SingularityDAO is a decentralized blockchain-based organization focused on simplifying the ease of accessing a crypto economy.

The CFO of Altcoin Buzz, Shitij Gupta, anchored the SingularityDAO AMA session on our Telegram channel. He was joined by Jon Grove, the CMO of SingularityDAO. Besides, the AMA took place on December 2nd, 2021.

Below is a recap of the AMA session with Jon Grove to understand the platform. The AMA was also in three segments: introduction, deep dive, and community questions and answers.

Segment 1: Introduction to SingularityDAO

Q – For the folks unaware of the project, what is SingularityDAO. What are the motivation and ideation behind the creation of SDAO, and what’s the connection to SingularityNET?

SingularityDAO is a DeFi platform to bring cutting-edge artificial intelligence to Crypto Finance. Currently, these tools are guarded by private institutions on Wall Street. Our goal is to make these advanced financial tools available to all.

All of our AI is designed to be hosted on the SingularityNET Marketplace, making calls using AGIX and powered by NuNet (we just launched this from our Launchpad and collected USD 2million in under 90 seconds), the latest SingularityNET Spinoffproject focused on decentralized computing.

As to why we have a separate token for SingularityDAO (SDAO) – there are a couple of reasons, also related to why we are a company instead of simply an extra product under the SingularityNET name.

Three reasons for spinning off:

1 – AGIX will be deeply integrated into the functionality of AI’s, and the token utility will not lend itself well to alternative functionality. AGIX is not your normal Crypto, and you can expect it to evolve into an incredibly complicated contract when things like AI-DSL are incorporated into Cardano. SDAO being a DeFi project needs to function using its unique tokenomic model, which would interfere with AGIX.

2 – SingularityDAO and all other spinoffs pursuing incredibly different goals and have entirely different teams. It makes little sense for them all to rely on a single token that, after 8 or 10 various spinoffs launched, all have other tokenomic requirements and different utilities.

3 – Legal requirements for different projects will inevitably be other based upon the functionality/target markets/utilities and clients. Due to this, it is also essential that each separate legal entity.

So, although SingularityNET as an ecosystem can be considered one entity in many ways, it’s required that we spin off multiple “arms” to meet different criteria without hindering the needed functionality of SNET and the AGIX token. Hence, SingularityDAO was born.

Q – A lot of depth in there. I think it’ll be helpful if we break it down into;

1. Connectivity of AI with SDAO – what exactly is the role of AI in DeFi?

2. Will AGIX have any utility in the SDAO ecosystem, or should we consider that to be separate?

3. Does the Launchpad have any connectivity to SDAO, or is that the AGIX ecosystem Launchpad?

1 – DeFi + AI

It’s well known that in traditional finance, AIs are now the tool of choice for most huge powerful financial entities working in the stock markets. However, those tools are within a walled garden that only the hyper elite ever gain access to.

At singularityDAO, we are changing that – we have assembled a team of Quantitative Traders from Wallstreet (all who took substantial pay cuts to come and change the status quo for the better) – Ph.D. level Ai Scientists, and of course the one and only Ben Goertzal, co-creator of Sophia the Robot and builder of her brain. We are rebuilding those financial tools, tuning them for Crypto, and giving them to everyone.

2 – AGIX in SDAO

Of course, those same AIs I mentioned will run on SingularityNET on Cardano, on NuNet. When we make a call from SDAO to an AI, asking for a trading signal, this will use AGIX; when that Snet hosted AI receives our AGIX based request for info, it will use the processing power of NuNet (the latest SNET SpinofSpinoffrocess the task which will of course use some NTX (NuNet) token. The whole ecosystem is designed to synergize and self-support.

3 – Launchpad

Leading in nicely from Nunet – the first token to launch from the SDAO Launchpad (we raised 2million dollars in 90 seconds, by the way). The SDAO Launchpad has many functions; primarily, we will use it to launch the Snet ecosystem. We will use it to accelerate new projects from the SingularityNET DEEP funding project (akin to ADA’s catalyst). But we won’t limit it to that. We will also allow any project to apply for launch from SDAO – they will need to pass stringent requirements – even if it means only one or two launches a year, we won’t launch anything but AAA projects.

We then offer all these projects the same things:

- Possible inclusion in our DynaSets

- Help with their post-launch tokenomics/staking/farming

- Introductions to our array of investors and VCs

- And just general assistance in bringing a project to life

Segment 2: Deep Dive

More Information About the Platform

Q – When you talk about AI – are you talking about machine learning? High-speed frequency trading bots used by financial institutions/algorithmic trading? or more along the lines of robo advisory DeFi products?

High-speed frequency trading bots are not AI at all, in any true sense of the word; however, most current projects claiming to use AI are employing.

