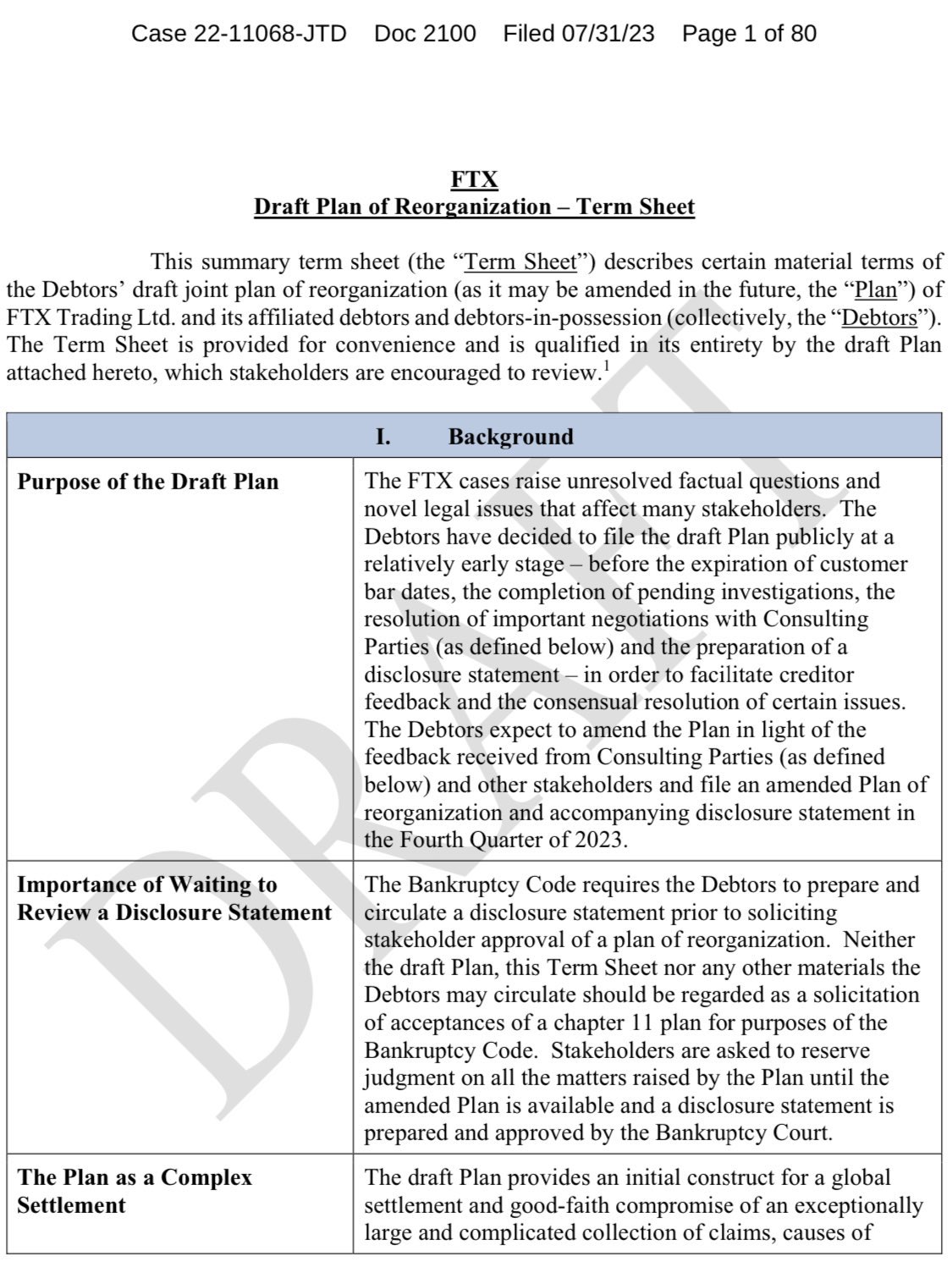

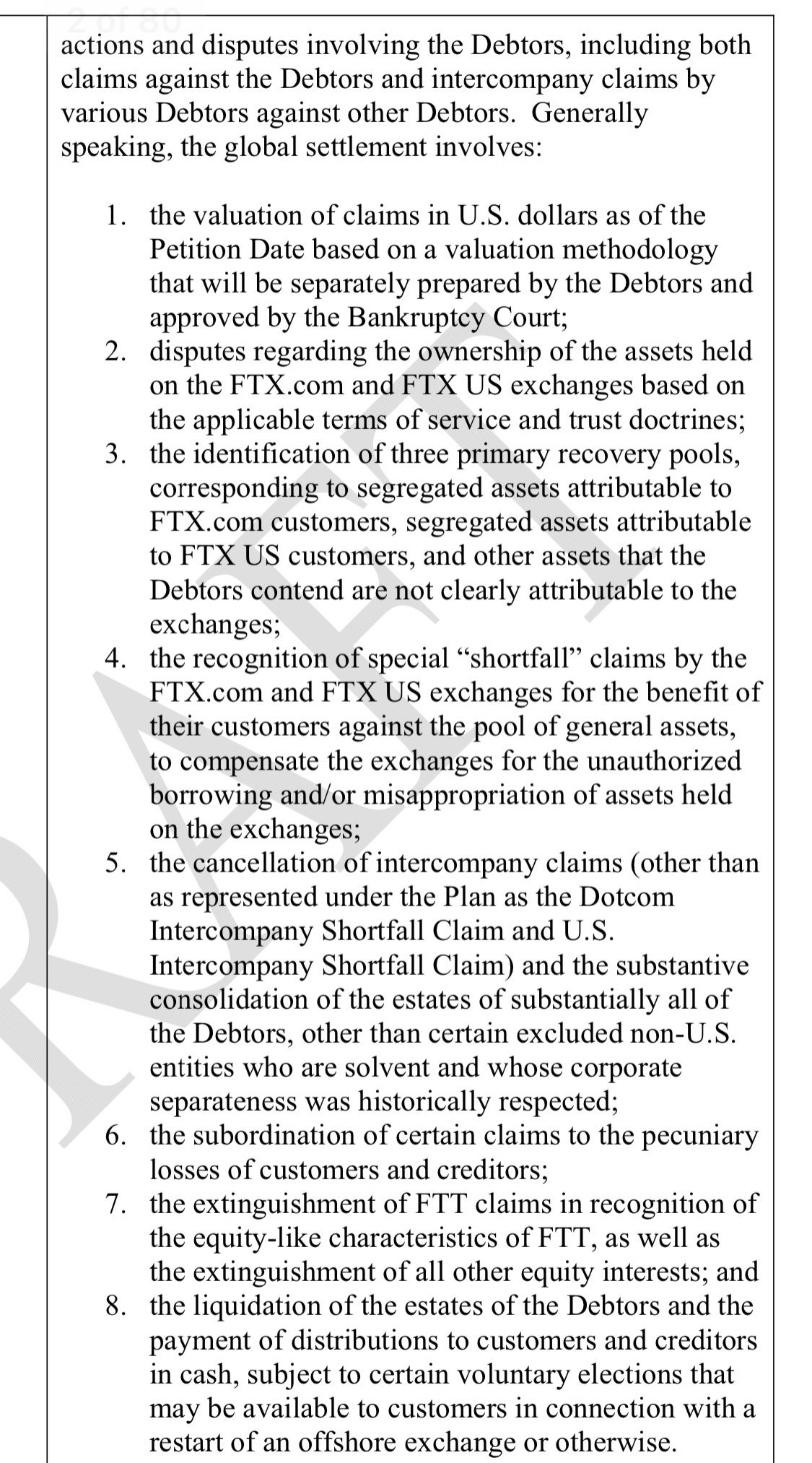

FTX has come up with a reorganization plan that would enable it to operate as an offshore company. The company proposed to divide its claimants into different classes.

Court documents filed late Monday night showed that an important part of the plan includes an opportunity for a particular class of claimants to potentially resurrect FTX through cooperation with outside investors, subject to a group agreement.

FTX Is Rising From Its Own Ashes?

Furthermore, to determine creditor repayments, the new FTX management created three recovery pools: assets linked to FTX US customers, assets linked to FTX US customers, and assets not directly linked to the exchanges. According to the company’s projections, almost all creditor classes will be regarded as impaired, which means they might not receive full payment.

The plan, interestingly, does not provide for recovery for FTT tokens because of their “equity-like characteristics.” FTX’s advisors underlined the fact that equity is frequently destroyed in US bankruptcy reorganizations.

Can FTX Restart?

FTX says that the reorganization plan is in its initial stages and is open to modification. The company’s Chief Restructuring Officer, John J. Ray III, assured users that the business would fulfill the plan on time. In addition, the company said it will work with creditors over the coming months to present a revised plan in the fourth quarter of this year.

While the restructuring plans sound interesting, there are concerns that FTX could recover its previous reputation. Due to the broken trust between the company and its users. FTX was previously considered Binance’s closest rival, and its founder, Sam Bankman-Fried, was one of the most prominent crypto figures.

