Aave is an Ethereum-based, decentralized, open-source, non-custodial money market protocol that allows the users to deposit and borrow cryptocurrency without any middle-man.

The AAVE system is managed by smart contracts where the asset deposited by the depositor maintains the liquidity of the market. Depositor also earns income from their deposit. And the borrower takes out a loan by depositing collateral.

The platform uses Chainlink’s decentralized oracles for the cryptocurrencies price feed. Find more details here.

The protocol supports 16 different assets including 5 stablecoins: BAT, DAI, ETH, KNC, END, LINK, MANA, MKR, REP, TUSD, USDC, USDT, WBTC, ZRX, SUSD, and SNX.

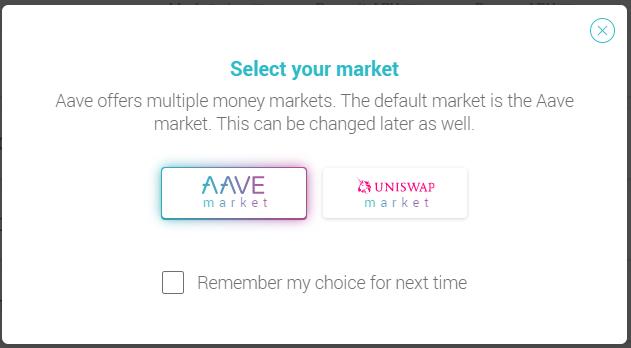

Currently, it supports two markets:-

- AAVE Market

- Uniswap Market

Working Guide

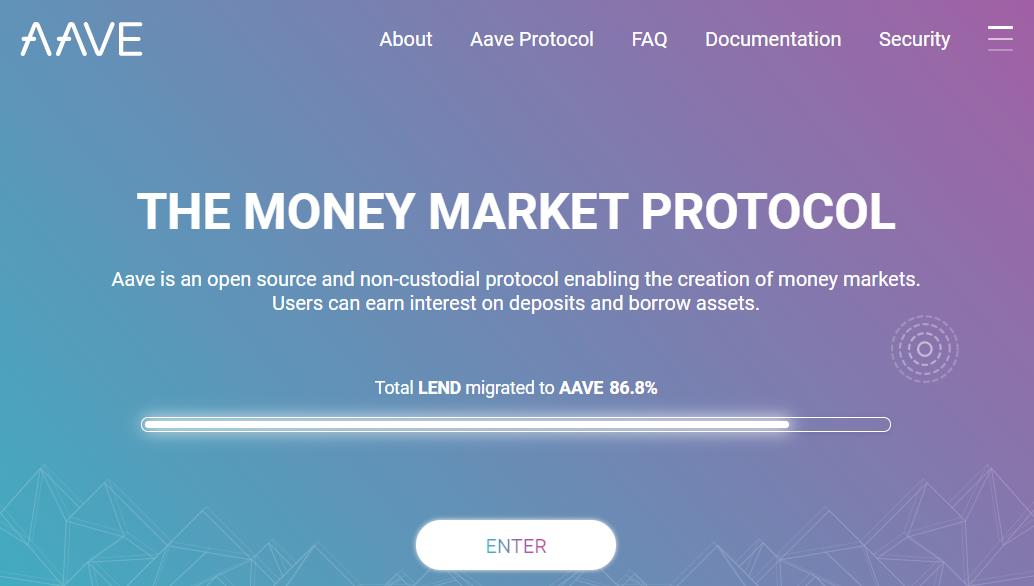

To connect with the AAVE platform, go to the link.

The platform landing page looks like this.

Table of Contents

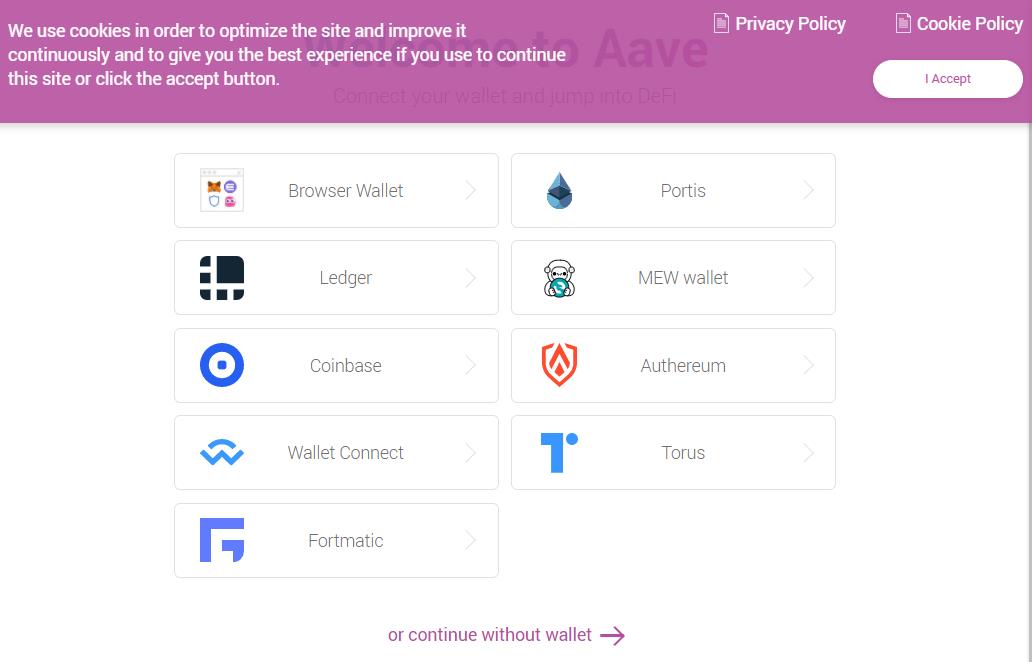

Connect Wallet

The platform supports many wallets through which you can connect and use the protocol.

