Digitex Futures is an interesting exchange. It offers zero fees trading. We recently had the opportunity to participate in their closed soft launch. We got to try the different functionalities and did some trades as well. Below is a walkthrough of our experience of the platform.

Getting Ready to Trade

Buy Digitex Token (DGTX) or transfer it from your wallet. It is recommended, not to transfer from an exchange wallet.

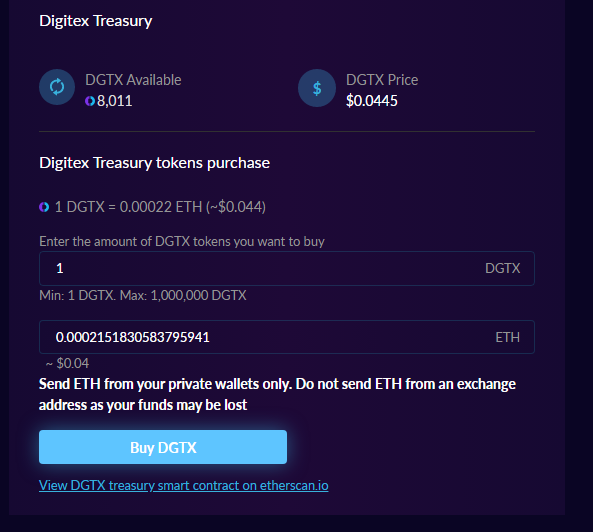

You can also buy DGTX directly from the Digitex Treasury. The treasury is slowly releasing tokens. (The total supply cap is ~1 Bn DGTX).

Currently, you can purchase using ETH. The Digitex Futures smart contract will automatically convert the ETH you send to DGTX. (All transactions in the Digitex Futures Exchange happens with DGTX.)

Note: Send ETH from your private wallets only. Do not send ETH from an exchange address as your funds may be lost.

The smart contract link is given in this link. After the transfer, you will have the amount in your wallet.

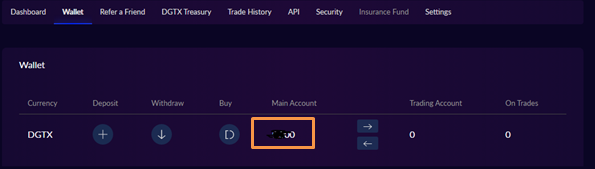

Futures Trading Dashboard

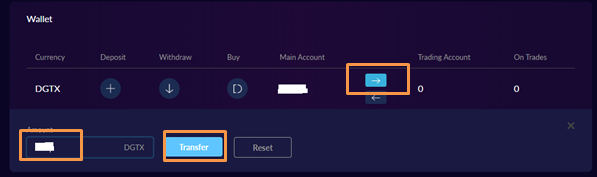

Transfer your fund to the Trading account. Select the arrow. Enter the amount. Click Transfer.

The Futures Trading Window

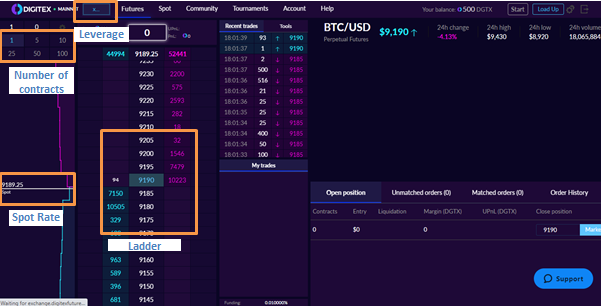

The Futures Trading window looks like the below screenshot. We will go through each of the four important features highlighted by the boxes below – Ladder, Spot Rate, Number of Contracts, and Leverage.

The Ladder Interface:

The Ladder Interface is very beneficial to scalp. It minimizes the number of clicks and simplifies execution. It takes one click to buy and one-click to sell. You can also get out at the same price you got in. You can do it multiple times. Digitex Futures takes zero fees.

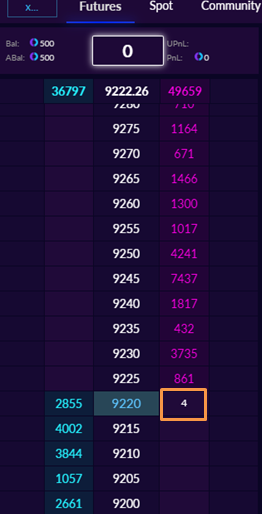

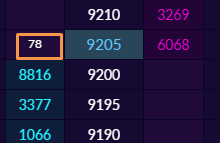

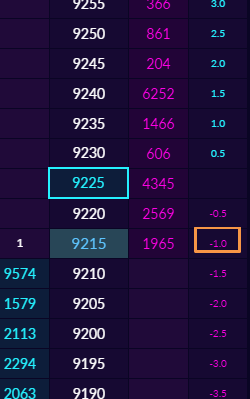

The green ladder (left) is the Bids (number of contracts sitting on each price increment. Each contract is backed by a certain number of DGTX). The price increment (middle) is kept at $5. This gives more control. The red numbers (right) are asks.

If you see in the below screenshot there is a white number (4) below the red numbers. This means that that line (2855 contracts at $9220) is getting attacked and people are selling in the market Bid.

Orders are placed by a simple left-click on the order book at the price level needed.

Correlating the Spot Price with the Futures Ladder:

Focus on the Spot Price. This is important as the Spot Price forecasts the Futures price. The Spot Price is derived from the weighted average of exchanges.

