Solana is a blockchain platform designed to host decentralized and scalable applications. In addition, Solana processes a vast amount of transactions within a short time and at a lower cost. Solana’s transaction speed does not sacrifice decentralization.

There’s been an increased interest in Solana and how it has performed during this bear market. So, Messari published a report analyzing Solana’s ecosystem during Q3-2023. We’ve covered a part of this report. But this article will delve deeper into it. This is the first part.

Solana’s Ecosystem Analysis

- DeFi

Solana has seen an increase in new DeFi protocols that identify as “Solana DeFi 2.0”. This term, among other things, is a pledge to stay away from the low-float, predatory tokenomics that were common in the previous cycle. Furthermore, the majority of these protocols have not yet introduced a native token.

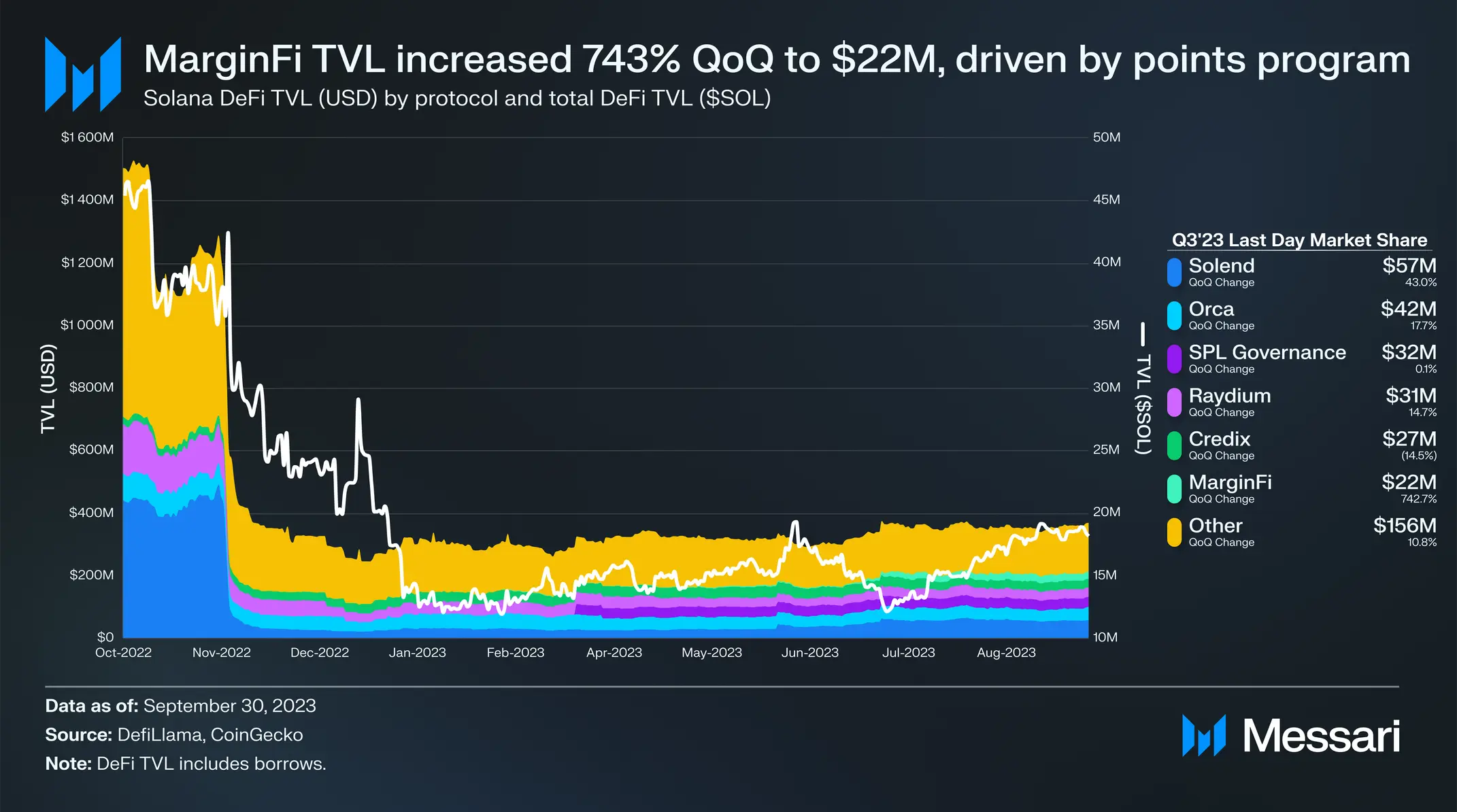

Lending platform MarginFi is one of the pioneers of this movement. MarginFi introduced a points system on July 3rd, offering users points for making deposits, taking out loans, and making referrals. At $22 million, its TVL increased by 743% QoQ, placing it as Solana’s sixth-ranked protocol by DeFi TVL. MarginFi introduced LST, a liquid-staking token, at the end of Q3-2023.

Perps exchange Cypher also launched a points system in July. Cypher suffered a $1 million exploit in August. But prior to that, it was one of Solana’s fastest-growing DeFi protocols.

