This surge is supported by a 75% increase in trading volumes, reaching $22 billion, signaling a strengthening upside momentum.

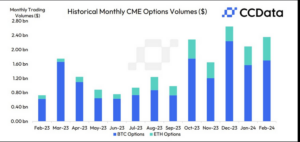

In February, the total derivatives trading volume on CME rose 1.58% to $96.4 billion. Let’s discover more about Ethereum (ETH).

Surge in Trading Volumes Signals Bullish Momentum for ETH

BTC futures volumes on the exchange increased by 0.31% to $74.2 billion, while ETH futures volume grew 3.25% to $17.1 billion.

Source: CCData

BTC options volume on the exchange extended 8.21% to $1.70 billion. Conversely, ETH options volume on the exchange reached an all-time high, surging by 26.4% to $655 million.

This data suggests that institutional players increasingly focus on Ethereum, anticipating upcoming catalysts such as the Dencun upgrade and a potential Spot Ethereum ETF later in the year.

The Dencun upgrade is often hailed as the most significant enhancement to Ethereum since the Merge. It aims to implement several Ethereum Improvement Proposals (EIPs), including EIP-4844, which introduces “proto-danksharding.”

Proto-danksharding is a feature designed to improve transaction processing efficiency by utilizing blobs. It expedites transactions and reduces costs for layer-2 chains and rollups dependent on Ethereum. The Ethereum developers have scheduled the Dencun mainnet launch for March 13.

Pending Spot ETH ETFs

Moreover, optimism surrounds the potential approval of spot Ether ETF applications by the SEC. Despite the regulator’s decision to postpone its judgment on spot Ethereum ETF applications from BlackRock and Fidelity, market participants remain hopeful that approval will come soon.

SEC just delayed @InvescoUS & @galaxyhq's #Ethereum ETF. 100% expected and more delays will continue to happen in coming months.

The only date that matters for spot #ethereum ETFs at this time is May 23rd. Which is @vaneck_us's final deadline date pic.twitter.com/gkVZL2QuPK

— James Seyffart (@JSeyff) February 6, 2024

- Some anticipate that the SEC will announce its decision on all spot Ether ETF applications simultaneously, following a similar approach to its handling of Bitcoin ETFs on January 10, to maintain fairness among applicants.

- The statutory deadline for the SEC’s decision on ETFs is scheduled for May 23rd.

Is ETH ETF Fever Waning?

According to Fox Business correspondent Eleanor Terrett on March 11, optimism regarding the US SEC’s approval of spot Ethereum ETFs by May 23 appears to be diminishing.

- Recent meetings have been predominantly one-sided based on discussions with individuals familiar with the situation.

🚨SCOOP: Optimism about the @SECGov approving the $ETH spot ETFs by May 23rd is waning.

Based on my conversations with people familiar, meetings in recent weeks have been very much one sided, with issuers and custodians trying to rally SEC staff to get the process rolling, but…

— Eleanor Terrett (@EleanorTerrett) March 10, 2024

Terrett noted that issuers and custodians have been attempting to encourage SEC staff to expedite the process.

- However, unlike the interactions seen with BTC spot ETF applications, these efforts have not resulted in meaningful engagement.

- Moreover, anti-crypto figures such as Elizabeth Warren are expressing discontent with the SEC’s approval of Bitcoin ETFs and are actively opposing similar approval for Ethereum.

If ether futures aren’t *highly* correlated w/ spot market, then why did SEC approve ether futures ETFs in Oct…

How does that protect investors?

Not saying SEC gonna approve spot ether ETFs, but not sure how they deny based on lack of correlation. Would be pretty bad look IMO.

— Nate Geraci (@NateGeraci) March 10, 2024

Meanwhile, Nate Geraci, President of the ETF Store, reveals that the SEC has argued against the high correlation between Ethereum futures and spot markets.

- Grayscale’s legal victory could serve as a compelling reason for approval, and the SEC’s options are to either reverse years of tacit acceptance of Ether as a commodity or potentially face new legal challenges if issuers decide to pursue them.

- Anyhow, the situation appears straightforward: if the SEC is comfortable with investors holding ETH futures ETFs, they should likewise be amenable to spot Ethereum ETFs.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.