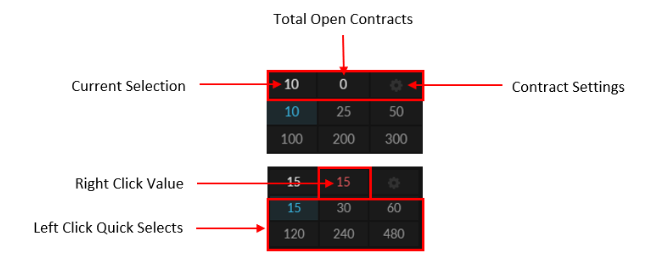

Select Contracts

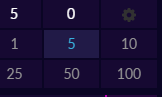

The select contract option comes in the top left of the default setting. This is where you choose how many contracts you place on the ladder with each click. You can edit the default settings. Note that each contract holds a certain value in DGTX.

Leverage

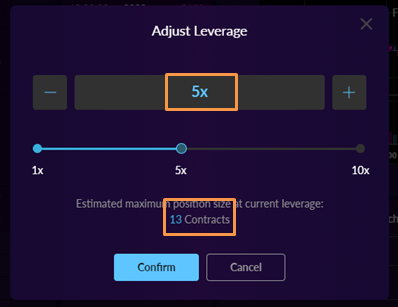

Leverage is the ability to control a large contract value with a relatively small amount of capital. The more the leverage the more the risk and higher the rewards. The leverage option can be found in the top left of the screen.

Select your leverage. It will also give you the number of contracts you will have with the current balance.

We have previously given some quick tips on how to select leverages based upon your risk-taking ability in our article Understanding Crypto Futures Contracts.

Stop Limit

We believe that putting a stop limit is very important for Futures Trading. However, when we tried putting a Stop Loss through the Tools option, we found that the option is not enabled yet. Check this out in the future when you start trading.

Futures Trading

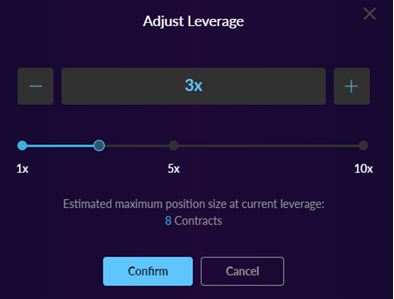

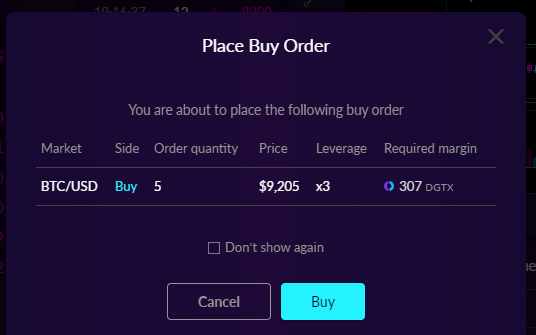

Based upon our calculations we take leverage of 3x.

The leverage appears on the top-right screen.

We will now select the number of contracts to order in 1 click. We select 5 contracts

Now we need to decide the futures strategy. Whether we want to go long, or we want to go short. Read more about Futures Trading Strategy in our article Understanding Crypto Futures Contracts.

If we want to go short, we will click below the lowest Red Line. If we want to go long, we will click above the highest Green Line.

We select to go Long. Check the Margin required. Digitex charges a High Margin. The system locks that amount. (Note: We are playing with lower amounts to minimize the risk of losing and would recommend you to do the same till you gather confidence.)

We place the long order by clicking on the below area

The top bar shows the available balance and the number of contracts.

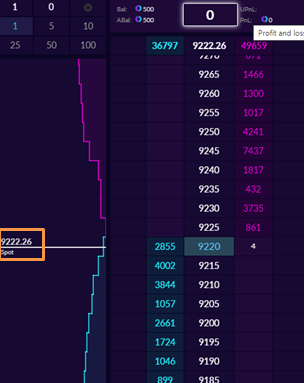

Also note that a new ladder will appear which will show you the profit or loss opportunity (in DGTX) for different price values (Note: the screenshot below is for a different order).

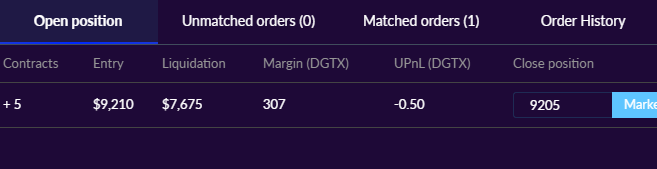

Positions can be monitored in the right bottom space of the dashboard.

Future Digitex Features

Digitex Futures is only starting with BTC/ USD Pair in crypto. It intends to follow it up with ETH/USD and XRP/ USD. It also plans to foray into Commodities, indices, and stocks. Spot Market of Digitex Futures is not yet live.

Conclusion

Digitex Futures looks cool. Commission-free trading is a massive winner. The UI is first class. Navigation and functionalities are excellent. It has launched itself with only one Futures pair. We would like to mention that we faced some problems while selecting Leverage, when the Confirm button was not working. Trading in DGTX makes it easy and also helps in improve the value of the DGTX Token. As Digitex Futures rolls out for more users, people will start to find the value in the platform. Focussing and starting with a single service works. All the best to the Digitex Futures team!

A futures contract is the riskiest trading strategy and if not done properly, might result in huge losses. To help our readers understand Futures Trading, we previously wrote a very important guide and gave tips for Futures Trading – Understanding Crypto Futures Contracts.

—

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided.

Do your own due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd. All rights reserved.