Connect your Metamask wallet. The application will ask to choose the market.

As we have mentioned earlier it currently supports two markets each with numerous tokens along with different APY.

Select the market to which you want to interact.

We have made this guide based on the AAVE market.

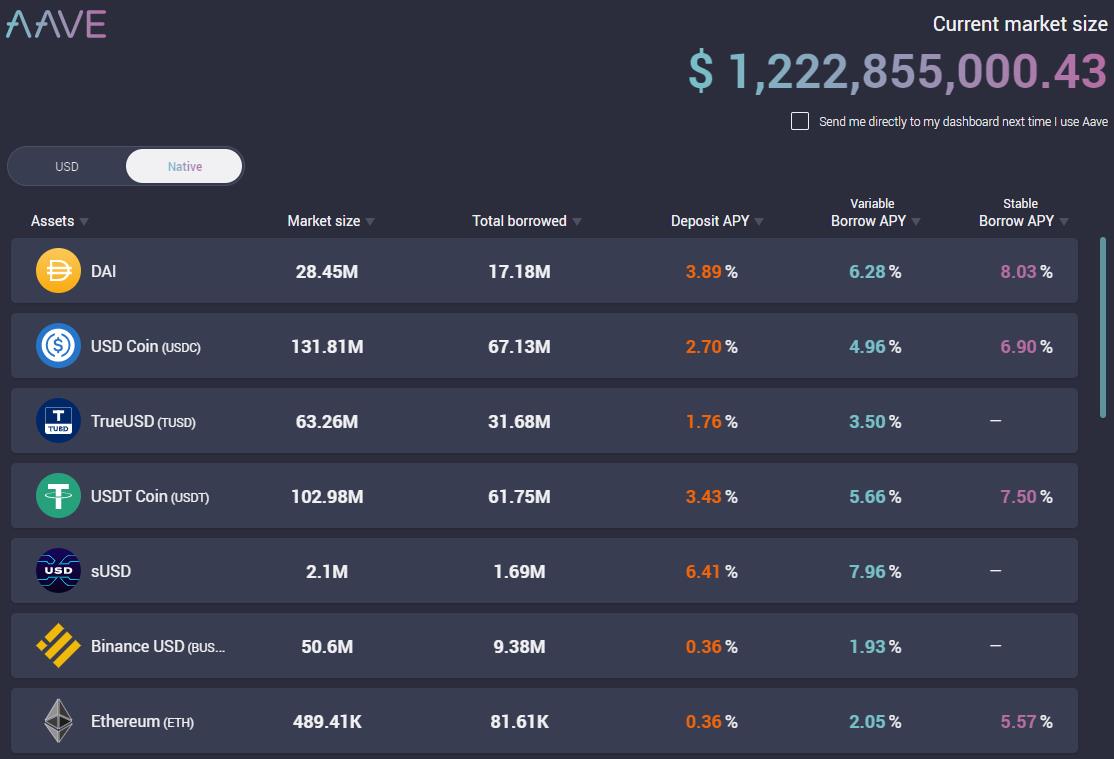

The application landing page contains the following details:

- List of tokens supported by the particular market(AAVE/Uniswap)

- Total current market size

- Individual token market size

- Total borrowed amount of each token

- Deposit APY (Annual Percentage Yield)

