On the Layer 1 landscape, there’s one dominant chain, Ethereum. It had a first-mover advantage with smart contracts. So, does this mean that all other L1s are being sidelined? No, not at all.

So, let’s take a look at the state of some top Layer 1 blockchains.

Ethereum (ETH)

Ethereum does well when we look at the core metrics. For example, of all L1 chains, it generates the most fees. After the Shapella upgrade, we saw liquid staking and LSTfi grow in popularity. Furthermore, meme coins and Telegram Bots also did their part.

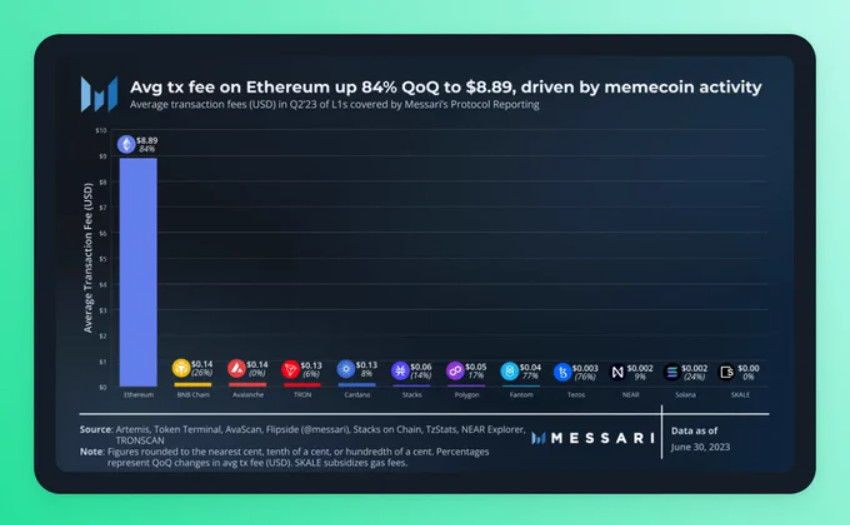

The downside for Ethereum users is the rising gas fees. We observe this quarter on quarter (QoQ). As a result, in Q1 and Q2, 2023, the transaction fees went up by 84%. That translates to $8.89. Gas prices also went up, by 53% to 47 Gwei. The EigenLayer airdrop hunt played a part in this. But also, meme-coins and the Telegram Bots added to the tally.

We see that in Q2, Ethereum and Tron are good for no less than 93% of total revenue for L1s. Ethereum managed to have $32 million in revenue on 5th May. That was when the PEPE coin peaked.

If we look at the P/S ratio, Ethereum also does well with a 122x. The P/S ratio shows the relative price of a network’s token compared to its revenue.

Even with TVL’s growth, Ethereum kept shining. With Tron together, it increased its market share from 82% to 85%. So, we see that Ethereum stays in control and on top of the pile. It still has a good grip on the DeFi space. However, other blockchains are not sitting still. So, let’s take a look at some other top L1s. But first, the picture below shows the transaction fee costs.

Source: Twitter

Cardano (ADA)

Cardano did well with its DeFi growth. It topped all other Layer 1 chains with QoQ growth. This was 14% QoQ. The protocols on Cardano responsible for this growth are:

- Indigo which launched in Q4’22.

- Liqwid launched in Q1’23.

- VyFinance which launched in Q2’23.

On 30th July, the Mithril upgrade went live on Cardano. It’s a stake-based signature protocol. For instance, it will not only improve the speed but also the efficiency of the mainnet node syncing. In turn, this allows for more Dapps and use cases. Decision-making will also become more decentralized. There will also be an improvement in the network security.

Mithril is officially live on the #Cardano mainnet! 🚀@IOHK_Charles @Cardano @Cardano_CF @IOG_Eng @conraddit @canadastakes1 @euskalstakepool @SPO_DINO @VFS_StakePool @sakepool_ada @sakakibara1JPN @cardano_aden @hix_coffeepool @shiodome47 @rx78pool @slowhand4040 pic.twitter.com/Bn0AThnYL2

— Banksy – LEAD Stake Pool (@LEADStakePool) July 30, 2023

Avalanche (AVAX)

Avalanche saw the most new address growth from QoQ. It also excelled in revenue growth among L1s for native tokens. LayerZero and XEN Crypto played an important part in this. They drove the activity levels and revenue up.

The C-chain also leads by QoQ transaction growth with a rate of 162%. That’s some great network usage for Avalanche. The chain also launched Avalanche Vista. This is a $50M initiative to pioneer tokenization on Avalanche. Furthermore, the DeFi OG Balancer Protocol is now live on Avalanche. This is one of the largest DEXes and AMMs by volume.

Today, the Avalanche Foundation introduces Avalanche Vista, a $50M initiative to pioneer tokenization on #Avalanche

Tokenization is poised to be one of the most impactful blockchain innovations of the next decade, and Avalanche is uniquely equipped to power these systems. pic.twitter.com/ZWy109CMCi

— Avalanche 🔺 (@avax) July 25, 2023

BNB Chain (BNB)

When we look at fees, BNB Chain beats Ethereum hands down. Like many other L1s. The average fee on BNB is $0.14. This seems high since most of my own BNB transactions hover between $0.03 and $0.07. However, the BB chain validators managed to cut gas fees by 40%. This means that average transaction costs declined by 26%.

BNB Chain also rules when it comes to deflation figures. During Q2, it had a 5.9% deflation rate. That’s because the chain, or rather the team, burns the transaction fees each quarter. For network users, BNB Chain also has the highest number of active users. BNB also has a variety of growth initiatives. For example, their Gas Grant Program plus a variety of incubation programs.

BNB Chain is proud to support agricultural sustainability with @agroglobaltoken 🌱🌿🌾🍃 https://t.co/hfXPLZss8g

— BNB Chain (@BNBCHAIN) July 31, 2023

Tron (TRX)

Tron has the best P/S ratio of L1s. It’s only 8x. Remember, this is the relative price of a network’s token compared to its revenue. Tron also fared well with its token burns. Its deflation ratio is 2.8%. It burns all collected fees. When we look at network usage, Tron has the highest transaction count.

The TVL for Tron also grew by 7% QoQ. That’s impressive, but even more impressive is its 48% YoY (year on year) growth. Tron also saw the Periander upgrade in early July. For example,

This optimizes stake 2.0. Tron’s staking mechanism will see improved flexibility. This leads to a reduction in smart contract costs. It also includes an improvement of the Tron network infrastructure performance.

Q2'23 Report: #TRONNetwork shows robust growth alongside @Ethereum, together dominating 93% of the L1 revenue.🤝#TRON’s consistent growth is proof of our solid network infrastructure!😎

More on @MessariCrypto: https://t.co/sYabkBCwTN pic.twitter.com/erdlNQCpi1

— TRON DAO (@trondao) August 1, 2023

Conclusion

Ethereum still rules the Layer 1 landscape and the DeFi space. However, there are many other L1s that are not sitting still. They manage to counter Ethereum in specific features. However, overall, they can’t beat Ethereum.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.