Over the last two years, there has been a huge rise in the growth of blockchain technology. As a result, several sectors within the industry have gained prominence. For instance, decentralized finance (DeFi) is one of the booming sectors of the industry. Every day, it appears that a new blockchain project is out in the market. And each time this occurs, we hear the term “whitepaper.”

This article will shed practical light on what a whitepaper is. In addition, we’ll use the Venus Protocol as a case study, examining how well they’ve followed through with their official document.

A “whitepaper” is a document published by a project’s developers. It describes the technology and purpose of the project they are working on. But, most importantly, it emphasizes its purpose to potential investors.

A typical blockchain whitepaper includes a variety of data types. This includes statistical data, diagrams, and formulas. Moreover, this data aims to persuade potential investors to invest in that project. Investors won’t take a project seriously if they do not have a whitepaper. The whitepaper brands them as professionals. It enables investors to understand how the project differs from others in the industry.

The First Step in Understanding a Whitepaper

The best way to understand a whitepaper is to read it. However, such reading can’t be casual. Reading could be boring if you’re not tech-savvy. But, you do not really need much scientific knowledge to get started. A little understanding of blockchain terms would help. Here are a few terms to understand before reading a whitepaper:

- Consensus mechanism – (proof-of-work and proof-of-stake)

- Nodes

- Soft-forks and hard-forks

- Governance

- Smart contracts

- Tokenomics

- Blockchain

A deep understanding of these concepts isn’t entirely needed. However, read enough to help you grasp what they are about. You can visit Wikipedia to read up on these terms.

Using Venus Protocol to Understand a Whitepaper

When going through Venus Protocol’s whitepaper, the first thing you’ll come across is an introduction section. Here the protocol defines what it’s all about. In this case, Venus described itself as a project intended to enable a fully functional algorithmic money market protocol on the Binance Smart Chain. Venus further noted that its designs are structured and forked based on Compound and MarkerDAO.

The next vital part of the whitepaper is the identification of the problem. Venus’s mission is to help bridge the gaps between traditional financial lending and decentralized protocols on top of blockchains. For instance, obtaining loans in the financial world is tedious. The process has many unnecessary procedures and verifications. These are sometimes time-wasting. Other Ethereum-based protocols have gas fee issues and are slow.

Venus Protocol solves this problem by utilizing the BNB chain for fast and cost-friendly transactions. Users can utilize the Binance Smart Chain to supply collateral and earn interest on that collateral. They can also borrow against that collateral and mint stablecoins on-demand in seconds. These options all take place directly on the blockchain.

👉Need to payoff some debts or borrow stablecoins at a very low interest rate? We've got you covered! There are close to 50M$ of TUSD available on Venus at only 1% Interest rate annually! $XVS @tusd_official @BNBCHAIN @Binance #DeFi pic.twitter.com/5fWXhAjBnb

