid restaking.

There’s also a much anticipated potential EigenLayer airdrop in the making.

In 2024, we will see a big Restaking Narrative that reaches max. hype around the time EigenLayer drops their token.

Some Cosmos plays that fit into that:

›› SOL via @Picasso_Network

›› AVAX via @CosmosAVAX

›› ETH via @EthosStake

›› BTC via @babylon_chain— Cryptocito | Cosmos ⚛️ (@Cryptocito) January 14, 2024

Risks of Restaking

Restaking also has some inherent risks. For example, Vitalik Buterin already spoke up about some of these risks. It can overload Ethereum’s consensus. So, let’s take a look.

- Unintentional slashing — This could happen because of a smart contract error.

- Operator collusion — Validators being in cahoots and using the same restaked ETH. They could try to attack a network and take control of its TVL.

- Centralization — Validators with big computational power controlling the restaking space in various networks.

the next collapse will likely be from a restaking service ..

those who will be affected the most or possibly lose their Networth will be those who;

BORROW FROM A — LOAN TO B —- BORROW FROM B — DEPOSIT TO C TO RESTAKE AT D

with no RISK MANAGEMENT in placeI'll be back to… pic.twitter.com/24pcPaP4O3

— 〽️ᄃムt 🐾 (@mztacat) January 10, 2024

Conclusion

Restaking is an upcoming crypto narrative. So, we explain what it is and how it works. There are also samples of platforms and tokens in this new narrative. Furthermore, we discuss the risks of this DeFi strategy.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.