Welcome to another edition of our DeFi series. In our previous article, Decentralized Finance (DeFi) – A Complete Overview, we summarized the different important projects in the DeFi ecosystem. In this article, we will take the next step and talk about Decentralized Exchanges (DEXs) and how Uniswap has set a standard for DEXs. We will also provide a detailed guide for how to use the Uniswap exchange.

Uniswap is now widely admired as the most recent revolution in the Ethereum landscape. It has given Ethereum a much-needed boost (with increased gas costs). This along with Compound, Yearn Finance, 1inch Exchange, Balancer, etc, has given real credence to the whole DeFi movement.

That being said, much of this is still experimentation (like Yam), but the progress and usage which these experiments have led to are taking the whole crypto world by storm. Cryptocurrency loans are now easily accessible, decentralized insurance is getting bigger (Nexus Mutual) and now Andre Cronje is bringing in mortgages to the equation too.

Uniswap is the real game changer.

— Shash (@shashxxx) August 14, 2020

Why Uniswap?

To understand Uniswap, we have to first understand why we are still stuck with centralized exchanges.

- Fiat on and off-ramp – As powerful as the DeFi revolution is, fiat still rules. We use it extensively in our daily lives. Even if traders convert their cryptocurrencies into decentralized fiat alternatives like DAI, they still face difficulties paying for every-day expenses only with cryptocurrencies. In addition, many people choose to invest their salaries into cryptocurrencies. This again requires a fiat on-ramp.

- Liquidity – Generation-1 DEXs failed due to a lack of liquidity. Also, they were relatively complex to use. There existed multiple wallets such as the trading and the spot wallet. Even transfers between these wallets cost Ether (IDEX v1).

- Effectiveness – Also the lack of liquidity can result in preventing you from taking quick trading opportunities.

- Still Centralized – Most of the DEXs are still centralized and run by a few nodes.

Let us also compare a DEX with a centralized exchange (CEX).

The fee is high but who REALLY makes THE MONEY in DeFi..

Trader – YOU

Pool Liquidity provider – YOU

Miner – YOU

Early Investor – YOUWho makes money in CeFi..

Banks – NOT YOU

Exchanges – NOT YOU

Market Makers – NOT YOU

VCS – NOT YOU https://t.co/TW6shIv0dL— Shash (@shashxxx) August 19, 2020

In decentralized finance, you can be the trader and the market maker. In both cases, you get paid (with only a fractional amount going into the protocol to pay the developers, namely 0.05% of the 0.3% fee). However, in centralized finance, these fees go to the banks and exchanges.

Uniswap and Metamask is a Win-Win

DeFi now enables a whole new ecosystem where you can

a) Purchase coins and also provide liquidity using Uniswap

b) Adjust your portfolio using Balancer

c) Take loans using Maker or Compound

d) Purchase insurance using Nexus Mutual, all in a decentralized way. You use a single Web 3 (Metamask) wallet. You retain your keys. It is trustless. You have total control of your actions. Imagine that in 2019!

How to use Uniswap?

- Install a Web 3 wallet. We will use Metamask in this case. Metamask is a decentralized wallet in the form of a Google Chrome extension.

- Go to the Uniswap website. Beware of fishing websites.

- Click on “Launch App”.

- You will do all your trading on the /swap page and your market making on the /pool page, each of which is accessible after you launch the app.

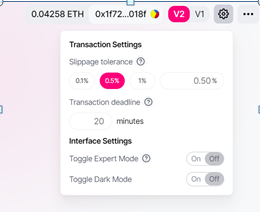

- Select the Uniswap version. Version 2 is advanced, however, it is still relatively new. Read the next section to understand the difference between V1 and V2.

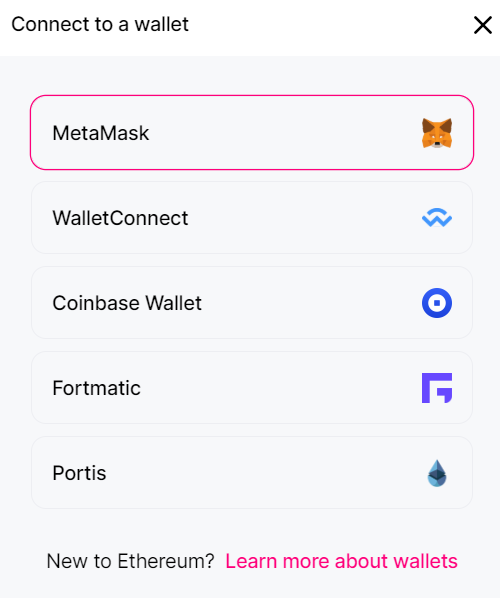

- Click on “Connect to a Wallet”. We will use Metamask.

