As cryptocurrencies continue to gain popularity and challenge traditional financial systems, regulatory bodies like the U.S. Securities and Exchange Commission (SEC) are tasked with evaluating their classification and determining the extent of their regulatory oversight.

However, they are evaluating cryptos with a financial test they created in 1946. Why doesn’t the SEC have the will to update the tools? In this article, you will learn what is the Howey test.

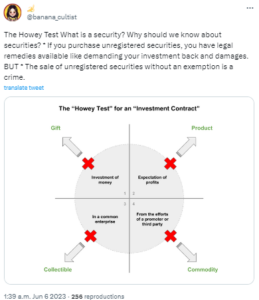

What is the Howey Test?

The Howey Test takes its name from the landmark Supreme Court case SEC v. W.J. Howey Co. which occurred in 1946. This financial tool set the legal standard for determining whether an investment qualifies as a security. The test consists of four elements:

- An investment of money.

- In a common enterprise.

- With an expectation of profits.

- Solely from the efforts of others.

Source: Twitter

Originally developed to assess investments in real estate, the Howey Test has been applied to various financial assets, including cryptocurrencies. However, it is essential to recognize that this criterion was designed without considering the unique characteristics and functionalities of digital assets. Cryptocurrencies operate in decentralized ecosystems, providing utility beyond mere investment vehicles.

Digital Assets vs. Financial Assets: The Need for Updated Criteria

Digital assets, particularly cryptocurrencies, differ significantly from traditional financial assets that dominated the past century. Here are the key distinctions that necessitate an updated evaluation framework:

- Decentralization: Cryptocurrencies are typically built on blockchain technology, enabling decentralized networks and removing the need for intermediaries. This decentralization disrupts the traditional notion of a common enterprise, as the value and control of digital assets are distributed among participants.

- Utility and Functionality: Unlike traditional financial assets, cryptocurrencies often serve various purposes beyond investment and profit. They can be used for peer-to-peer transactions, smart contracts, decentralized applications, and more. These functionalities extend far beyond the expectation of profits and highlight the need to consider the utility aspect when evaluating digital assets.

- Global Accessibility: Cryptocurrencies are accessible to anyone with an internet connection, providing financial inclusion to the unbanked and underbanked populations. So, this global accessibility challenges the notion of investment being solely reliant on the efforts of others, as users actively engage in transactions and contribute to the network’s operations.

- Technological Innovation: The advent of blockchain and decentralized technologies has ushered in an era of innovation and disruption. This innovation necessitates a flexible and adaptive regulatory framework that encourages the development of new financial technologies while protecting investor interests.

Source: Twitter

We Need the SEC to Design a Coherent Crypto Adoption Policy

Currently, tokens that do not pass the Howey Test are considered utilities. This means that these assets don’t have to pass through strict regulatory requirements. Any asset needs to pass this test so US citizens can use them massively. While this distinction can be beneficial in certain cases, the whole industry feels that the SEC is not willing to have the

So, what The SEC is doing is trying to destroy the industry by hitting the “big towers” of the crypto industry. What it is causing is for us to come together.

Important exchanges like Binance, Robinhood, and Coinbase strive to foster the adoption of cryptocurrencies under a coherent legal framework that encourages innovation. However, The SEC never gave solutions, only obstacles.

Source: Twitter

This shows that web3 companies do want regulation, as it is the only sustainable way to have any business, but the U.S. government does not see it that way.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.