Bankman-Fried gained fame for his huge political donations. However, on November 11th, 2022, FTX filed for bankruptcy due to liquidity problems. Bankman-Fried has since been arrested by US prosecutors and released on bail. However, he faces trial in October for charges including conspiring to defraud investors.

FTX has sued the 31-year-old former crypto billionaire and other key executives to recoup around $1 billion in mismanaged funds. While Bankman-Fried is no longer associated with FTX, many believe a comeback will be almost impossible. However, it appears the market reacted with optimism as the FTT token rose by over 20%.

What’s up with Bankman-Fried?

Bankman-Fried’s trial is scheduled for early October. However, prosecutors are calling for his bail to be revoked, citing fears that he could jeopardize their case. Bankman-Fried reportedly shared private documents with a New York Times reporter that were used in publishing a piece about Cory Ellison, the former CEO of Alameda Research and Bankman-Fried’s former flame.

Prosecutors consider Ellison one of their key witnesses and believe Bankman-Fried’s actions could manipulate the case. However, Bankman-Fried’s lawyers argued that their client committed no crime but was only exercising his right to respond to media inquiries. Bankman-Fried also agreed to stop making public comments about anyone involved in the case.

SBF stole billions.

He donated $93 million of those billions to politicians.

Today the campaign finance charge was dropped.

— Bitcoin News (@BitcoinNewsCom) July 27, 2023

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.