This is the second part of our 4-part series about crypto trends for 2024. The articles are loosely based on this Messari Report.

So, without further ado, let’s dive straight into this second part of 2024 crypto trends.

#2 Despite the recent run-up, BTC is the Godzilla of finance. ETF looming, institutional adoption, geopolitical tailwinds, and nowhere near overheated compared to historical cycles.

Check out market value to realized value. We're at ~1.3 today. Wait until 2.0+ to reevaluate. pic.twitter.com/zGd6KaB9wa

— Ryan Selkis (d/acc)🪳 (@twobitidiot) January 2, 2024

Top Crypto Assets for 2024

- Bitcoin

Bitcoin is still the main crypto OG coin. When Bitcoin talks, everybody listens and follows BTC’s movements. Bitcoin seems easy, but there’s so much more going on below the surface. The two major Bitcoin events coming up this year are the BTC spot ETFs and the halving. Both events should be good for some serious volatility. In general, Bitcoins are better.

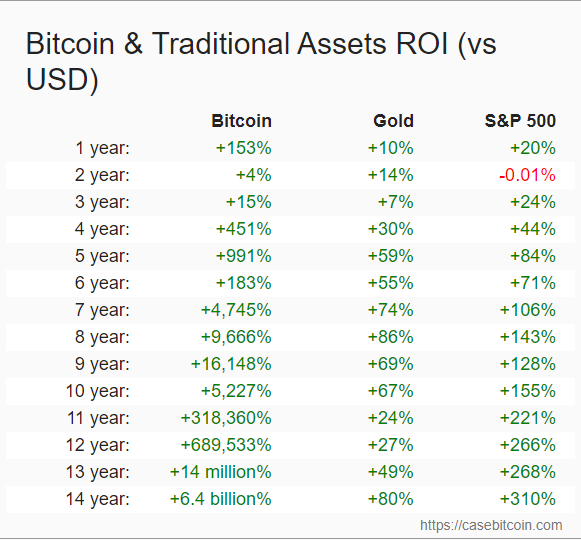

Even if the SEC rejects the spot ETFs in January, the consensus is that the SEC will approve them this year. On the other hand, Bitcoin has so far weathered each storm. It may have gone down, but it was never out. It always took back its previous position or did better. Not only that, but it is no wonder Wall Street wants in. Take a look at the chart below. It shows the ROI of BTC against other potential inflation hedges.

Source: Casebitcoin

- Private Transactions

Blockchains are pseudonymous and not anonymous. Nonetheless, privacy is a right that everybody should have. You should also be able to exercise this online. That’s why we see more projects bringing solutions to the crypto table. Aleph Zero (AZERO), Secret Network (SCRT), Oasis Network (ROSE), or DOP are among the names to keep an eye out for in 2024. These all work with zk technology. Monero (XMR) is currently still the largest chain in this field. The question is, for how much longer?

- Stablecoins

Stablecoins are your safe haven in times of crypto volatility. As a result, they take pole position for most explosive growth potential. Their payment volume is almost 10x PayPal’s volume, and growing. USDT and USDC still lead the field.

- CBDCs

The Central Bank Digital Currency or CBDC seems inevitable. It’s a digital form of fiat. However, there’s a big downside. Issuing governments can have an eerily big control over your finances. They can record and trace all your transactions. 1984 and Animal Farm combined into one real-life and real-time movie. Currently, 131 countries are actively researching CBDCs. See the map below.

Source: Atlantic Council

Crypto and Politics

Crypto and politics are important in this year’s crypto trends. We concentrate on two main areas, the US, and Europe. In a nutshell, US politics are rather complicated. The current Democrat administration doesn’t have much love for crypto. And that’s an understatement. The Biden administration tries to make it as difficult as possible for the US crypto space.

For example, Senator Elisabeth Warren, as mentioned earlier. Gary Gensler, the SEC chair, is one of her close allies. Another sample is Operation Choke Point 2.0. After the upcoming election, we may see a new, crypto-friendly administration in place. However, it will take time to introduce new laws. It’s a long way for a Bill to become a law in the US.

On the other hand, the situation may improve with big banks turning their attention to crypto. Legislation is due and sometimes crypto can also celebrate victories in court. Ripple, Grayscale, and Coinbase all had victorious cases fighting the US government. Nonetheless, there are also plenty of cases in which the US government managed to keep the upper hand.

In Europe, there’s a slightly different situation. There appears to be a clear crypto regulation with MiCa. However, the question remains of how workable this legislation actually is. There are many positives, but also plenty of question marks remain. Or will places like the United Arab Emirates or El Salvador lead the regulatory way for crypto?

With #MiCA in 2024, the EU's #crypto sector undergoes pivotal regulation. The legislation covers various crypto assets

Expect (besides 🚀 #alts)

– Clear guidelines for market participants

– Reduced fraud risks & heightened security

– Strengthened consumer protection measures— Tech & Dresses 🪐 (@TechandDresses) January 3, 2024

CeFi

Binance is still the biggest CEX in the world. However, their #1 position is not taken for granted anymore. CZ had to step down as he pleaded guilty to money laundering in a US court. His sentencing will be on February 23, 2024. As a result, Binance lost a market share of 25 points last year.

Coinbase seems to be in the hot seat during 2023. There were plenty of positive events for them. For example,

- The gloves came off when they sued the SEC.

- A partnership with Circle and the USDC issuance.

- Launched a Perp exchange.

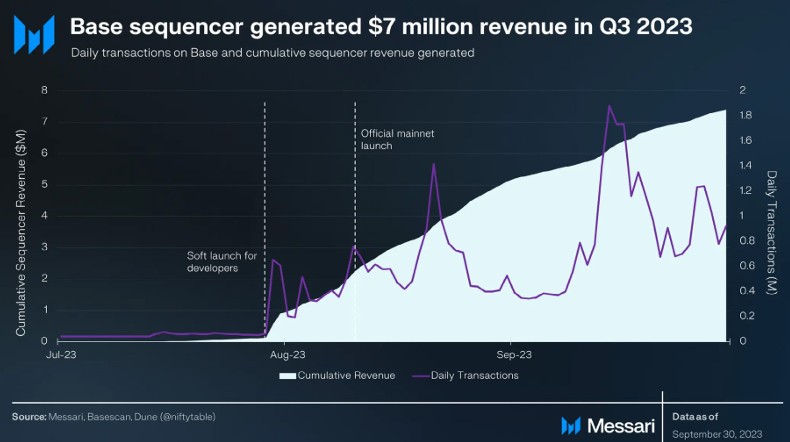

- Base, their L2 chain. This generated $7 million in revenue in Q3, 2024. See the picture below.

- Project Diamond, their RWA platform.

- They are the custodian for the majority of BTC spot ETFs.

There are three other CEXes that gained market share last year. These are OKX, Kraken, and Bybit. In general, exchange tokens keep up with the pace and see upward price movement during Q4-2023.

Conclusion

This is Part 2 of our 4-part series on Crypto Trends for 2024. We covered Top Crypto Assets, Crypto and politics, and CeFi. You can watch the first part here.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.