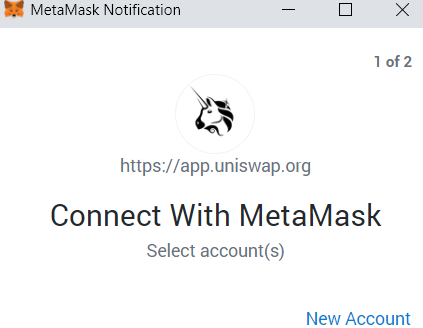

- Connect with Uniswap

- The settings function has several features which include selecting a slippage tolerance.

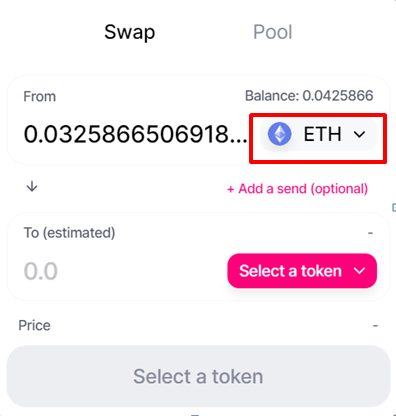

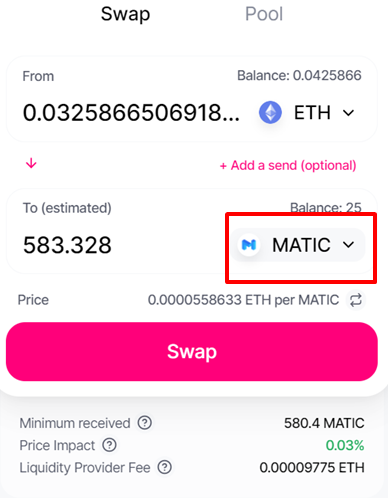

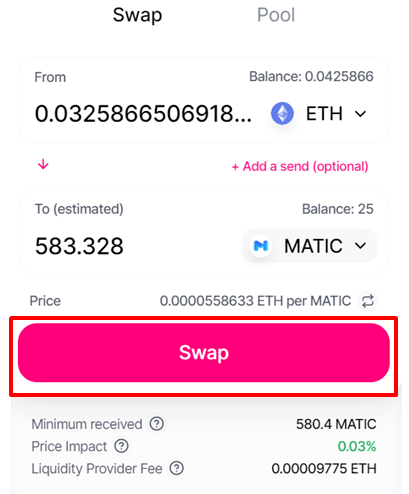

- A trader uses Swap. Select the input token. I select ETH.