- Variable borrow APY

- Stable borrow APY

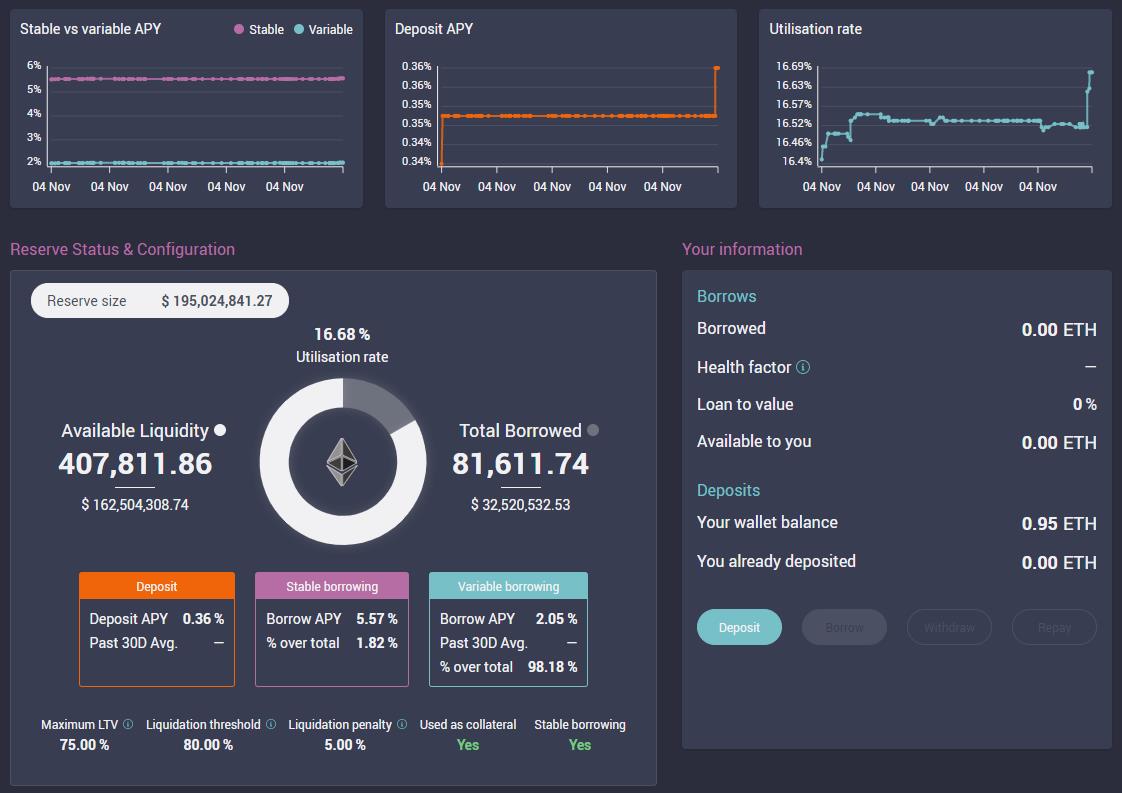

To get more detail about individual token click on it.

Deposit

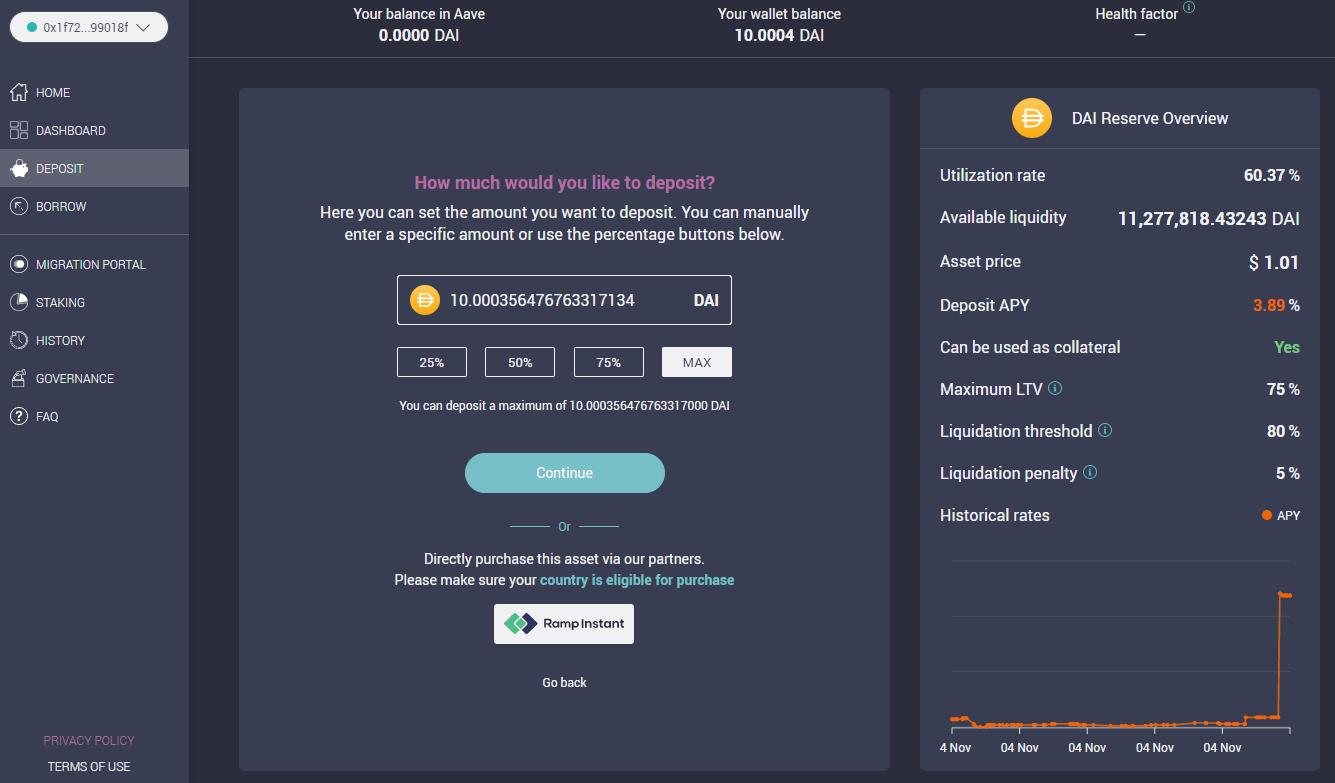

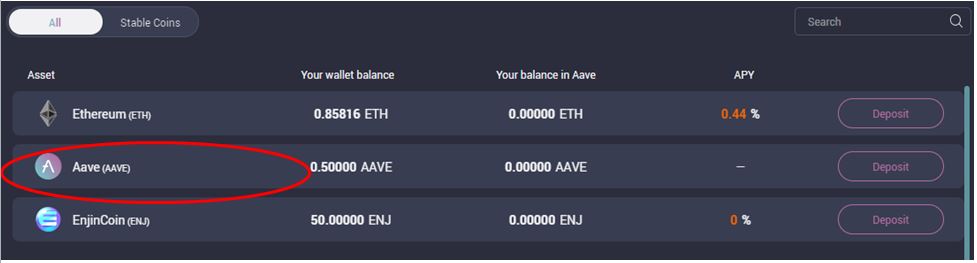

To deposit any token you are required to navigate to the Deposit tab. Select your desired token.

Users are required to deposit collateral before taking out a loan from any lending platform.

We want to deposit 10 Dai as our collateral. Depositing an asset requires a series of approval before actually depositing the collateral.

Click on Continue, it will ask you to first approve the Deposit process.

Once the user provides the approval, after that they can proceed with depositing assets.

