Michael Saylor and MicroStrategy. If you hear this combination, you most likely associate this with Bitcoin. And no wonder. They are the largest private company that holds Bitcoin on its balance sheet. Michael Saylor is one of the biggest Bitcoin maxis. If you start doubting Bitcoin, listen to one of his speeches.

That’s precisely what I did. I listened to his speech about Bitcoin during the recent BTC Prague event. This was in early June 2023. So, let’s see what he has to say.

Source: Twitter

The Endless Economic War

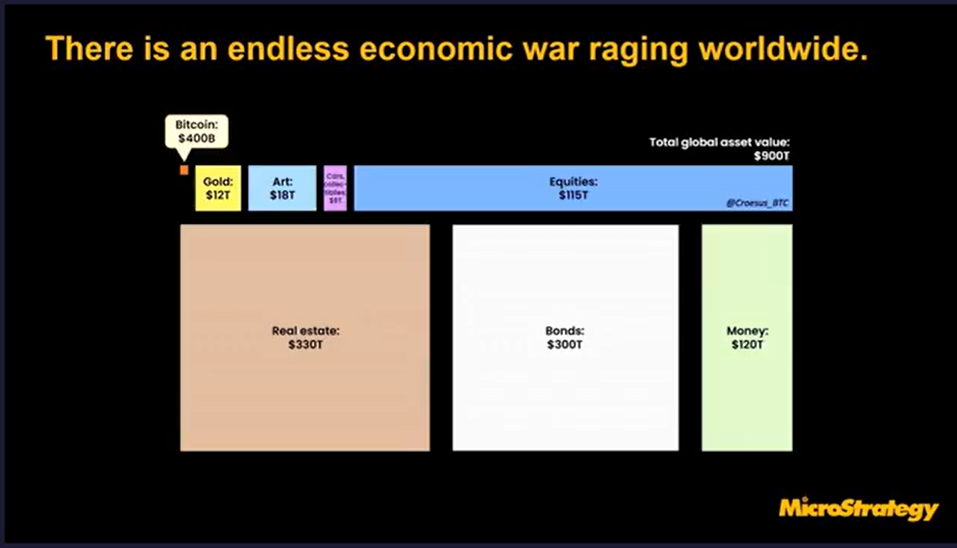

Since the beginning of time, we have seen an endless economical war. This war redistributes wealth. There are three drives that play a part in this redistribution of wealth.

- Governments – These are the most influential actors.

- Technology – The Googles, Apples, Teslas, and AIs of this world. The second most powerful driver.

- Work – That’s you getting up each morning to go to work.

Governments have shifted the power to bonds and real estate. See the picture below. Now, if you want to survive in this world, you need to take government policies and technology into account.

The World Reserve Currency (USD)

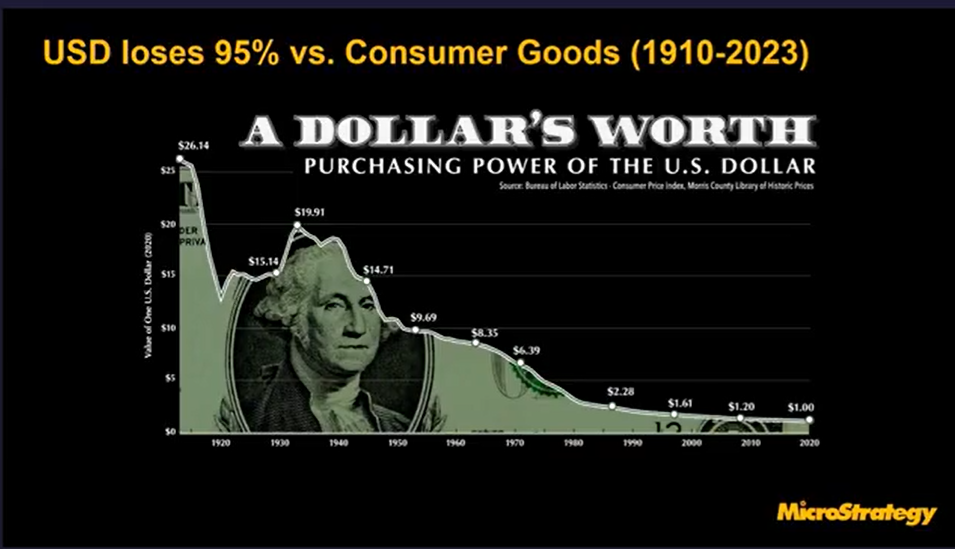

The USD or the world reserve currency is collapsing. The S&P index, real estate, gold, and art have taken over. So, here are some comparisons, on how the USD fares against other assets. For example, over the last 100 years, the USD lost vs:

- Consumer goods 95%. This makes consumer goods 20x pricier than 100 years ago.

- Gold, 99% of the value.

- S&P, 99.8%. The 500 most valuable companies.

However, other countries even fare worse. Their currencies are collapsing vs. the USD. For instance, between 2011 and 2023, they lost,

- Argentina’s Pesos, 99.8%. Argentines companies need to make 500x more revenue just to keep up.

- The Turkish Lira, 95%.

- Indian Rupee, 90%, between 1980 and 2023.

- Pakistan Rupee, 82%.

- Brazilian Real, 65%.

