The importance of lending and borrowing cannot be emphasized enough, not just in the decentralized finance (DeFi) ecosystem but in any financial sphere.

Non-custodial permissionless lending protocol Euler Finance, however, brings a new twist to lending and borrowing in the DeFi space. The permissionless lending protocol focuses on providing its users with the opportunity to lend and borrow crypto assets. On Euler, users will also be able to borrow a wide array of ETH-based tokens. Therefore, essentially democratizing the crypto assets interested persons can lend or borrow.

This article covers important details about Euler Finance, how it works, its features and innovations, and what makes it different from other lending protocols available today.

More on Euler Finance

As previously indicated, Euler is a permissionless, non-custodial lending protocol. Built on the Ethereum Chain, the protocol basically enables users to borrow and lend almost any crypto asset. Furthermore providing users with the opportunity to earn interest on their crypto holdings. They will also enjoy a secure hedge against volatility in the crypto space. All this is also made possible on Euler Finance without the need for any third-party interaction.

Apart from the complete elimination of third-party bodies, Euler introduces a number of amazing features. These features are also unique and new to the DeFi ecosystem. Some of these features include: MEV-resistant liquidations, protected collateral, permissionless lending, reactive interest rates, etc.

Lending and borrowing is an important financial activity. In conventional scenarios, lenders and borrowers interact via third-party organizations like banks, etc. DeFi lending platforms like Compound and Aave change this narrative by eliminating the need for third-party organizations. Euler Finance further transforms decentralized borrowing and lending by accounting for the risks associated with crypto lending and borrowing. The protocol also boasts of allowing its users to borrow a greater array of crypto tokens than ever before.

Important Euler Features

Several features make Euler Finance different from other available decentralized lending and borrowing protocols. Some of these features include:

- Euler Permissionless Listing – The non-custodial protocol allows its users to decide what crypto assets it would list. Also, any WETH trading pair on Uniswap v3 will also receive support on Euler.

- Reactive Interest Rates – Euler interest rates automatically reduce governance and borrowing costs. Therefore, resulting in maximum capital efficiency.

- Multi-collateral Stability Pools – The protocol also makes it possible for lenders to swap their crypto holdings for discounted collateral assets during liquidation periods.

- Asset Tiers – Euler asset tiers also help maximize capital efficiency while keeping systemic risk at the lowest possible level.

Other important features include MEV-resistant liquidations, protected collateral, etc.

How To Borrow on Euler Finance

1. The first step to borrowing on Euler is to activate the asset that is to be borrowed. This can be done on the Markets’ table icon on the homepage.

2. After activation, click on the “Borrow” icon in the Quick action menu.

3. Next is to select the Euler sub-account of interest.

4. Select the asset to be borrowed.

5. Input the desired amount. You can also either select:

- The Max button – is represented by liquidation x 1.5 (not recommended except for self-collateralized loans).

- Safe Max button – this results in a health score of 1.25 (recommended but not for self-collateralized loans).

- Liquidation button – borrowers usually have a health score of 1.

Euler (EUL) Tokenomics

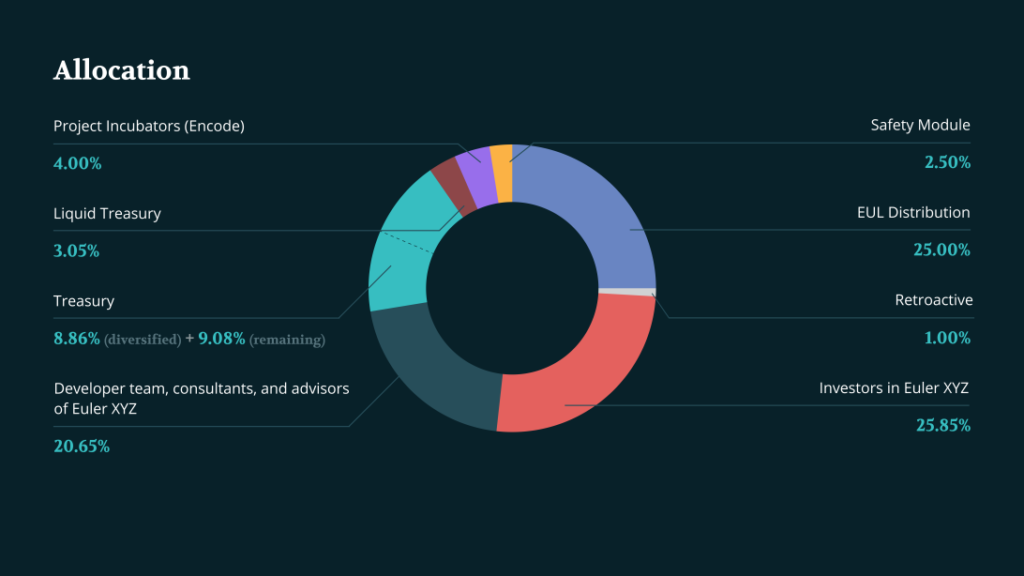

Euler (EUL) is the native token of Euler Finance protocol. EUL is an ERC-20 token that also doubles as a governance token on Euler. The total supply of EUL tokens is 27,182,818.

- Also, 25% of the total supply will go to borrowers on community-selected markets over a four-year period.

- 1% will go to users who participated during Euler Finance’s soft launch.

- 2.5% will go to stakers.

- 9.082% to an ecosystem treasury, unlocked (see Treasury).

- 8.869% to governance partners.

- 3.05% liquid assets deployed by the Treasury.

- 25.85% to investors in Euler XYZ Ltd.

- 4% will go to early startup Encode.

- Lastly, 20.65% will go to employees, advisors, and consultants of Euler XYZ Ltd.

In conclusion, Euler Finance has been in the limelight in recent times for all the right reasons. According to DeFi Llama, the protocol recorded a 160% growth in its TVL over the last 30 days. That is up from $89.91 million on May 31 to $247.41 million on June 27, 2022. At the time of writing, Euler TVL is at $245.48 million.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.