The Bitcoin Spot ETF approval is imminent. The deadline for the first approval is this coming 10th, January 2024. It looks like a done deal. The likelihood is up to 99%. There was a last-minute change to the deadline. Applicants are releasing Bitcoin-related videos. There were over 30 meetings with the SEC. Many insiders confirmed the deal.

So, what is about to happen with the approval of Bitcoin ETFs? Can we sell the news? Let’s take a closer look at how the BTC price may react to approval.

An Initial Pump

Bitcoin has seen some positive price action over the last 90 days. Today, BTC is up by no less than 7%. Its current price is $45,110. That all started around the time the first Bitcoin ETFs started making the news. Although the first application by Ark 21 dates to April 2023. Grayscale even applied back in October 2021.

JUST IN: 🇺🇸 CNBC says SEC could notify spot #Bitcoin ETF issuers "as soon as this week if they've been cleared to launch" pic.twitter.com/HFpR6eelKp

— Bitcoin Magazine (@BitcoinMagazine) January 2, 2024

The final deadline for the SEC is 10th January 2024. However, the approval may come earlier. Initial word was that applicants would receive an update today, Tuesday, or Wednesday. However, the SEC seems to still be going over the paperwork and needs more time. Now, this update by the SEC saw a delay to Friday.

Nonetheless, the BTC price rally is all about the possibility of approval by the SEC. What happens if the approval comes through? Most people will expect an immediate pump. That’s quite likely as well. However, don’t expect to see ‘God candles’. BTC is most likely not going to a new ATH on the immediate back of this news.

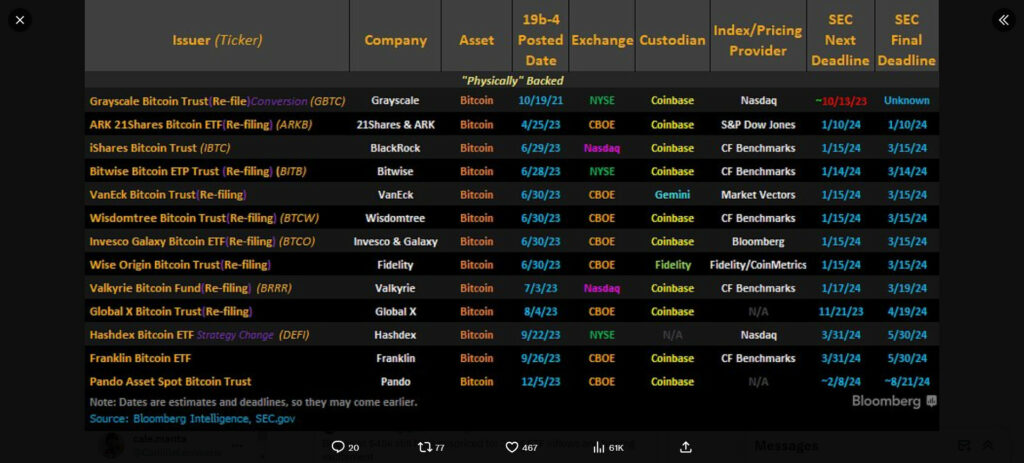

A more likely scenario is that BTC will indeed pump. But it shouldn’t surprise you if, after this initial pump, the upward price movement stops. Get ready for some more sideways action. However, at much higher prices than we have today, at $45k. The picture below shows all BTC ETF applications and all-important deadlines.

Source: X

Consolidation

Euphoria rules now and the sky seems to be the limit. There seems to be only one direction, and that’s up. However, the excitement of the approval won’t last forever. With the approval, it may disappear faster than expected.

The BTC spot ETF approval will most likely have a long-lasting effect. For the mid and long-term, it’s a clear bullish signal. However, what about the short term? What is going to happen now? So, this may come as a bit of a surprise, but we’re not in the ‘up only’ stage yet.

It’s quite possible and likely that BTC will see a standstill or a small pullback. This will most likely weed out the ‘sell the news’ crowd. The crowd that’s waiting for the God candles is the next one to get rekt. That’s because the market will most likely pump a couple of $1,000. But it will start to dump soon afterward.

There will be a pullback idk when but surely before the real up only bull market.

Below 35k? Below 25k? i don't know but all depends the how people react the ETF news.$BTC pic.twitter.com/e5bqr7fzDB

— Poseidon (@CryptoPoseidonn) December 29, 2023

A Pullback

We now may enter a pullback zone for BTC. But this pullback is most likely not as big as the bears among us hope for. The remainder of the ‘sell the news’ crowd may get caught up in this, though. On the other hand, the ‘up only’ or bullish crowd will find the pullback essential enough.

As a result, we may see people in both camps getting rekt. The pullback could see a dump to $35-$40k. Enough to give the bulls the heebie-jeebies. Although not enough for the hard-core bears among us. Many bulls will sell again, and the bears keep waiting for the price to dump more. As a result, the bears probably don’t buy in at all.

So, this is how both camps get rekt. If we look at previous bull runs, it never is ‘up only’. There are always pullbacks, before a major leg upstarts again. Be prepared for this and don’t panic sell. These pullbacks can turn out to be great entry opportunities.

Full On Bull Run

Retail’s role is now almost over. It’s the grand entry of the institutional players. The Bitcoin ETFs are in full swing now. Buy activity keeps increasing. The crypto market enters the second stage. From now on, the market is in full bull run mode. However, this doesn’t mean there are no pullbacks anymore. These will happen along the way. See the picture above, from the 2017 bull run.

Happy days all around. Except maybe for the people who got rekt after the BTC ETF approval. The ones that got caught out with the pullback after the ETF approval. Everybody else is enjoying the ride. Be aware, though, that this is only one possible scenario. Many variations are possible and anything can happen.

In case you are wondering what will happen after #Bitcoin ETF approval. pic.twitter.com/fT6M8JCUuf

— Vivek⚡️ (@Vivek4real_) January 2, 2024

Conclusion

With the imminent approval of the Bitcoin ETFs, we look at a possible scenario when this happens. Will we go all the way to a new ATH without brakes? Or will we see some pullbacks and a gradual build-up? The actual approval will most likely see an immediate price increase. However, the follow-up can be a short pullback. Don’t let that be a surprise, since after that pullback, we’re most likely in the middle of the bull run’s second leg.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.