— Venus Protocol (@VenusProtocol) April 27, 2022

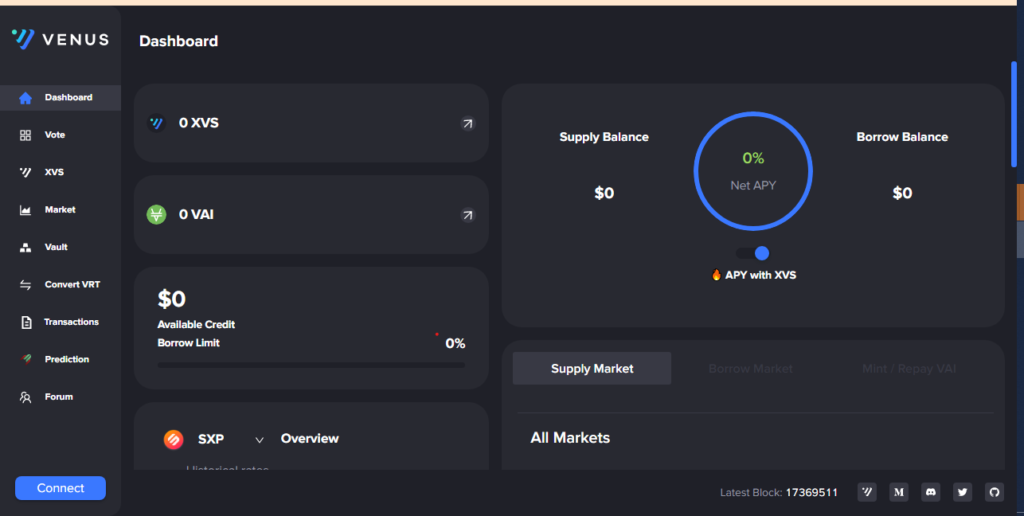

Furthermore, users can access them via a graphical user interface. Venus unlocks billions of dollars in value currently locked up on blockchains that do not have lending markets. This includes Bitcoin, XRP, Litecoin, and others. It also allows participants to access liquidity in real-time.

What Is Venus Protocol’s Use Case?

The whitepaper of any project should outline its use case. For example, the third page of Venus Protocol’s whitepaper details its multiple use cases. Users who own crypto they don’t want to sell can use it as collateral. By doing so, they retain ownership of the asset. Furthermore, they can also take out an over-collateralized loan and borrow against it. These processes do not require any meddling. In addition to the mentioned functions, users can also mint stablecoins and utilize them for yield farming.

Venus Protocol released its whitepaper in 2020. Let’s see if the platform has stuck to the claims in its whitepaper.

Did Venus Stick to the Claims in Its Whitepaper?

Our previous article examined the protocol section of the whitepaper. We’ll look at the Venus section for this article, located on the fourth page of the whitepaper. This session addresses the money market and the synthetic stablecoin platform. Let’s find out our answer!

