Over the past few months, we’ve seen several institutions embrace cryptocurrencies.

Asset managers like BlackRock, WisdomTree, Invesco, Valkyrie Investments, Ark Invest, VanEck, and Fidelity have shown serious interest in Bitcoin. Here is the first part of this article.

Bitcoin Is More Secure Than Other Coins

These firms have applied for a Bitcoin ETF from the SEC. Let’s see some reasons why Web2 investors must pay more attention to Bitcoin. While cryptocurrencies are largely volatile, Fidelity presented a couple of reasons why these investors should dive into BTC. But this article covers more of their argument for BTC.

In the ever-shifting landscape of wealth preservation, many investors are wondering if they should pick the enduring brilliance of gold or embrace the digital revolution with #Bitcoin…

Bitcoin Vs Gold: Which Is A Better Investment?https://t.co/3SGOcgm21z

— Bitcoin Education | Athena Alpha (@athena_alpha_) October 27, 2023

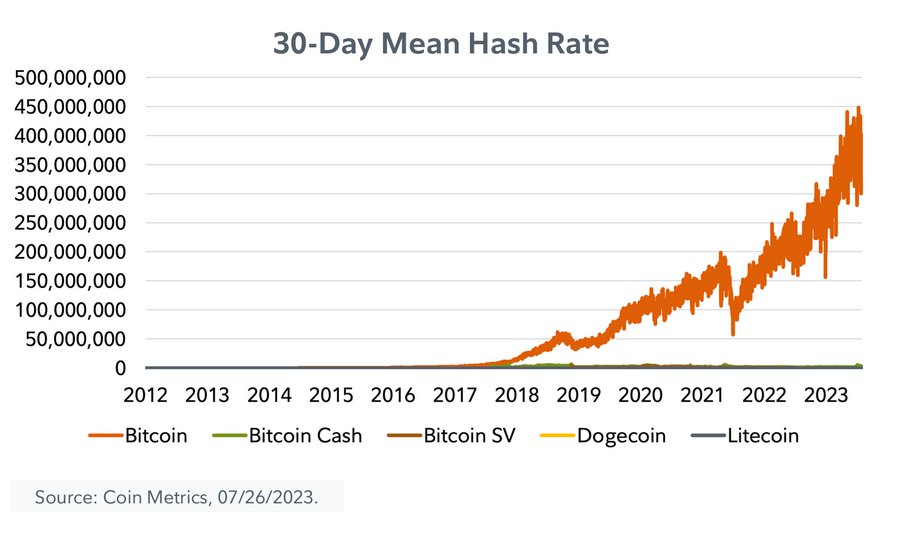

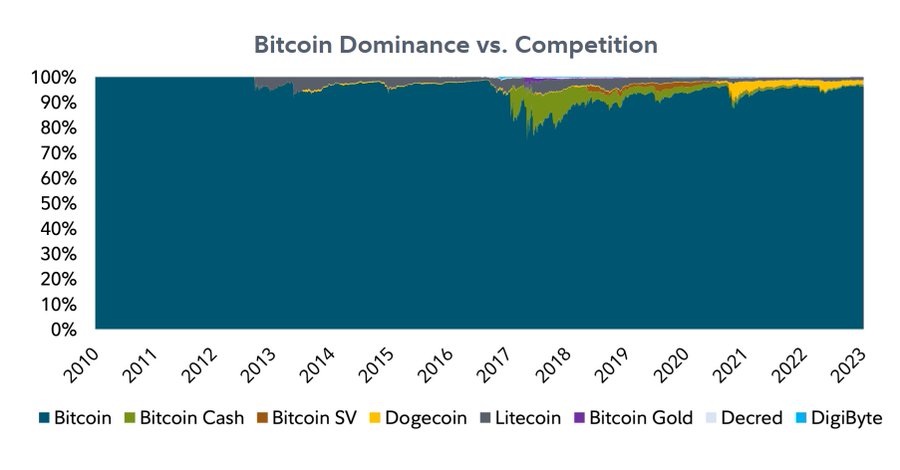

One of Fidelity’s core arguments in support of Bitcoin is its security features. Fidelity provided numerical data showing how secure Bitcoin is compared to other coins. It wrote in its research that “in terms of sheer computational power required to alter the network’s consensus, bitcoin far exceeds any remaining proof-of-work competitors.”