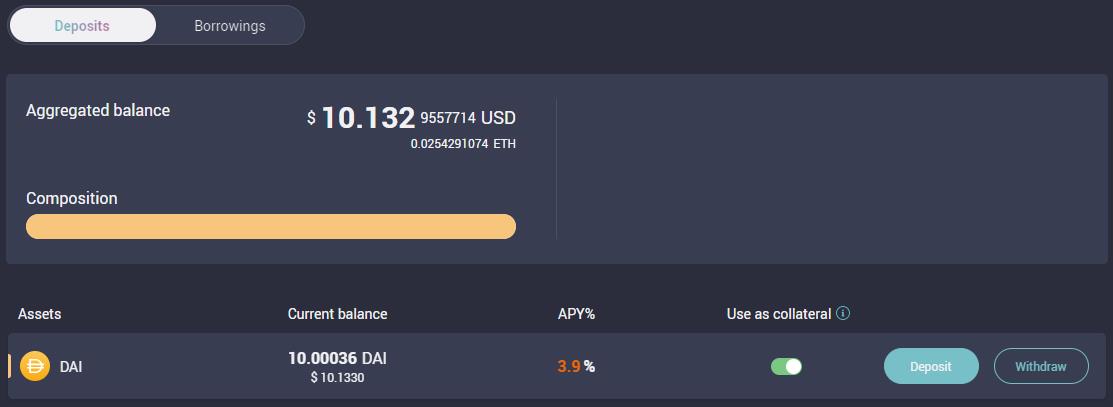

When the Collateral Deposit is done, You can see the DAI amount in your dashboard.

The token has an annual yield of 3.9% which a user will receive as an interest.

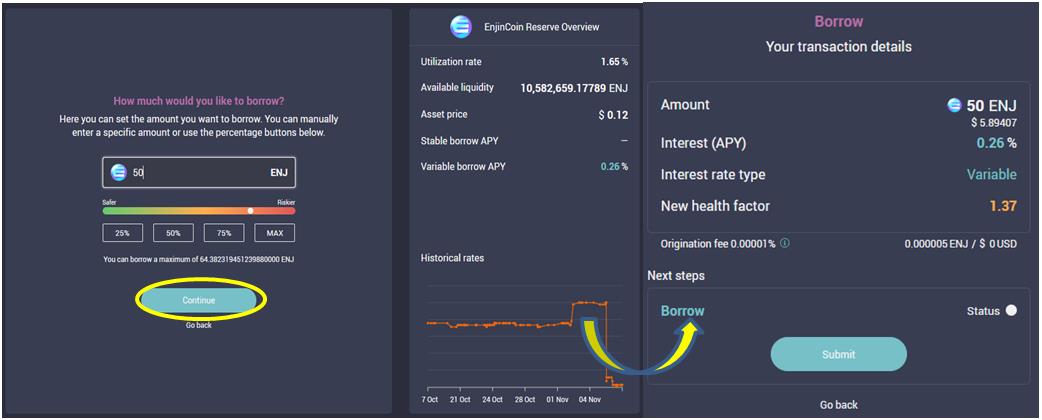

Borrow

To borrow, navigate to the borrow section.

The amount of a token to be borrowed depends upon:

- Collateral amount

- Liquidity of the asset

Users can borrow against the collateral that they have deposited. The application consists of a bar that shows your risk status when you enter the amount of token to be borrowed.

It is always recommended not to borrow the max amount to avoid liquidation.

Important: It is advised to maintain the health factor >1 to avoid liquidation.

You can also check the details of the risk parameters of the various token from the link.

To borrow any coin (we are borrowing ENJ coin) just click on the token available on the borrow pane and enter the amount of token you want to borrow.

Users are also required to select the loan rate i.e variable or stable rate. After filling all mandatory parameters, you can approve the transaction to process your request.

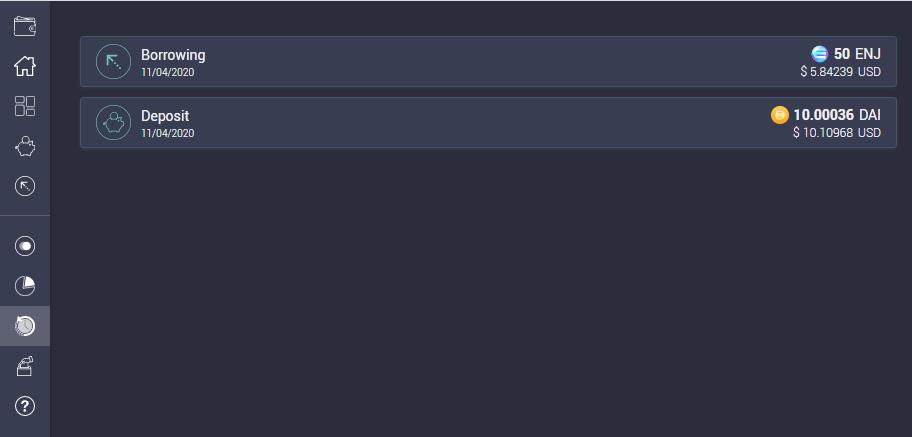

Once the transaction is successful, you can see the borrowed amount in your Dashboard.

Stable rate- As the name implies stable rate remains stable or fixed in short term but can be adjusted in the long-term depending upon the market condition.

Variable-rate- The variable rate depends upon the demand and supply on AAVE.

Users can change the rate at any time through the dashboard.

