Emotions play a bigger role in the financial market than most people can imagine. We all love to follow what’s trending. So, the concept of narratives in the crypto space refers to trending beliefs, stories, or ideas that shape how people engage with cryptocurrencies.

These narratives can also influence market trends, investor sentiments, and how people adopt new innovations. In this article, you will discover 4 crypto narratives you need to keep in mind.

Emotions in the Crypto Industry Are More Important Than in Others

Market players are constantly seeking trends and crypto narratives to better understand what is happening, why it is happening, and its potential effects. Also, crypto users tend to rely on previous market cycles to decide their actions in future market environments. Without a doubt, crypto narratives play a role in deciding what we invest in.

For example, during the last bull cycle, DeFi and NFTs were the biggest narratives. They also saw the most revenue. The benefits of jumping into narratives when they are trending are the same as getting into an investment early. The chances of success are way higher than getting there late.

GM #crypto world

177 days until the #bitcoin bullrun triggers

What narratives are you focusing on the most from here

Gaming/Metaverse 🕹️$ENJ $SAND $NAKA$PYR$WILD

AI 🤖$VRA$OCEAN$FET$AGIX$VRA… pic.twitter.com/d0OrmrbEfh

— Fitzo Crypto (CRYPTO BULL UNTIL November 2025) (@FitzoCrypto) September 18, 2023

Some of the narratives that dominate the crypto market in 2023 include:

- Artificial intelligence (AI)

- Liquid staking derivatives.

- Decentralized stablecoins.

- Bitcoin Ordinals.

- Chinese coins.

- Blockchain interoperability.

- Layer 1s.

- Layer 2s (Optimistic rollups and ZK rollups).

Now, let’s look at four other crypto narratives that are leading the market.

1) Re-staking

The liquid staking sector has seen a huge boom since the Shanghai upgrade. It ranks as one of the biggest categories in crypto, with a $20 billion TVL. Liquid staking makes it easier to stake tokens and improves network decentralization.

This might be one of the next big things.

New platform @EigenLayer, a "re-staking" solution.

No discord. No airdrop announcement. No token details. Not a lot, yet. Real alpha, hidden in Coinbase's 2023 Report.

🧵 What is Eigen and how it might revolutionize Ethereum: pic.twitter.com/4X5narCMKM

— olimpio (@OlimpioCrypto) January 2, 2023

Protocols like Lido allow users to stake ETH and receive stETH of equal value. There’s also the possibility of transferring this stETH to other exchanges within the DeFi market.

Similarly, re-staking is a term used to describe a process in which liquid staking token assets, such as stETH, are reused in staking into the validators of a network or other platforms. The Eigen Layer project was the first to introduce this trend.

EigenLayer’s goal is to develop into a decentralized marketplace where Ethereum validators and node operators earn fees for extra services. It enables users to restake rewards or assets earned from staking ETH on platforms like RocketPool (rETH) and Lido (stETH). Users can also reuse these assets to secure and validate sidechains or non-EVM chains.

EigenLayer currently has a TVL of $229.57 million. And as more protocols join this network, these figures are bound to increase.

2) De-AI

The cost of AI training in Web2 ranges from $3M to $12M, which is pretty expensive. There are also other issues hindering the growth of AI, such as data centralization, monopolization, and hardware constraints.

Ultimately, the power of AI lies in the hands of those who control it.

If we (the people) take control of AI and use it for good and decentralize control over information,

Then it can be a POWERFUL tool.

At https://t.co/PaUHJYKMS3 we're keeping AI uncensored

— AraMind AI (@Aramindspace) September 18, 2023

De-AI is a growing trend seeking to decentralize artificial intelligence. No doubt, the AI narrative fueled by the likes of ChatGPT is one of the biggest stories of the year. But centralization remains a headache. However, several Web3 projects are coming up to decentralize AI and the process of machine learning.

So, the benefit of decentralizing AI is to ensure data accuracy. Rather than a small group of people contributing data, collecting data from a wider source can ensure better accuracy. So decentralizing AI will create a market between data and models. It will also eliminate risks such as single points of failure.