As for Robo Advisors – sure, we will have some of these; a good example is working on an AI that watches Twitter. And builds sentiment analysis weighted by how reliable or influential a tweeter may be and factors like how often a particular topic is mentioned daily. We are working on an AI that watches macroeconomic news and creates reports.

Others that are simply looking for interesting patterns in TA on Bitcoin, we have AI’s that watch our traders as they work, merely looking for any ways they can discern, and then questioning, “is this a real pattern.” All kinds of AI’s will be employed, and then signals will be formed, and if a lot of signs all point the same direction, they become more robust and potentially are acted upon. You could think of it as similar to how TA works. If there is a fib level to be hit, that’s an excellent target. If there is a continuation pattern with the same target as a fib level, the likelihood of that signal being actual increases. The more signs with similar outlooks, the more likely the outcome.

Q – So, help me with the real alpha question. You have Singularity Net with Ben Goertzel at the helm and is working to evolve AI; You have Singularity DAO working on DeFi and now the Launchpad. Lastly, there is NuNet. Which one should I put my money in?

The answer is “yes” and also “this is not financial advice” HAHA!

Joking aside, they are all great projects. That’s why we are building them. But, they also have very different goals. It’s better not to think of them as needing to choose; are we not all taught to diversify? There you go… diversify.

Q – Let’s dig a little bit deeper into Singularity DAO. Tell us your past achievements and your upcoming milestones?

In May, we launched our token; since then, we have launched:

- Swapping of Ecosystem tokens within our dApp

- Liquidity Providing

- Yield Farming

- Staking (both locked and unlocked) APYs range from 20-50%

The link is most recently, Launchpad <- first sale NuNet – 2mill USD in 90 seconds.

Just last week, we opened SDAO for trading on Binance Smart Chain (Pancake Swap) and within the next couple of days will be launching Yield Farming over on BSC too (finally get away from the eth fees for those who wish to).

Cross Chain bridges come next week; we are just doing some final checks as BSC did a hard fork two days ago, so we need to make sure all is still perfect on the bridge before launch.

That’s what we have done, as for upcoming:

- Everything launched on BSC will also be launching on Polygon within the next couple of weeks.

- Then, of course, we have the imminent launch of our main product – DynaSets.

Anything more than that can wait until after Christmas.

Q – Great work all around. What are DynaSets – I’ve been hearing that a lot from your Community recently?

DynaSets are where the magic happens! hah

Dynamic Asset Sets – DynaSets. These are somewhat like hedge funds or ETFs in traditional finance.

