Kamino Finance is a lending and borrowing protocol on Solana. In a short timeframe, it managed to become Solana’s fourth-biggest protocol by TVL.

Their TVL over the last 30 days improved by 448%. That’s impressive. The platform also doesn’t have a token yet. So, an airdrop is possible. In this article, we will take a closer look at Kamino Finance and the good opportunities to earn yield in USDC.

USDC yield from @Kamino_Finance has been around 20% APY these last few days and just peaked to 48% right now.

This is a huge opportunitiy to farm one of the biggest airdrop and earn super decent APY on USDC. pic.twitter.com/81UGoxIDbh

— Solar ☀️ (@DefiSolar) January 1, 2024

What Is Kamino Finance?

Kamino Finance launched towards the end of 2022. So, to take fourth spot in TVL among all other Solana protocols is quite impressive. The protocol works with SOL, various stablecoins, and liquid staking coins. For example, mSOL. The platform also offers various features. For instance,

- Kamino Lend — here is where you can lend and borrow.

- Multiply — for one-click looping strategies (profiting from borrowed funds).

- Long/short — for one-click leverage strategies.

- Liquidity — optimize your concentrated liquidity positions. You can use them as collateral.

Kamino 2.0 is live!

An industry-leading Borrow / Lend market; brand new UI; unified risk management; new & unique DeFi tools

It’s taken over a year of extremely focussed effort to build a new protocol from the ground up. Amazing effort from the team pic.twitter.com/T8nokICesu

— Kamino (@Kamino_Finance) November 16, 2023

On their website, Kamino offers an easy-to-use UI (user interface). For example, their liquidity pools offer some juicy APY. Starting with around 1.6% over the last 7 days for the JitoSOL-SOL pool. However, other pools go up to current APYs of 510% over the last 7 days.

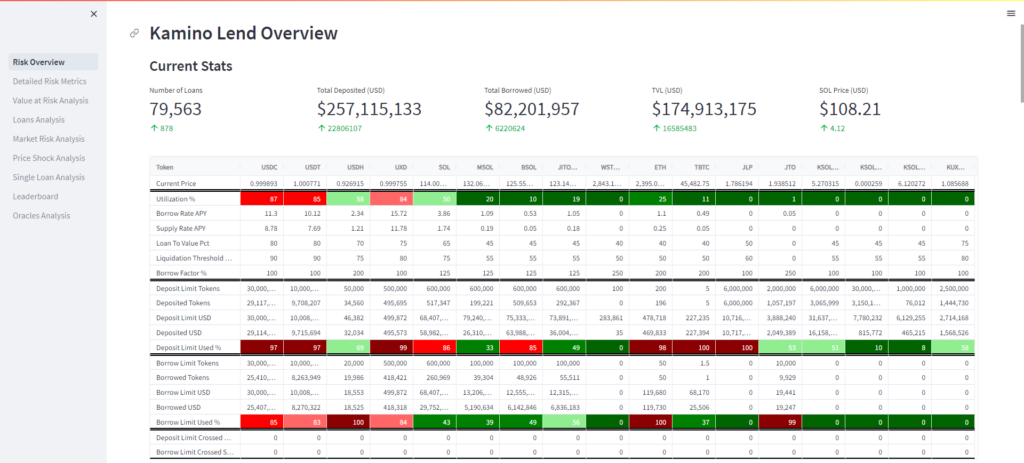

In the lending and borrowing section, USDC recently stood out. Before New Year, it had a streak over a few days with 20% APY. However, on the 1st of January, it peaked at 48%. Now it’s back to around 10%. What is interesting is the fact that they offer a single liquidity market. This is in contrast to the most often used multi-pool setup. So, let’s take a closer look at some Kamino features. The picture below shows the Kamino Finance stats for lending.

Source: Kamino Finance Risk page

How Does Kamino Finance Work?

The various options at Kamino Finance all work differently. The easiest option is to use the lend and borrow features.

