The importance of stablecoin to the entire crypto ecosystem cannot be over-emphasized. Stablecoins introduce much-needed stability to the volatile cryptocurrency ecosystem.

TrueUSD (TUSD) is currently one of the top stablecoin available today. Its current marketcap is more than $1.2 billion with a 24-hour trading volume of $47.9 million. Therefore, in this article, you’ll learn more about this stablecoin.

What is TrueUSD?

TrueUSD is the first-ever regulatory-compliant stablecoin backed by US dollars. Unlike other stablecoins like Tether which is backed by the dollar, TrueUSD claims to be the tokenized version of the US dollar.

😎 $TUSD trading volume increased by 56.96% in 24 hours, data source: @CoinMarketCap#TUSD🔗https://t.co/OsPDK9GNdq –The world’s most transparent stablecoin, fully collateralized and independently attested live on-chain pic.twitter.com/tqqPjBt2bP

— TrueUSD (@tusdio) June 28, 2022

While stablecoins are important to the crypto space, the recent crisis of TerraUSD (UST) shows that stablecoins are not fool-proof. Especially stablecoin tokens not backed by a reliable store of value. Before we learn about TrueUSD (TUSD), let’s learn more about stablecoins.

What are Stablecoins?

Stablecoins are unique cryptocurrencies designed to get their market value from external sources. Simply put, they are cryptos pegged to or backed by real-life assets like fiat currencies, gold, other stablecoins, etc.

Stablecoins have four (4) broad classifications based on their underlying collateral or peg. These classifications include:

- Fiat collateralized stablecoins – These stablecoins are usually pegged to top fiat currencies like the USD, EUR, etc. TrueUSD is a perfect example of a fiat collateralized stablecoin.

- Algorithmic Stablecoin – These stablecoins maintain their peg with algorithms. These algorithms provide them with a consistent value, therefore helping them to remain pegged at a certain price. The now-defunct TerraUSD (UST) stablecoin is a good example of an algorithmic stablecoin.

- Crypto collateralized stablecoin – These stablecoins are pegged to other top stablecoins like Bitcoin, Ethereum, etc.

- Commodity collateralized stablecoin – These stablecoins are backed by precious commodities like Gold, Oil, etc.

In this case, TUSD is in the Top 10 stablecoins with the highest marketcap (Position 6):

Top 10 Stable coins by Market Capitalization 📊#USDtether #USDC #BUSD #DAI #FRAX #TUSD #USDP #USDN #USDD #XAUT pic.twitter.com/uMpLLhEdmx

— CrowdFundJunction (@CrowdFJ) June 28, 2022

More on TrueUSD

As previously indicated, TrueUSD (TUSD) focuses on helping to create a new global financial space. On the TrueUSD platform, interested persons can carry out a number of functions. Some of these functions include:

- Minting – TrueUSD (TUSD) has a 1 – 1 relation with the US dollars. Interested persons can also easily mint the stablecoin.

- Trade – Users can trade TUSD in over 70 exchanges. The stablecoin is also available in over 160 different markets, 20+ Over-The-Counter (OTC) platforms, and in over 5 different continents.

- Hold – TUSD is a good hedge against crypto volatility. So instead of holding volatile tokens, users can simply hold TUSD. Especially as its value is pegged 1 – 1 with the US dollars.

- Lastly Vaults – TUSD is also available for staking, mining, and farming on to DeFi platforms like Ethereum, Tron, Binance Smart Chain (BSC)

Launched in 2018, its reserve works for escrow accounts which provide TUSD with real value. Notably, users can swap TUSD for its USD counterparts.

How to Get TUSD

There are two main ways to get TUSD. Interested persons can mint the stablecoin on an exchange or Mint it directly on the TrustToken app.

- Minting on an exchange – Interested persons need to purchase TUSD from an exchange like Binance, Bittrex, OKEx, Upbit, etc. It is important to note that TUSD currently has the support of over 70 exchanges.

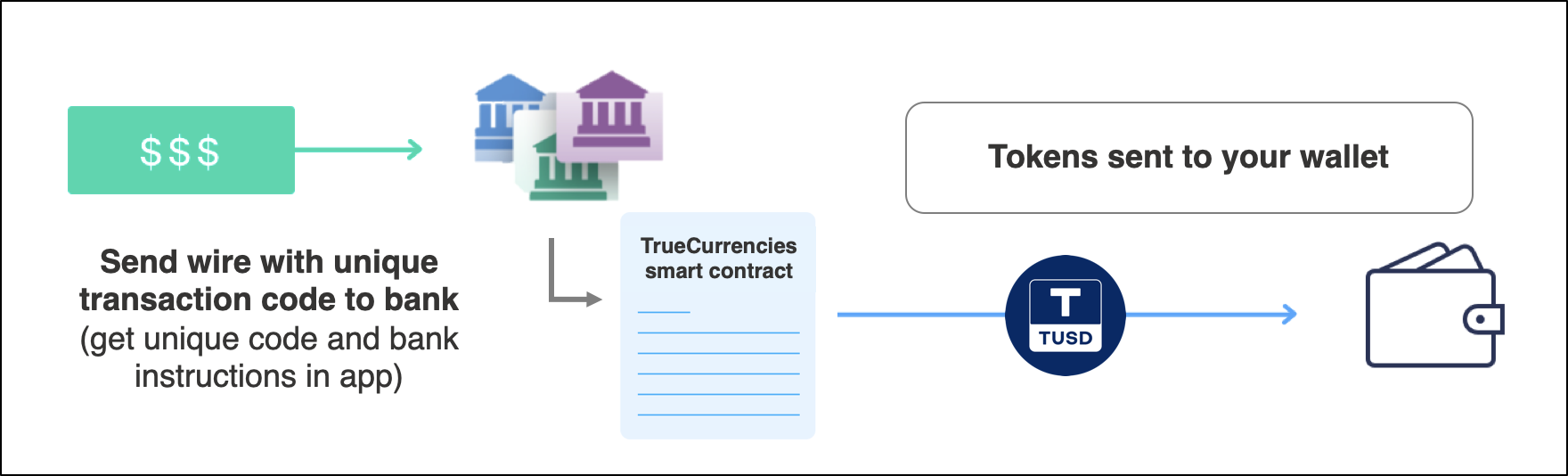

- Using the TrustToken app – This process requires users to:

- First, create and verify an account

- Then, set up an ERC-20 or BEP-2 wallet address

- Lastly is to transfer funds directly to the wallet from a conventional bank account. The funds change into TUSD stablecoin tokens.

Source – TrustToken

Conclusion

Apart from the TrueUSD, the Truecoin ecosystem also has several other tokenized stablecoins backed by other fiat currencies. Some of these tokenized stablecoins include the tokenized British Pounds (TGBP), tokenized Canadian dollars (TCAD), tokenized Australian Dollars (TAUD), etc. Plans are also still in place to launch other tokenized stablecoin backed by world-renowned fiat currencies.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.