The bull is back. Markets are growing. People are optimistic. New money is coming in for the first time in 2 years. Now is the time to set yourself up for huge gains in the bull market cycle.

OR NOT if you are not prepared. Well, we have you covered. A new bull market cycle portfolio with 8 GREAT picks including one we know for sure you haven’t heard about before. See how we are setting up our $1000 crypto portfolio to get to 6 figures in this new market cycle.

Building for the Bull Market

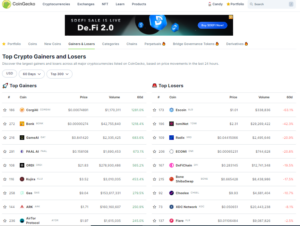

Whether you agree the bull market is here yet or not, one thing is clear. The worst is over and many coins have made huge gains off their bear market lows. Check out some of the huge gainers in just the last 60 days:

- ORDI from Bitcoin Ordinals up 550%.

- Kujira from our Master Portfolio is up 490%.

- ThorChain is up 190%.

- Solana is up 190%.

- Chainlink is up 145%.

Source: CoinGecko

And those are just the names you know. It’s been the beginning of a good broad alt-market rally. And we think it will continue. So, here are our picks for our portfolio to carry us through the bull cycle. Stay tuned for our low-cap wildcard that NO ONE on Crypto Twitter is talking about.

The Biggest Big Caps

The foundation of any portfolio in crypto should be on large-cap players. They have proven themselves over time and overall are less risky than smaller projects. But, with still the big potential for high ROI. Or even 50-100X.

I know you’ve heard talk of Bitcoin going to 750k or 1 million per coin if it gets priced similarly to gold and gold’s supply. Well, 1 million is a 30x from here and very possible. Plus, a halving is coming in April. Don’t believe people when they say the halving is priced in. Every 4 years people say this, and every 4 years they are WRONG.

So without question, Bitcoin is in our portfolio. So is Ethereum. ETH has issues. Lots of them. But it still dominates and more, and smoother operating L2s only means more total volume, TVL, and transaction activity for Ethereum. After all, they all go there for the final settlement and must pay for gas.

Our 3rd big cap is one that was left off to the side to die off and just wouldn’t go away. We are talking about Solana. Off its deathbed and $8 low, bold investors have already done great with Solana in the last few months. And we expect this growth to continue. So our 3 large caps in order of holding will be:

- Bitcoin (25%)

- Ethereum (20%)

- Solana (15%)

Mid-Caps & Strong Narratives

Following strong narratives will help you get those big bull market returns too. We have 40% more to invest. We are putting 9% in each of these 4 big narrative coins. Here are some of the narratives we are following:

-

Proof of Work

Yes, proof of work is making a comeback. Ethereum’s switch to Proof of Stake became a healthy reminder of what people liked about Proof of Work in the first place. So, our favorite PoW project besides Bitcoin is Kaspa. Kaspa is Proof of Work but with better scaling than most PoW projects. It has great fundamentals all the way around.

-

Real World Assets

The tokenizing and selling of real-world assets on-chain is something we only expect will grow from here. One of our top choices in this narrative is Centrifuge. Centrifuge is up 150% in the last 60 days. But we don’t care. It should continue here as TradFi finds its way into crypto. It is already Real World DeFi on-chain.

-

AI

You don’t need us to tell you how much of an impact AI is having on markets, jobs, the economy, and more. And its effect will only grow. Our AI pick, because we expect chip production and chip space for computation and image rendering to continue to be a bottleneck in the system, is Akash.

Akash has a system of buying, selling, and leasing GPU space to help with AI computations. Because the public is so interested in the results of AI searches and prompts, we often don’t think about how much computing power is necessary to render a drawing or to analyze a set of documents.

And it’s a lot. Many of the new crypto AI apps will need a place like Akash to rent GPU space while they get started to prove their concept and show their app can be successful. Simply, as AI grows, so will Akash.

-

Financial Appchains

We like the appchain narrative and have for a while. Financial appchains in particular have lots of things going for them. The financial tradeoffs when building are advantageous both to the chain and to the Web2 trading firms.

And the undisputed leader in this area is Injective. They are just crushing it all the way around and that will continue.

The Wild Card

And last, our 8th selection, is a little bit of a wildcard. You probably noticed we had 4% left. 60% in the Big caps. 36% in the mid-caps and strong narratives. So here’s where our last 4% is going. We went deep into the vault with our Research team to get this recommendation. Microvision Chain and its token $SPACE will get the last 4% of our portfolio.

So, MVC is building Layer 2 for Bitcoin with UTXO-based smart contracts. UTXO is the specific type of transaction output you get from Bitcoin. Most other coins don’t use it. It’s a scaling solution for Bitcoin and also they are working on Decentralized Digital IDs. Both are stories we like A LOT.

Our Research Team LOVES this project. Every coin comes from PoW mining. No pre-mining either. It was a fair launch project. As of now, about 1.9 million $SPACE are in the market out of a 21 million total supply. But we couldn’t just give this one with so much potential only to our paid Alpha members. So it’s in this bull market portfolio for you too. Now we can all track its progress.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.