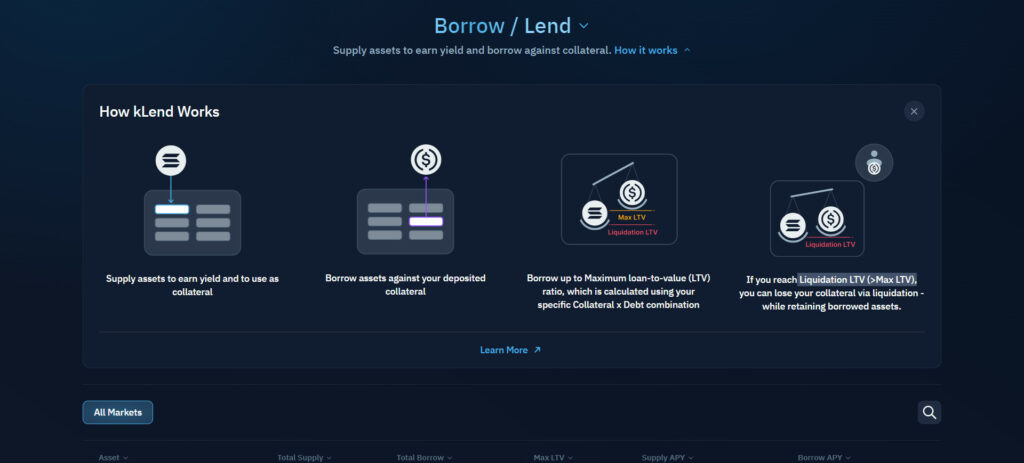

Lend / Borrow

- Click on the lend / borrow tab.

- Pick the asset that you like to lend. Currently, you have 16 options.

- Supply APY shows the current yield. Be aware that this can fluctuate.

- Click the ‘Supply’ button.

- In the pop-up, choose the amount you want to supply and click the ‘Supply’ button.

That’s it, now you can sit back and relax and earn that passive income. Interesting is that liquid derivatives also offer leverage. However, be careful when using this option. Make sure you understand how leverage works. When using leverage, your liquidation window also becomes smaller.

Another option is to use your position as collateral. This allows you to borrow against your collateral. Up to your Maximum loan-to-value (LTV) ratio. The platform calculates this by using a specific Collateral x Debt combination. When you reach the Liquidation LTV (>Max LTV), you lose the collateral, but not the borrowed assets.

There’s extensive information about lending and borrowing on their Doc pages. This includes information about withdrawals. However, that’s not all. The lending and borrowing features offer more options. For example,

- kToken collateral. —Use your concentrated liquidity (CLMM) LP positions as collateral. This gives you various lending strategy options. For instance, yield looping. By looping, you borrow at a low interest rate. However, you lend the borrowed asset at a higher rate. The difference is your profit. You can repeat this multiple times. Their docs explain how all this works.

- Borrowing assets — Supply collateral into K-lend and start borrowing. Find out more in Kamino’s docs.

Source: Kamino Finance app

Other Options on Kamino Finance

As already mentioned, Kamino Finance offers more than only lending or borrowing. Here’s a brief look at these other options. For instance,

- Liquidity Pools

These were Kamino’s first products. Kamino launched these pools in August 2022. These are also the pools that reward you with the kTokens, as explained earlier. Find out more in their docs.

- Long / Short

These are single-sided token vaults with leverage. This feature is still in Beta. As the name implies, you can long or short assets. Currently, seven assets are available for leverage in this section. Kamino uses flash loans to borrow leveraged tokens. For example, the USDC stablecoin. Their docs have a good explanation.

1/ Introducing Kamino Leverage

A cost-effective spot leverage product on Solana, powered by Kamino Lend, that enables you to get leverage without paying excessive funding rates.

Long/Short is now in beta:https://t.co/3WZP37qYvG pic.twitter.com/pxhLsRZXMF

— Kamino (@Kamino_Finance) December 21, 2023

Multiply

In Multiply, you can use leverage again. This time it’s on yield-bearing assets. Multiply combines various other features on Kamino. For instance, E-Mode or kTokens. Both are from the underlying K-Lend mechanisms. Their docs explain how it works and have a word on associated risks as well.

Kamino will also start adding a point system soon. These points will give you shares in their airdrop.

Conclusion

Kamino Finance is an up-and-coming DeFi platform on Solana. In a short timeframe, it managed to take the fourth spot in TVL on Solana. Recently, their USDC yield peaked at 48% yield. We take a closer look at how Kamino Finance works.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.