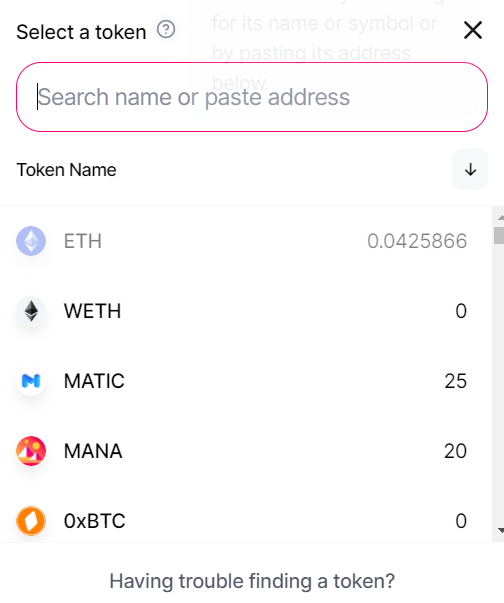

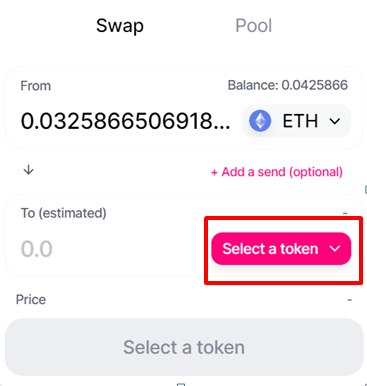

- Select output token

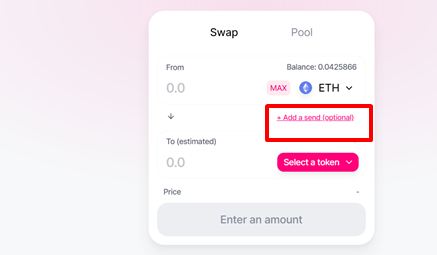

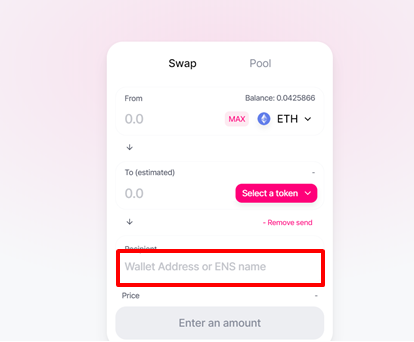

- You can also add an address where you want to send the token after the trade.

Click on Add to send

Add address

- Swap and the Output token will be in your Metamask wallet (or your preferred address).

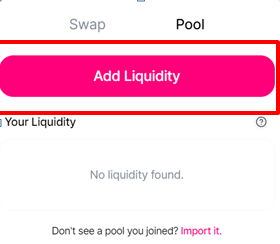

- If you want to be a market maker, go to Pool and add liquidity

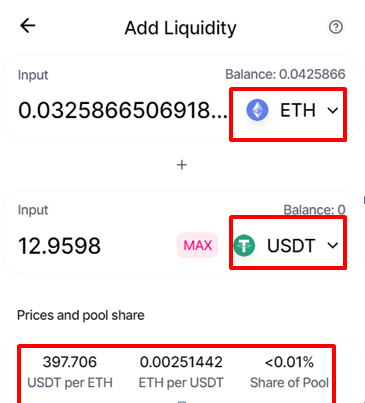

- Select the tokens you want to put in a pool.

Tips from Altcoin Buzz

Altcoin Buzz Co-Founder and CEO, Shash has certain tips for using Uniswap

How to get the best price

- Find your trading pair on https://uniswap.info/ and look at transactions

- Wait for a big transaction

- Place your order immediately when someone places a large order in the opposite pair.

- Eg You want to swap your ETH to SWAP. Wait for a big SWAP to ETH order to come, then place your order.

Trading Pair

- Trade against $WETH instead of $ETH. It has lower fees and faster transactions.

- You can later swap $WETH to $ETH 1:1 to save on time and money.

Uniswap v1 vs v2

Uniswap has currently 2 versions running simultaneously. v2 is the latest and has certain improvements over v1.

- Swap any ERC20 token directly with any other ERC20 token. Wrapped ETH (WETH) enables this feature.

- V2 has a stronger Oracle system. It is more decentralized and manipulation resistant

- In the case of a series of transactions, the amount need not be paid upfront. For example, even if you do not have DAI, you can swap 1 ETH at a rate of 400 DAI on Uniswap, sell 1 ETH in another protocol for 420 DAI and return the 400 DAI to uni swap. Your profit is 20 DAI.

- Uniswap v2 introduces Uniswap v2 Core smart contracts. The routers convert between ETH and WETH. Core stores the ERC 20 token balances internally.

- V2 is written in a new programming language, Solidity, instead of Vyper.

- It is also compatible with various other standards like ERC 777

- Uniswap v1 had a bug. It consumed all remaining gas fees on failed transactions. V2 fixes this.

- V2 also introduces a liquidity provider fee of 0.30%. This makes the Governance stronger and the protocol becomes more sustainable.

Conclusion

Uniswap has everything blockchain promises. It is finance, decentralized, and trustless. There is no need to deal with any centralized exchanges. You are the sole custodian of the fund. The Uniswap exchange pays you to provide liquidity.

Note that, market making is still a risk and needs to be done very carefully after detailed study. We will discuss this in later articles. It also has a very simple UX, zero complexity.

In addition, Uniswap is a building platform for a lot of future solutions. And yes, Vitalik Buterin also considers it as a landmark! We encourage you to understand the benefits and risks and then leave your centralized exchange and embrace decentralization using Uniswap. This is what Blockchain is about!

Check out our previous De-Fi article: Decentralized Finance (DeFi) – A Complete Overview

Check out our most recent video on Uniswap tricks and a comparison between the decentralized and centralized cryptocurrency exchange markets.