The Money Market

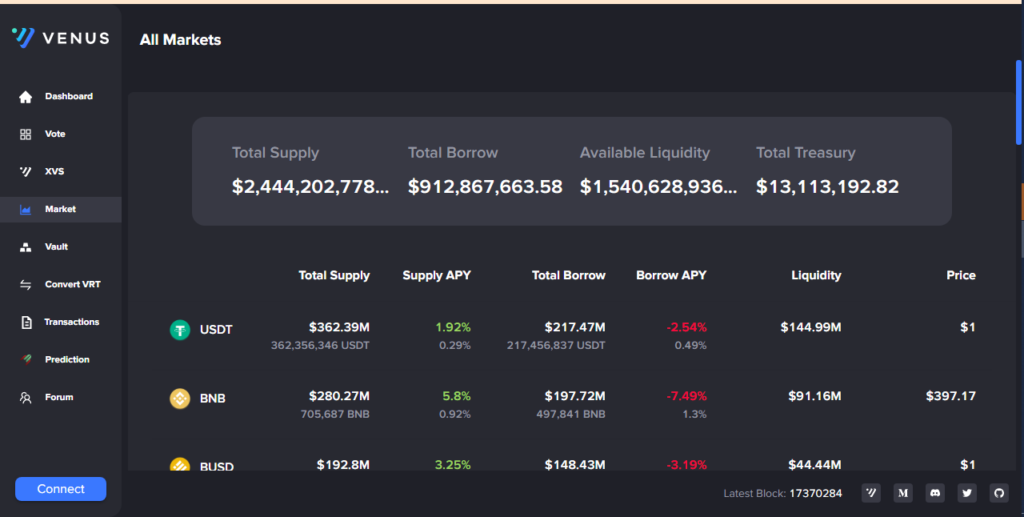

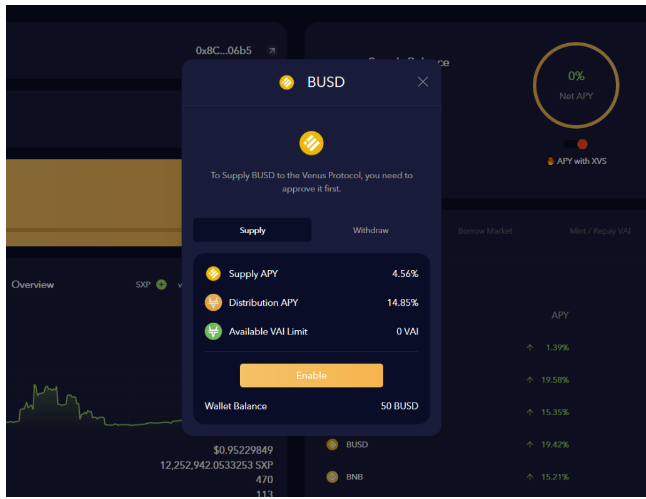

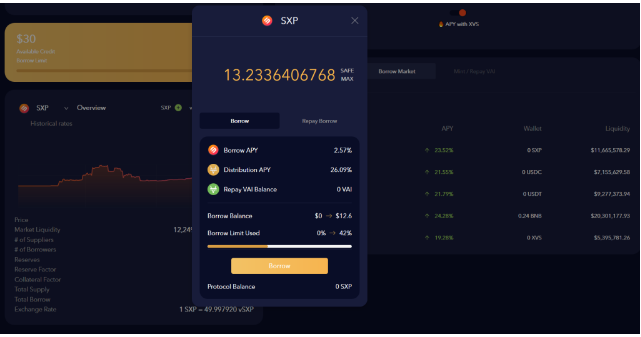

Users can borrow cryptocurrencies and stablecoins on the Binance Smart Chain with no credit check. According to the whitepaper, they can also provide cryptocurrencies and stablecoins. This is in exchange for a variable APY for providing liquidity to the protocol. The money market has two main aspects: supply and borrowing.

Venus users can deposit various supported cryptocurrencies on the platform. Users can then utilize these assets as collateral for loans or supply liquidity and earn an APY. In other cases, users can use these tokens to mint synthetic stablecoins. According to the whitepaper, users will be able to participate as lenders by supplying assets to Venus. Also, the platform pools user assets into smart contracts. This allows users to take their supply out as long as Venus has a positive balance. Furthermore, Venus will reward users by supplying them with vTokens, such as vBTC. Users can only use this token to redeem their collateral.

Borrowing is a feature of Venus’ market. However, users who intend to borrow any supported assets must provide collateral that will be locked in the protocol. Users can proceed to borrow after supplying their collateral. Also, they can borrow based on the asset’s collateral ratio. Usually, Venus sets its collateral ratios between 40 and 75 percent.

Does the Money Market Work?

Yes, the money market on Venus is a big part of the protocol. Like a bank, the Venus market enables people to supply and borrow. In addition, Venus Markets is always operational.

This means that users can lend or borrow crypto assets in seconds without requiring any involvement or authorization from the platform. Last month, the UST and LUNA markets launched on Venus. According to Venus’ website, total borrowing on the platform runs at $915,577,463.19. In addition, BNB has one of the largest markets on Venus.

So, we can agree that Venus kept to its word about this section.

Synthetic Stablecoins

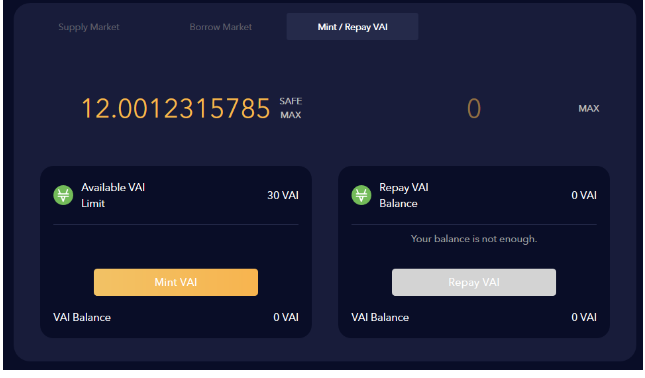

In its whitepaper, Venus Protocol said it would allow users to mint VAI (VAI), a synthetic stablecoin based on the price of $1. Also, stablecoins on the Venus Protocol can be designed synthetically. In addition, users can add them as a proposal via governance. Venus further said its default stablecoin would be VAI. Users can mint the token using collateral already pledged in Venus. Synthetic stablecoins are created by supplying and locking a single or a basket of cryptocurrencies.