So, hard work alone won’t solve the issue of being on the wrong side of this economic war. In other words, in 100 years, the governments took all your wealth. They redistributed this to their cronies and friends. Saylor concludes this section with the following statement.

“To preserve wealth, investors must convert their currencies. They need assets that are scarce, desirable, portable, durable, and maintainable.”

The picture below shows the inflation rate over the last 100 years.

Smart Investors?

So, what are the smart investors? Let’s look at some samples.

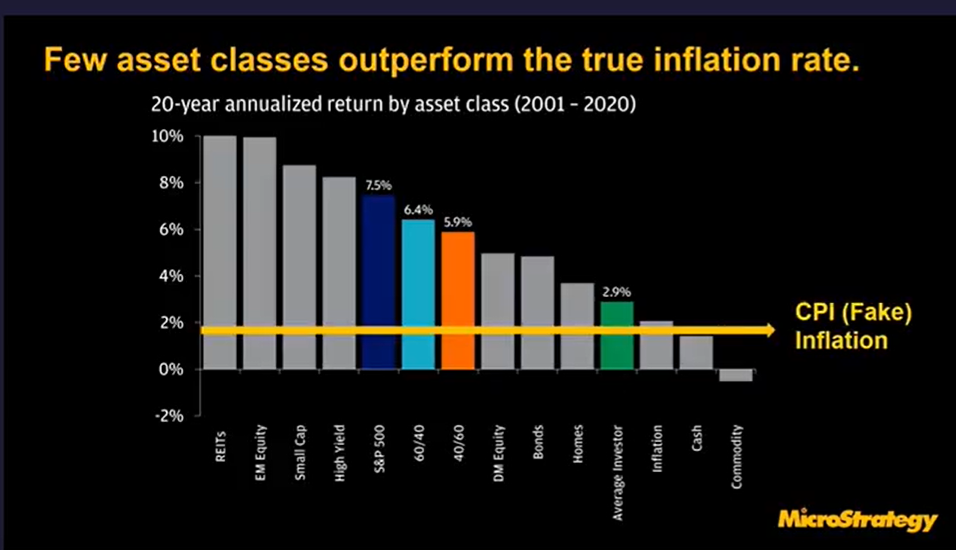

Investing in stocks with the S&P as a guideline. The S&P index goes up 7-8% per year. However, so does the inflation number. So, you end up tracking the monetary inflation rate.

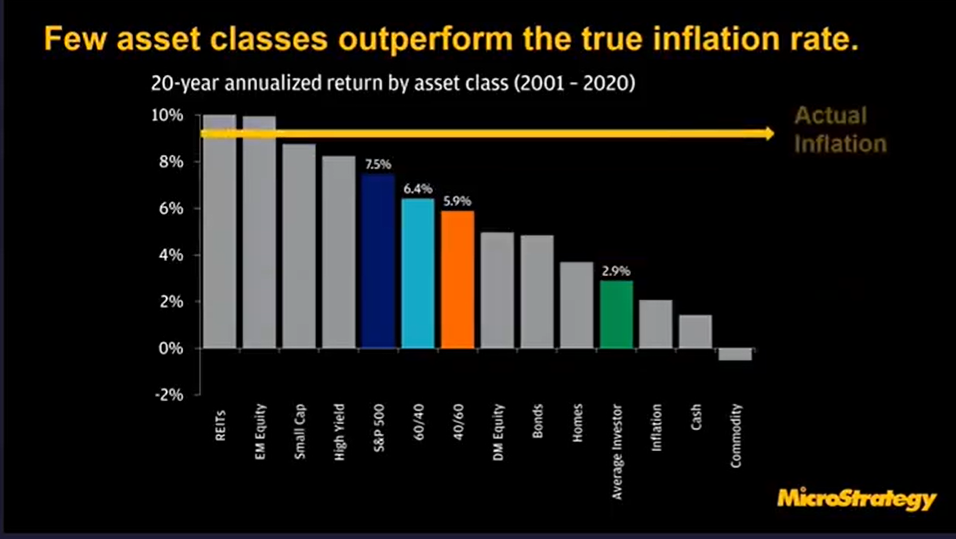

Let’s move on to assets that can outperform the true inflation rate. For example, commodities and cash. They underperform.

According to the government, the consumer inflation rate is 2%. But this is not true. Saylor calls this ‘fake’. Because, every 10 years or so, expensive assets get moved out of the consumer basket. They get replaced with cheap assets. It’s hard to break out of this cycle as a consumer. See the picture below.

The actual inflation rate of the USD over the last 100 years is 7.5%-8%. So, even the S&P barely holds up to this. So, this leaves you with owning real estate in prime locations. This will give you a small profit margin.

Most investors perform not so well, due to bad habits. According to Saylor, if you look at a 30-year performance chart of the S&P, 99.5% of the time, nothing happens. Only one day per year, 85%-90% of all gains occur. That’s why you should hodl and not trade. He continues to say that trading Bitcoin is a sign of ‘lesser intellect’.

Of all the 500 companies on the S&P index, only 1% can beat inflation. In other words, buying stocks is a lucky game. You most likely won’t buy one of these 1% companies.

Conclusion

This is Part 1 of our 2 series of articles on the future of Bitcoin by Michael Saylor. He’s the founder and the CEO of MicroStrategy. Here’s a link to Part 2.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.