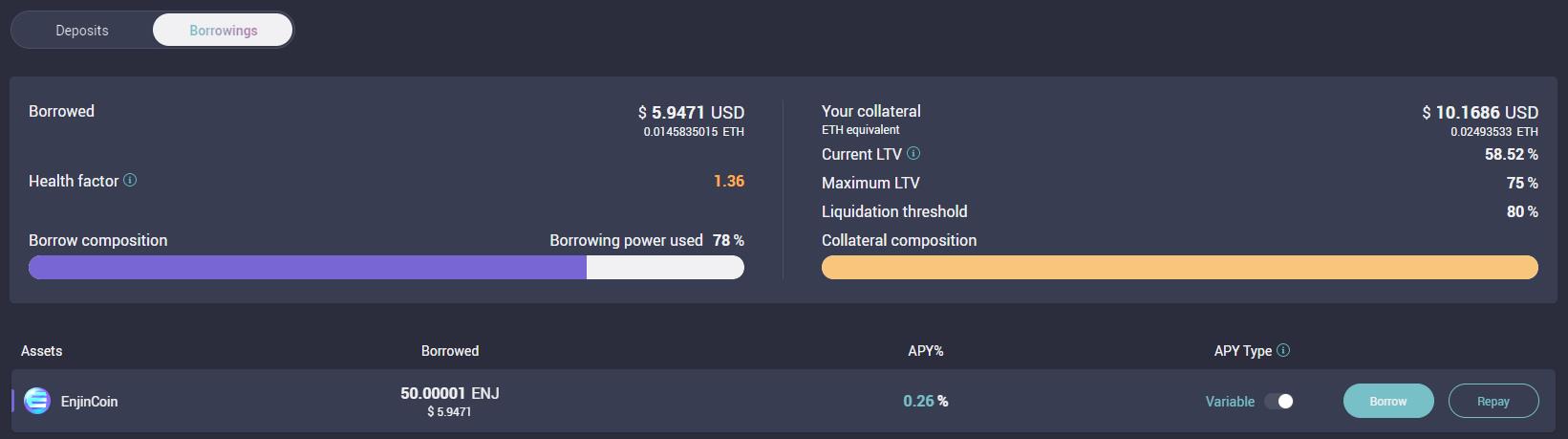

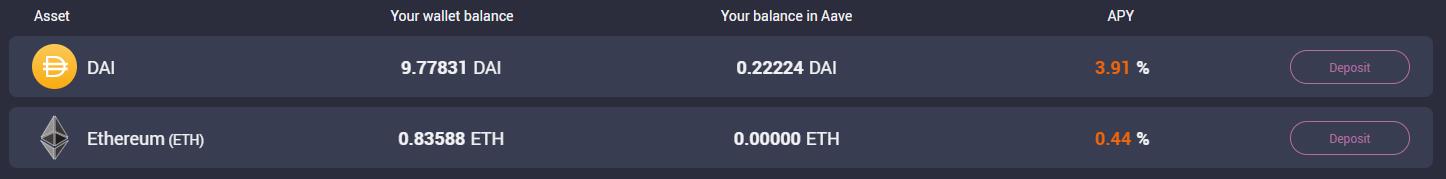

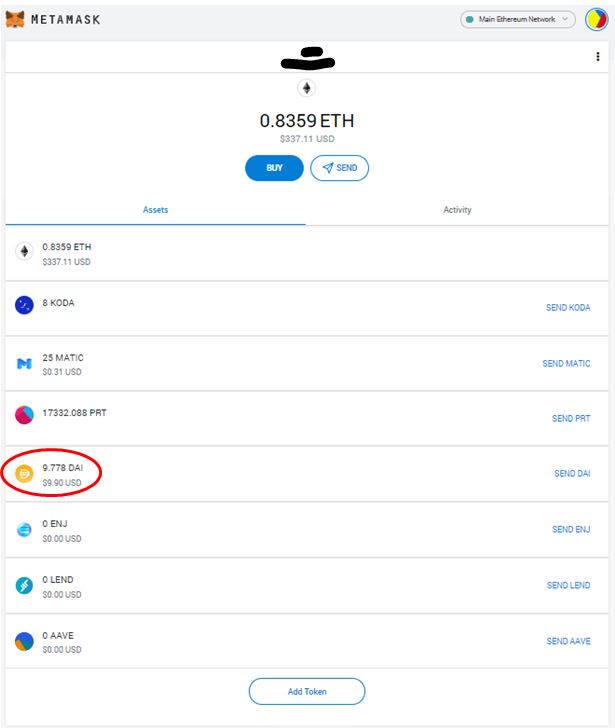

Metamask Wallet After Deposit (Dai) and borrow (Enj)

After the deposit and borrow activity, you can now see the following in your wallet:

- Missing Dai amount (used as collateral)

- Enjin Coin (borrowed 50 coins)

You can use this ENJ coin for further transactions.

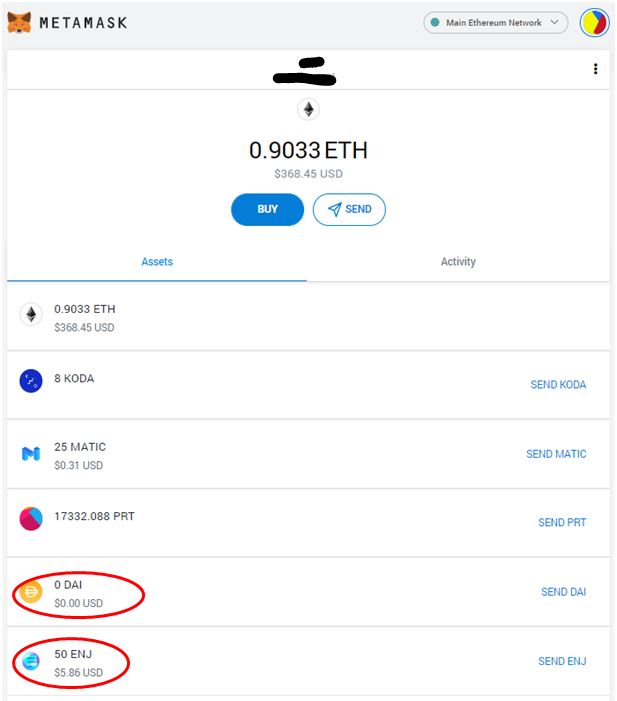

Migration Portal

The migration portal allows the users to migrate the LEND tokens into AAVE token.

