Recently, the SEC filed lawsuits against 18 cryptocurrencies. This included some well-known names. For example, Cardano (ADA), Polygon (MATIC), Solana (SOL), or The Cosmos Hub (ATOM). That’s on top of another 40+ lawsuits they already filed.

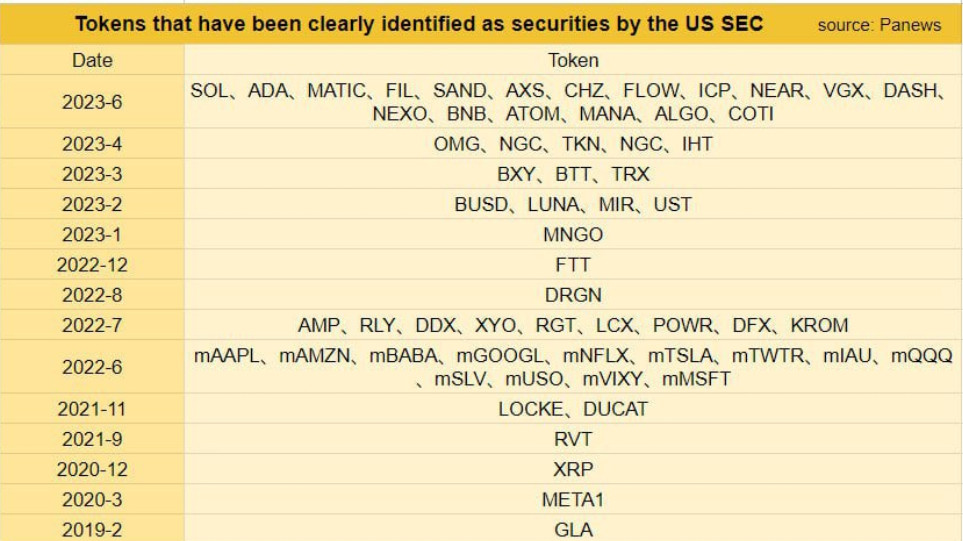

So, let’s take a look at what tokens the SEC considers to be a security. Below is a picture of all tokens and coins that are currently considered a security by the SEC.

Source: Network News

What Is the SEC up to in Respect to Cryptocurrencies?

We should keep in mind, that the SEC only has jurisdiction in the US. Other countries, or regions, may deal differently with cryptocurrencies. For example, in Europe they have MICA. This is a set of laws, that intend to, for example:

- Protect those that want to invest in crypto.

- Maintain financial stability.

- Be proactive in promoting industry-wide innovations.

In Hong Kong, they opened up the crypto market on 1st June 2023. They are now proactively approaching US-based companies to move to Hong Kong. For example, Coinbase.

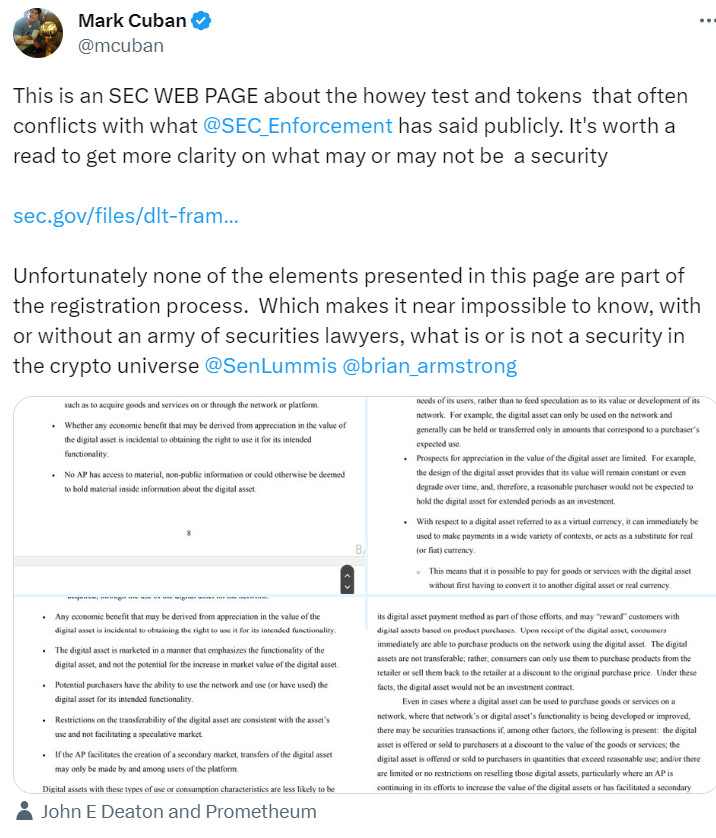

The MICA, for example, seems to be a rather constructive way to regulate the crypto industry. There’s a lot more clarity and transparency in the industry. This is in contrast to an often-heard critique against the SEC. They don’t provide clear guidelines. As a result, the US crypto industry doesn’t know what rules they need to abide.

It even gets stranger, when we consider how the SEC determines that a token or coin is a security. For this, they use the so-called ‘Howey test’. However, this test dates back to 1946. That was well before there were any digital assets available. For example, for traffic, like cars and planes, rules and laws get regular updates. That’s because these vehicles and their environment evolve. So, regulation needs to adequately address these changes. You could ask or expect the same for the financial world, where digital assets are now common.