Fidelity also presented Bitcoin’s decentralization features as one of its main appeals. Decentralization refers to how much control a single entity or organization has over the network. No single entity can control or restrict data on a platform like Bitcoin.

According to the Fidelity report, “Bitcoin continues to show increasing decentralization as the number of holders has become distributed, active addresses continue to increase, and bitcoin mining pools continue to become more fragmented and competitive.”

Fidelity wrote that it believes that Bitcoin is currently “the most secure and decentralized monetary network.” The asset manager further argued that it expects the network to remain the most secure and decentralized in the future.

BTC Leads in Terms of Use Cases

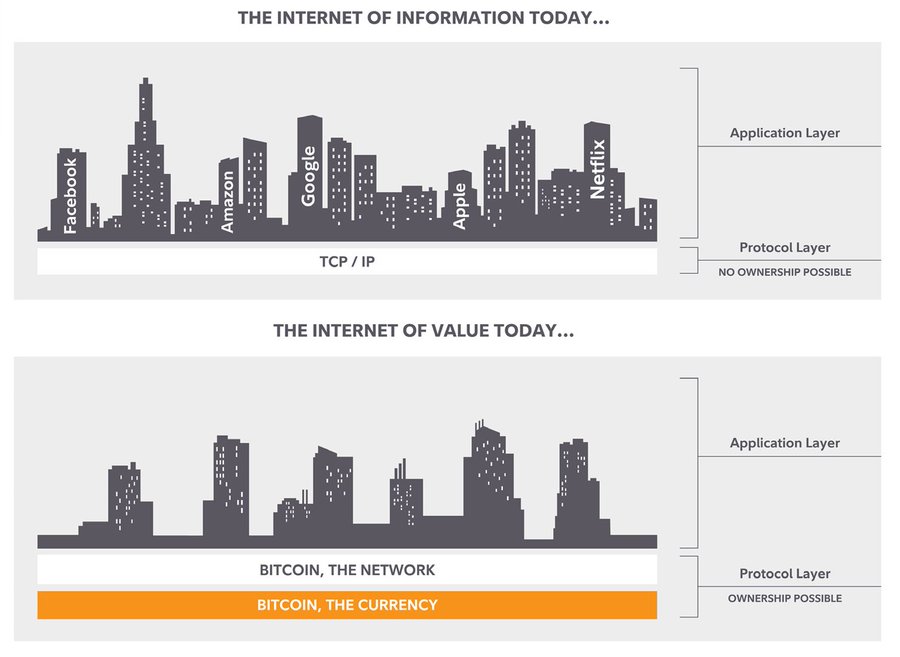

Fidelity claimed that Bitcoin’s nature as a scarce store of value keeps it relevant in the crypto space despite the possibility of future changes. Though there has been great progress in the past few years in terms of other assets establishing their product-market fit, Fidelity believes that most competing digital assets will not be able to serve other important use cases.

However, BTC has a clear-cut use case. This results in differing risk-return investment profiles for Bitcoin and other digital assets.

A renowned canadian psychologist has jumped on the bitcoin bandwagon. Why investors should embrace the asset is likely to make banks irrelevant, he says. He argues that if banks don't adopt the asset, it will make them irrelevant.

— Maylen Gartner (@MaylenGartner7) September 18, 2023

Fidelity added that separating bitcoin investments from other digital asset investments would help new investors in developing a framework for investing in cryptocurrencies.

Fidelity further stated that there is a possibility of countries opposing the development of digital assets, which is another reason to embrace BTC ahead of other cryptocurrencies. BTC can ward against systematic attacks.

In addition, Bitcoin’s lack of coding complexity makes it less risky than other digital assets. Bitcoin has been the de facto store of value in crypto for more than 14 years. And so far, there is little competition for its place. This makes it the best bet for the coming years.

Fidelity claims that the growth of the digital asset market and possible instability in traditional assets will propel BTC in the coming months. The asset manager believes investing in Bitcoin is a good strategy.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.