The migration ratio of LEND: AAVE is 100:1 i.e for every 100 LEND token users will receive 1 AAVE token.

To migrate LEND, just approve the migration process and you will receive the resultant AAVE token in your account.

You can check the AAVE token in the dashboard also.

Staking

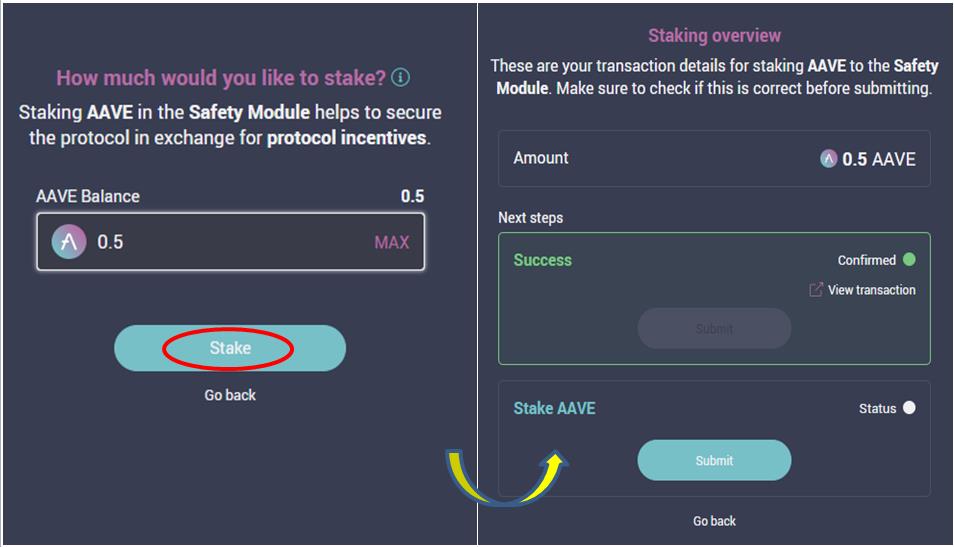

Users can stake the AAVE token by depositing it in the protocol safety module. The safety module is a smart contract-based component where AAVE holder deposits their tokens and receive incentives. The purpose of staking is to act as a mitigation tool in case of a shortfall event.

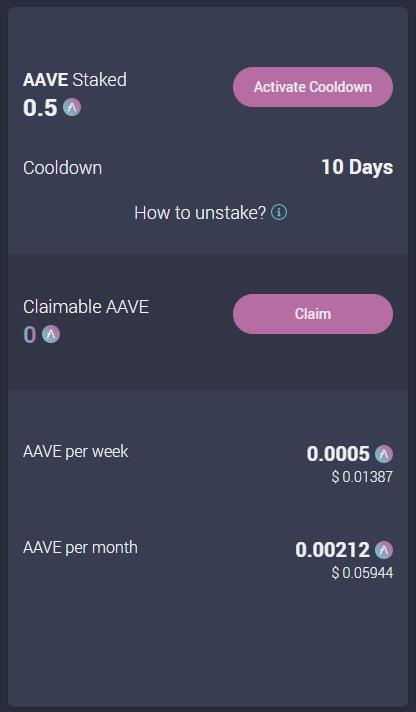

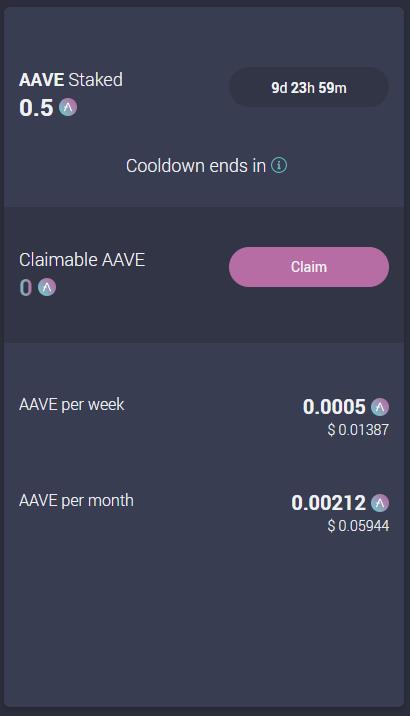

After the staking transaction is successful you can see your AAVE staked balance along with weekly and monthly incentives.