Source: Twitter

The Tokens Considered a Security by the SEC

Out of the current 60+ tokens considered a security by the SEC, some already ceased to exist. In a couple of cases, it seemed like the SEC was on to something. One of their first cases turned indeed out to be a scam (Meta 1). However, that all changed once they filed a lawsuit against Ripple (XRP) in 2020.

Ripple and its founders decided to fight back. This court case keeps lingering. To this date, there hasn’t been a verdict. On the other hand, it’s quite possible that the outcome of this case will become a landmark. Here’s our latest update on this case.

The current SEC chairman, Gary Gensler made a couple of statements about crypto. Some of them are without clear juristic clarity. For example, “everything other than Bitcoin” is a security according to Gensler. This resulted in a much louder cry for regulatory clarity.

From the mentioned tokens by the SEC, you most likely will only know a handful. There are quite a few small and obscure projects on their list. See the first picture in this article. However, there are also quite a few better-known projects. For example,

- Algorand (ALGO)

- Axie Infinity (AXS)

- Binance Coin (BNB)

- Binance USD (BUSD)

- Cardano (ADA)

- Chiliz (CHZ)

- Cosmos (ATOM)

- Decentraland (MANA)

- Filecoin (FIL)

- Luna (LUNA)

- Polygon (MATIC)

- Ripple (XRP)

- Solana (SOL)

- Terra USD (UST)

- The Sandbox (SAND)

- Tron (TRX)

What Do These Tokens Have in Common?

To determine if a cryptocurrency is a security, the SEC uses the Howey test. As already mentioned. However, what do most of the current ‘securities’ share or have in common?

- Most of them had an ICO (Initial Coin Offering). As a result of the relentless SEC lawsuits, newer ICOs exclude US citizens.

- Their tokens have use cases. For instance, the main purpose of these tokens is to secure the chain, by, for example, staking. PoW or PoS is irrelevant.

There are a few more things they may have in common. However, with an ICO, you can argue that you get involved with the hope of price appreciation. On the other hand, securing the chain may be harder to prove as a security. In Europe, many projects now make sure that they are in legal waters with clear rules by MICA. For example, Lukso and Aleph Zero went the extra mile in Europe.

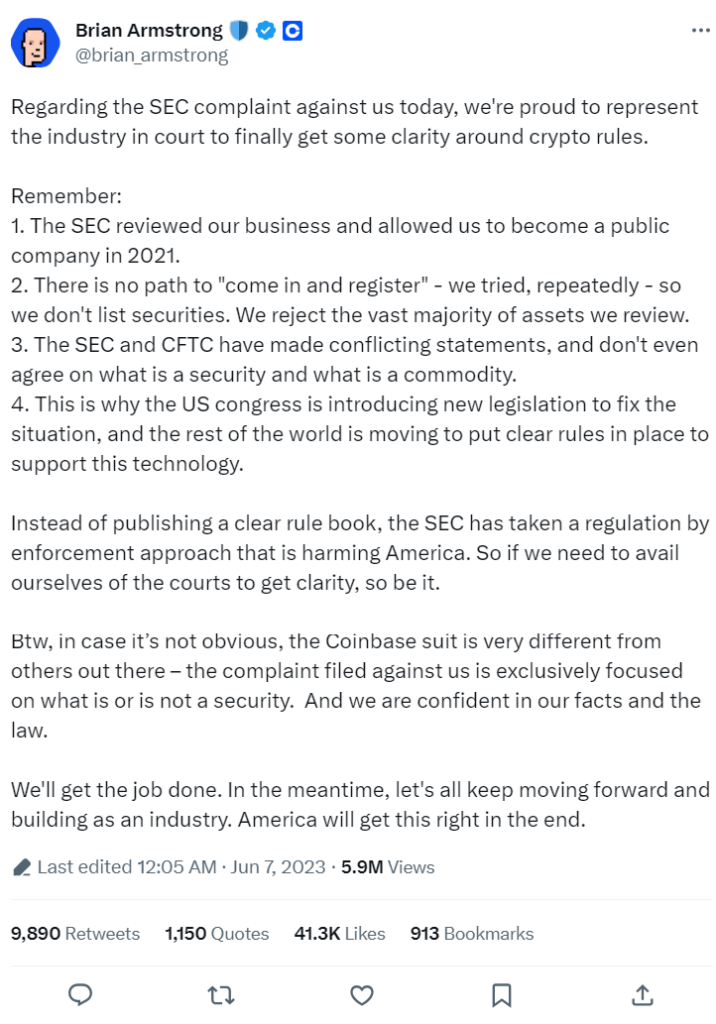

It appears that better and clearer crypto regulation in the US is a necessity. For example, a company like Coinbase clearly indicated that they want to register. However, according to Brian Armstrong, their CEO, there’s a lack of clear rules to which they need to abide by.

Conclusion

In this article, we look at the tokens that the SEC considers securities in the US. We showed you how the SEC determines what a security is. There’s also a list of the most prominent projects that the SEC considers as security.

Furthermore, it’s interesting to see how other jurisdictions handle this issue. They seem to be offering more constructive regulations.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.