By now you’ve heard. SEC sues Binance. SEC sues Coinbase. 2 Huge funds dump their alts on Friday in response and almost all coins that are NOT Bitcoin or Ethereum went down 20% or more in a day.

But this is not the end. No matter what the SEC does. In this article, I will show you 3 reasons why crypto will survive this attack and give you 2 super helpful trading tips.

Reason #1: Global

I know this has probably been a stressful few days for you. For us too. But let’s step back from the emotion and use logic for a second. Right now, about 1 in 5 Americans uses crypto in some way. And that’s a lot of people. In a country of 320 million, 20% is 64 million people. But crypto is global and transnational.

India alone has almost twice that at 115 million. China has nearly the same number of users as the US and crypto is illegal there. Of China’s 1.2 billion people, 5.5% or 66 million use crypto. And the Chinese Government is one of the largest Bitcoin holders in the world.

Source: Twitter

Now don’t get me wrong. For now, the most investment infrastructure and human capital for crypto is in the US. And if Operation Chokepoint is a success to cut off the on-ramps to crypto, that WILL hurt. But it’s not nearly the death sentence people think it is. Other high-population countries with at or near 20% adoption in their country include Nigeria, Indonesia, Malaysia, and Brazil.

Potential hubs are emerging for crypto outside the US too like in Dubai, Singapore, London, and Malta.

Reason #2: Fundamentals the Same

Let’s look at this list. Lots of coins that you know are on it. Coins like:

- MATIC

- ATOM

- ADA

- XRP

- CHZ

- BNB

- SAND.

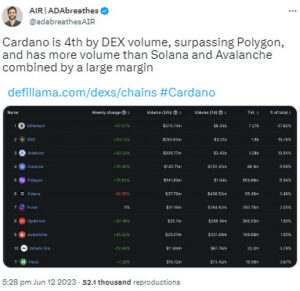

So I am going to put this question to you. What is fundamentally different in these coins now from a week ago? We will look at 4 of the biggest coins on this list. Three of them, MATIC, ATOM, and Cardano, are 0% different than they were a week ago. If you liked their fundamentals, roadmap for the future, liquidity in the token, or other factors, then NOTHING is different for you.

Source: Twitter

Now the 4th we are looking at is a special case, XRP. XRP looks like it’s in a BETTER situation than it was a week ago. There is more and more evidence and opinions coming that they will win their case against the SEC. So if you liked Polygon and Cardano at 83c and 37c, why wouldn’t you like them more at 64c and 28c? They are currently at 27% and 23% discounts from a week ago.

I am going bargain hunting. What projects are you watching now that prices came down so fast?

Reason #3: Bitcoin and ETH Relative Strength

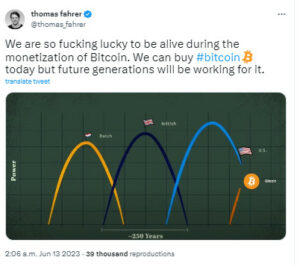

The SEC would not attack crypto if it did not see the value in it. There is already a parallel crypto economy. It has its base money in Bitcoin. It has payment coins in ETH and stablecoins. People don’t need US banks and SWIFT as often as before.

That’s not changing. And because BTC is already considered a commodity and not a security it did not suffer as adults did. Ethereum looks like it’s on the road to becoming a commodity too.

Source: Twitter

At least the market thinks so. Instead of down 20% or more, BTC and ETH are down 2.9% and 6.4% respectively. Markets know these 2 are not going anywhere and if the alts have to force sell, they will sell for one of these 2 safer tokens.

Bitcoin is clearly the safest token in the entire industry for investment. It’s the only one with clarity worldwide.

2 Super Helpful Tips for Traders

Now if you are a trader, there are 2 ways you can look at this. Either

- Very Short Term OR

- Very Long Term

Tip 1: Bargain Hunt

Like in my examples of Polygon and Cardano above, you could bargain hunt and earn a quick 23% just if the price recovers to where it was a week ago. And depending on how long that takes, that could be a nice ROI for you.

The other is the same piece of advice we’ve given the whole bear market. And that’s finding projects you love that are now on sale and buying them to hold long-term.

Tip 2: Check Liquidity

Liquidity CAN be a problem in crypto. So let’s look at MATIC as an example. MATIC is liquid. It traded for $629 million yesterday. And only 1 of the top 10 exchange pairs by volume is a US exchange. Coinbase did $15.3 million at #7.

Even if that goes away, the top 3 trading pairs on Binance and OKX did 10x that amount. So MATIC will be fine. But check this for the other coins you want to buy. Don’t count the DEXes because DEX buyers can be from anywhere but check out the CEX volume like I just did here on CoinGecko. You will see that the Coinbase & Binance.US impact on this token will be minimal, if any.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.