What just happened in the last 24 hours. Bitcoin is up close to 10%, BNB, LUNA, AVAX, MATIC, and almost every token seems to have made overnight gains. The global cryptocurrency marketcap is over $2 Trillion once again.

But who or what moved the market? Could this be a bull-trap? What should you expect next? Surprisingly all the answers lie in that Bitcoin Long Term Holder. Let’s talk about it in this article.

Before we talk about this particular indicator let me very briefly explain to you what on-chain data is, what it represents and how it can help you establish an edge.

What is On-Chain Data?

On-chain data is raw data that represents blockchain activities like transactions and block creation. And from this data, we can analyze what happens on the networks that lead to market movements.

Do you remember the March 2020 BTC sell-off? Well, no one predicted that crash was coming. But this crypto quant chart clearly showed the exchange inflows were rapidly going up and a crash was imminent. I am sure that if we have seen this on-chain data in time, none of us would have booked losses.

Indicator 1: Spent Output Profit Ratio (SOPR)

Now, in the current market situation SOPR, the Spent Output Profit Ratio has been indicating a market recovery. SOPR is an estimate of the profit ratio of all the investors and traders in the market. It’s a ratio of the value of assets when you sell to the value of assets when you bought the same assets.

In other words, when the SOPR value is greater than 1 ( SOPR > 1 ), assets are gained and the investor is selling at a profit. When the SOPR value equals 1 ( SOPR =1 ), assets are at break even. And when the SOPR value is less than 1 ( SOPR < 1), investors are selling assets at a loss.

When SOPR is going up, investors are taking profits and when SOPR is going down, investors are selling assets for a loss. So knowing the value of SOPR can help you make buy and sell decisions instead of getting into a FOMO.

In a bull cycle, the bull run begins right after a market correction when SOPR is below ‘1’. This could be the right time to buy.

Indicator 2: Long Term Holder SOPR (LTH SOPR)

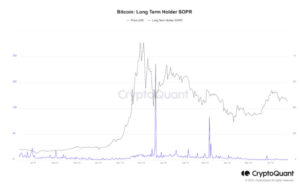

Long Term Holder SOPR is applicable for long-term holders. By definition, a long-term holder is someone who is holding Bitcoin or any asset for the past 155 days and beyond. When the value goes up, it implies the actual liquidity in the market is increasing, as the assets of long-term holders are considered illiquid. This is a chart where this indicator is expressed in bitcoin.

In 2014, LTH SOPR spiked two times and both the time, the market trend got reversed. Here is another chart for 2018:

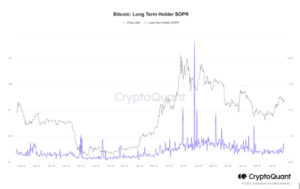

The LTH SOPR spiked once and the market trend reversed and Bitcoin went to bear market in 2018.

In 2019, Bitcoin was on a downtrend and LTH SOPR spiked which presented a good recovery to near ATH levels.

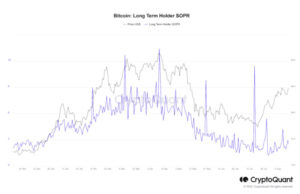

For 2021, we saw three prominent spikes. In March, April, and July. The first spike indicated the trend will be reversed soon, the second and most prominent spike, confirmed the trend reversal and indicated local top.

More About Long Term Holder SOPR

Then, Bitcoin fell to $36k where we saw a smaller spike. This was an indication of reversal, but an absence of volume proved to be an issue. Even if you ignored the volume, you would be buying near the local bottom. The third spike occurred in July and right after Bitcoin recovered from the correction. So what is the current scenario?

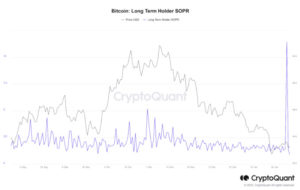

Yes, just two days back on February first, the indicator spiked again. But wait, did LTH SOPR flash at 69k? No, but a spike was flashed on November first week, and it turns out long-term holders could not time the top this time. Though in November’s first week, Bitcoin was trading above $60k, considering we are at $37k in February 2022, seems not a bad call after all.

So, what is the indicator telling us?

If you notice, the magnitude of the Bitcoin Long Term holder spike of July and February are identical. So this might be a recovery call after all and that is what happened briefly.

But as per the historic LTH SOPR ‘theory’, in times of bearish sentiments, the flash could be signaling the beginning of the bear market. So with what the current SOPR indicates, you need to stay very careful. We might see brief moments of recovery but a long-term rally cannot be seen.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.