Alkemi Network focuses on linking centralized finance (CeFi) to decentralized finance (DeFi). The network has an institution-grade liquidity network for individuals and companies. This makes it possible for them to get decentralized finance products and generate returns on their digital assets.

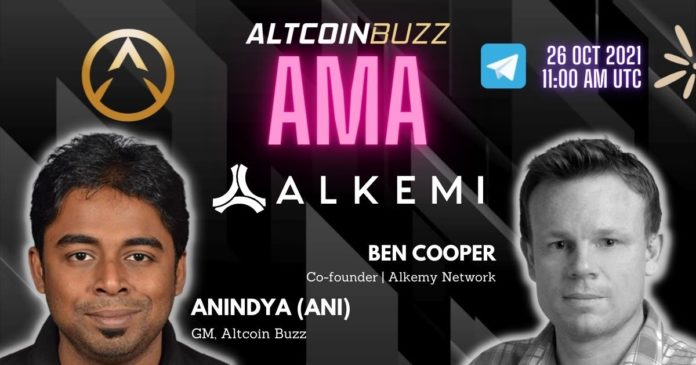

The General Manager of Altcoin Buzz, Anindya (Ani) Baidya, anchored the Alkemi Network AMA session on our Telegram channel with Ben Cooper, the Co-founder and Chief Experience Officer of Alkemi Network. The AMA took place on October 26th, 2021.

Below is a recap of the AMA session with Ben Cooper to understand the company’s recent actions. The AMA was distributed in three segments: introduction, deep dive, and community questions and answers.

Segment 1: Introduction to Alkemi Network

Q – To start, tell us about yourself. What’s your background, and how did you come up with the idea of Alkemi Network?

I am the co-founder and Chief Experience Officer at Alkemi Network with over 15 years of experience in UI/UX, design, and branding. Also, I am responsible for overseeing product user experience, marketing, and engagement.

Before joining Alkemi Network, I worked for numerous start-ups and development companies in various design and management roles. Before that, I was the SE Asian project manager for the United Nations, where I oversaw the development and auditing of clean energy projects under the UNFCCC. I also served for over six years in the Australian Army.

Alkemi Network was co-founded by Ryan Breen (CEO), Brian Mahoney (CSO), and myself (CXO) in 2018 to enable everyone to use DeFi. Ryan and I worked on arbitrage bots – building in DeFi before it was even called DeFi, and we met Brian during our successful time at Techstars.

Brian had over ten years of CeFi experience, and as we began working together, we discovered the constraints preventing institutions from accessing DeFi. Brian calls them the 3Cs – capital, connectivity, and control.

There was an emerging opportunity for us to build a custody-free, decentralized liquidity network that could enable institutions, exchanges, and individuals to access DeFi and earn yields on their Ethereum-based digital assets. So we got to create Alkemi Network, a name we chose to describe the fusion of our CeFi and DeFi expertise.

Segment 2: Deep Dive

Q – You are the first decentralized liquidity network to facilitate permission and permissionless KYC liquidity pools. This value proposition sounds amazing. Would you please explain this in detail?

The idea behind this was straightforward, and we wanted to provide both a KYC-Verified pool and a permissionless “Open” pool of digital assets where users could participate in DeFi.

Institutional users required a compliant environment to participate in DeFi while meeting their internal processes. Hence, we built the KYC layer for that extra level of verification, compliance, and lower counterparty risk, which is enforced for the Verified pool.

However, we also wanted to cater to the broader crypto and retail community userbase who wished to use permissionless DeFi, so we made that available. We believe DeFi should be available to everyone, and we wanted to maintain that through two separate pools.

The interesting dynamic that results is that any users who wish to KYC can arbitrage between the two pools. Also, the $ALK token is permissionless and distributed to lenders and borrowers across all markets through our liquidity mining program so that all users can benefit from the governance opportunities.

Q – Through your product, you aim to onboard Web2 clients. How does your rollout strategy look, any big institutional names?

At the moment, we are right on course, and we have been bringing on some Web2 (i.e., traditional finance users) alongside some digital asset natives.

Our beachhead strategy focuses on the centralized financial ecosystem participants who hold digital assets but haven’t yet participated in on-chain finance; we are currently in discussions with a long list of counterparties around the world who are eager to take their first steps into DeFi, who hold Ethereum or USDC, wrapped Bitcoin and DAI and are just getting familiar with what the idea of Web3-based finance is all about and how smart contracts work. And most importantly, why being in a secure pool with known borrowers and lenders is so important from a compliance perspective.

We are continuing to onboard new users and are negotiating with some significant firms looking to access DeFi market liquidity at highly competitive rates.

Q – Alkemi Earn is your primary product. Tell us more about it.