Unstake

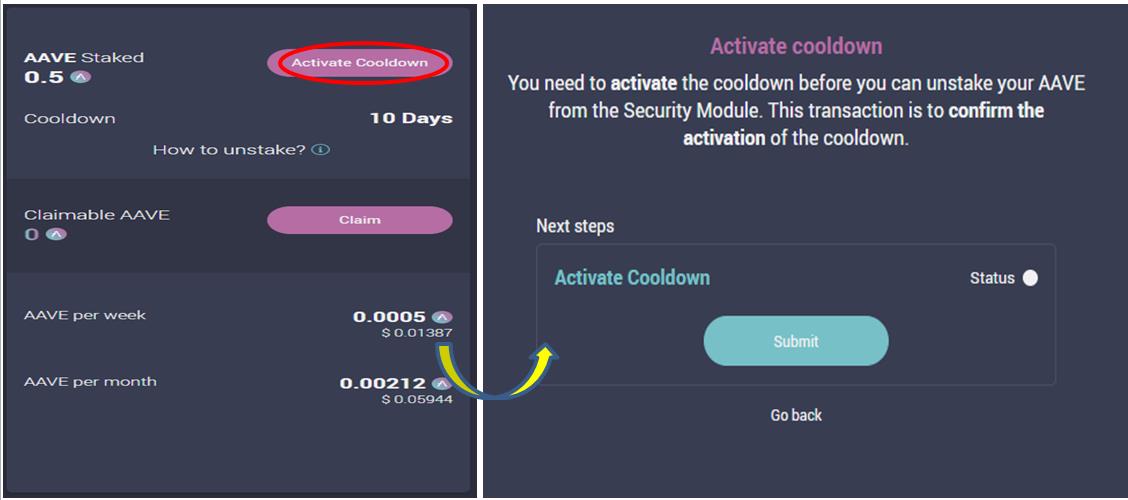

Users can unstake the tokens once the cooldown period of 10 days is over. The cooldown period is the time required before unstaking the token.

To unstake, you first need to Activate Cooldown by pressing the button.

Once you have confirmed the Unstake process, you can now see a timer of 10days is activated.

After it is over, you will be able to unstake the AAVE token.

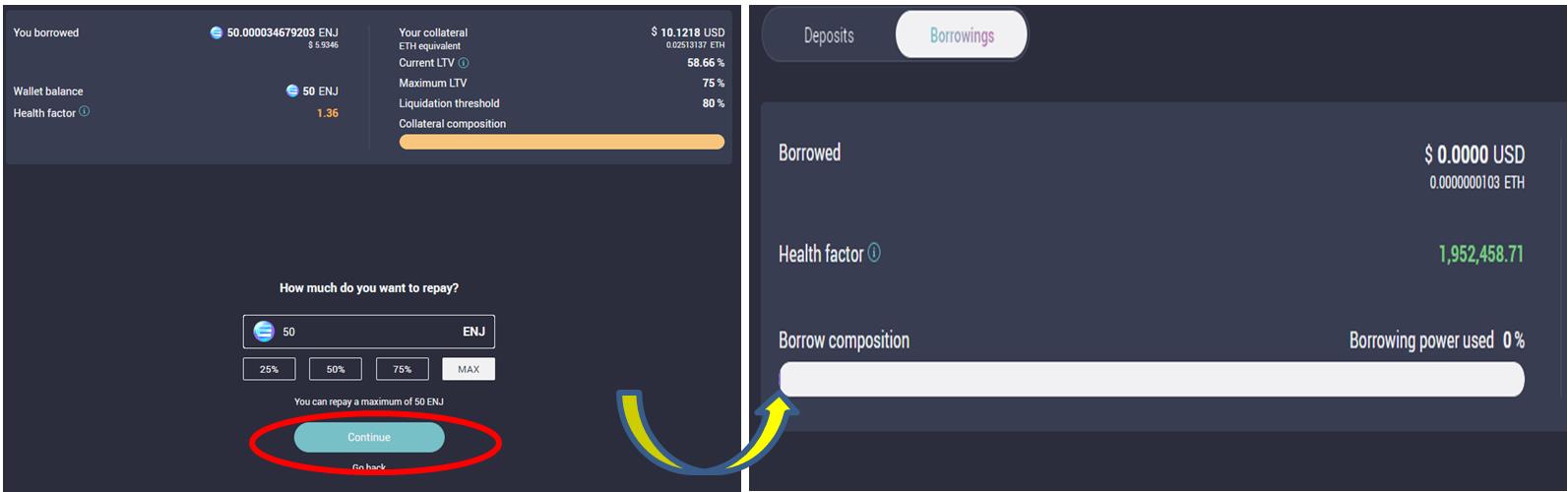

Repay

Users can repay the token that they have borrowed whenever they wish. Just enter the amount you want to repay and confirm the transaction.

You can now see the borrowed balance becomes zero in your dashboard.

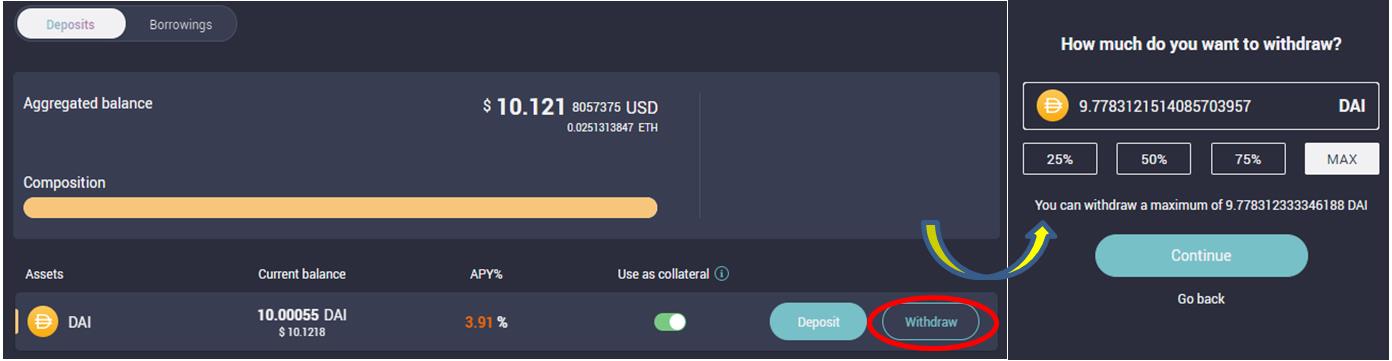

Withdraw

If you have repaid all your loan, and no longer want to use the platform or merely want your collateral free or for any other reason, you can proceed with withdrawing your collateral.