-

NFTs

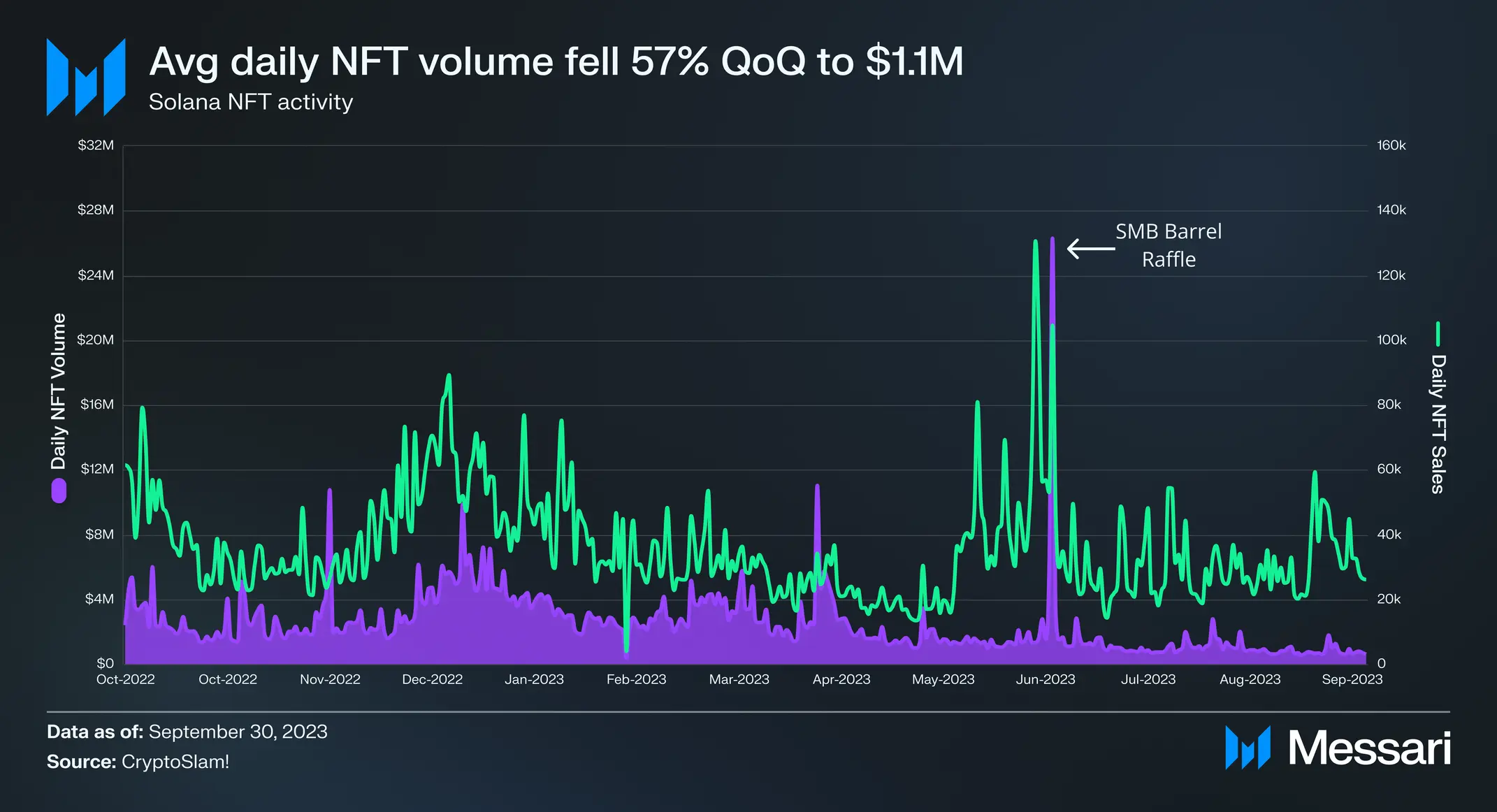

The report noted that the average daily NFT volume dropped 57% QoQ to $1.1 million. Additionally, sales and unique customers decreased QoQ as well. At the end of Q3-2023, Magic Eden overtook Tensor in the majority of marketplace volume share for the first time since mid-June.

Tensor’s market share increased from 1.2% at the beginning of the year to over 74% in the first part of August. Also, Mad Labs emerged as the top collection by market cap at the end of the quarter.