In terms of its pricing mechanism, a synthetic stablecoin will rely on market forces. It would also use collateral and safety mechanisms to keep its peg to the fiat currency that it synthesizes. According to the whitepaper, VAI will first maintain a peg of 1:1 per VAI: USD.

Users will first exchange vUSD for other assets using the Swipe Wallet platform to redeem their assets. However, verified users can exchange vUSD for all supporting assets, such as USD. They can redeem these assets directly to their bank account.

How Does It Work on Venus?

As the whitepaper said, VAI is a synthetic stablecoin, meaning there are no underlying fiat reserves to guarantee its value. However, VAI is useful for over-collateralized minting. Here, users can mint VAI on Venus using the vTokens from the underlying collateral they previously supplied to the protocol. It is also used to participate in governance to change the parameters of VAI.

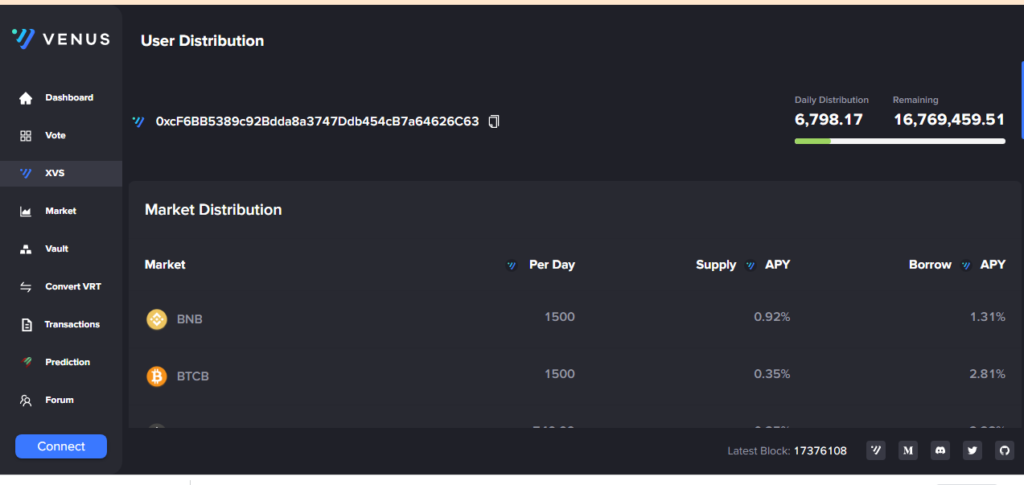

Venus Token (XVS)

According to the whitepaper, the XVS token is for network governance. For example, it enables XVS holders to propose changes to the network. Furthermore, holders can vote on upgrades, adding new collateral.

Is the XVS Token Active on Venus?

Yes, the token pretty much functions like the whitepaper said it would. XVS is also used to mint VAI stablecoins.

What Is vToken According to the Whitepaper?

vTokens are the protocol-created pegged assets when users provide collateral. It represents a unit of the supplied collateral and can also function as a redemption tool. As the whitepaper noted, the vToken is functional in Venus.

In Conclusion

If you read through everything, you’d discover that whitepapers aren’t tedious. Instead, they need you to read them calmly. Our example, Venus Protocol, appeared to have stuck with the claims of its whitepaper. Do you think you can use whitepapers better now?

⬆️ Also, get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ALTCOIN BUZZ ACCESS PRO membership (worth $99). MEXC supports U.S. Traders in all trading pairs and services.

(To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your “newly signed up MEXC UID” and “Telegram ID” on our Twitter @altcoinbuzzio)

⬆️In addition, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

⬆️Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.