Just click on the Withdraw button and enter the amount of token you want to withdraw.

Once the transaction is confirmed, you can see the deposit collateral amount is reduced in the AAVE dashboard.

Also, the withdrawn Dai amount is now moved to your Metamask wallet.

History

You can check your account transaction history from the History tab.

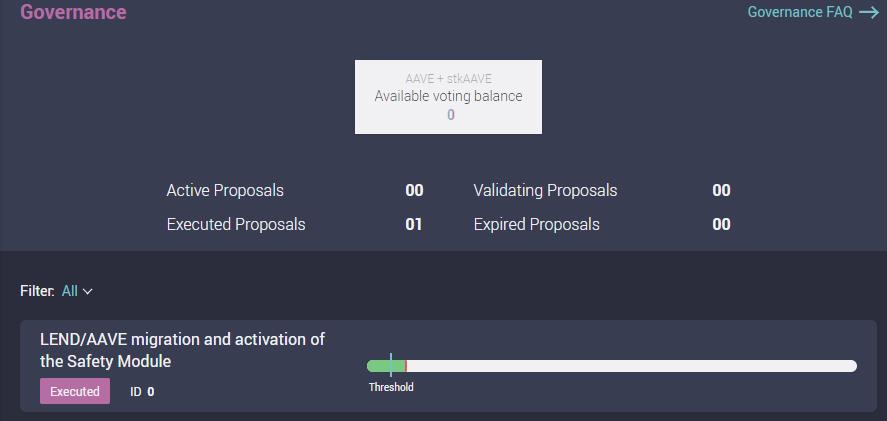

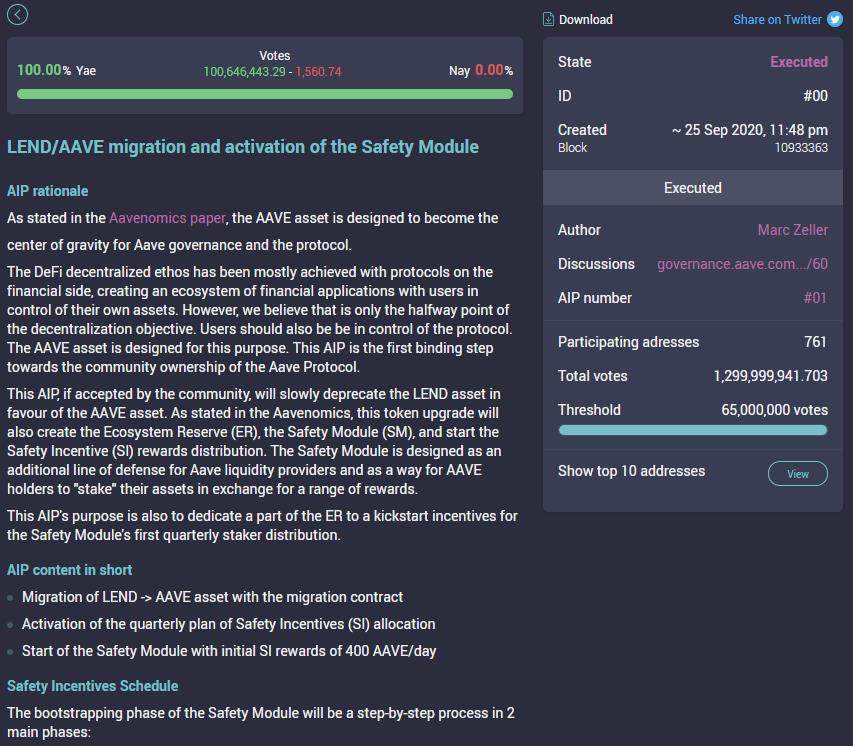

Governance

The AAVE governance portal consists of a list of the proposal upon which AAVE tokens or stkAAVE (Staked AAVE) tokens holders can vote. Users can use both and the amount will be summed up in your voting.

You can click on the proposal to get more details about it.

The platform also allows you to share the proposal on Twitter and you can even download it if you want.

Fee

The platform charges two types of fee:

- From borrowers-00001% of the loan amount is collected on loan origination. Out of which 20% is used for referral integrators and 80% is swapped to the LEND token and burned.

- From Flash Loans– 0.09% is collected from the loan amount. Out of which 70% is redirected as extra income for depositors of the protocol and 30% is split using the same 20%/80% model of the origination fee.

Apart from these two the users also need to pay the transaction cost.

Liquidation

Like any other DeFi lending platform, the AAVE platform also requires to maintain a collateral ratio (health factor in this case) to avoid liquidation. The platform’s users mandatorily need to maintain a health factor >1.

Liquidation happens due to two reasons:

- Collateral value fall

- Borrowed debt rise

To overcome the above two scenarios, the users can follow the below two ways:

- Pay debt

- Deposit more assets

The platform also charges a liquidation penalty (or a bonus for liquidators) depends upon the asset used as collateral. You can find more details about the liquidation fee here.

Conclusion

Aave has been in the market for quite some time and has picked up the best practices from many existing platforms. The User Interface is excellent and brings with it a lot of features. However, the platform needs to upgrade as the Uniswap market supports only version 1 liquidity pool token which is quite weird from the user’s perspective. But we are hopeful that with the platform’s upgrade these issues will be taken care of in near future.

Resources: AAVE official website

Read More: How to Use Compound Finance

Thanks for sharing this guide!

DeFi is soon to revolutionalize the world. Thanks for sharing the content.