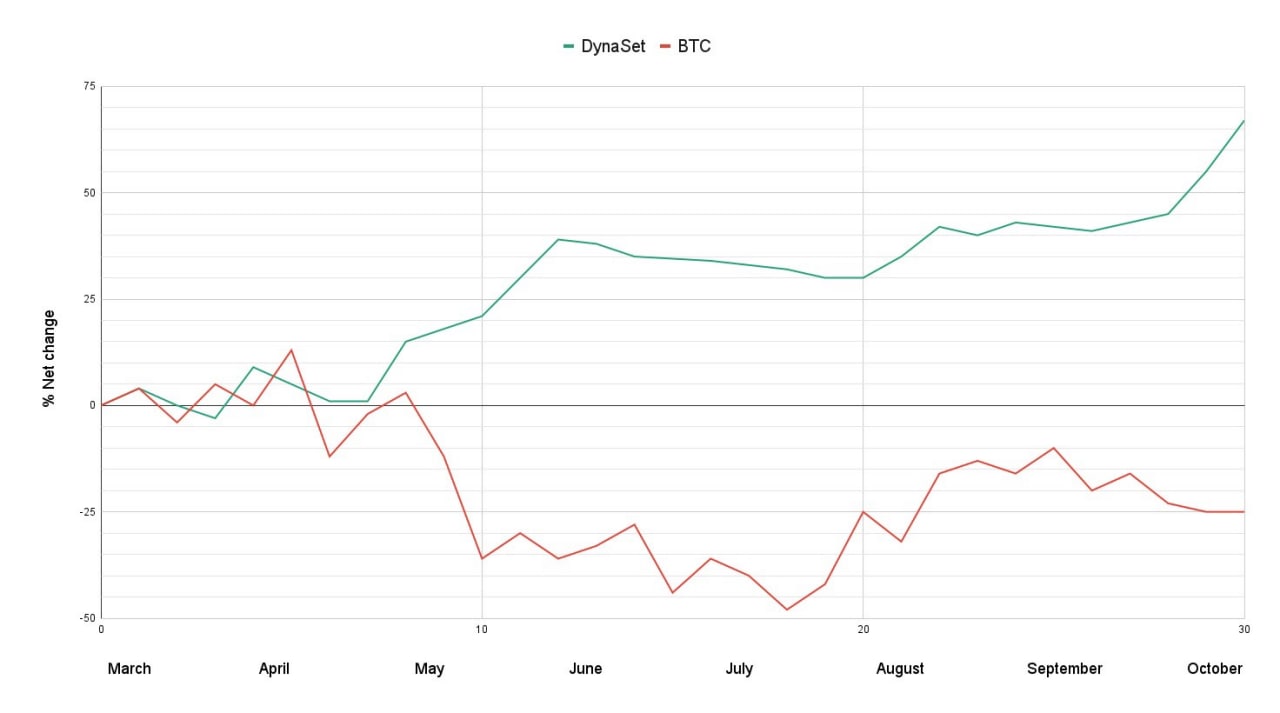

You could say an AI-powered portfolio manager. Invest in a basket of tokens, and our Team of Quants, assisted by advanced AIs, will automatically rebalance those tokens, live, day to day, to generate optimal Alpha on the tokens you own. I could share our most recent backtest if you like?

Shitij – Yes, please, and what basket of tokens do you invest in, for example

Jon –

So, in December, we will be launching our Beta. I haven’t announced the contents to our Community yet, so I have to be a little careful how I answer this. But let’s say WBTC (wrapped bitcoin) will be involved, as will ETH, and perhaps even a few small surprises from closer to home.

I’ll give a little spoiler; we won’t launch 1 DynaSet. More than that, I can’t currently say it’s a surprise.

Q – So it’ll be along the lines of different DynaSets based on the investor’s risk tolerance or maybe sector-based as in ETF. Or is it safe to assume that DynaSets will be large-cap projects – for me, that’s one bill+ market cap, obviously with your native tokens being the exception?

Yes and no. There will be DynaSets based around large-cap, for sure. But, a secondary goal is to bring liquidity to small-cap utility tokens that find it hard to survive as they try to build legit projects and avoid the mindless shill and hype of pump & dump coins.

DynaSets could look more like this:

- Crpyo Market leader Set

- Snet ecosystem set

- DeFi Set

- MetaVerse Set

- High-risk, a low cap set

Just as some examples.

Possible rewards

Q – What are some of the airdrops or promotions you are doing with your Community? Some insider tips on how to partake and get hands-on some free SDAO tokens.

Well, currently, in the run-up to Christmas, we are running what we have coined our “Advent Ambassador Program.”

People can visit our website singularitydao.ai and find a link to an advent calendar – each day at a random time, a new door will unlock, and behind the door, there may be a task + reward, a prize, or a new piece of unreleased info about the platform (or maybe all 3).

We are also running a more in-depth Ambassador program alongside this where people can earn tokens by helping us with marketing, go out and write tweets, create YouTube content, share our content, help us with translations, and we will gift you some SDAO.

Alongside this, of course, every project that spins off from SingularityNET has committed to giving, for free, 5% of its total circulating supply to AGIX token holders, so that is worth noting.

SDAO token holders themselves – who knows, maybe we can also offer something similar? But what we do offer is membership to our DAO. DAO members get a portion of all Alpha generated as fees by the DynaSets.

Segment 3: Community Questions and Answers

The five best questions were rewarded with USDT 500 each from this segment.

Q.Twitter – What is the principle behind veto power in voting? Does it help whales overturn DAO decisions?

Veto could certainly be used for that. Although we HOPE that the voting power will become more decentralized than that, it will mean that the majority opinion will be the winning one.

Q.Twitter – I could read that with SingularityDAO, we will have the facility to connect crypto assets with the “most promising projects in the initial stages,” but could you tell us which projects you refer to? And how do you know that they will be reliable?

I can’t tell you which projects we refer to, as they may or may not exist yet. But we will know they are reliable because we will test them heavily, make sure the Team is trustworthy and in line with the ethics of building a better world for all and enriching the communities involved.

Q.Telegram – Artificial intelligence is one of the basic elements of the SingularityDAO ecosystem. Well, do you have an expert technical team in this field so that you can use the artificial intelligence concept at the optimum level?

We certainly do and will be doxing them all to the world over the coming weeks.

Q.Telegram – Do you have an audit certificate, or are you working to AUDIT your project so that the security of the project becomes more secure and reliable?

All our Audits are hosted here. Security is of utmost importance.

Q.Telegram – Will you or your Team listen to the Community’s suggestions for SingularityDAO input, and to what extent will the Community be involved in decision-making for the benefit and efficiency of your project?

Of course, that’s the purpose of a DAO. In the earlier stages of a project’s life. We have to make decisions ourselves, but as the Community and the DAO matures, we will eventually hand overall decision making.

The Altcoin Buzz community gratefully thanks Jon Grove for participating in the SingularityDAO AMA session on December 2nd on our Telegram channel.

Also, join us on Telegram to receive free trading signals.

Find out more about the blockchain and crypto space on the Altcoin Buzz YouTube channel.