This week’s Altcoin Buzz Alpha highlights all come under the same theme. Getting in early to high potential protocols.

This week we have 2 public sales. Hard to get earlier than that. Also, we have 2 restaking altcoins. This new important trend is just starting and a new Bitcoin Layer 2 with tons of airdrop potential. Ready to get some actionable Alpha? Then let’s go.

2 Public Sales Coming Up

To start with, let’s have a look at the 2 public sales coming up. Our Research Team put lots of info together on both for our members.

- SubQuery

The first is SubQuery. Here are more details from the upcoming sale. SubQuery is part of a narrative we like with Web3 infrastructure. It does data indexing as well as providing RPC nodes for various networks. Note that the sale is starting TODAY. January 30.

- Massa

Massa Labs sale is going on through Republic. Massa Labs is a 3-year-old Layer 1 chain designed for scalability. It claims decentralization but it does have VC backing, too. Despite the VC backing, it does maintain a high Nakamoto Coefficient, a measure of decentralization. You can register for the sale now, which they are doing as a US-based Reg D offering.

🎉 Massa’s Allowlist is open for our community to participate in our Reg D offering!

🙏 To address our gratitude to early Massa supporters for trusting our vision, the Allowlist is open for those who qualify!

👉 Register here: https://t.co/hDAIjX9ZFx pic.twitter.com/DHeMegqtQW

— Massa Labs (@MassaLabs) January 23, 2024

Both projects have their potential AND their risks. But if you like the idea of getting in early on projects, getting in at the public sale is about as early as you can get.

Liquid Staking & Restaking

Next, 2 big protocols are making moves in staking and restaking:

- Solana

Solana restaking started this week on the Picasso Network. SOL and a couple of liquid or wrapped versions like jtoSOL, mSOL, and bSOL are the first 4 tokens available for restaking. Restaking lets you take the coins you are holding and put them to work to multiply your returns.

1/ SOL restaking will be going live with Jan. 28th !

Initial Assets: $SOL , $jitoSOL , $mSOL , $bSOL

1st Cap: 50k SOLFinalized details for vault contracts and design will be posted this week 📝 https://t.co/otGZis5HQb

— Picasso $PICA (🎨,🎨) (@Picasso_Network) January 21, 2024

- Eigenlayer

The reason why restaking is a thing on CryptoTwitter and Ethereum now is due to Eigenlayer. Eigenlayer allows you to restake your ETH liquid staking tokens to use for DeFi or other purposes. Currently, EigenLayer offers two options:

- Users can re-stake their LSTs with EigenLayer through its smart contracts, receiving additional staking rewards in return.

- Validators can natively re-stake their staked ETH by configuring their beacon chain withdrawal credentials to EigenLayer smart contracts, earning additional staking rewards in return. Validators can also choose their preferred modules built on EigenLayer.

This is an important new development for a couple of reasons

- It lets investors use their crypto more effectively. ETH stays staked to help secure the network. Yet with Eigenlayer, that restaking enhances security even more.

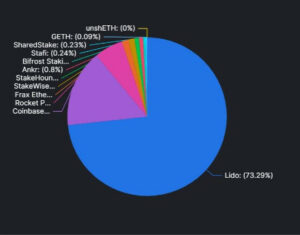

- It could help decentralize the network a little more. There are huge centralization concerns now even among ETH’s biggest fans. The huge holdings of Lido, Coinbase, and Binance in liquid staking protocols are a concern. Decentralizing staked ETH and its related security is a positive.

It’s not without its risks though, too. We discuss these in detail in our Alpha reports. But briefly, it’s easier for validators using Eigenlayer to get slashed and has to pay penalties related to restaking tasks. That would negate some of the extra returns you are earning.

Also, this could start ETH down the road of rehypothecation of assets as we have with stock shares in the US. Or with a more direct crypto example, when many were recommending deposits on Anchor Protocol on Terra, then borrow against it and redeposit it for those sweet returns. Remember that? I sure do. You are creating a leveraged trade for yourself depending on how well collateralized your position is. So be aware of this.

Source: BeInCrypto

That said, we like how it enhances security and gives users more freedom to use their coins how they wish. Right now, EigenLayer supports 9 of the top 10 liquid staking coins. They are:

- Lido Staked Ether (stETH)

- Rocket Pool Ether (rETH)

- Coinbase Staked Ether (cbETH)

- StakeWise Staked Ether (osETH)

- Origin Staked Ether (oETH)

- Swell Staked Ether (swETH)

- Ankr Staked Ether (ankrETH)

- Stader Staked Ether (ETHx)

- Binance Staked Ether (wBETH)

The only one in the top 10 missing is Frax. But support for both Frax and Mantle, another fast-growing liquid staking protocol, is coming very soon.

MintLayer

Last, for today, we have MintLayer. MintLayer is a Bitcoin L2 that allows for smart contracts, atomic swaps, and more. And its mainnet launches tomorrow. This competition, going on now with Zealy, is just one example of the airdrop campaigns going on (and expected to continue) with MintLayer.

Tomorrow marks a pivotal moment in Mintlayer's history! Our mainnet launch is on the horizon!

Marking the transition to Mintlayer's native environment. 🍃

Get ready for a journey inspired and driven by #Bitcoin, prioritizing security and reliability.https://t.co/bJtJeK1Txq

— Mintlayer (@mintlayer) January 28, 2024

At the mainnet launch, 66% of the total supply will start circulating. So again, this is a case of getting in early. Some other positives in the tokenomics include:

- Long vesting schedules for the Team

- A relatively low % for the Team at 12.5%

We like this and the one big L2 that’s a little further along in this process than MintLayer. Stacks. As Bitcoin Layer 2 needs to grow, the need for both protocols should continue to grow, too.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.