That is correct. Alkemi Earn is our flagship DeFi borrowing and lending protocol where users can deposit Ethereum-based digital assets to earn a dynamic APY yield. Currently, the four markets available on the ‘Verified’ pool include ETH, WBTC, DAI, and USDC. The ‘Open’ pool offers ETH and USDC markets.

We have two pools. The first is the ‘Verified’ pool, which users can only access through KYC/AML verification processes. We also established an ‘Open’ pool at TGE for permissionless access – like in regular DeFi. The important thing is the pools are kept separate, and there is no mixing of funds.

When we beta-launched Alkemi Earn back in April, we established a Liquidity Mining Program to reward borrowers and lenders across the network with ALK multi-utility tokens. $ALK tokens are distributed according to participants’ allocated and borrowed capital in the Alkemi Earn markets across the ‘Verified’ (permissioned) and ‘Open’ (permissionless) digital asset pools.

On the other hand, an interesting feature of rewarding both borrowers and lenders is that borrows are subsidized by receiving a stream of $ALK tokens. When borrowing rates are low, it may lead to negative borrowing rates (paid to borrow – i.e., net positive yield).

The liquidity mining program will run for the next four years and allocate 35% of our total token supply to borrowers and lenders across the pools. You can find more information in our protocol documentation here.

Q – Many people who are already in the DeFi space do not want to do KYC. So it’s great that you have kept the open pool for them. What benefits will the Verified pool bring in?

Ultimately, the biggest blockers to institutional adoption are counterparty risk and compliance. The benefits of the ‘Verified’ pool are threefold, to build a protocol that will adapt to the regulatory landscape, enable institutional capital to flow to the decentralized financial ecosystem, and broaden overall adoption for on-chain transactions and settlements.

This is upgrading the entire financial infrastructure from legacy systems to the new natively digital solution offered by blockchain-based finance.

Q – Your open pool has a collateral ratio of 23,554%. What is the collateral ratio below which assets get liquidated? How do you calculate the same?

Users must make sure they can over-collaterize when borrowing; they can borrow up to 80% of their deposit value in assets on the protocol, although if the value of those deposits falls and their 80% borrow rate rises, they are alerted. Liquidators may partially liquidate their collateral to bring the ratio back into safe limits.

Q – Apart from lending and borrowing, do you plan to bring yield farming opportunities in your protocol later?

For sure, our liquidity mining program is a rewards opportunity that runs in parallel to the native lending/borrowing yields offered in the protocol. The $ALK tokens are assign to borrowers and lenders across the digital asset markets.

Also, we have considered staking opportunities for users with accumulated $ALK tokens both within the Alkemi Network ecosystem and externally via partnerships with other protocols/platforms. We can’t confirm more details at this time, although we look forward to announcing more upcoming features in the future.

Q – So, $ALK tokens distribute as rewards and for governance votes. Is there any other use case for the token?

Correct, the $ALK tokens core utility is currently governance. However, we are also currently in the process of looking to expand the utility beyond this shortly.

Q – You are currently on Ethereum. Do you plan to onboard on other chains in the future?

We have been researching some roll-ups and alternative L2/sidechain solutions for our open pool. However, our main preoccupation has been to find a suitable alternative that can fulfill the same level of security.

As a primarily institution-grade DeFi platform, we chose to build on Ethereum for its settlement layer properties. Our primary consideration is providing that institution-grade settlement to our clients with zero downtime. Including industry-leading decentralization, and a significant marketcap of the base layer. This will accommodate the kind of size transactions institutions will be looking to settle.

Segment 3: Community Questions and Answers

There will be awards of $250 in USDT and $100 in $ALK worth for the best two questions.

Q.Telegram – How to lend stablecoin on Alkemi?

Ok, so with Alkemi Network, you have some options. If approve the KYC process, you can connect to the ‘Verified’ pool, deposit DAI or USDC, and earn yields. You will also earn $ALK tokens through our liquidity mining program.

If you want to use our permissionless DeFi solution, you can access the ‘Open’ pool. Then, you deposit USDC to earn a yield and the $ALK tokens.

Q.Telegram – Many projects have problems with UI / UX, and this one turns off new users. How do you plan to improve the interaction with new users and with users outside the crypto space?

As a UX/UX designer myself, I love this question. UI/UX refers to how easily users can interact with a website or product. In addition to merely being pleasing to the eye, a functional design is fast, frictionless, and easy to use. UI/UX in crypto products is generally poor for one simple reason: there isn’t much investment into that area of research.

Projects seem to be more focused on shipping a product than putting in the research or investment into developing. Also, honing the user experience for their users. At Alkemi Network, our goal is to research and gather user feedback to improve our product and user retention continually.

The Altcoin Buzz community gratefully thanks Ben Cooper for taking part in the Alkemi AMA session on October 26th on our Telegram channel.

Also, join us on Telegram to receive free trading signals.

Find out more about the blockchain and crypto space on the Altcoin Buzz YouTube channel.