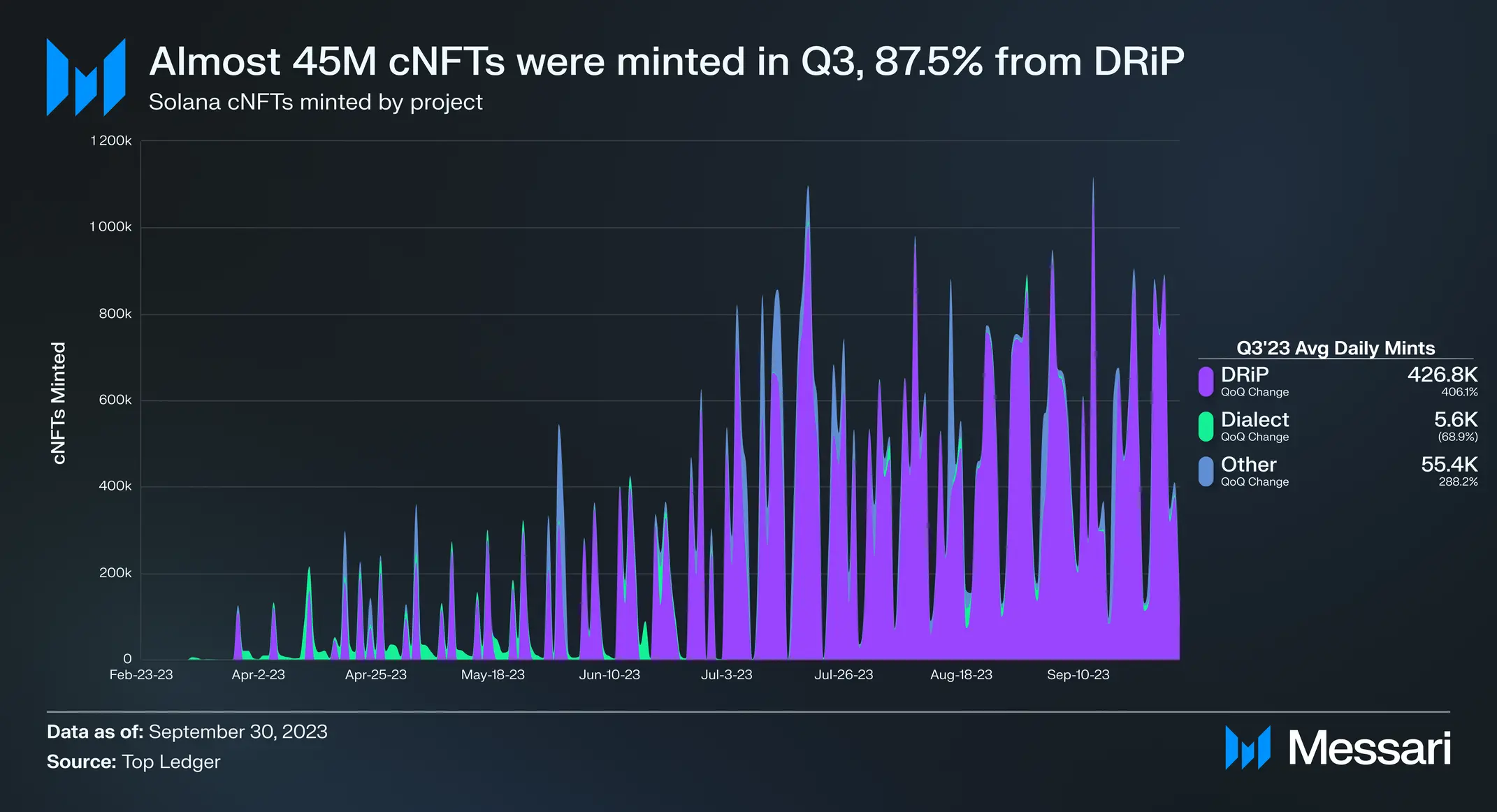

Solana introduced state compression at the start of Q2. This was a cheaper way to store data on-chain. It involves hashing data into Merkle trees and posting its root hash on-chain.

Metaplex’s compressed NFTs (cNFTs) standard was its first significant use. The cost to mint and store one million cNFTs can vary from 5.3 to 63.7 SOL, depending on the composability level. The cost without compression is 24,000 SOL.

In Q3-2023, about 45 million cNFTs were created, representing a 316% QoQ growth. With an 87.5% market share, DRiP was responsible for the most mint.

Another popular use case for cNFT is dialect. Dialect is a Web3 messaging program that uses cNFTs for Dialect stickers. There’s already a Dialect web application.

As previously mentioned, Tensor debuted its own Tensorian cNFT collection in August. Tensor has served as the main cNFT trading platform since its introduction in May 2023. Magic Eden plans to address that, though, by introducing cNFT support in September. So far, Tensor has maintained nearly all of its market share, accounting for 97.2% of volume.

-

Web3 Gaming

Web3 Gaming is a huge part of the Solana ecosystem. Throughout Q3-2023, there were several significant developments in that sector. For example, Star Atlas debuted early access for its SAGE Labs open-world game in September. Users competed for $1.2 million in prizes. SAGE has played a part in improving Solana’s overall transaction count.

-

Solana and payments in Q3

Payments are another developing Only Possible on Solana (OPOS) use-case. Solana recorded significant successes in Q3-2023, including the integration with Shopify and Visa. In September, Visa revealed that it was joining Ethereum in extending its USDC settlement test to Solana.

Solana bullish narratives:

– Faster than ethereum

– Cheaper than ethereum

– Mass adoption oriented

– 2nd biggest NFT ecosystem

– Solana Pay integration w/ Shopify

– Chosen by Visa for stablecoin settlement pic.twitter.com/t1k9N1Pg8m— Diane DeFi (@dianealmaze) October 20, 2023

The Visa Crypto team outlined their belief that Solana has the potential to support mainstream payment flows. Among the features listed were Solana’s multiple nodes, parallel transaction processing, quick transaction finality, low and predictable fees derived from local fee markets, and several validator customers.

Shopify struck a partnership with Solana in August. So, Shopify merchants can accept Solana native USDC. Shopify makes up roughly 10% of all American e-commerce. The integration with Solana Pay is a huge step for the crypto platform.

Conclusion

Q3-2023 saw a great deal of work and expansion in Solana’s ecosystem, especially in light of the current weak market. The report mirrors Solana’s resilience and push to remain one of the standout crypto networks.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.