User numbers, transactions, and revenue increase, and numerous projects are experiencing explosive growth in Arbitrum.

Considering the competition in L2 chains, Arbitrum is developing a robust ecosystem. Here are some differences:

| Arbitrum | Polygon (POS sidechain) | Optimism | |

| Scaling technology | Sidechain | Optimistic rollup | Optimistic rollup |

| Consensus mechanism | Inherits Ethereum’s security | Proof of Stake | Inherits Ethereum’s security |

| TPS | 40,000 | 7,000 | 2,000 |

| Programming language | EVM compatible | EVM compatible | EVM compatible |

| TVL as of writing | $2.09billion | $885 million | $772 million |

So, What is Arbitrum’s Position Now?

Arbiturm’s wide EVM compatibility, including Solidity and Vyper, makes it one of the most promising EVM-compatible rollups. Moreover, it has already partnered with a vast range of Ethereum decentralized applications (dApps) and infrastructure projects. It includes Uniswap, Sushi, DODO, and dozens of others.

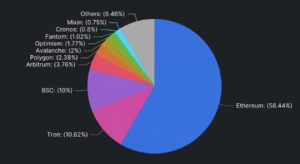

Source: DeFillama

Now, let’s examine some of the best projects on the Arbitrum platform, how they work and where the Arbitrum ecosystem is headed next.

1) GMX

With its zero price impact trades, limit orders, low swap fees, and safe positions from liquidations, GMX has become the leading perpetual exchange in DeFi. It is attracting a significant number of active users and building strong partnerships in the cryptocurrency space.

The DEX provides traders with features such as spot swaps and perpetual up to 50x leverage. It is the largest protocol on the Arbitrum network with a TVL of around $500 million:

- Focuses on zero-price impact trades and low swap fees.

- Trades are facilitated through its multi-asset pool called GLP, which pays liquidity providers for their services.

- Uses Chainlink Oracles to provide dynamic pricing.

Source: GMX

The GMX token serves as both a utility and governance token that allows holders to participate in voting on proposals and can easily be traded on exchanges like Binance, KuCoin, and OKX.

So, GMX has a favorable position to expand with more liquidity entering Arbitrum due to its dual exchange model and community-built tools. This also acts as an LPers playground.

2) Radiant

Radiant is a cross-chain DeFi platform that allows users to deposit any major asset on any major chain and borrow supported assets across multiple chains. The mission is to consolidate liquidity across top Layer 1 and Layer 2 protocols.

Source: Radiant

So, lenders can earn value through the native token $RDNT, and borrowers can withdraw against collateralized funds to obtain liquidity without selling their assets. The Radiant DAO’s primary goal is to consolidate the ~$22 billion of fragmented liquidity currently dispersed across the top ten alternative layers.

3) Gains Network

Gains Network is a decentralized trading platform on Arbitrum that allows trading of various assets with high leverages of up to 150x on cryptos, 1000x on forex, 100x on stocks, 35x on indices, and 250x on commodities. It has grown to over 100,000 users with $29 billion in volume traded since inception. These are its features:

- No order books or liquidity for each pair, but a single gDAI vault for all trading pairs listed.

- Synthetic leverage is used, and the DAI vault and the GNS token back the leverage.

- Utilizes a custom real-time Chainlink decentralized Oracle network to get the median price for each trading order.

Source: Gains Network

4) TreasureDAO

Treasure is a decentralized NFT ecosystem built for metaverse projects on the Arbitrum network. Its NFT marketplace, Trove, has driven over $250M+ in total market volume to date. The native utility token of the Treasure NFT marketplace is $MAGIC, which is used for mining, quests, and transactions within the Bridgeworld Metaverse. It will also serve as the bridge currency for future projects within the ecosystem.

How Does TreasureDAO Work?

It supports the universal usage of digital assets across multiple gaming ecosystems. Developers can create personas, currencies, assets, brands, and even storylines that cross over virtual worlds.

- Treasure is a marketplace for trading digital assets such as NFTs and other collectibles.

- It provides instant access to liquidity for those seeking to convert their NFTs into other crypto assets such as MAGIC.

- The marketplace offers a selection of gaming collectibles, avatars, and assets with vital data such as their scarcity, usage, and title of origin.

- It also shows the bidding activity and ownership history which can add to the value of the asset on the market.

Source: Treasure

5) Sperax

USDs is a Stablecoin that generates auto-yield natively and was deployed on Arbitrum. It’s the largest Layer-2 Ecosystem of Ethereum. It has achieved $20M TVL in the first 2 months since launch.

SPA is the governance and value accrual token of the Sperax ecosystem. SPA holders can stake SPA tokens to receive veSPA.

Source: Sperax

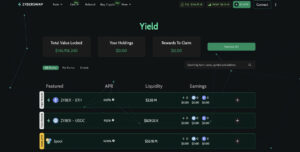

6) ZyberSwap

This platform is a decentralized exchange (DEX) built on the Arbitrum blockchain. It offers an automated market-maker (AMM) and low fees for swapping crypto assets. Also, It provides rewards for staking and yield farming on the entire Arbitrum network, with all major changes decided via governance voting.

Further, the platform has undergone a thorough security audit and is incubated by Solidproof, which provides free audit and KYC processes for new projects.

Source: ZyberSwap

7) Jones DAO

Jones DAO is a protocol specifically designed to optimize liquidity and yield by offering institutional-level strategies through its vaults. By using yield-bearing tokens, each strategy not only improves liquidity and efficiency but also unlocks capital for DeFi. This vital feature differentiates Jones DAO from other protocols and can generate lucrative returns for its users.

The protocol caters to three distinct groups:

- Users who prefer not to manage their strategies actively and wish to leverage the pre-deployed strategies offered by the vaults.

- Users who prioritize liquidity and prefer to keep their tokens liquid instead of locking them.

- Users who seek to earn an additional yield on their treasury positions.

Source: Jones DAO

Conclusions

Arbitrum is a top-notch Ethereum scaling solution with growing TVL, user adoption, and a diverse ecosystem of dApps. In February 2023, Arbitrum surpassed Ethereum in daily transaction volume for the first time in history. This remarkable achievement serves as a testament to Arbitrum’s surging popularity within the crypto community.

Its success depends on maintaining innovation and user adoption. If it does, it could be a crucial component of the cryptocurrency, serving as a backbone for current and future projects in DeFi, NFTs, and the creator economy, thus advancing the Ethereum ecosystem as a whole.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.