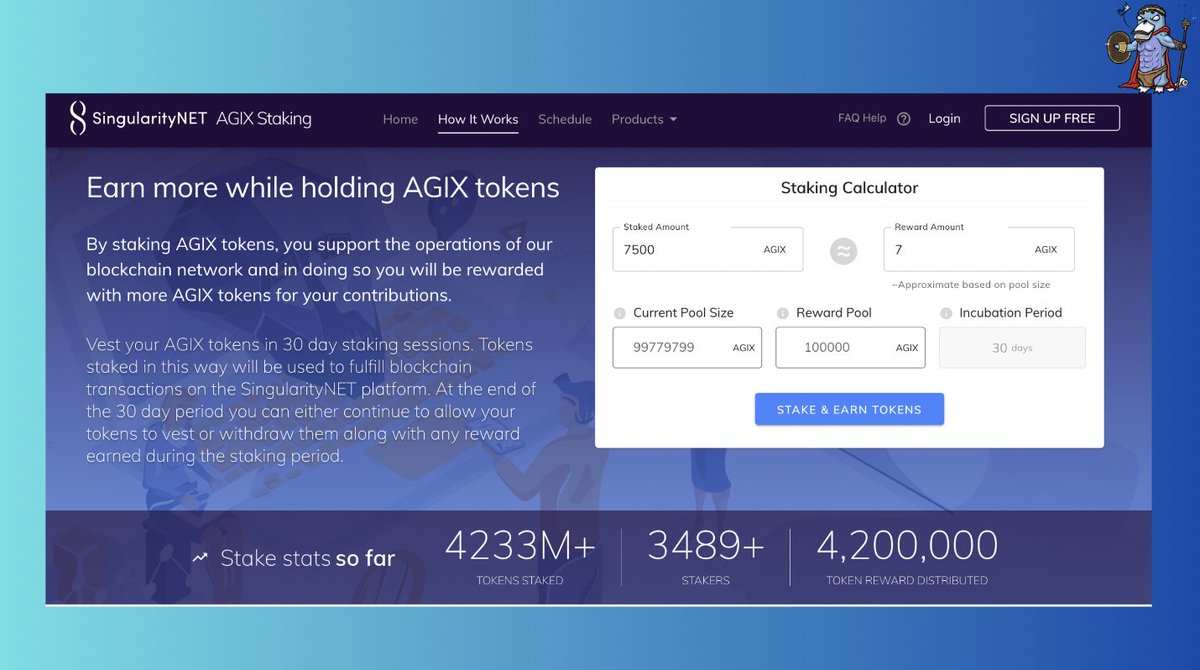

Source: SingularityNet

SingularityNet is one of the top projects involved in decentralizing AI. There are others as well. So, to participate in this trend, you can accumulate the tokens for this project. As these projects attract more users, the value of their tokens is bound to surge.

3) Shared Sequencer

Shared Sequencer is another narrative centered on decentralization. We recently talked about Ethereum and its centralization problems, and we posed shared sequencers as the true solution to this.

Layer 2 platforms like Arbitrum, Optimism, and zksync currently use centralized sequencers. Although it ensures faster confirmation times and greater efficiency, it presents the risk of a single point of failure and censorship.

📗 @OffchainLabs partners with @EspressoSys to bring decentralized and open shared sequencing technology across @Ethereum rollups

📗 #Espresso Sequencer is a consensus protocol allows various transaction ordering policies to be implemented at the builder level, such as #MEV… pic.twitter.com/posB8sjLSB

— Arbitrum Universe (@ARB_Universe) September 12, 2023

Shared sequencer offers a solution, as every rollup can use it as “decentralization as a service” by sacrificing profit from MEV. This tackles the issue of censorship. In addition, it allows the inclusion of transactions from different rollups in one block. This way, it reduces the cost of batch submission.

Some projects are currently developing shared sequencers. And it is very possible that they will introduce tokens to grant governance rights and raise funds. So, keep an eye on such projects.

4) Gamble-Fi

The market for online gaming is worth $88.65 billion in 2023. That’s a staggering sum that shows the demand for this service. It also shows that the adoption of crypto in gambling has increased by 44.6% this year.

After https://t.co/gIf3cSCNyD's huge success in the deepest crypto winter, it is proven time and again that gambling and Ponzi schemes are the only narratives that can survive any season.

Of course, LSDfi, Perp Dexes, RWA, L2s etc. had their own time, but @friendtech wins big. pic.twitter.com/Y0KJVl0OCw

— Hercules | DeFi (@Hercules_Defi) September 18, 2023

Crypto gambling projects have appealing structures. Some of them have Ponzi-like tokenomics with features such as revenue sharing and buyback and burn mechanisms. As the user experience continues to advance, gambling may be one of the sectors that sees heavy adoption.

These four crypto narratives have yet to see much of the spotlight. But they have true potential. As mentioned earlier, there are projects already developing solutions in these areas. So, identify the ones that meet your goals and keep an eye on them.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.